People which are for longer time in the blockchain industry have heard many times how blockchain technology is going to change the way world works. Several industries like (finance, cyber security, forecasting, cloud storage,…) are soon going to be disrupt by the distributed ledger technology. One of the industries that catched my interest is fine art.

Why fine art industry? Fine art industry still operates as it used to in 20th century. The technological advancement for our civilisation has exploded after 2nd world war and alot of industries improoved during the years but fine art market didn't. Why is that so?

Buying a Monet or a Picasso is a fun experiance for the very few rich people, but selling fine art pieces is not. Why is that so? Fine art industry hasn't changed for decades and it's still beeing controled by very huge auction houses which take very huge fees for buyers and sellers. For example one of the biggest fine art auction houses in Europe Sotheby's. At Sotheby's fine art auction house they charge buyers 25% fee for purchases up to $200.000 , 20% fee for $200.000 to $3 million and 12% fee for $3 million to ∞. These fees are just legal ripoff's, but why can they do it? They can do it because fine art industry has huge issues with forgering fine art peaces and some of fine art auction houses are very old companies which have established a good reputation over the years.

So why not trust them if everything is fine except huge fees? Well this article is about why we need to forget about old way of auctioning art, because there is a new startup on the brink called Maecenas, a blockchain company which uses distributed ledger technology to disrupt fine art investment so they can allow even ordinary people to get a piece of a Picasso. (for more about Maecenas check bellow)

Most of people know that investing into fine art is a very good long term investment because even in economical crises they maintain their value or even gain on it. The only problem is people have a hard time buying a piece of a Picasso or a Monet because these arts cost alot and not everyone can afford them. Not every person has few million $ in their pocket to spend them for fine art.

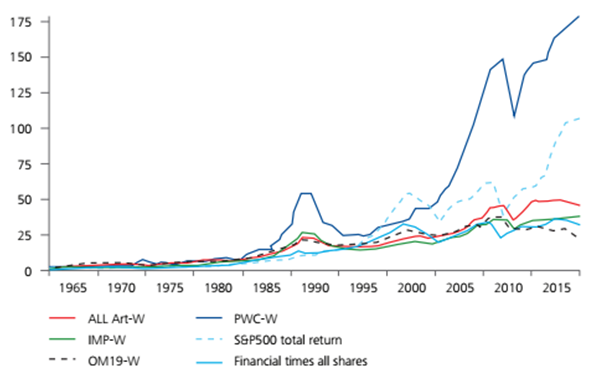

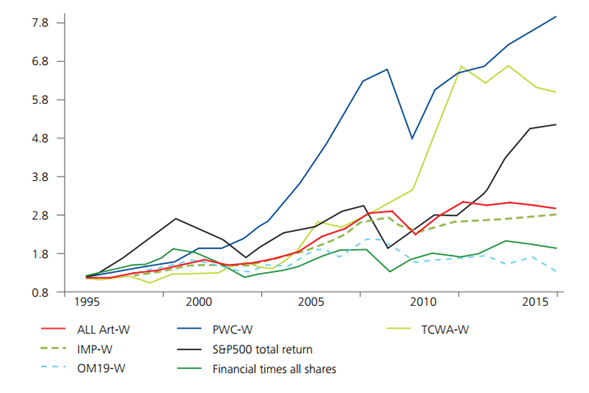

World collecting category indexes vs the S&P 500 total return index and the financial times all shares without dividend reinvestment

50 year period

20 year period

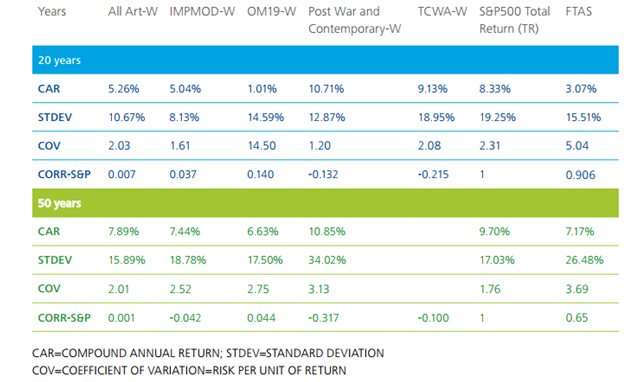

Mei Moses table World and Collecting category indixes

Risk and correlation

20-year period: it is clear from that the S&P 500 Total Return Index has been more volatile than all of the art indices over the last 20 years. The risk associated with each index is measured by the standard devidation of the changes in their annual returns. The absolute risk associated with the Mei Moses All Art Index has been lower than that of the S&P 500 Total Return Index over the last 20 years (10.67 percent vs 19.25 respectively).

50-year period: over this longer period, all of the art indices , except the Mei Moses All Art index have shown higher volatility than the S&P 500 Total Return Index. The absolute risk associated with the Mei Moses All Art Index has been lower than that of the S&P 500 Total Return Index over the last 50 years (15.89 percetn vs 17.03 percent respectively). However , the Post-War and Contemporary Index demonstrated a significantly higher level of volatility during this period at 34.02 percent. According to Mei Moses the correlation of returns among assets is another measure used in financial decision-making. The negative or close-to-zero correlation factor between the annual percentage changes in the diffrent art categories and stock indexes fort he last 20 and 50 years indicates that art may play a positive role in portfolio diversification.

Maeceneas – Decentralized art gallery

Fort he first time, technology will alow investors, collectors and owners to exchange shares in paintings and sculptures instantly with minimal fees. Maecenas will charge only 2-6% exchange fee through their platform and every fine art will be able to get tokenized so even average Joes will get acces to investing into fine art space. In order for people to use their platform they will need ART tokens which will also have few important usages. Economy of Maecenas will not only allow you to run auctions for fine art but the platform will also alow owners of fine art to lease their items to museum for exhibitions and income which will be generated will be shared with the owners. This leasing and income collection will be performed by smart contracts through Ethereum platform. This might sound crazy but it's not, blockchain technology offers few variabilities in fine art sector and by right aproach of Maecenas they could revolutionise how this industry will work in the future. Maecenas is currently still beeing in crowfunding stage and by time of writing this article they have raised 45.592 ETH (aproximately $13.3 million). They have writen in their roadmap that their platform will be ready in 2018 Q2 – Q4.

NOTE: I am not encouraging anyone to invest into this space, i am not beeing sponsored by Maecenas, i decided to write about fine art space and Maecenas because i personaly like their vision and how they could revolutionise this industry.

verry good.) i follow.)

@soyer thank you very much ^_^

Nice to meet you, @investmox! Great Post, ive upvoted you and followed you and i have also sended you a small tip^^, i wish you a great time here and a nice day :D

Thank you very @masterart much, this was my first try for writing an article and this makes me happy that atleast someone likes it :)