If the Hive supply wasn’t already confusing enough with the regular supply, virtual supply, conversions etc, here is another one:

Available HIVE supply.

What is it and how it is different than the regular HIVE supply? Is it inflating at the same rate or faster than the regular supply?

Let’s take a look.

As already mentioned, there is the regular HIVE supply and the virtual HIVE supply.

The regular HIVE supply is the simplest data, and it represents the amount of HIVE tokens in existence. It is shown on most of the hive block explorers. At the moment this number is around 450M.

The virtual HIVE supply has also been around for a long time. It is connected to the supply of the stablecoin, HBD. It represents the amount of HIVE in circulation and on top of it, the theoretical HIVE that can be created from HBD conversions at the current feed price. Because this number is in correlation to the HIVE price, it can vary a lot. At the moment the virtual HIVE supply is at 630M, or close to 200M on top of the regular supply, or in percent terms additional 30%. This is one of the highest it has ever been and is because of the low HIVE price.

Available HIVE supply

The available HIVE supply is a result from the Hive HardFork, back in March 2020, when around 83M HIVE was put in the DHF/DAO. The DHF by design doesn’t hold HIVE, but HBD only. But bearing in mind the extraordinary circumstances that lead to the HardFork, most of the prior company tokens, the so-called ninja mine were transferred to the DHF. This HIVE is put in slow mode conversions, where 0.05% a day is converted to HBD, that can be used by the DHF to pay for development and proposals. The HIVE in the DHF is locked and can’t be used for proposals and can’t leave the DHF.

When we remove the HIVE balance in the DHF, from the regular HIVE supply we get the available HIVE supply. At the moment there is around 41M HIVE in the DHF, so the available HIVE supply is 450 – 41 = 409M.

Now that we have defined what is what, let’s take a look at the historical data.

HIVE Supply Breakdown

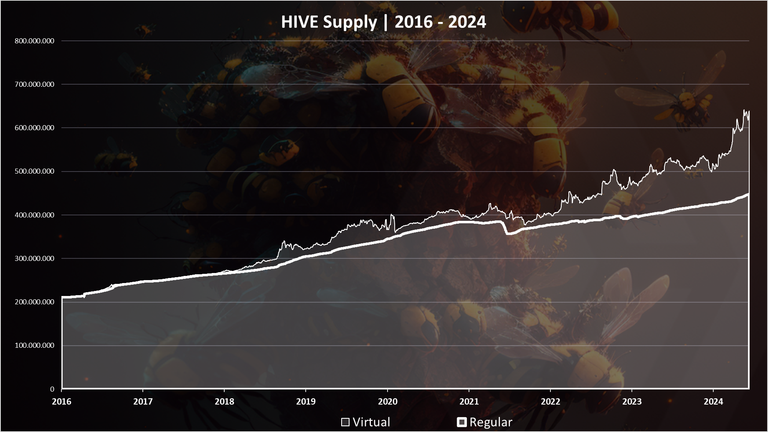

The regular and the virtual HIVE supply, for which I’m making regular monthly reports, is presented in the following chart.

The light color on the top is the virtual HIVE supply, while the bold line is the regular HIVE supply. As mentioned, the virtual HIVE supply is in correlation of the HBD supply and the price of HIVE and can vary a lot. Additionally, the virtual HIVE supply included the HBD in the DHF, that is locked. As the HBD balance in the DHF grows so does the virtual HIVE supply.

