Despite geopolitical turmoil and price dips, institutional investors are doubling down on crypto.

Last week was tense. With the U.S. signaling involvement in the growing conflict with Iran, global markets shivered. But surprisingly, the crypto market didn't see an exodus. Instead, it witnessed a massive inflow of $1.24 billion into crypto investment products—mainly Bitcoin. According to new data from CoinShares, major investors aren’t running scared. They're buying the dip.

Price Drops, But No Panic

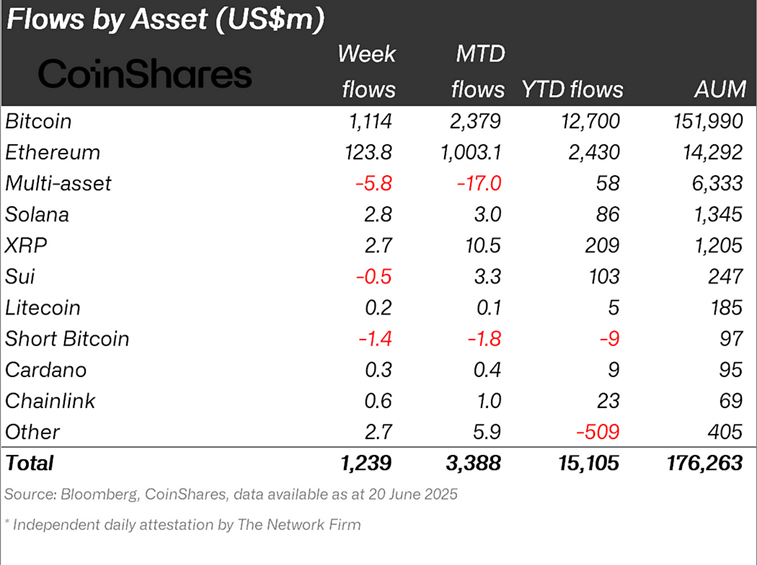

Selling Despite notable price drops for Bitcoin and Ethereum, crypto investment funds remained highly attractive. These funds, available via traditional exchanges, let people invest in crypto without needing to manage private wallets or keys—making them a go-to choice for institutional players. Over the week ending Friday, June 21, crypto investment products saw $1.24 billion in inflows, pushing total assets under management (AUM) from $175.9B to $176.3B.

Bitcoin Dominates Inflows

Bitcoin remains the top choice for institutional investors. Even as its price slid from $108,000 to $103,000, money kept flowing in. James Butterfill from CoinShares explained the sentiment: “Many investors saw this dip as a buying opportunity.” He also pointed out that there was only $1.4 million in outflows from short-Bitcoin products, further showing that confidence in a longer-term rebound remains high.

Crypto ETP flows by asset through Friday (in millions of US dollars). Source: CoinShares

Crypto ETP flows by asset through Friday (in millions of US dollars). Source: CoinShares

Market Sentiment Turns Fearful

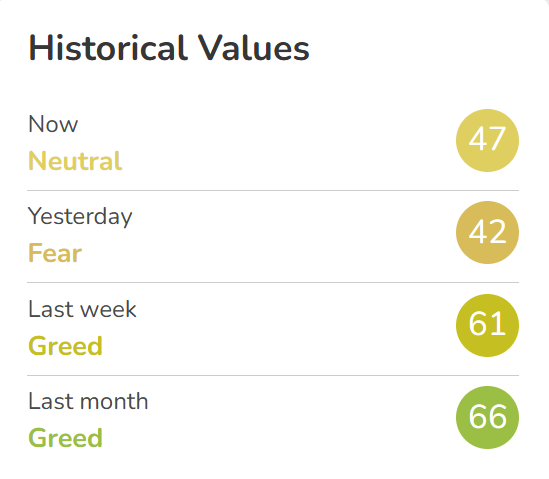

While institutional inflows were strong, general market sentiment took a hit. The Crypto Fear & Greed Index, a popular tool to measure investor emotions, dropped from “Greed” to “Fear” over the weekend. However, by Monday, June 23, the index recovered slightly to 47, shifting sentiment to “Neutral.” According to Butterfill, this cooling off was influenced not just by global tensions but also by a U.S. public holiday, which typically reduces trading volume and market engagement.

Source: Alternative.me

Source: Alternative.me

Source: Alternative.me

What's Next?

Will this rebound in sentiment continue? Can Bitcoin regain strength after the recent dip? Most importantly—will inflows into crypto investment products continue if geopolitical risks stabilize? For now, one thing is clear: institutional investors are not backing down. If anything, they're doubling down while others are still fearful.