Paedophile hunters.

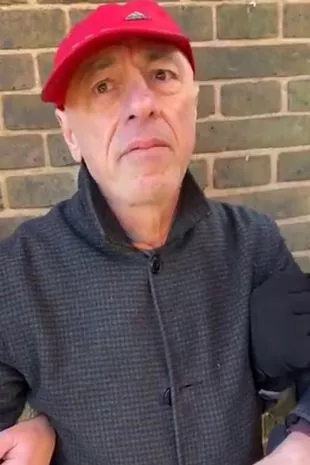

Last week a former Labour Party MP and junior minister of defence was arrested on suspicion of grooming a 15 year old boy following a lengthy sting operation by online paedophile hunters. It has been the most talked about story in Britain, but strangely enough barely picked up by many national broadcasters, including the BBC and the Guardian.

On the day the online paedophile hunters live streamed a sting operation and the moment of the arrest, which lasted around 30 minutes and has been widely shared on social media. It already had 36,000 views and around 3,000 comments that day.

Mr Caplin reportedly denies all allegations against him.

It is believed he was suspended from the Labour Party last year and is said to have denied any wrongdoing. Caplin held two Government posts during his time in office, as assistant Government whip and a junior defence minister and minister for Veterans at the Ministry of Defence.

He is also one of the leaders of the Israeli lobby for the Labour Party and was instrumental in the campaign that helped oust Jeremy Corbyn from his position as Labour leader.

Now this news omission makes more sense. To hear more about the story I would recommend listening to George Galloway’s show in which he hammers home the appalling record of the British state and relationship to paedophiles.

Dragflation

I’ve been watching the UK bond market with apprehension as it’s been creeping up alarmingly.

Last week the interest rate the British government owed on £2.25 billion in 30-year bonds climbed to 5.2%, the highest since 1998. The yield on the bonds rose to 5.25 percent in trading, higher than during the “budget debacle” engendered by brief prime minister Liz Truss’s 2023 proposal to slash taxes and hike spending.

Craig Inche at Royal London Asset Management told the Financial Times;

You’ve probably got a bit of a buyers’ strike going on at the moment...The flood of long-dated bonds amid a weak economy is giving bond buyers pause.

It comes in the background of hovering recession and poor economic data.

Britain’s economy failed to grow in 2024’s third quarter, the Office of National Statistics (ONS) has estimated, and the Bank of England projects that the GDP remained flat in the year’s final three months.

Construction activity grew by 0.7 percent but that was largely erased by a 0.4-percent decline in factory output. The service sector showed no growth. Business was especially poor for ad agencies, law firms, and restaurants.

Third-quarter numbers also revealed no growth in living standards and that households had tapped into their savings.

The ONS also trimmed its second-quarter growth figure from 0.5 percent to 0.4 percent.

Prime minister Keir Starmer who took office in July, warning of economic shoals ahead, including tax increases that took effect on 30 October.

The U.K.’s economy will barely avoid a recession if current trends continue, Philip Shaw, Investec’s chief economist, wrote in a note, adding that the stagnant economy improves the likelihood that the central bank will cut interest rates early this year.

In December, business confidence fell to its lowest ebb of 2024, according to a Lloyds Bank survey. Companies expect sales to fall and prices to rise as 2025 begins, according to a poll by the Confederation of British Industry.

Treasury minister Rachel Reeves is rethinking additional tax increases due in April, a government spokesman said in a statement, adding that “every moment of delay is further damaging business confidence, output, and employment.”

The government has also raised business’s contribution to the national health insurance program by £25 billion.

The higher bond rates come at a time when the U.K.’s economy remains weak and analysts expect it could slump further when new measures of economic health are gathered in March.

Observers also have warned against the dangers of stagflation, in which inflation and higher interest rates jack up prices while economic growth flat-lines. In that scenario, the Bank of England could be reluctant to cut interest rates to spur growth at the cost of fuelling inflation. But it will not be stagflation, rather it is Dragflation that the U.K. will suffer; declining economic growth and rising inflation.