f93c66938df0d4990ccd5c45ec38c73d01cfb637

Proposal: DAO Deposits Stable Coin to HBD Savings, using Interest to buy & burn DEC daily

This proposal is a response to the previous failed proposal by bulldog that suggested the DAO spend 500k to acquire DEC. Instead, I propose the following:

Proposal:

- Convert DAO Stable Coins (equivalent to 250k USD) to HBD.

- Deposit 246k HBD into savings. (Why less than 500k as per bulldog's prior proposal? Answer: This keeps the DAO diversified, and allows for others to propose alternate uses for the remaining stable coins)

- Currently, HBD offers a 20% Annual Percentage Rate (APR).

- Earn interest on the deposited HBD.

- Divide the earned HBD interest by the number of days in the month Divide this then by 2.

- Use half the calculated amount to purchase and burn DEC from the market each day.

- Use half the calculated amount to purchase and acquire DEC for the DAO Treasury.

- Use 4k USD HBD to immediately commence the daily buy and burn, over a 30 day period until subsequent interest is received for the following month this would be ~133 HBD or thereabouts per day

Proposed scenario

Considering the current HBD APR and a proposed 246k USD in HBD, approximately 133 HBD of DEC would be burned per day. At the time of writing, this would result in buying and subsequently, burning 75,000 DEC on the first day and adding 75,000 DEC to the DAO, if that day was today.

The second day would see similar buy and burn pressure. To avoid "prediction" or gamification of the timing of the buy, a random number generator should be used to determine each day's time of purchase so it is not able to be predicted or "front run" by people intending to manipulate the market.

To ensure immediate implementation, we deposit only 246k USD and use the remaining 4k as a "Seed" to start the daily buy-burn process as soon as possible after the approval of this proposal.

If, on any given day, DEC is > 0.00095 USD, the excess HBD compounds into savings, earning a return for the DAO.

It is important to also note that the DAO shall acquire these funds in a way that is not likely to spike the volume of HBD in any given day, meaning the buy order and deposit into HBD savings would staggered.

Benefits:

- Consistent removal of DEC from supply when below peg.

- Earning returns on stable HBD balances through the HIVE blockchain HBD APR when DEC is at peg.

- The DAO retains 246k USD in HBD Deposits

- Growing the DAO Reserves in HBD when DEC achieves peg.

Downsides/Risks:

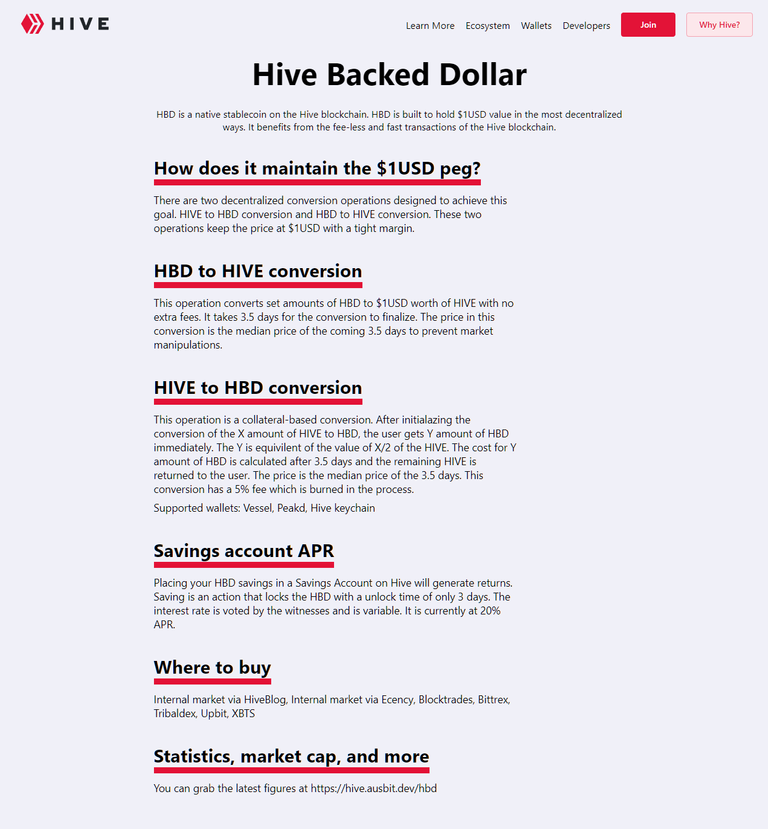

- Difficulty in understanding the mechanism of HBD APR and its integration into the HIVE blockchain. For more information on HBD, refer to this link.