HIVE Balance in the DHF

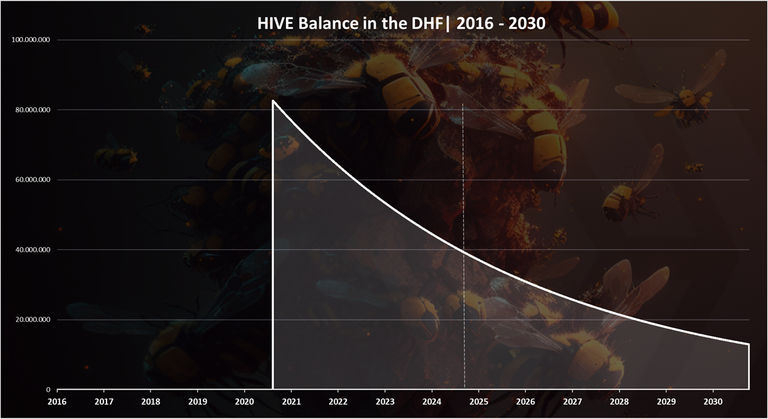

As mentioned, 83M HIVE were transferred from the Steemit accounts into the DHF with the Hive HardFork back in March 2020. Later in October 2020 with another HardFork these funds were put in slow conversion at a rate of 0.05% per day. The long timeframe for conversions was initially set to avoid price volatility.

The dotted line is the current date.

As we can see from the chart above the HIVE balance in the DHF has been going down, and from the initial 83M, there is now 41M HIVE. More than 50% of the initial balance has now been converted to HBD in the DHF.

As shown in the chart, at this pace, the conversions will continue till 2030, and beyond. In 2030 there will still be around 12M in the DHF, if it is not changed with another HF. The impact on the overall tokenomics from this balance at that time will be low. Even today, four years from the start of the HIVE to HBD conversions in the DHF, the impact of this balance has been reduced.

As far as I understand the initial idea was for these tokens to be converted to HBD in a period of five years. But obviously the way they are set up, as a percent of the current balance, the conversions keep on for much longer. The daily amount of absolute tokens converted is a function of the HIVE balance in the DHF, and keeps going down as the HIVE balance is reduced. For example, when there was 83M, around 41k HIVE were converted to HBD daily, while now this number is around 20k HIVE per day.

On a yearly basis, in the first year, around 13M HIVE was converted to HBD in 2021, then 11M in 2022, 9M in 2023, and in 2024 it is expected around 7.7M HIVE to be converted to HBD in the DHF.

Available HIVE Supply

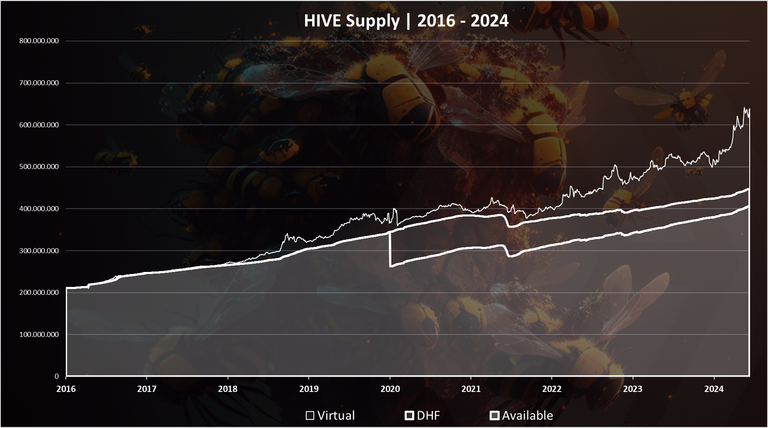

When we add the breakdown for the HIVE balance in the DHF we get this chart.

Available, regular and virtual HIVE supply.

The available HIVE supply is the lowest line on the chart.

We can notice the sharp drop in the available HIVE supply in 2020, when the Hive HF happened, and the tokens were moved to the DHF. Since then, the amount of these tokens has been going down, and the two lines are slowly converging to each other, slowly closing the gap.

This process will continue in the years to come.

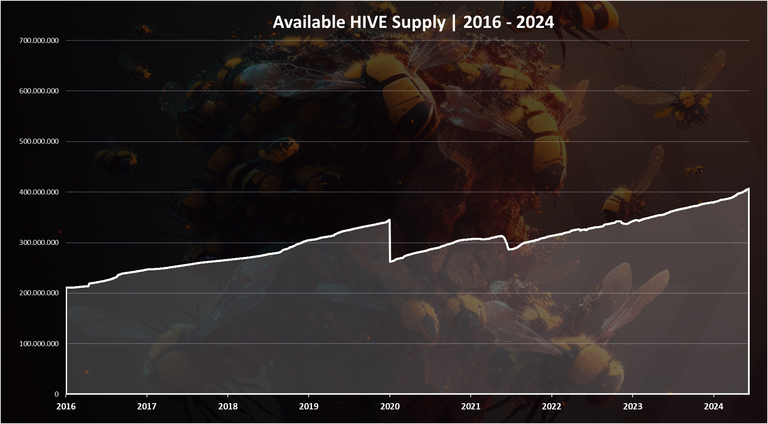

The available HIVE only chart looks like this.

