As interest in cryptocurrency grows among institutional investors, global investment banks, like Goldman Sachs and JPMorgan Chase, are reexamining their views about bitcoin.

Goldman Sachs is hosting a call for its clients to learn about the implications of current policies for bitcoin, gold, and inflation.

This follows Paul Tudor telling its clients that he has “almost 2% of his asset in it”.

Sharmin Mossavar-Rahmani, Goldman Sachs’ head of Investment Strategy Group and chief investment officer for Wealth Management, will host the event.

Two economists will present:

- Furman, former chairman of the Council of Economic Advisers and professor at Harvard Kennedy School (HKS)

- Jan Hatzius, Goldman Sachs’ chief economist and head of Global Economics and Markets Research. According to the firm, Hatzius is also a two-time winner of the Lawrence R. Klein Award for the most accurate U.S. economic forecast, including during the global financial crisis.

Grayscale Investments’ products. The company revealed that the majority of its record-high investment in the first quarter (88%) came from institutional investors, dominated by hedge funds

Many people in the cryptocurrency community view this as a bullish move for the industry

Some good tweets I found were:

“Bitcoin is inevitable, all who have gone against it are now being forced to kneel, first JPMorgan, now Goldman Sachs,”

Or “Even banks realize fiat money is losing value … The race is on,”

Therefore, Hedge Funds and Bank clients begin to realize that even USD is no longer a safe-haven. This is what happens when you make the money printer go “Brrr” !

The finance industry is very worried about the constant monetary expansion done by most central banks. It is kind of a schyzophrenic relationship as investors love it in the short term but they know that it is not a solution in the long run.

Most investors know this is actually making the problem worse.

These monetary injections are often compared to a drug addict one's...

Money is 99.99% trust… and governments are losing it.

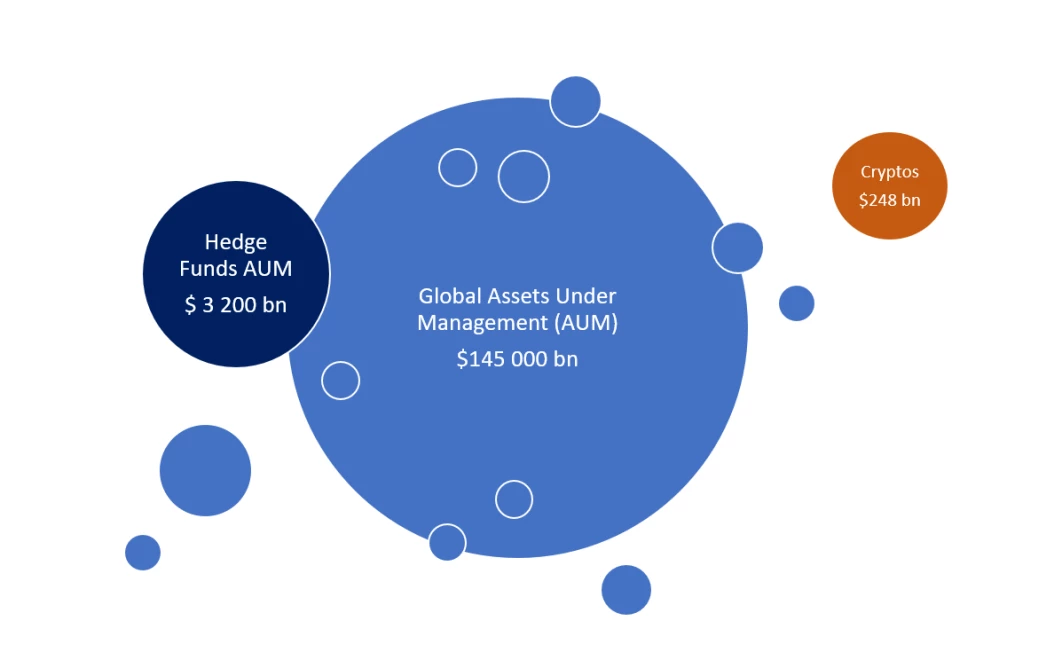

Currently Hedge Funds are the only ones genuinely looking to add this asset to their portfolio as an inflation hedge.

If they would follow P.Tudor and put 2% of their assets into Cryptocurrencies, that would mean >600bn flowing into cryptocurrencies.

Tripling the current Cryptocurrencies Total Market cap

Let’s hope this Goldman Sachs' call will help crypto adoption in the Hedge Funds community!

➡️ UpTrennd

➡️ Publish0x

➡️ Hive

➡️ Twitter

➡️ Facebook

➡️ Be paid daily to browse with Brave Internet Browser

One word: HODL

Be happy that you did 5 years from now. :D

If only I had stick to this...

My belief in Bitcoin and crypto keeps getting stronger by the day. With time the ones that have gone against BTC calling it rat poison will be proved wrong.

Where is Warren Buffet, is he watching?

Buffet is a great investor. He has been quite bad for the past 10 years, he invests in the old economy as he clearly stated he does not understand the new one.

Let’s enjoy the new economy together 🤪

Lots of panic in the financial world as the printers keep Brrrrrring the money. Interesting to see more people.talking about cryptocurrency as hedge, securities and all that fancy stuff because this signifies the mainstream potential on the horizon.

They are getting down the rabbit hole aren’t they !? 😇

Once you go crypto, you can't go back