Options Basic: Buying or Selling Options

- What is an Option?

- What are Open and Closed Position?

- What are Calls and PUTS?

- What are buying vs selling options?

- Mixing the Buyer/Seller with Call/Put Matrix

- Why Sell Options vs Buy?

What is an Option?

Options are financial derivatives that control 100 shares of the UNDERLYING stock. They have a Ticker, an Expiration date, a strike price, and the Value of the option which is called the premium.

The option "premium" value comes from the two pieces:

- Intrinsic Value: is the profit from exercising it immediately, based on the current market value versus the strike price.

- Time Value: reflects its potential profitability over time until expiration.

What are Open and CLOSE Positions?

To make a new bet, you OPEN a Position.

To end the bet, you CLOSE a position.

A rolling of an option (is the closing of one position and opening a new one). Often it is just really two transactions rolled into a single transaction and we look at the net of the two premiums.

What are CALLS and PUTS?

Reading Google (or the Internet) can be good or bad depending on how something is explained. I find most common answers are complex because they oversimplify the meaning.

In the Stock market, you either OWN the stock, you don't have the stock, or you SHORT it.

If you own the stock, you are LONG the stock (thinking the stock will go up in value).

If you don't own the stock, you have no position in it.

If you borrow the stock (from others), you are SHORTING the stock (thinking the stock will go down in value).

We know there are two types of options known as "calls" and "put".

For now, let's use a common meaning for these two words:

CALLS Are when you think markets are going up (as a buyer of the option).

PUT Are when you think the markets are going down (as a buyer of the option).

Call options and put options form the basis for a wide range of option strategies designed for hedging, income, or speculation. We cover this in the future as you can use BOTH CALLS and PUT together.

What are buying vs selling options?

Now we need to understand the BUYER vs SELLER in starting your OPEN position.

Here is a way to understand it:

Buyer has the RIGHTS but is not obligated to follow the agreement of the option contract.

Seller is obligated to turn over his physical share (100 shares), if the buyer exercises his RIGHTS.

You now need to understand that you have 2 possible ways to start a position using Option:

Buy to open a new position (the BUYER of the OPTION)

Sell to open a new position (the SELLER of the OPTION).

You have one way to end a position depending on how you started the OPEN position:

- If you started with BTO (Buy To Open) you have to STC (Sell to Close)

- If you started with STO (Sell to Open) you have to BTC (Buy to Close)

It might sound confusing already, but if you are still following this you are almost at the very end.

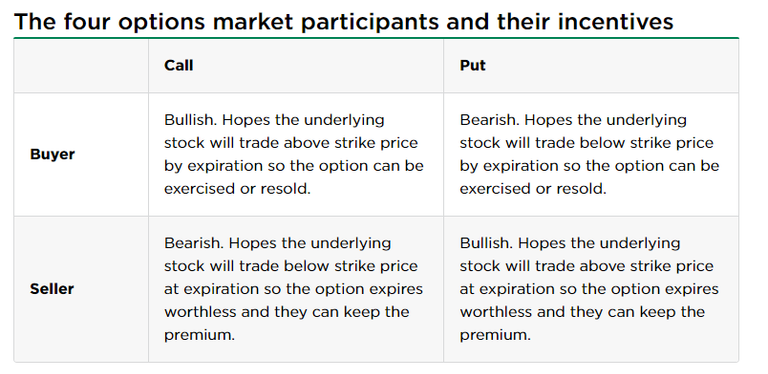

Mixing the Buyer/Seller with Call/Put Matrix

The next step is the combine the two possible ways you can take with the two type of options and you get this matrix:

Let's take this one step further and assign more common terms used:

- Buy to Open CALL option - aka "Long Call"

- Sell to open CALL option - aka "Covered call"

- Buy to open PUT option - aka "Long Put"

- Sell to open PUT option - aka "Cash Secured Put"

Last Step can be a bit more complex but let's talk about it with common terms used today:

Buy to Open CALL option - aka "Long Call"

Sell to open CALL option - aka "Covered (short) call"

Sell to open CALL option - aka "(Naked) short call"

Buy to open PUT option - aka "Long Put"

Sell to open PUT option - aka "Cash Secured Put"

Sell to open PUT option - aka "(Naked) short Put"

Long Call - A long call option is a type of financial contract that gives the buyer the right but not the obligation to purchase a stock at a specified strike price within a certain time frame.

Covered call - Covered calls are a neutral strategy, meaning the investor only expects a minor increase or decrease in the underlying stock price for the life of the written call option. This strategy is often employed when an investor has a short-term neutral view of the asset and, for this reason, holds the asset long and simultaneously has a short position via the option to generate income from the option premium. You own the 100 shares and can deliver them to the buyer.

Naked short call - A naked short call is a bearish-outlook advanced options strategy that requires you to sell stock at the strike price if the option is assigned. Because you don't have 100 shares, this practice is mostly banned.

Long Put - A long put is a position when somebody buys a put option. It is in and of itself, however, a bearish position in the market. Investors go long put options if they think a security's price will fall.

Cash Secured Put - A cash-secured put is an income options strategy that involves writing a put option on a stock and simultaneously putting aside the capital to buy the stock if you are assigned. In simpler terms, it is when you write a contract where you promise to purchase 100 shares of stock in exchange for being paid a premium.

(Naked) short Put - A naked put option seller has accepted the obligation to buy the underlying asset at the strike price if the option is exercised at or before its expiration date.

Why Sell Options vs Buy?

The buyer of the option has to get everything right:

- The direction of the move (call/put).

- The size of the move (picking the strike price)

- The time (or timing) of the move (picking the expiration date)

The seller of the option only needs to have one of the events not happen to win.

- The direction of the move (call/put).

- The size of the move (picking the strike price)

- The time (or timing) of the move (picking the expiration date)

One of the most common things we see is the BET of what going to happen often run out of TIME each day that passes. The option world sees this and PRICES the adjusted for the TIME that DECAYING away (making it harder for all the conditions to be met).

This is one reason why some folks are focused on making money on the TIME DECAY. Remember the two pieces that make up the Value of the Option: [Intrinic Value] + [Time Value].

As each day passes, you have less and less time for all the conditions of the option contract to be WORTH MORE. You are running out of TIME until the option expires worthless.

Posted Using InLeo Alpha