Here we can see a clearer representation of the available HIVE supply. After the drop in 2020 and the transfer of the HIVE to the DHF, the available HIVE supply has been growing and it has now surpassed the 400M mark. We now have 409M available HIVE. Out of this 183M HIVE is powered up, accounting for 215M liquid HIVE.

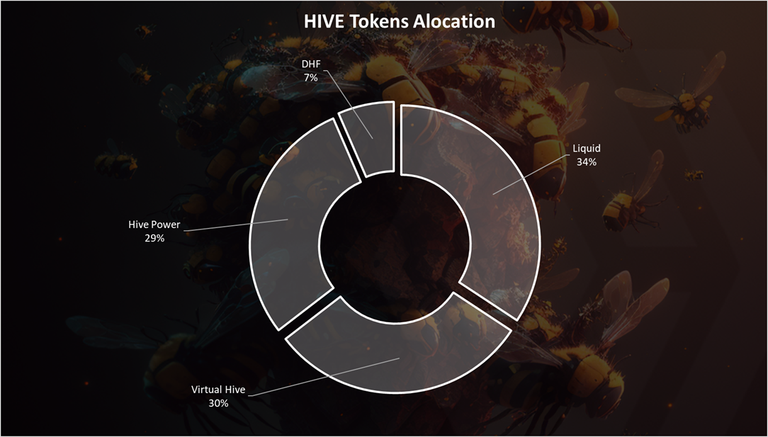

The chart for the current HIVE token allocation looks like this:

Out of the 630M HIVE total virtual supply, including the potential HBD converted to HIVE, we have 34% liquid share (215M), 29% Hive Power (182M), 30% virtual supply that is volatile depending on the HIVE prices and 7% in the DHF (41M).

Inflation, Regular VS Available

Now that we have extracted the data for the available HIVE supply let’s take a look at the inflation rate for it. Is it inflating differently than the regular HIVE inflation?

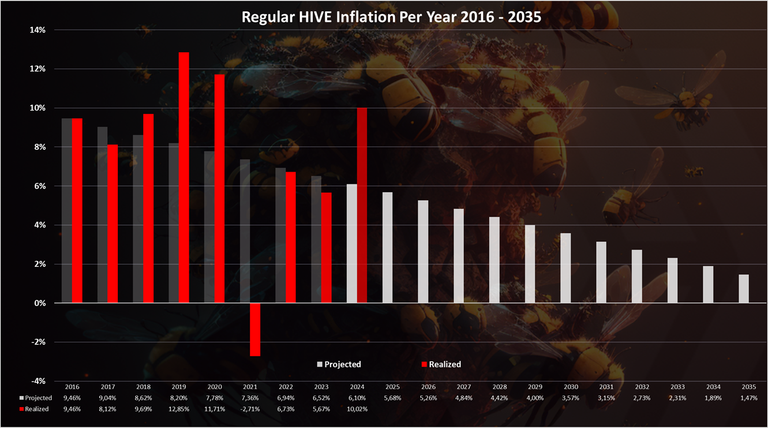

First a reminder of the regular HIVE inflation. Here is the long-term chart.

We have the data for the projected and realized inflation here.

Now let’s break down the data for the regular and available HIVE inflation.

