As things settled in India with Modi as India's Prime Minister this year, other important Ministers were also finalized into the PM's Cabinet, forming the Council of Ministers.

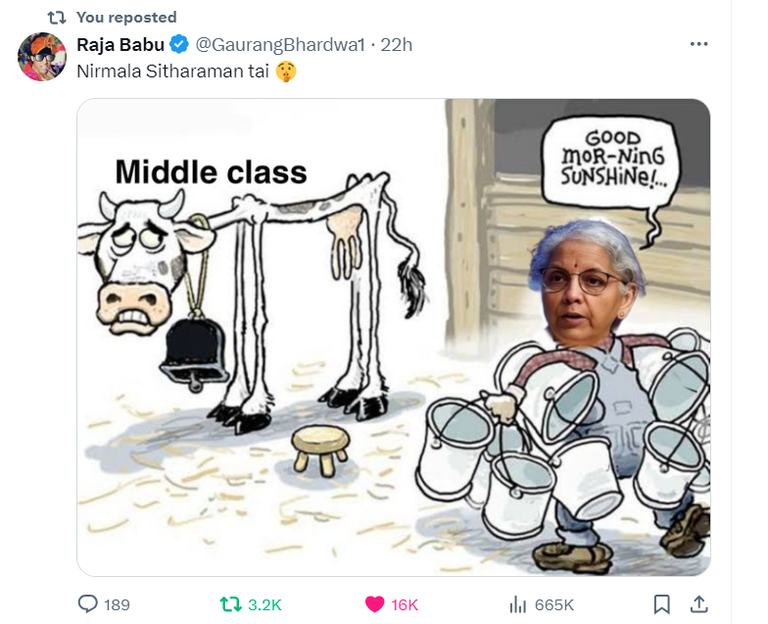

Recently, allocation of Ministry Portfolios took place with party member individuals allocated Ministries from Finance, Home Ministry, Railways etc. Yet again, the Finance Ministry was alloted to Nirmala Sitharaman after which these tweets greeted me!

As can be inferred, a section of Indian Middle-class Indians were disappointed with Nirmala Sitharaman being again appointed as India's FM.

Nirmala Sitharamam becomes FM only because Modi gets to be India's PM

It appears that a formula can be applied here -

When Modi is India's PM i.e, PM = Modi, so will Nirmala Sitharamam be India's FM, i.e, PM = Modi then FM = Nirmala Sitaraman.

*When we translate this formula into hindi language it will be - "Modi ke Saath, Nirmala ka Vikas" *

This turns out to be very convenient for Nirmala Sitharaman as she gets to be Cabinet Minister without contesting elections. This may likewise be convenient for PM Modi as well.

So, as Modi makes a hat trick becoming India's PM for 3rd time so does Nirmala Sitharaman automatically make a hat trick as well.

It appears she's India's FM not because she enjoys the confidence of Indian Citizens based on her past performance but because she's a Modi loyalist!

OK, OK... we get it that there is big discontent among Indian middleclass against Nirmala Sitharaman.

Let us move forward from here and unwrap the cause of this discontent. Wow and this discontent pours out fast -: TAXS

Sitharaman is seen as a merciless Tax Minister not a competent Finance Minister!

It appears Nirmala Sitaraman has been India's Tax Minister rather than Finance Minister...

The outflow of Indian middle-class Citizens' hard-earned cash has pressed them down hard!

Less savings, more debt! As such everything is more expensive with inflation around.

Of course, 18% tax on health insurance and imposing taxes on Provident fund is definitely unreasonable! Both these provisions are a necessity and not a luxury!

It makes Indian Tax payers feel like this.

