I saw this post and thought it would be useful with a BitAsset twist ;)

James Turk: “It is getting very ugly for the big banks, Eric. The price of many bank shares are in clear downtrends, particularly the European banks. Many of them are being swamped by unsecured loans that will never be repaid and will therefore have to be written-off as total losses.

The country in worst shape is probably Italy. The banks there have non-performing loans – which are those that are impaired and not meeting the original borrowing terms – that in the aggregate dwarf total bank equity. Even worse, non-performing loans in Italian banks have risen again over the past year from 17% to 18%. It is hard to imagine that 18% of all loans within that country are non-performing, but the Italian economy is in trouble as evidenced by its 11.7% unemployment rate.

Spain, Portugal and others have growing bad debt problems in their banks too, and we have to recognize that these bad debts may be insurmountable. That’s because the bad debts in many banks are larger than the bank’s capital, so they can’t take these losses because it would wipe out their book equity. In other words, many banks are insolvent because the difference between the true value of their assets and the value at which they are reported on bank balance sheets is in the aggregate greater than the shareholder equity of the bank.

So we have to remember not to be misled just because these banks are still open for business. Even though many of them are insolvent, they remain liquid because of the largesse of the European Central Bank, which bends over backwards to keep insolvent banks from failing because of the alternative choices when they do fail.

Either the government bails out the bank, or depositors do like occurred in Cyprus and Greece with bail-ins and other schemes that cause losses to depositors or prevent them from withdrawing their money. But the situation in the US is not much better, as we can see on the following chart.

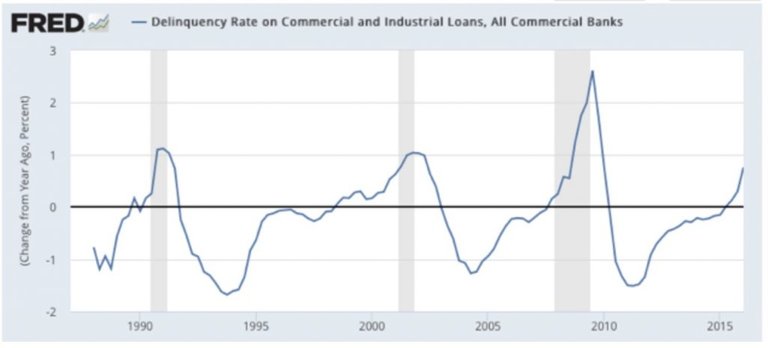

This chart from the Federal Reserve shows the year-over-year rate of change of delinquent loans owed to US banks. The chart was just recently updated through January 2016, meaning it lags by 6 months and therefore does not capture the weak economic conditions so far this year, which I expect have worsened delinquencies.

When the rate of change crosses zero, it has been a good indicator of recessions. Importantly, it is now signaling that a recession is beginning, providing more evidence that supports the same conclusion from a variety of other economic indicators. The upshot is that counterparty risk is likely to gain increasing attention in the months ahead. In fact, I think that a rush to safety has already begun.

We clearly see the rush to safety in alternatives outside of the banking system such as the rising price of Bitcoin, which rose another 4% last week and has nearly doubled in price from its January low. And the rising price of gold and silver this year indicates that the precious metals are benefiting too.

But here’s the scary part: If these early indicators about bank problems are correct, and I believe that they are, we face another 2008-type crisis for the simple reason that debts today are much bigger and therefore more unmanageable than they were eight years ago. Huge debt loads and bank non-performing loans in a slowing economy promise a train wreck."

My own opinion is fortunately we know how to get to the other side of the valley and make some wealth - buy some BitGold/BitSilver. After all, they are the ultimate safe havens and with BitShares there is NO COUNTERPARTY RISK.

Link the source bro. :)

Nice catch. Fixed.

While I tend to agree with the notion of another big banking/debt crisis ahead, I am not absolutely sure about any kind of digital asset offering a safe harbor. While they may offer exceptional safety during "regular" stormy conditions, i fear they also could become a financial death trap when the "big one" comes.

My reason to think so is, that the worth of blockchain based assets/systems (or any other digital asset at that) relies on one critical factor: Access to the internet. Everyone, from the developers to the end-users needs network access to make use of these systems and keep them running. Yet practically no one has access to the net without the intermediate services of a telco provider.

Not only does every telecommunications company of today need functioning banks for its financing and operation, they also need huge numbers of paying customers to support their infrastructure. Even if an elite of early crypto-adopters could stay solvent in a large financial breakdown, the rest of the world will not. People stop paying their phone bill (or start looking for cheap, basic contracts), long before they stop to buy food or pay for housing.

Take away large swaths of customers from any network provider and they will come crashing down very fast, eaten up by their huge operational costs. We actually saw this during the comparatively small and harmless dotcom-bubble. At least here in Europe, providers immediately started to go belly up, leaving behind thousands of kilometers of dark fiber.

To me it therefore seems quite plausible, that internet access providers might just collapse and cease to operate during a full scale financial crisis, especially if we also keep in mind what kind of social unrest and possibly violence such an event might bring along, rendering each and every crypto-asset completely worthless in one fell swoop. You can not use something out of your reach.

That would certainly be a worst case scenario and I don't know how to account for something like that. However, the good thing about BitAssets is that they track the price of something like gold rather that the belief that a token, like a Bitcoin, has value. Hence, once the Internet comes back on the BitAsset keeps the peg to the published price.

History shows, that it is often necessary to have some kind of worst-case crisis, for accelerated adoption of new concepts to happen. So yes, I do agree that systems like that may prove of great benefit when the lights come back on. Sensibly hedging against the chaos of transition is actually not tremendously hard. It just has to happen offline, in addition to building for the future online.