Hi investors,

It's been an extremely eventful week in the crypto space.

- Bitcoin establishes new ATH above 24k

- Ledger customer database gets leaked

- Stripe announces Treasury

- Ripple gets sued by the SEC for selling XRP

DISCLAIMER: This content is not financial advice and only represents my personal opinions.

Always do your own research.

Let's dive in!

Bitcoin Market Update.

BTC is trading at $23,358 USD at the time of writing, we're up +218.27% YtD and +19.92% since last week with Bitcoin briefly breaking above $24k before pulling back to current levels.

Not bad.

The market is looking somewhat toppy though as we've yet to have any solid corrections since the first week of September but let's just say that this rally could also go higher, it will ultimately depends on the news and the macro background.

Right now, the backdrop is just tailor-made for Bitcoin.

The 60/40 portfolio is in bad-shape and these 40% of bonds are looking for a new home. Equity? Crypto? Gold?

Source: XE

Also, we've got Mondern Monetary Theorists in the White House (I see you Stephany Kelton).

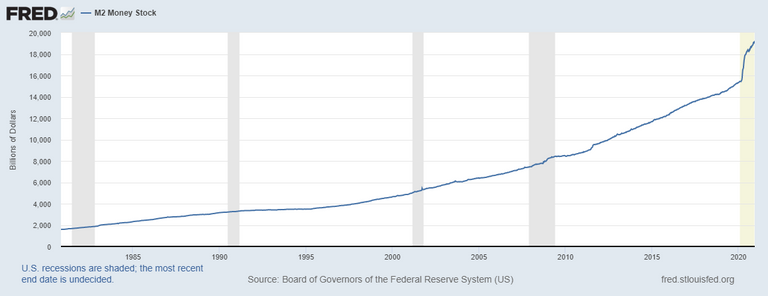

This means that you can expect more fiscal stimulus/deficit next year as the Biden administration tries to kick-start the economy with printed money and inflate the US debt away.

Corollary to the ballooning of the money supply is the broad realization that cash has become a terrible store of value.

With two digital-native generations (Millennials and Zoomers) now active in the workforce and keen to store their savings in crypto, you’ve got the perfect set up for a generational transfer of wealth towards those holding scare digital assets.

Digital scarcity just makes sense for those who grew up with the internet.

Finally, there's the Bitcoin narrative, which is just irresistible:

Capped supply? ✅

Self-sovereign bank account in cyber-space? ✅

Digital gold? ✅

Asymmetric risk/reward aka my-only-decent-chance-at-retiring-before-I-turn-85? ✅

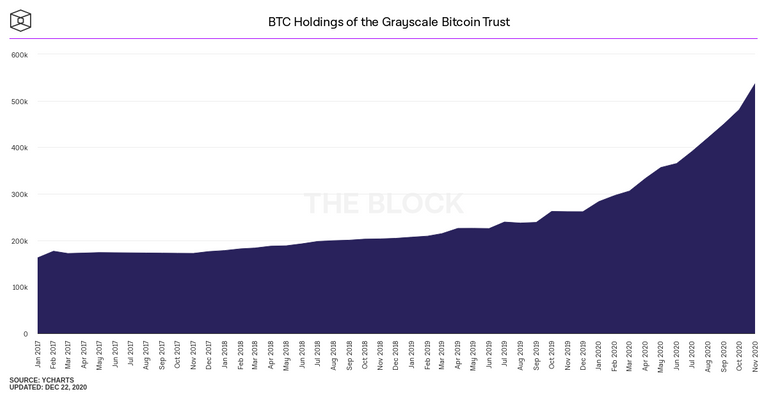

Institutional buy-in? Happening 📈

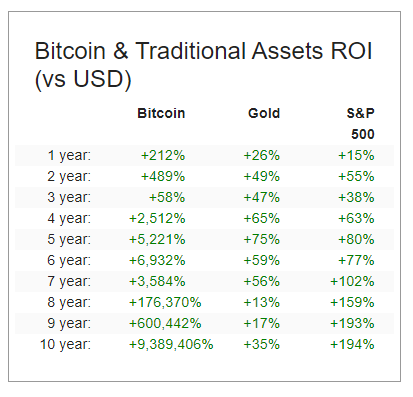

0.1% fiat-denominated savings accounts just can't compete with an asset that performs over 200% in a year.

