Conversions play a major role in the Hive ecosystem. In the past years there have been multiple adjustments and improvements in the process. This resulted in conversions enabled in both directions. On top of the two-way conversions, we now have the @hbdstabilizer that is buying and selling HBD, providing liquidity and incentives on the internal market.

Was more HIVE added or removed trough conversions?

Where did the major conversions come from?

Types of Conversions

First let’s take a look at all the possible ways to convert HIVE to HBD and the opposite.

1. HBD to HIVE Conversions

The HBD to HIVE conversions have been around since the beginning of the chain and they are quite simple to track. There is only one way to create HIVE from HBD and that is when HBD is converted to HIVE via the 3.5 days process. This mechanic has been in place since the creation of the chain. What it does is provide support for HBD on the downside, preventing it from dropping below $1 as long as the debt limit is not reached.

2. HIVE to HBD Conversions

The HIVE to HBD conversions are a bit more complicated. They come later in development and some things were added on top of another.

There are three ways in which HIVE is converted to HBD:

- 1.Regular HIVE to HBD conversions

- 2.HIVE to HBD conversions from HIVE transfers to the DHF

- 3.HIVE to HBD conversions in the DHF from the existing HIVE in the DHF

The regular conversions would be the standard way for converting HIVE to HBD. When the price of HBD is above $1, users can convert HIVE to HBD at a fixed price of 1.05, that the blockchain guaranties for this type of conversions. When these types of conversions are made, half of the HIVE is instantly converted to HBD, while the other half is locked as collateral, and it is released after 3.5 days. The amount of HIVE that is given back depends on the price of HIVE in the 3.5 days period when the HIVE was locked as collateral.

This feature was added with the HardFrok at the end of June 2021. What it does is preventing HBD to increasing in price, giving stability on the upside. Because this feature was introduced later, we can see in the past there were high prices for HBD, formerly SBD.

The second type of HIVE to HBD conversions is when HIVE is transferred to the DHF (Decentralized Hive Fund). Because the DHF works with HBD, payouts to proposal workers are made in HBD, the HIVE needs to be converted to HBD for these funds to be usable. Unlike the standardconversions that have collateral locked for 3.5 days, these conversions are instant. As soon as HIVE is sent to the DHF it is converted to HBD at the blockchain median price. These conversions were added with the HF in October 2020. Most of the transfers to the DHF are made by the @hbdstabilizer, that works in both directions to provide instant liquidity for HBD.

The third type of HIVE to HBD conversions are the conversions from the existing HIVE in the DHF. These are the funds that were allocated to the DHF when the Hive creation HardFork happened. Around 83M HIVE were allocated in the DHF in March 2020. Later with the HardFork in October 2020 these funds were put in a slow conversion mode where 0.05% per day is converted to HBD to avoid price volatility. These conversions will go down as years passes. We are now almost half way trough with 42M left in the DHF.

@hbdstabilizer

The stabilizer has been a major player in the Hive ecosystem and its tokenomics. Up to recently it had around 200k HBD daily budget, while now it has scaled down to 12k. Because of this we will be looking at it separately here. The main goal for the stabilizer is to try and keep HBD around the dollar. The stabilizer receives HBD from the DHF, and if the price of HBD is higher than $1 it sells HBD on the internal market. If the price of HBD is lower than $1 it converts the HBD to HIVE and then uses that HIVE to buy HBD on the internal market, giving support for HBD on the downside.

The period that we will be looking at is from April 2020 to June 2024.

HBD to HIVE Conversions

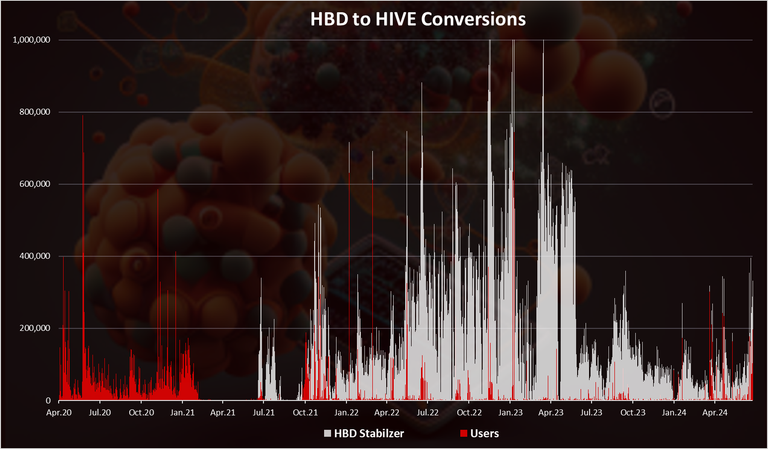

This is the one type of conversion for creating HIVE. Here is the chart.