Indians want to plug the heavy bleeding of their money from the wound of unreasonable taxes

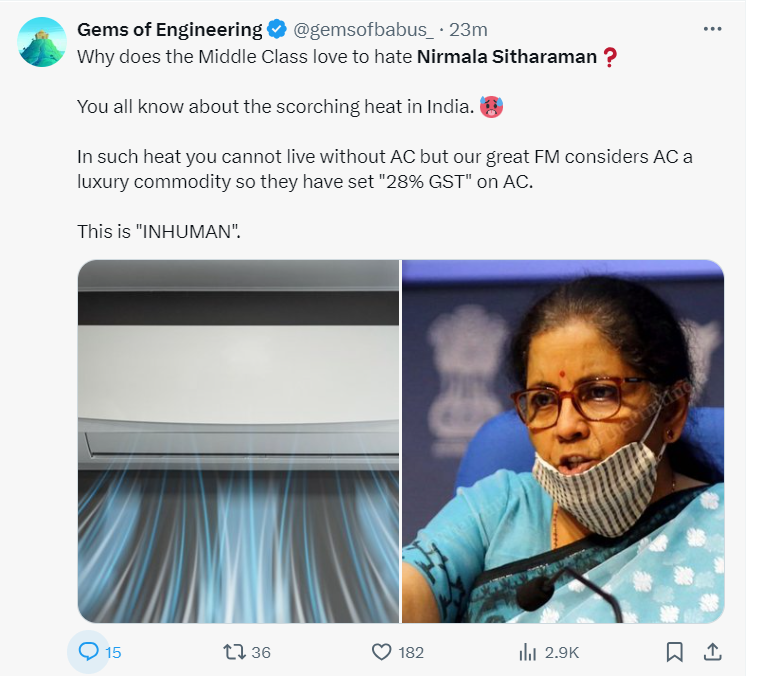

Also with unbearable excessive heat around these days in India, Air conditioners should not be charged 28% GST classifying it as a luxury good. Obviously, ACs have become an essential commodity these days for people to manage severe heat stress.

It's a fact that people have died due to heat stroke in hot regions like Delhi. So just because the climate is not having mercy on Indian Citizens, it does not mean the Finance Minister should be merciless!

When middle-class hopes for tax relief, Sitaram says she's provided them relief by not increasing taxes further!

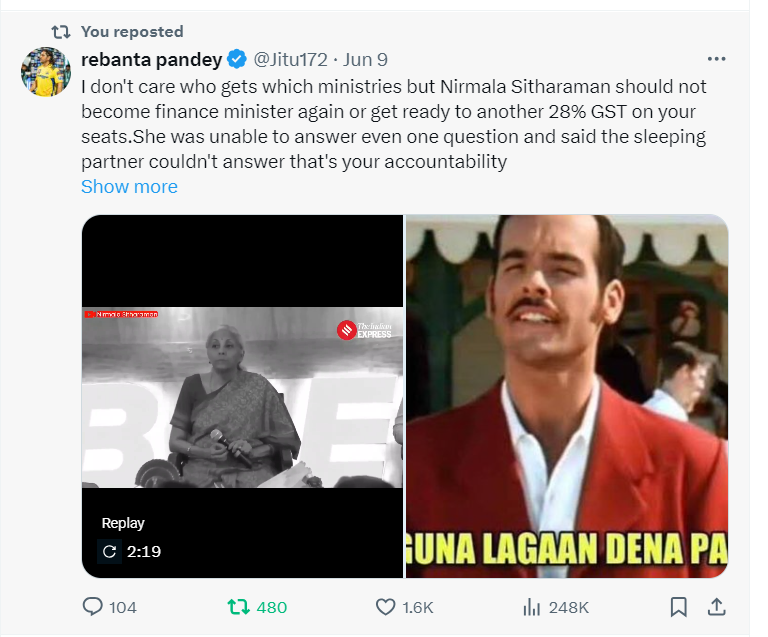

However, no mercy from Nirmala Sitharaman. Watch this clip where she answers a question posed to her on why she has not given tax rebates to the middle-class and salaried class of Indian Citizens.

She replies very obstinately that the Indian middle class should be happy she has not increased income tax rates for them!

Yet she gave considerable tax rebates to Corporates where Taxation Laws (Amendment) Ordinance 2019 was passed to reduce the taxes of Corporates.

So, this succeeded in reducing the base tax rates for Corporates from 30% to 25% while it was reduced further to 22% for companies not availing other Government incentives and subsidies!