- Potential future decrease in the HBD APR below 20%.

- Possible decoupling of HBD from its peg.

- Funds locked for 3 days, making them inaccessible in case of emergency capital needs for the DAO.

- Lower liquidity of HBD compared to other stable coins, requiring a measured, multi-day, or multi-week approach for entry and exit from the position.

- Decreased future demand for DEC, resulting in HBD interest being used to purchase and burn a constantly declining asset.

- Potentially a labour intensive, manual process for the DAO; but arguably one that could be automated via the use of robotic process automation

Assessing Success:

- Returning DEC to its peg.

- Maintaining DEC stability over several months.

- Seeing a material, consistent increase in the DAO's DEC balance

- Activation of the SPS Flywheel, leading to a decline in circulating SPS supply and an appreciation in its value as it becomes scarcer.

When to Stop:

- The DAO would need to agree on a future proposal to withdraw funds from HBD savings and decide how to utilize them.

Transparency/Funding for this Proposal:

@holoz0r personally funded this proposal.

Thank you for your time. Please maintain a civil discussion in the comments. Remember, I won't be emotionally affected if you disagree with my proposal.

This image of Zyriel is here to remind everyone that Splinterlands isn't Life and Death. :)

If you don't know what HBD is, and you didn't click the link: https://hive.io/hbd/

Thank you to those who provided feedback on this proposal prior to it being published. I have made some modifications to take into account all of your suggestions in a balanced manner. Your contributions of feedback and wisdom are appreciated and valued.

My main concern with this is the ability to actually acquire that much HBD. If anyone has any suggestions or advice about how to convert that amount of stables into HBD efficiently please let me know.

The liquidity of HBD is not optimal, and achieving this would likely require a longer period of time. One possible approach could involve utilizing the HIVE internal markets. To accomplish this, we would convert the stablecoins into regular HIVE and then use a script to purchase HBD on the internal market.

To minimize fees, we could consider exploring over-the-counter (OTC) transactions for converting USD stablecoins to HIVE. However, implementing this process through the DAO might present some challenges that need to be addressed in order to reduce fees effectively.

Yeah, whatever method, it it will take time.

Hey mate, the longer this proposal is on the table, the more I worry about this point. To ensure liquidity is available to enable the swap, it would take many days or weeks to obtain the HBD throughout the enactment of this.

It is problematic, and I may end up voting against(!) my own proposal if this proceeds to a full proposal.

I'm certain that there is enough long term liquidity of HBD, but it certainly won't be available all in one hit.

I'm was on the fence but I'm going to vote for it after reading that bit. You've earned my trust. ;-) Even if you did say "get DEC to peg"

I don't think liquidity plays any role here.

When you use the conversion tool from HIVE to HBD you create those HBD burning those HIVE (and viceversa in the other way), adding/removing tokens to/from circulation.

It's all about inflation and balance between marketcaps of the two system currencies this blockchain has.

Also this,

https://peakd.com/hive-13323/@dalz/rxdxls

And this,

https://peakd.com/hive-167922/@dalz/hive-inflation-for-may-2023-the-hive-supply-reaches-400m

Correct, but that would require Stable Coin -> HIVE -> HBD - which is fine by me, but some stakeholders may not understand these mechanisms and elect to vote not in favour of the proposal.

This is why I listed this as a risk.

We can reduce the HBD supply to be add in savings to start with. For example start with 50K HBD (instead of 250K) and in future add more if suitable.

Yeah, it doesn't need to go in all at once. The key to this proposal is long term sustainability and trying to get the DAO an "income" from interest once DEC hits peg.

There is a bHBD and BUSD pool on cubdefi by @leofinance. Though the liquidity is not that high but total amount can be split into 50 or 100 equivalent orders and swaps can be done at regular intervals. This will also give pool time to come to par value as arbitrage bots will do the opposite.

Unfortunately, I found out that they do not back bHBD with actual HBD, so you cannot convert it back to real HBD. I tried unwrapping a small amount of bHBD to HBD around a month ago and they still haven't gotten it to me and told me not to unwrap more because they don't have it. It is extremely unfortunate and I would not use this for SPS DAO funds in any way.

That feels sketchy of the pool.

We could use the conversion mechanic built into the blockchain itself, but then if the DAO wants to exit the position in a hurry, it is a bit problematic to do this without then crashing the HIVE price.