I have separated these conversions into two categories: hdbstabilizer in white and regular users in red.

We can see that back in 2020 the HBD to HIVE conversations were made only by users. The stabilizer was not active then yet and all the conversions were made by users. Then in 2021 the stabilizer started operating and since then it has been dominant in the HBD to HIVE conversions. The stabilizer is doing this to support the price of HBD, using HIVE. Any excess HIVE is sent back to the DHF and recycled.

It’s interesting to see that HBD to HIVE conversions have been very low from users when compared to the previous period. Its most likely that because previously there was low liquidity on the internal market and users were mostly converting HBD to HIVE. While now there is enough liquidity on the internal market provided by the stabilizer so users just sell HBD instead of converting. If there are no conversions from the stabilizer this usually means HBD doesn’t need a support in the price.

We can notice that in May 2023 the volume on the hbdstabilizer dropped this is due to the lowest funding it receives now from 200k to 24k and then later to 12k.

Its interesting to note that in the last few months there are a bit more users conversions, probably due to the lo volume the stabilizer has now.

Note that these are not NET conversions. Most of the HIVE created above is converted back again to HBD. We will see details about this bellow.

HIVE to HBD Conversions

Now with the HIVE to HBD conversion. As we have seen above, these are bit more specific and there are multiple types of conversions.

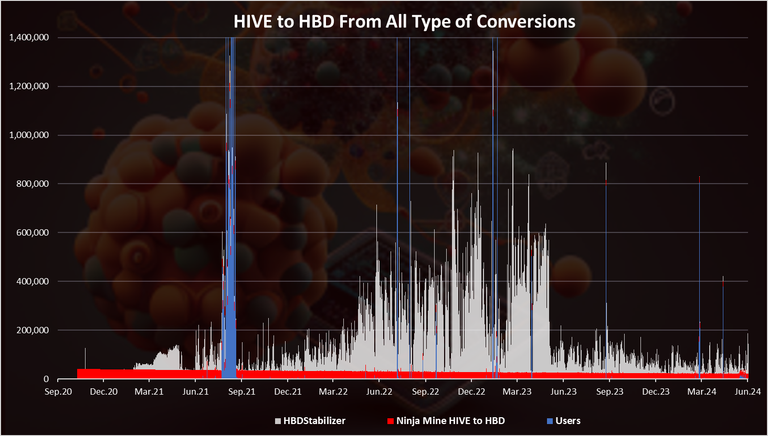

Here is the chart.

As we can see the @hbdstabilizer is dominant here as well, the white columns. For the stabilizer the HIVE to HBD conversions is counted including the HIVE that is sent back to the DHF. These are unused funds that the stabilizer doesn’t need at the moment and it sends them back to the DHF as HIVE where they are converted back to HBD. The stabilizer is mostly recycling funds, receiving and sending them back, and only uses them if there is a need to support the HBD price.

The conversions that are happening in the DHF from the ninja mine HIVE to HBD (red) are also presented on the chart, and we can see that they are constant as coded in the blockchain 0.05% from the HIVE per day. At the moment there is left around 42M HIVE in the DHF, from the initial 83M. On a daily level the HIVE amount converted to HBD decreases as the funds in the DHF drops. At the start in October 2020 there was around 44k HIVE per day converted to HBD, and now there is around 21k.

The blue columns are conversions from users, and we can see that these are happening occasionally when there is a sharp increase in the HBD price on the external markets, users convert HIVE to HBD and make arbitrage.

Net HIVE Created/Burned from Conversions

When we combine all the ways HIVE is converted to HBD, and the opposite we get the final net numbers from conversions.

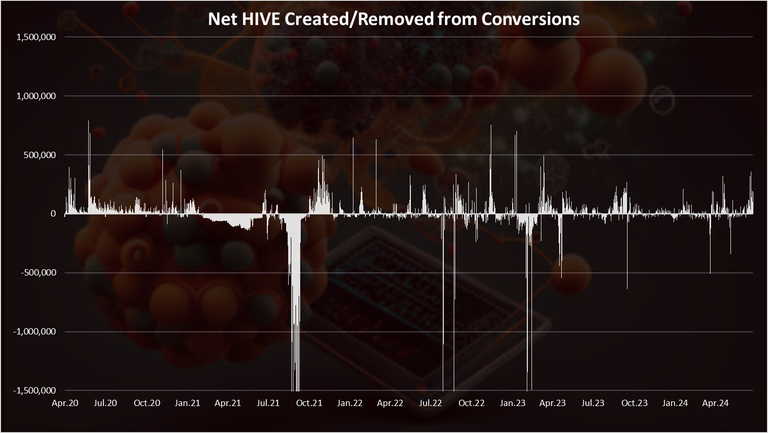

When we sum up the created and removed HIVE from conversions, we get the chart above.

