Note: This is a reproduction of an article that I just wrote for the Litecoin Alliance. For the article in its original location, go here.

Disclaimer: I hold LTC along with several other crypto currencies. None of the following constitutes investment advice. Readers are encouraged to do their own research and to never risk more money than they can afford to lose.

What is a fork?

A fork in cryptocurrency is a change to the code of a particular project. For cryptocurrencies, this code represents the public ledger of all transactions or the “blockchain”. In general, there are two currencies created after a fork: a currency that follows the original and unchanged blockchain and a new currency that follows the changed blockchain [1, 2].

A fork can happen accidentally or intentionally. In the accidental case, a bug or flaw in an update can make that update incompatible with the previous editions of the blockchain. In this case, developers must find a way to rectify the situation so that the different blockchains can be merged. The intentional case is split up into two cases, soft forks and hard forks.

Soft forks are changes to the software protocol of a blockchain that are backward-compatible. Soft forks are usually used to accomplish something useful like an upgrade to the system [3, 4]. As an example, Pay-to-Script-Hash (P2SH) was added to the bitcoin network as a soft fork [5]. The only thing required for a soft fork is a majority of the miners in the network to upgrade, and the new rules of the soft fork will be enforced.

A hard fork on the other hand is not backward-compatible. This means that two new blockchains emerge from a hard fork. These often occur as a result of a disagreement amongst the development and mining communities about the direction of the currency or whether or not a given upgrade or change should occur. Hard forks are the ones that dominate the news, because of the politics surrounding them. It is easier to understand hard forks, and other forks for that matter, by examining a couple notable examples.

Notable Forks

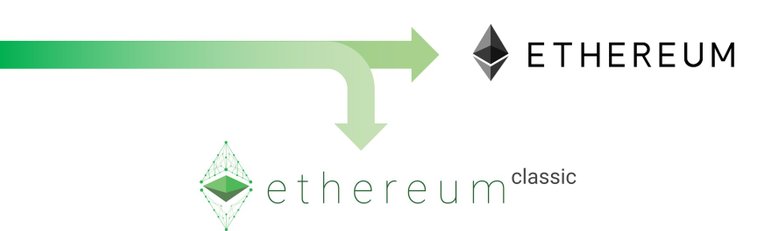

Ethereum (ETH) and Ethereum Classic (ETC)

One of the first and most notorious forks was the Ethereum fork that happened as a result of a hack on the DAO [6]. DAO stands for The Decentralized Autonomous Organization, and was one of the early applications built on the Ethereum Network. The crowdsale for The DAO raised around $150 million dollars in Ether, at the value of Ether at the time, making it one of the largest crowdsales ever [7]. However, there was a loophole in the code that was exploited by a hacker, allowing him/her to drain around one third of the raised funds in Ether, amounting to about $50 million at the time.

The developers were then faced with a serious dilemma. How could they allow this manipulation of code to stand? As a result, a hard fork was proposed that would essentially return the funds that were invested into The DAO back to the original investors. This proposal split the community. The people that were against the fork argued that things that happen on the blockchain should be immutable and the fork essentially amounted to a bailout. On the other hand, proponents of the fork believed that the hacker could not be allowed to profit from his/her maneuver and that the community should intervene. They also believed that leaving such a large amount of Eth with a malicious actor would cause future problems.

This conflict led to a split of the original Ethereum community. The blockchain with the fork became Ethereum (ETH) as it is today, while the unforked, original blockchain became Ethereum Classic (ETC). Exact numbers vary, but as many as three million or more ETH were stolen during the original hack. If the fork has been 100% successful, those tokens would be worthless. However, with the fork, they became ETC tokens, with a total value of about 33 million dollars at the time of writing [8].