Alternatively, if there is sufficient faith in HBD and the HIVE eco system, the DAO and its various stakeholders could see this as a pretty sweet asset. Others, who dislike stables, might see it as a liability, but my view is this is something we can do with idle funds to earn a return, and over the long term, do meaningful things to increase the DAO's financial position.

I'm sure this would be met with potential arguments of "at what cost", but I feel as though that predicting something that distant into the future is a game of folly.

Would you be willing to clarify a bit on this?

@khaleelkazi

This is a long running issue I raised too, amongst others. The actual process works fine minting and burning bHBD when there is liquidity. However the LEO finance team minted their own bHBD without a HBD deposit, the reason provided was for arbitrage opportunities, but that doesn't make sense to me, you can trace where it all went on the blockchain. Eventually it appears to makes its way to binance where you can no longer see where it went.

Its s shame we don't have a decentralised wrapped hive, and HBD. Perhaps the witnesses can crate a multisig system, so its not reliant on one key holder. Maybe once the L2 Eth chains take off after the next upgrade would be a good place to launch something like that.

Thanks for this information.

In their communication, they said every bridged coin will be backed by the native coin.

So it's not the case.

That explains why I always have the issue with Leofinance bridges recently when converting from BSC to HIVE and versa.

There are BUSD and BHBD pools on cubdefi now. So there is a way to aquire the HBD but the DAO would have to do that in portions so the HBD price stays consistent. Liquidity is low on HBD but there is room for more. There is about 100k HBD that can be bought per day if you use all ways of swapping or trading. Possibly the buy can be done with daily purchases in the 10k 25k range. It would take about 2 weeks to aquire the needed HBD but we can put the first portion in savings immediately.

i did see the live composition of the proposal and i find to be a good one and my vote are yes !!!

Thanks mate

I will support this as it supports the block chain that our game is run on and it's also not yolo'ing Dao reserve funds into something that would most likely not work and backfire with the end result being that if the Dao every needing quick funds it would have to dump dec on us and tank the price. This would give dec a permanent amount that is burned repeatedly. If we have a couple more things like this that are constant such as the new market fee and such then we have a constant burn and reduction of dec supply in a sustainable manner with way less risk. If hbd and hive were to fail then we would be screwed anyways seeing as we are run on the chain and would have to fork again. Thanks for the dec burn required for this proposal. If you voted for the last proposal then this should be a no brainer "yes" vote since it "Dec to peg" positive. Unless of course people just want to be mad that their other proposal didn't pass.

I voted against the other proposal due to the reasons you outlined in the first sentence. Decided to put my mouth where the money is and self fund this proposal that built upon the intentions of the first one.

It seems like a legit plan to me so I voted yes, but I don't understand why 50% are voting no.

Early days in game.

The general concept of moving stables to HBD is good for DAO and good for Hive Blockchain. I'm fine with the total amount of ~$250K, but as other commenters have pointed out, stretching out the investment over time would be the best approach.

Absolutely.

aside from all the scary stuff - this proposal is no different than a company buying back stock, sure it may inflate prices but the only thing that will actually get the fly wheel going is eliminating all sources of DEC outside of burning SPS (aside from rentals and sales of course) and pricing everything in DEC - even then: until we have card-staking on land the card market is so diluted that the spending and accumulation of DEC may not get us back to peg immediately

The whole point of this is to not get it to peg immediately, but to create long term, sustainable buy pressure while also growing the DAO's reserve in the event that DEC reaches peg.

This is about long term sustainability.

I like this, it's a balanced hedge that is sustainable and makes the DAO work for the benefit of all while not placing as much risk and doesn't invite bad actors to exploit as the benenfits will be gradual and ongoing. I also appreciate that you took the time to actually respect the DAO and not want to throw all our Stable Coins at this idea and leave 50% for other proposals that would seek to improve security of the Dao via diversification. And the benefit gained from this proposal cannot be interpreted by or correlated to your weight or position in terms of your holdings. Really appreciate this effort @holoz0r. You have my SPS in support. It's not often I give a Yes to a vote, pretty sure this will be only my 3rd or 4th!

I appreciate your input on this. It's a compromise, and some feedback I heard the other day was that "the only thing wrong this is is that its too sensible".

I had the same thought when bulldogs proposal failed. HBD could be a steady income for the dao and even make it possible to buy other assets with the proceeds. The liquidity thing is an issue but it is possible in several smaller swaps and buy orders. HBD stabilizer is doing quite an ok job.

Thank you, solymi! I appreciate your wisdom and family friendly response.

Always trying to stat family friendly 😇

All the love from lake Balaton 😍

First of, I appreciate the initial idea!