We can see that the daily volume here is actually quite low, with most of the days under 50k HIVE. This is much lower than the volume from the first two charts when we have more than 500k per day. But this is mostly because of the stabilizer, who is mostly recycling funds and most of it is zeroed out.

The volume for the net conversions increases when there is a deppeg in the HBD price, on the upside or on the downside. The sharp spikes in burning HIVE usually come when the HBD price on the external markets is trading above $1.

We can notice the recent spikes in 2023, on the downside when HBD was trading above $1 and HIVE was converted to HBD.

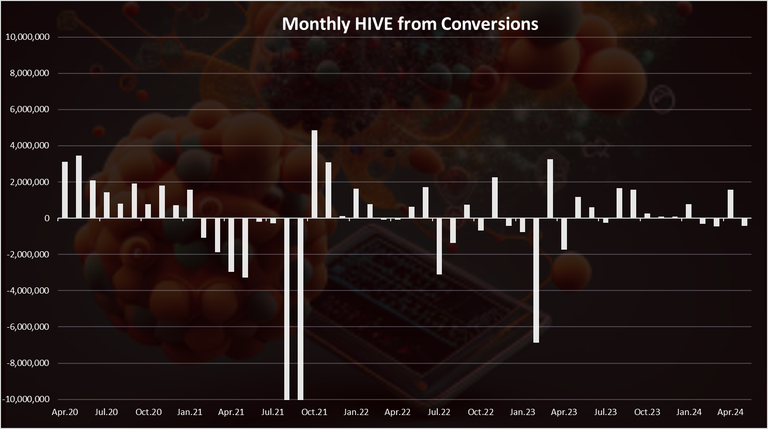

On a monthly basis the chart looks like this:

A bit clearer picture here.

We can see the large amounts of HIVE burned back in August and September of 2021. This is the period when HBD was trading above $1. A 15M HIVE was burned in August and another 14M in September for a cumulative 29M in these two months.

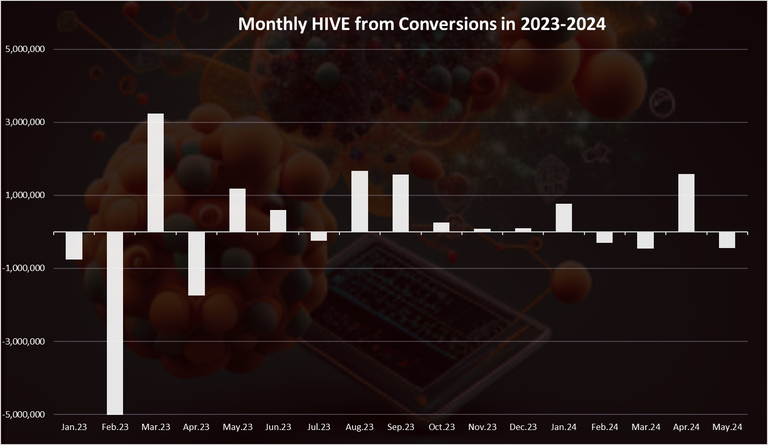

When we zoom in 2023-2024 we get this:

In February 2023, almost 7M HIVE was burned and converted to HBD. April 2023 was also negative with 1.7M HIVE burned. In the recent months there is less volatility with smaller amounts of HIVE created from conversions. May was slightly negative, while April was positive.

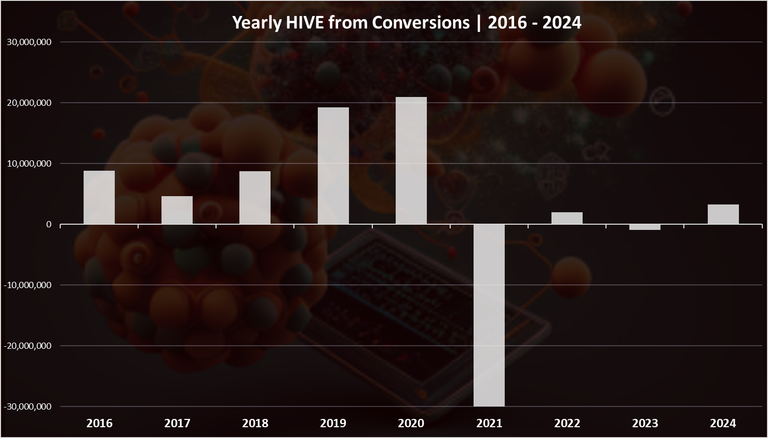

On a yearly basis we have this:

If we really want to take a look at the long-term trend, we can check the yearly trend.