And while past performance is no guarantee of future returns, many will take the chance of asymmetric rewards against the certainty of loss.

The result is a rapid monetization event amplified by internet meme culture and Bitcoin’s ponzi-like economics.

Bitcoin just looks unstoppable right now.

Bits and Bytes.

Over 350K home addresses, names and phone numbers belonging to LEDGER customers got publicly leaked earlier this week.

If you own a LEDGER wallet, your funds are safe. If your personal details are on the leaked list though you now got to live knowing that some bad actors might know that you hold crypto...and where you live.

Here's LEDGER CEO Pascal Gauthier talking about the leak on the What Bitcoin Did podcast:

This whole affair is a sad reminder that being your own bank is hard and that you should never-ever disclose your home address for crypto related acquisitions.

Here's what you can do to self-custody your crypto securely:

This whole affair is a sad reminder that being your own bank is hard and that you should never-ever disclose your home address for crypto-related purchases.

Here's what you can do to self-custody your crypto securely:

Read this article.

Follow the 10 Commandments of Bitcoin (most of these apply to any crypto assets).

Learn about the Dos and Donts of Crypto Key Management.

Get a Password Manager (like LastPass) and 2FA on all your email addresses.

Install privacy tools in your browser.

Don't order crypto stuff at your home address.

NEVER SHARE YOUR 24-WORD SEED PHRASE TO ANYONE (that includes LEDGER employees)

Consider getting one of these:

The last one is a joke obviously but you get the idea. It’s important you take online and personal security seriously, there’s a reason why banks and iron vaults were invented in the first place

Now on to the next piece of news.

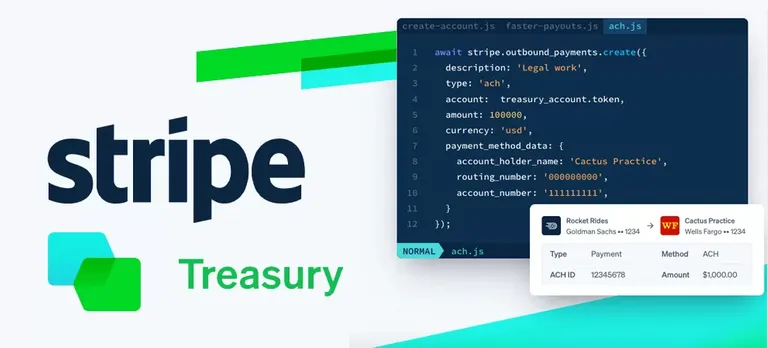

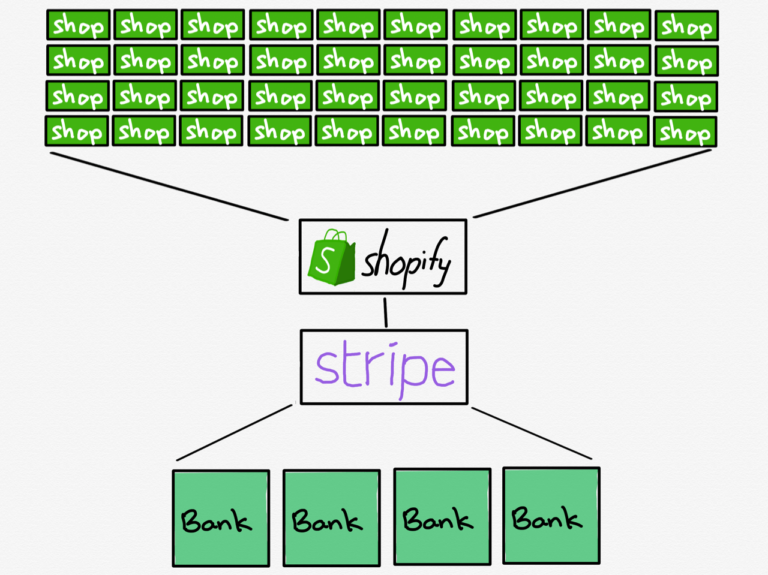

Stripe recently announced the launch of Treasury, a banking-as-a-service API which allows its users to integrate banking tools directly into their platforms.

The banking back-end and liquidity will be provided by a number of financial institutions including bulge brackets banks Citi and Goldman Sachs.

Stripe has already secured an impressive partnership. Earlier this year Shopify announced that it's working on integrating Treasury into its the Shopify platform. The result will be called Shopify Balance and it will allow Shopify merchants to open a commercial bank account directly within the Shopify app.