My main concerns about this proposal is the required work involved to do the trades. When I heard about the idea that a DAO representative should do this, I've got this weird feeling of centralisation. If it would be a one-time thing, I guess it wouldn't be a big issue, but since the liquidity of HBD is already somewhat low and requires continues buying and the daily selling of HBD and buying of DEC requires that as well, there would def. need to be a script written. And then the question is: who does it and who reviews said script and who is running it?

Another issue I have is the amount of 250k, which is a big sum. I would feel more comfortable with something around 50k to 100k to start out.

I understand that the proposal system as it exists right now only allows for yes/no votes and as I said in the beginning, I appreciate the initial idea, but right now, I'm not confident about the current plan as it's published here.

It could be turned into a bot-like operation, for sure. We have much more complex tasks being done in an automated manner by various HIVE bots and market makers and other people. We have the tech.

I'm personally not fussed if it isn't 250k; but many members in the community think this proposal is "too cautious", or "wouldn't do enough" to "immediately" prop up the price of DEC.

My underlying goal with this proposal is to have a sustainable income for the DAO once DEC reaches peg, and in the intervening time period, an equal measure of DEC is removed from supply, and added to the treasury.

As I mentioned in the proposal, I'm not emotionally attached to it passing or failing, it is simply a concept, and if people want to tweak this further, should this one fail, then they are more than welcome to create their own proposal, and I'll likely support it. :)

I'm not sure if this proposal will need more refinements or more specifics (exact timeline to buy in, as one example needing a more specific answer) but it more or less addresses my main concerns with the previous proposal. So it's a yes for me.

Sure, I'm happy to clarify with a representative (or agent) of the DAO should this be approved in order to implement the mechanics in a sustainable manner.

I don't understand how the 20% is earned. Is it newly created HIVE or does it come from fees? I also don't understand how the peg at 1$ is maintained. To me it sounds unbelievable that a system that pays out 20% APR and holds an a peg at 1$ by algorithm can be safe and ungameble. I feel we put the DAO assets at risk and 50% is too much. Can anybody untie the knot in my belly with a good explanation ? :)

Here is the full explanation: https://hive.ausbit.dev/hbd

before I could consider a vote either way, I need to see the numbers for DEC. Sure, it moves in the proper direction with this, but based on current supply, what is the timeline that you anticipate DEC getting to peg from this proposal?

I personally do not know enough about HBD, what holds it in place and all that. But with it being an algo based stable, definitely makes me a bit nervous. So leads to the question if the risk is worth the rewards where the rewards are potentially getting dec to peg sooner and dao making interest income.

There's no way to know as there are many other factors that may push DEC to peg. Land 1.5, the recently proposed proposal to allow DEC burning into soulbound cards, riftwatchers in DEC, future changes / editions being released. There's too many variables.

The only known numbers are those I calculated (and included) in the initial proposal at the time of writing.

I like it - better to earn with money siting idle

As a hive stakeholder, this will get my vote. I am willing to give it a try.

Cheers. Thanks for your emotional support in the past where I may have had outbursts of uncertainty.

I haven't kept up with much SPL (or any other) news lately but on the surface that looks like a great idea.

I love this idea and I will vote yes for it.

However, when I read all the comments, I also have the same concern about how to get enough HBD and the impact on the market.

You probably don't need to worry, it doesn't look like it will pass. That's okay. I'm looking forward to what alternatives the community may offer in future proposals.

Love this one, I hope this one will pass. Lately I'm getting discouraged by some of the community's decisions. Good luck.

We'll just have to wait and see. I won't be upset if the community doesn't support it, but I feel like it is a balanced and fair proposal.

That better not be Italian for placenta!

i think its a palace in athens 😆

I wasn't initially sure about this due to my lack of understanding around HDB liquidity (or specifically the swap functionality) - thanks to our discussion in MavChat I'm fully on board with this suggestion.

Jarvie's comments above add a great deal of detail to this , as well.

sounds like @holoz0r has been spruiking. Has he been spruiking? Floor need mopping now? All clean.

I like the balance between risk and profit. I vote yes.

I tried to come to something balance, I'm glad you see it that way.

Sounds like an interesting proposition.

Cheers

Personal remarks on this proposal: Blockchain sleuths may note the irony of me publishing this proposal and only recently commencing a withdraw from my own HBD savings for my total HBD balance.