This includes the legacy chain as well back from 2016 for reference. We can see that up to 2021, there were only positive conversions, because the HIVE to HBD conversions were not even technically possible prior to 2021. Since the introduction of these types of conversions more HIVE is now converted to HBD.

Most of the burning came in 2021, when we had a bull market. More than 20M HIVE was burned on a yearly level. In 2022 even with the bad market conditions, the conversions were barley positive with plus 2M on a yearly level. In 2023 they were almost neutral.

In 2024 at the moment the conversions are positive with 3M HIVE created.

Note on the ninja mine conversions. These are happening regardless of market conditions and user behavior. They are programed after the HF in 2020. Their impact is getting slower by the year, but if we exclude those from the above the amount of HIVE created from conversions will be higher.

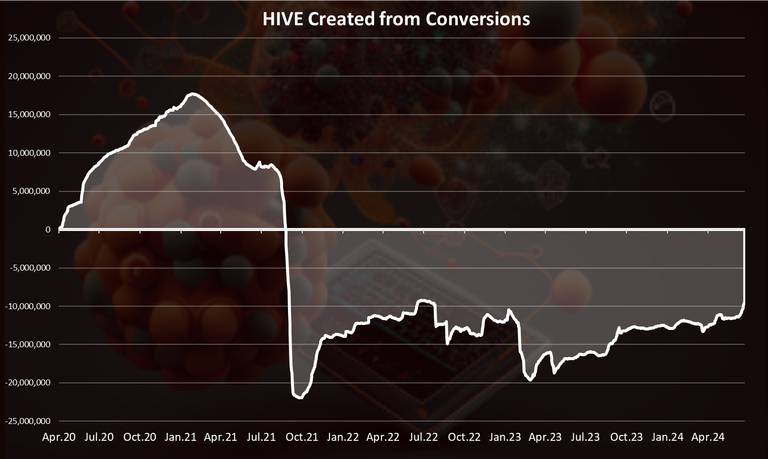

Cumulative HIVE Created from Conversions

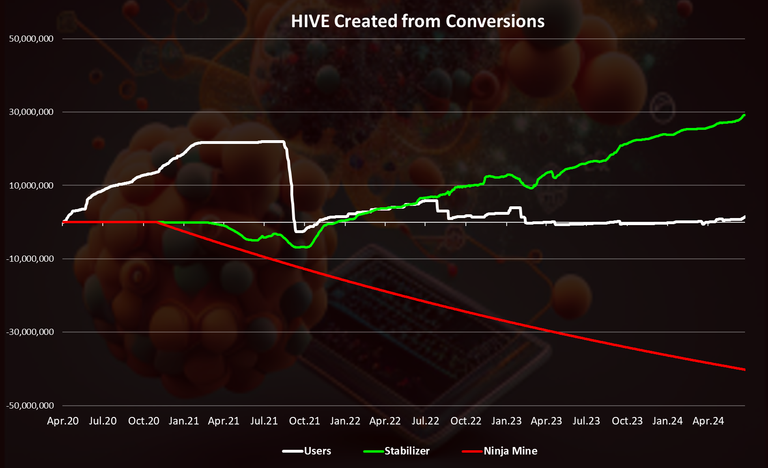

When we plot the amount of HIVE created from conversions starting form 2020 we get this:

We can see that cumulative HIVE created from conversions is net negative when it comes to the HIVE supply. A total 0f 10M HIVE burned, although we can notice the sharp drop back in 2021 when a lot of the burning happened. Since then, there have been ups and downs but the conversions remained negative.

If we really wind it back starting from 2016 then the conversions are still net positive for 37M because of the period when the HIVE to HBD were nonexistent.

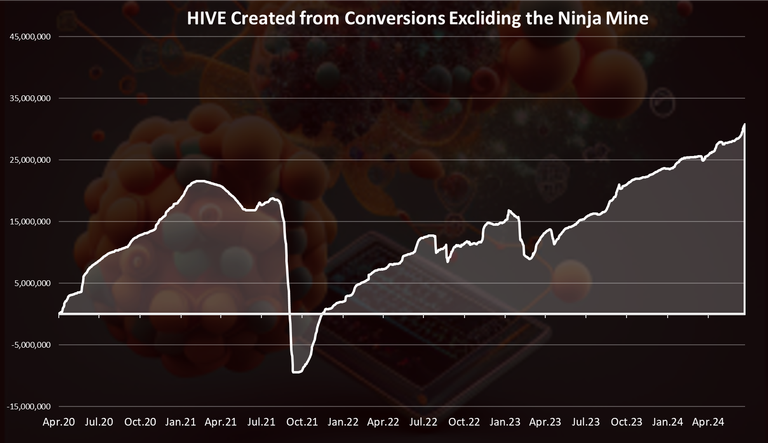

Cumulative HIVE created excluding the ninja mine conversions:

Because of the specifics of the ninja mined HIVE conversions that are not market driven and to HIVE that is not in circulation if we removed them we will have this chart:

This is quite the difference. Without the ninja mined HIVE conversions, that are removing HIVE, the amount of HIVE created is positive in the period to a total of 30M. We can notice that in the last period the conversions have been growing even more aggressive.

Plotted on one chart the conversions by category looks like this:

Here we can see that the conversions from users (the white line) are at very small scale now, and it seems that this trend started since the introduction of the stabilizer. The stabilizer (green) keeps adding HIVE and removing HBD, while the ninja mine conversions (red) acts in the opposite direction and remove HIVE.

Conversions in 2024 by Category

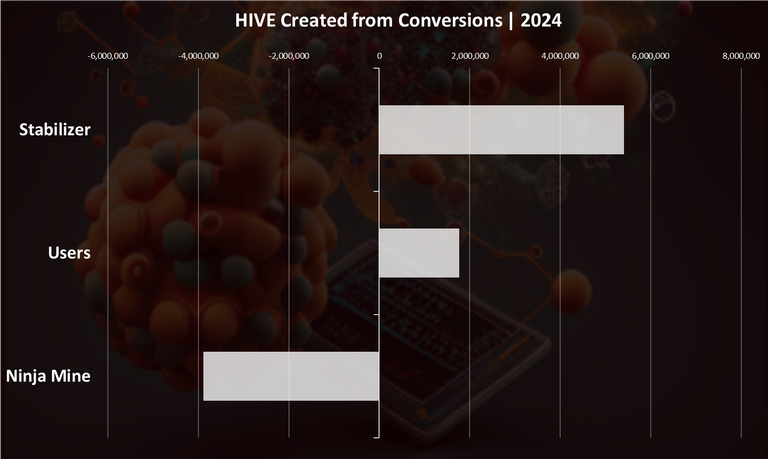

Who was adding and who is removing HIVE in 2024? Here is the chart.

These are net results.

As we can see the conversions from the @hbdstabilizer are on the top with 5.5M HIVE created in this way. This HIVE went to supporting the HBD peg on the internal market.

The conversions from the regular users are close to 2M HIVE.

The conversions from HIVE to HBD in the DHF have removed 4M in 2024.

As we can see most of the conversions are from the stabilizer who is creating HIVE from the HBD it received from the DHF and buying HBD on the internal market. While this action is performed from the stabilizer it as a result from users selling HBD. The supply of HBD in 2024 has remained almost constant around 12M HBD, while we have added around 3.4M new HBD from inflation in the first half, that mostly was removed out of circulation from the stabilizer, resulting in HIVE created. Out of the 3.4M new HBD added in circulation in 2024, around 1.7M was DHF payouts, 0.9M authors rewards and 0.8M HBD interest.

All the best

@dalz

With Hives price back in the dumps I wonder if we will see a increasing amount of off ramping of HBD back into hive. There's a decent chance that hive would out perform the 20% APR of HBD

@hbdstabilizer is really playing a pivotal role in maintaining stability. The dynamics between user-initiated conversions and automated stabilizer actions is proof of how we're improving our strategies to balance HBD's value. I'm so happy for this and HBD is a very solid stable coin. Thanks as always for the cool updates brother

You actually reminded me to use @hbdstabilizer again

It’s been long I did so😁😁

Nice update!

How to use it?

Now if we can get more people to join Hive and participate in the economy.

I wish I had converted my liquid HIVE to HBD before the downtrend.

Thank you so so much for giving us this comprehensive report and information

With the way the Hive price has been moving the past few days/weeks, it is interesting to see this data. A lot of people have been converting their HBD to Hive, me included.

It’s obvious that the smart people have been trying to stack up some more Hive

That’s amazing

If I read that chart right, there are around 40m left from the ninja mine to be converted to HBD in DHF, meaning about half of the initial amount?

🤩

Huh... what is the DHF? Also, who funded the hbdstabilizer? Lol I only learned abt this now. Way to go!

!ALIVE

!LOLZ

!PGM

!DHEDGE

It is necessary that we are familiar with these information because it helps us to be actually aware