Pretty cool.

Source: Stratechery

This type of integration was actually predicted by ex-CTO of Goldman Sachs Martin Chavez back in 2019 in this fascinating interview on The Scoop which I highly recommend you listen to:

Here's Chavez making predictions about the future of banking:

There's going to be more software in the future than there was in past.

[...]

The whole financial ecosystem is reinventing itself around API boundaries. The new question that matters is "where are you going to be the very best provider of a service that's encapsulated by an API?".

And in other places you probably need to be an astute consumer of a service that's provided by an API.

Spot on.

As on cue, we’re seeing legacy institutional players leveraging popular platforms like Shopify to expand their banking operations to retail customers via APIs.

Software is eating the world and it’s now the turn of banks.

It's also a reminder for us crypto enthusiasts that not all the internet of value is being built on public blockchains like BTC and ETH.

Legacy systems like banks are digitalizing fast and they are still very much in the race to provide seamless payment rails to the world.

Next.

Steven Mnuchin, the US classiest Treasury Secretary is pushing for some eleventh hour anti-crypto regulation.

Proposed via FinCEN (the agency in charge of fighting money laundering in the US), the rule is similar in spirit to the Swiss implementation of the FATF Travel Rule.

Virtual Assets Service Providers (VASPs i.e. crypto exchanges and other regulated institutions) have to collect KYC information about transactions to self-hosted crypto wallets (when the tx is greater than $3,000) and to other VASPs (when the tx is greater than $10,000).

In such cases, VASPs must “obtain and retain the name and physical address of the counterparty of a [crypto] transaction” i.e. the recipient of the transaction (!!)

WFT?! Have we gone mad here?

How do you accurately establish the identity and physical address of the recipient? Hint: Unless the sender and the receiver are the same people, you often can’t.

If KYC information cannot be established then there’s a chance that VASPs will make it altogether impossible for their customers to withdraw to self-hosted wallets rather than risk being found non-compliant.

Even if they could, do we really want VASPs to collect and build huge honeypots of KYC information about people behind addresses? What if this information gets leaked like what happened with LEDGER?

Anyone in possession of such information would not only know the names and physical address of crypto holders but also how much they hold. Remember this is crypto and you can easily look up wallet addresses and find out how much they contain.

What about (self-hosted) wallet to (self-hosted) wallet transactions, could those also be governed by the rule one day under a broad read of the law?

As Jeremy Allaire noted on the Laura Shin's Unchained podcast, this is a botched regulatory job which is being rushed out of the gates by a departing Treasury Secretary with personal animus against crypto without discussion nor coordination with industry participants.

If adopted, not only will it add extra compliance costs to VASPs without meaningfully delivering tools to achieve its AML goal, it could also significantly encroach on the privacy of honest holders and put them at personal risks of physical attacks.

Sigh.

Get used to it though, regulation of the crypto industry is just getting started. I just don't see it slowing down under an interventionist-prone Biden administration and the rest of the Western world will pick cues from the US as always.

Say what you want about Donald Trump but the crypto industry was left (at least to this point) “relatively” to its own devices for 4 years and produced some great regulatory developments such as the OCC authorizing US chartered banks to custody crypto.

One can only wish that the next administration learn about the subject matter and engage into constructive dialogues with the industry before bringing the hammer down.

Speaking of regulation, I've kept the best for last.

The US SEC has filed a complaint against Ripple and top executives Brad Garlinghouse and Christian Larsen for selling unregistered securities.

The unregistered securities in question being XRP coins.

The market immediately dumped on the news.

Interestingly, XRP-copycat Stellar also dumped though in a less spectacular fashion.

This is not surprising, Stellar founder Jed McCaleb also co-founded Ripple with Chris Larsen and there might be some nervousness in the market that Stellar might be next on the regulatory chopping block.