HIVE Added per Year, Regular and Available | 2016 - 2024

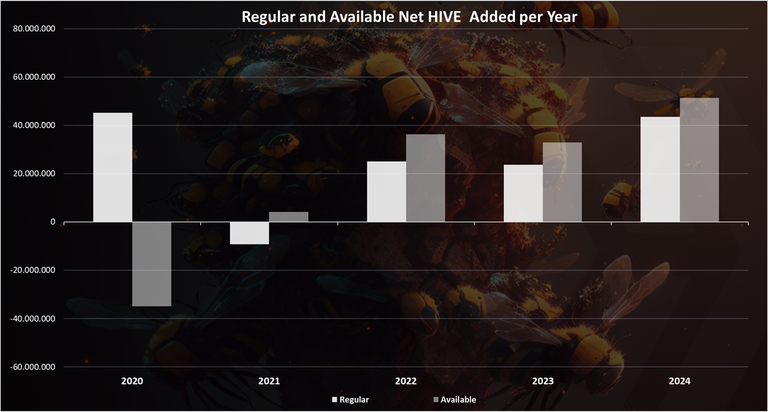

This is the amount of HIVE added each year, for the regular and the available HIVE supply.

The white columns are the regular inflation, while the grey is the available inflation. The data is starting from 2020, because prior to this there was no difference between the two.

As we can see in 2020, the Hive HardFork happened, and we have a huge discrepancy between the regular and the available HIVE added. Basically, on top of the regular supply (around 45M new HIVE added in 2020), while as available supply there was -35M HIVE removed. This is due to the removal of the HIVE from regular supply and locking it in the DHF.

In the next year we have a somewhat comparable situation, where we can see the evolution of the HIVE supply with and excluding the HIVE balance in the DHF.

In 2021, the regular HIVE inflation is negative -10M HIVE, while the available is positive 4M HIVE. What this means that the difference around 14M HIVE, is HIVE removed from the DHF.

In 2022 the regular inflation is 25M HIVE, while the available is 36M, or 9M more HIVE. In 2023 the regular inflation is 24M HIVE, while the available is 33M. 2024 is projected to be around 44M regular and 50M available HIVE added in circulation.

As we can see from the numbers in 2021 to 2024, the gap between these two data points has been going down. This is due to the lower amount of HIVE tokens in the DHF that are converted to HBD each year. The biggest difference was in 2021 with 14M difference between the two, and each next year this is going down and now we are at 7M difference between the two.

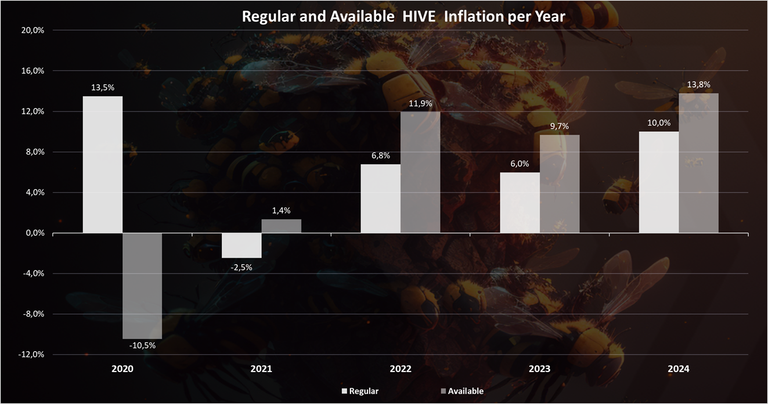

When we plot the chart above in percentage points % we get this:

The trend here is the same as for the absolute amount of tokens added in the previous chart, just a different unit, for a better understanding.

We can see that back in 2020, we have 13.5% regular HIVE inflation vs -10.5% available HIVE inflation. In 2021, the numbers are -2.5% vs 1.4%, then in 2022 6.3% vs 11.9%, and a 6% vs 9.7% in 2023. For 2024 the projected numbers are 10% vs 13%.

Obviously from the data above we can see that after the huge deep in the available HIVE inflation in 2020, the following years, this type of inflation is higher than the regular one, between 3% to 5% per year. This trend should go down going forward, as the amount of HIVE in the DHF is reduced and the two numbers will be closer to each other. Probably the biggest effect of this is now behind us.

At the end to note that, when we do such analysis, as available HIVE, another important metric is the liquid HIVE, excluding the powered HIVE. This is ultimately the amount of HIVE that is available. The liquid HIVE supply is affected from the HIVE power ups, but also from the HIVE to HBD conversions.

All the best

@dalz

I wonder why HIVE in the DHF wasn't put on slow burn mode instead.

