The Nasdaq-listed company pivots away from Bitcoin mining to focus entirely on Ethereum—investors seem unconvinced.

In a bold move that bucks the current trend of corporate Bitcoin accumulation, Bit Digital has officially announced a full pivot away from Bitcoin mining. Instead, the Nasdaq-listed tech company will now focus all its efforts on Ethereum accumulation and strategy. The news, however, hasn't been warmly received by the market.

Source: Bit Digital

Source: Bit Digital

From Bitcoin Mining to Ethereum Accumulation

On June 25, Bit Digital issued a press release confirming its strategic shift. The company, which trades on the Nasdaq under the ticker BTBT, has decided to cease all core operations tied to Bitcoin and reorient its business entirely toward Ethereum.

Bit Digital previously operated as a Bitcoin mining company, while also offering advanced computing services for technologies like artificial intelligence. Going forward, the company plans to mine and accumulate Ethereum, reinvest mining revenue into ETH, and raise funds through equity sales to accelerate this new Ethereum-centric strategy.

Not the First to Back Ethereum

While most headlines focus on companies adding Bitcoin to their treasuries, Bit Digital isn’t alone in choosing Ethereum instead.

Earlier this year, BioNexus Gene Lab, a biotech company based in Asia, revealed its own Ethereum-first strategy, shifting its reserve assets toward ETH.

Even more notably, Sharplink Gaming, a major player in sports betting tech, has gone all-in on Ethereum—investing over €400 million into the asset, making it the largest corporate Ethereum holder. The company believes Ethereum, not Bitcoin, holds the key to the future of digital commerce and utility.

Market Reaction: Confidence or Concern?

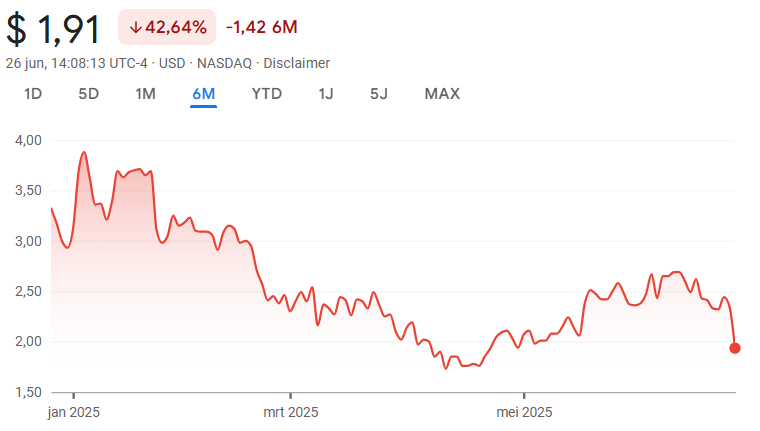

Despite Bit Digital’s announcement, the market response has been decidedly negative. According to Google Finance, BTBT stock fell 16% on June 26, opening at $1.93. Over the past month, the stock is down nearly 25%, and it has dropped 34% since the start of the year.

Interestingly, this decline follows a brief recovery: the stock had rebounded from a low of $1.76 on April 21 to $2.69 on June 11, almost approaching its year opening price of $3.33. Whether the new Ethereum strategy can reverse this longer-term downward trend remains to be seen.

The broader market doesn’t explain the drop either. On the same day Bit Digital stock sank 16%, the Nasdaq index rose by 1%. Additionally, Ethereum’s price fell by about 1.5% on June 25, while Bitcoin actually gained—a further challenge to Bit Digital’s timing and positioning.  Source: Googlefinance

Source: Googlefinance

Final Thoughts

Bit Digital's Ethereum pivot reflects growing corporate interest in Ethereum as a platform with broader utility than Bitcoin. But for now, investors appear skeptical. Whether this is visionary strategy or premature risk will depend heavily on Ethereum’s performance and adoption in the months ahead.

Hello.

It appears that significant parts of this writing are machine-generated.

We would appreciate it if you could avoid publishing AI-generated content (full or partial texts, art, etc.).

Thank you.

Guide: AI-Generated Content = Not Original Content

Hive Guide: Hive 101

If you believe this comment is in error, please contact us in #appeals in Discord