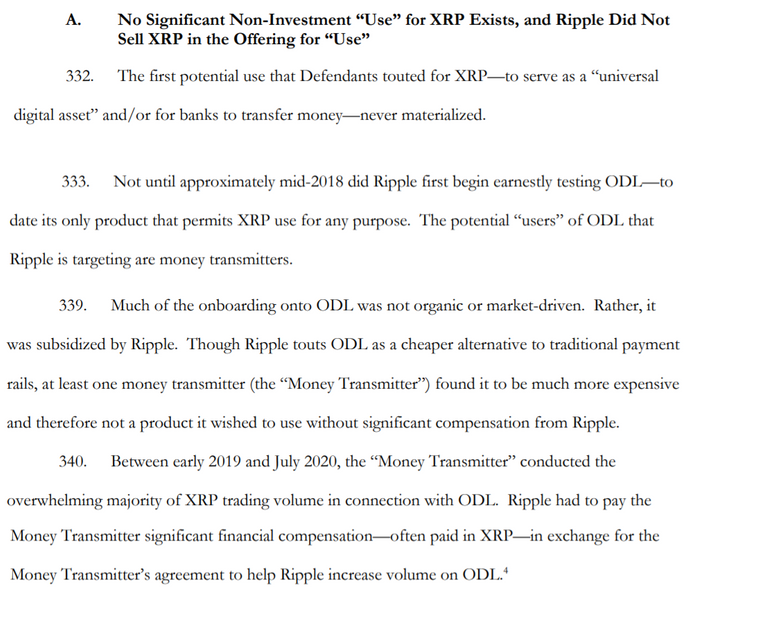

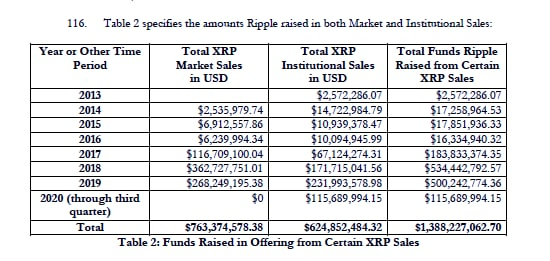

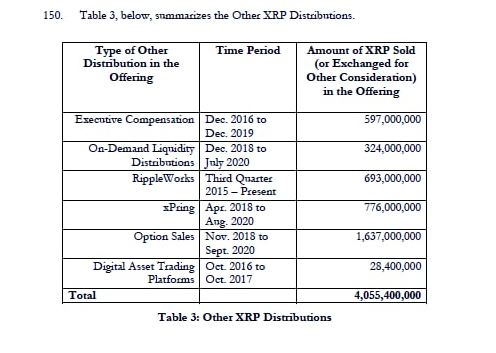

The SEC filing against Ripple et al. is a brilliant summary of what everyone except brain-washed XRP holders already knew about the asset:

XRP was created by the same people that founded Ripple.

After creating the company, they "gifted" Ripple (the legal entity) 80 billion XRP and kept 20 billion for themselves for their personal enrichment.

Ripple's only reason to exist is as a distribution mechanism for XRP.

Since it inception, Ripple has engaged in a 7-year long pattern of market manipulations, coin dumping and phony partnerships with the goal of faking adoption and pumping the price of XRP.

Most of the payment solutions developed by Ripple don't need and don't use XRP.

The only Ripple solution that does use XRP is called ODL (On-Demand Liquidity aka xRapid).

ODL development only started 2 years ago. The solution never caught on and Ripple has had to pay its customers (with XRP!) to incentivize them to keep using the platform so they could keep claiming growth in adoption in their marketing material.

To sum up, Ripple's attempts at meaningfully integrating XRP into its software business never materialized. Meanwhile, Ripple never made money commercializing its other payment solutions so the firm had no choice but to keep selling XRP to funds its operations. They did it for years, to the great personal benefit of its founders. This ultimately caught the attention of the regulators and here we are now

Frankly, they had it coming.

Sadly, I think it's also unlikely that the filing will end up in a trial. Instead, you can expect some form of settlement between Ripple and the SEC followed with a Ripple announcement which neither confirms nor denies that XRP is a security.

Ripple will eventually resume business-as-usual with or without XRP.

Whether XRP itself will end up being delisted from exchanges is also unclear at this point. What's likely is that the lawsuit will certainly get in the way of any institutional adoption as I don't see many banks willing to risk touching ODL and XRP while the lawsuit goes on.

Already we’re seeing institutional players distance themselves from XRP. Bitwise, a crypto index provider just announced that it was pulling XRP from its Bitwise 10 Crypto Index Fund (BITW).

As for me, I won't miss Ripple if the company goes down, I have and will never hold XRP and I think Ripple is a shameful sorry excuse of a company driven by lies and greed.

Anyways

See you next weekend for more market insights.

Until then,

Merry Xmas 🎄