Now maybe we can put it on fast burn mode :)

I'd definitely vote for a burn proposal to get the DHF supply down. I don't know if many feel the same way though.

100 perecent

Hi, @simplegame,

This post has been voted on by @darkcloaks because you are an active member of the Darkcloaks gaming community.

Get started with Darkcloaks today, and follow us on Inleo for the latest updates.

eh that's a bit off of the projection 😂

A bit

Also Hive is going very low now due to market conditions...

There seem to be different percentages in the image immediately above this information?

Yea that need updating, tnx!

Corected!

👍

Does this impact the liquidity of Hive in general, just a query??

So what you are saying is, in simple terms is that the Hive supply of 450m contains 41m belonging to the Dao. And you are presenting inflation figures comparing the conversion of the impact of Dao to HBD (equity to debt swap).

Hive is unique in that it has created itself a perpetual DAO debt instrument instead of having equity unlocks like other chains. However, by converting the equity to debt, you cannot include the DAO HBD part that you call "Hive Virtual Supply" in the market cap anymore, so why do you do it? It is a debt instrument. Instead you should be showing how the DAO HBD debt is now over 50% of the market cap, dwarfing the equity!!!!

So the 450m Hive is the Fully Diluted Market Cap and that 409m is the true market cap currently.

That means the debt limit and market cap are being even further massively understated.

When reading through your stats I am wondering why you are not using the correct terminology as it makes understanding your work more difficult. Instead you use phrases like regular/available supply. The correct terms are clearly defined by token aggregators for digital assets.

Not sure what is fhe point of this comment ... there are multiple points ...

And to your now almsot personal attacks towards me, I'm once again telling you, and this time it will be my last reply to you .... I dont make the rules ...its how the blockhain works, I'm not a CEO of Hive .... and If you are so sure of outside apps who are very wagly familiar with hive specifics, can you please check what supply does the Coinmarket cap shows for hive and is that the corect one?

Its not my intention to attack you Dalz and I apologise if that is the case. Thanks for putting the numbers out there.

!discovery 30

!PIZZA

This post was shared and voted inside the discord by the curators team of discovery-it

Join our Community and follow our Curation Trail

Discovery-it is also a Witness, vote for us here

Delegate to us for passive income. Check our 80% fee-back Program

$PIZZA slices delivered:

@jlinaresp(3/15) tipped @dalz

I like how the supply of Hive is increasing but what is Hive in DHF?

What does DHF mean?

Decentralized Hive Fund, where users submit funding proposals to work on the Hive ecosystem.

What might have been causing the inflation of hive

Side note: The second graph gives the impression that the DHF has been half used up, with 40 Million Hive already used. What about the money going into the DHF from various sources is that factored in here?

If we take a very rough average value of Hive over these years as being around $0.30USD, that's a rough figure of $12M spent from the DHF.. and we don't even have a basic educational video about Hive for any audiences to show for it.

Spending the remaining funds on powering numerous competing UIs without addressing marketing issues could kill Hive.

Here are the funds spended each year .... just above 8M

The chart above is in HIVE units so to speak. All other sources go into it in HBD form, and those are factored in the virtual supply that converts all hbd to hive, including all the hbd in the dhf.

To clarify, are you saying that the 2nd chart in your post includes - one way or another - all sources of value that are within the DHF (expressed in the chart as Hive) - or are there other funds not represented in the chart?

When you say 8M spent - is that in USD? What percentage is that of the total value of the DHF?

Thanks

The focus of this post is not the DHF so there is no breakdown for it

This chart includes all the HIVE, not exaclty steuctured as value in the DHF. There is more value in the DHF from the aditional 23M HBD there that is taken into acount together with the 10.7M freely circulating HBD, or a total of 33.7M HBD L, then is converted to HIVE in the chart above as virtual supply.

For the 8M, that is in HBD.

I think part of the challenge here is the English translation doesn't always make full sense.

I was referring more to this chart:

This chart is only for HIVE in the DHF, HBD excluded.

I had assumed that the DHF was all stored in only one token and not a mix of both - it's not something I have studied the mechanics of in depth.