In the interests of complete and total transparency, this withdraw is taking place in order to fund several upcoming expenses in my life which include:

I don't even own scrabble

I think they were my first domino pieces cause we were poor and couldn't spill werds gooder.

that really made me rofl 😁

My first reaction was to vote against this. I like Hive as a chain for running Splinterlands but I'm not particularly interested in it for investing reasons.

Still, as long as Splinterlands is around, it's somewhat safe to assume that Hive will be around as well. So I don't feel like we increase our overall risk too much by doing what you propose and I feel like the proposal is fleshed out well.

You have my support.

Thank you for sharing your opinion. I think we are all aware of the incredibly strong connection that links the success of hive and splinterlands together.

You have my vote. Would getting rid of some BUSD as part of this be an idea?

I'd say that if the DAO holds 3 stable coins in equal value, it would be an equal percentage of each in order to ensure that there is deleveraged risk from each stable coin it holds.

Alternatively, if the distribution of the dao's stable coins was

40 A

20 B

40 C

You would see an equal measure taken from each stable, except in the situation where it is already HBD. Thanks for adding this as a technicality to the proposal and enriching it with your question.

It's the first point.

True, but the DAO has more than one stablecoin. The reason I a mentioned BUSD is that since SEC intervention with BUSD and possible classification as a security (also due to lack of clarity from their issuer Paxos), the risk of keeping BUSD has grown.

i don't really understand where the difference is from previous proposal. yes, i understand that purchases etc. are better regulated, but at the end of the day, hbd holders can now use the liquidity to finally get out of hbd. because the current situation there is even worse because the demand there is much lower than dec. or am i seeing something wron?

so why is it better to give liqidity in hbd than in our own ecosystem?

HBD is consistently trading at its intended peg, which means that there is no need for additional liquidity to exit it. Anyone who wanted to exit HBD would have already done so. This situation is different from Splinterlands, where people bought DEC at 0.7 and could sell it at 0.95, as mentioned in the previous proposal. With this new proposal, the interest gained would be utilized to fund DEC buybacks.

Thanks for adding the clarification here :)

The Interest component means that there is continual investment into Splinterlands tokenomics while also having the cake available in HBD form.

I was anti the 500k into DEC proposal but this one I am for because it addresses the issue of not being diversified and aims to sustainably help the eco system rather than a one off boost.

Please consider editing to allow the team more wiggle room on the transaction side of things. e.g. buy happens once a week not daily. This is just to reduce their work load and unless automated daily may not be possible.

Yeah, I'm happy with that, as well. I don't really mind how it is done, it is that a move like this is good for the reasons outlined in the proposal.

This has my vote. I had a similar idea circling in my head for a while. However, I'd prefer if we didn't burn the DEC and just held it until we have a healthy market and vote on what to do with the extra DEC. I'd rather see the extra funds in the DAO but overall it's a win and helps up get closer to peg and the flyingwheel that will be burning a lot of SPS for our DEC.

I like the 50/50. Creates a world where those who wanna burn, and those who want to accumulate each get a slice of the pie.

has my vote

Cheers

I would only change part "burn DEC" to keep DEC, DAO should keep bought DEC for future revard alocation

Thanks, I think that 50% is good, as it creates pressure on the supply of DEC. If DEC is above peg, then well; you get HBD, which in future can be used. The 50% goes to the treasury, so its there for future use.

This is by far a better proposal than the last one. That said, I think I'm still opposed to this idea.

Yes, it is still diversified compared to DEC because HBD is still a 'stable' coin but it is still less diversification that I'd like to see for the DAO.

At the end of the day, the DAO would be what funds development for the game if the current DEVs abandon the project. As such, I'd like to see a % reserve of the DAOs funds in assets that are as far away from SPL as possible.

I do acknowledge that these funds are only barely a step away from HBD anyways as they are all HIVE swap versions of the tokens instead of the 'actual' stable coins so maybe it doesn't matter if it is in HBD vs swap.stablecoin as if Hive goes down then all of the swap.coins are worthless anyways.

Yes I like this proposal better!

I like the first half of the idea, which is to buy HBD in order to get 20% interest.

Here is an idea for what to do with the interest.

Buy SPS to be donated to Splinterlands for the specific purpose of BOOSTING the amount of SPS being given in rewards to players each day. This will inject value in the ecosystem by using the DAO's interest to directly fuel the rewards given to players. The SPS given this way would be bought from the market first so no extra inflation. It is also 100% sustainable over the long term.

I think that there's enough rewards defined in the whiter paper for battles. It's been open information for years at this point. SPS has a capped supply, while DEC does not.