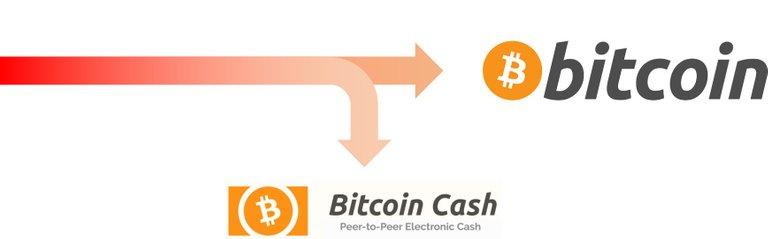

Bitcoin (BTC) and Bitcoin Cash (BCH)

A much more recent fork was the one that occurred on the Bitcoin blockchain on August 1, 2017. This was the point at which Bitcoin Cash split from the Bitcoin blockchain [9]. This argument arose around scaling issues with the BTC blockchain. In 2010, a block size limit of 1 Mb per 10 minutes was placed on the blockchain. Originally, this was to help prevent spam and attacks. However, as the community grew, this limit began to stifle growth of the network.

With many possible scaling solutions, a spectrum emerged. At one end were those that believed that BTC should be scaled at any cost to increase adoption. This included measures like raising the block limit. On the other side of the spectrum were those that believed that BTC needed careful and thoughtful development to scale appropriately [10]. They believed that hasty decisions about BTC development would have unforeseen consequences that could jeopardize the overall implementation of the technology as a whole.

A compromise by the community had the potential to avert the BCH fork. This compromise was the installation of SegWit (Segregated Witness, a popular scaling solution) along with a future doubling of the block size limit from 1 Mb to 2 Mb [11]. This compromise was not enough for a few developers and miners who pushed the BCH split forward nonetheless. With the advantage of hindsight, it appears that the contingent against the fork was right, with support for BCH precariously low [12].

Upcoming Forks and Market Reaction

While forks happen on smaller blockchains all the time, the ones on the largest networks will always dominate the news, because of the money involved. The drama for BTC is also far from over. There are two upcoming potential forks on the BTC blockchain, the Bitcoin Gold fork in late October and the B2X fork in November [13].

It is hard to predict what the market will do in the run-up and aftermath of a fork. Sometimes the uncertainty leads to investors pulling their money until after the fork occurs, leading to price drops. Sometimes the opposite happens, as investors who want to be a part of both new blockchains buy large amounts of the currency that is about to fork. With all the market volatility involved with forks, readers are encouraged to research the implications of each fork thoroughly before making investment decisions.

Sources

- https://bitcoin.stackexchange.com/questions/30817/what-is-a-soft-fork

- http://www.tech-recipes.com/rx/48517/cryptocurrency-what-is-a-fork/

- http://www.investopedia.com/terms/s/soft-fork.asp

- https://en.bitcoin.it/wiki/Softfork

- https://en.bitcoin.it/wiki/Pay_to_script_hash

- https://www.cryptocompare.com/coins/guides/the-dao-the-hack-the-soft-fork-and-the-hard-fork/

- https://en.wikipedia.org/wiki/The_DAO_(organization)

- https://coinmarketcap.com/currencies/ethereum-classic/

- http://fortune.com/2017/08/11/bitcoin-cash-hard-fork-price-date-why/

- https://www.coindesk.com/economic-case-conservative-bitcoin-development/

- https://www.nytimes.com/2017/07/25/business/dealbook/bitcoin-cash-split.html?_r=0

- http://fortune.com/2017/08/07/bitcoin-cash-bch-hard-fork-blockchain-usd-coinbase/

- https://news.bitcoin.com/another-bitcoin-fork-bitcoin-gold-project-plans-to-fork-bitcoin-next-month/

Full Size Cover Graphic:

Like some of my previous posts, I made this cover graphic! Let me know if you want to use it for a piece or other work... Cheers!

@mrainp420 has voted on behalf of @minnowpond. If you would like to recieve upvotes from minnowponds team on all your posts, simply FOLLOW @minnowpond.

To receive an upvote send 0.25 SBD to @minnowpond with your posts url as the memo To receive an reSteem send 0.75 SBD to @minnowpond with your posts url as the memo To receive an upvote and a reSteem send 1.00SBD to @minnowpond with your posts url as the memoAs a follower of @followforupvotes this post has been randomly selected and upvoted! Enjoy your upvote and have a great day!