This would induce more selling pressure on sps and stunt any price appreciation. If you want your sps to gain value, you need demand that comes from actual players and ones that wouldn't just sell it. We have many avenues to boost the amount of sps you recieve now as it stands. The buy and burn of dec creates a feedback loop that once it eventually reaches peg, sps will climb due to demand and burns needed to acquire dec. Inflation of rewards just dilutes the value of them.

Wasn't the hbd stabilizer handling that amount daily?

I know it's lower now, but perhaps somebody could make arrangements for something one off.

What is the total market cap of HBD?

How does it achieve a 20% Return which is very high in the real world and much higher than any other stable/safe asset in existence that I know of?

As a serious investor in the real world, these are 2 questions that I would need to understand before I could vote for this. I think its important that everyone understand at least these 2 things in order to vote for this proposal.

Thank you.

A bit of insights that may be helpful about HBD

HBD has had a 20% savings interest for quite a while now ... the savings rate is voted by the witnesses and we have seen such a consistent stability of the asset during all the ups and downs of the market and that why we have kept it at that rate.

There are some strong safety dynamics to the Hive backed dollar... that do really well and avoid some problems other backed currencies have.

The main marketplace for the token is the hive/hbd pair and best interface is https://hivehub.dev/market/advanced

If you're looking at other markets or coingecko they'll usually be off in their assessment of the value of HBD because they don't look at the trading going on for hive/hbd pair.

HBD does have a bit higher fluctuation but always comes back to right around $1

You can also do a blockchain transaction from hive to hbd which uses a 3.5 day median to convert so you'd need to convert whatever assets you have to HIVE most likely to get it over to HBD. (this safety feature of the Hive backed Dollar is both frustrating because of slowness but brings huge safety to HBD)

Asking what it's market cap is not maybe the best... the answer is... not enough. That's part of the thinking for increasing the interest on the savings account. Increase the amount in existence. However also it's backed by HIVE so there is a limit to how much there can be in correlation to HIVE... HIVE itself would have to go up in price for there to be a lot more of it in existence.

Also there is an issue with the proposal in thinking the dao can withdraw every day and convert to DEC. It's a every 30 day sort of thing. Which is fine... and maybe they can run a script that does the converting every day.

I think someone is gonna have to create a script. My suggestion is that the dao claims their savings interest HBD each 30 days reinvests one half then sends the half of HBD meant to burn DEC to another account (safety) with a recurring transfer and then exchange for HIVE in the internal HBD/HIVE market. Then it will have to convert to swap.hive which has a fee. Then uses the trade market or DEC/swap.HIVE pool... then has a burn.

I assume someone can make this sort of script with not too much effort but should probably be done not with the main DAO account. I mean it's not easy and there are some fees but a good dev will figure this out splinterlands has some devs that are witnesses and know Hive pretty well.

Thanks Jarvie for giving a better answer than I could possibly ever do. Thanks for also doing some architecting as to how this could work with a possible escrow account

Hey Jarvie, thank you for taking the time and effort to address these issues. I'm listening to the input from both the pro and against voters. The goal for me is to understand it so that I can make an informed choice. Thanks again, your answers were helpful.

I'm grateful to jarvie too, for answering your concerns. Please message me on discord at any time if you've got questions. I may have missed your message / tag in mavs (I saw a notification on my phone, but dismissed it in my bleary eyed "just woke up state") - but conversely am happy to discuss this with you on chain, on stream, or indeed anywhere. :)

Thank you Holoz! :)

HBD has a market cap of 11M, and it is arround 6.5% out of the Hive market cap. If the hbd market cap reaches more than 30%, then the hbd price can drop bellow $1. HBD has no premine so the inly way to create more is trough its regular small inflation or trough HIVE to HBD conversions.

You can monitor the health of HBD here:

https://www.hbdstats.com/

Thank you for this information @dalz

https://podcasts.apple.com/us/podcast/58-a-davemccoy-conversation/id1623545445?i=1000615289196

everybody must listen, even if listen before. Do Now!

@thepeoplesguild

Thank you Jagged! And the People's Guild is a great format, those guys do a terrific job! :)

Thank you for participating in SPS DAO Governance @holoz0r!

You can place or monitor SPS Stake Weighted votes for and against this proposal at the link below:

Link to this Pre-Proposal

Updated At: 2023-07-11 14:01 UTC

This is always the most relevant and important reply of replies.

@holoz0r smirks with disatisfaction but still emotionally fine.

The broken image and the post updating every 20-30 minutes causing me a discord alert is the annoying bit.