GOI has forgone a sum of Rs. 1,45,000 crore due to tax rebates given to Corporates.

Understanding the extent of imposed tax burden from a broker's point of view

This question posed to Nirmala Sitharaman would give an idea of the extent of taxes that is extracted from a broker by the Government of India.

So, even though a broker earns money by putting his own investment and undertaking risk by himself, the Government who has not lent a helping hand in this ends up snatching away a good portion of that money.

GOI collects taxes from this money levying different kind of taxes - GSD, IGSD, long-term capital gains tax, Stamp Duty etc.

This enriches GOI, while impoverishing the broker with GOI being the sleeping partner and the broker being the working partner.

Further, cost of buying a home in Mumbai City increased because homebuyers have to pay an additional 11% tax with GST and Stamp duty charges. These taxes are on white money , i.e., on the money that is settled on people's bank accounts after they have finished completing all their tax formalities.

Sitharaman was asked what she would do for the broker and middle-class home buyer so the tax burden is reduced for them which would provide lucrative earnings for the broker and reduce the cost of buying homes for home buyers?

Nirmala Sitharaman's good humor is kindled so instead of attempting to answer this question earnestly she jokes saying that a sleeping partner should not be expected to answer the question sitting down!

Ha... ha... but there is no empathy from her, hearing this person, I feel his burden of taxes.

Let's cut seats of Sitharaman's Government like she cuts off our savings!

Even though this question was posed in a humorous tone, Indian Middle-class Citizens don't appreciate Sitharaman not answering the question. They feel this Government that is not bothered about people's tax burden should have 28% GST cut on the seats they got. Ha...ha... that would put this NDA Government out of power, they are after all leading by a margin of 66 seats.

NDA Government gets 296 seats. While Nirmala Sitaraman is part of BJP Government which did not even manage to secure the simple majority mark of 272 seats with BJP securing only 240 seats. BJP forms Government by joining hands with its alliance partners getting enough seats to form the Government.

Fine, let's impose 28% GST cut on this combined number of 296 seats then NDA gets 83 seats. Just see the magic how they become incapable of forming Government after the cut.

Then why reduce the savings of the Indian Middle-class Citizens by these severe cuts on their hard-earned money? It pains us dammit!

Heed with calmness, cool down taxes to provide relief to Middle-class

Ohh... this sort of comment might just invoke the wrath of India's Finance Minister, Nirmala Sitharaman further.

Ok maam... we just want you to see that tax cuts are painful, and we felt that you will only feel this pain if the same cut is imposed on the seats your Government has won.

However, we hope you just heed to what we Indians want from you, TAX RELIEF. Now, if you heed and provide the Indian Middle-class tax rebates, we will be fine with you.

After all you provided Corporate entities tax rebates, who just make profits and keep it with them. They would invest only when middleclass is able to spend and consume the goods they manufacture correct?

Why would Corporates invest, when consumer demand is not increasing but is on the other hand declining? Read on further, I am coming to this point now...

Why can't Nirmala provide straight answers to pertinent questions asked?

We have seen how she ducks to answer pertinent questions, by siding it away at first humorously and then defending her move obstinately by claiming she did not increase taxes for the salaried Indian class.

Now here was another tough question for her that she listened to intently but passed it on to someone else to answer! Great!

Question was how she plans to mitigate job losses that has arisen due to the closure of manufacturing units in the automobile sector and the slowdown of the FMCG segment (Fast Moving Consumer Goods segment) caused due to decline in consumption.

Incidentally, these questions expose the distressed plight of the Indian Economy. This implies that the demand for automobiles and Consumer goods have fallen down because consumers don’t have money to spend.

India has the largest number of youth population, and they don't even have enough purchasing power to buy consumer goods that are low cost and basic.

I am referring to the decline in the consumption of products in the FMCG segment. FMCG products are low-cost products like snacks, chips, biscuits, soda, personal use iteams like soap, lotion, sampoo, toothpaste and such things.

Surely, it's strange that India which has a large population of young people are facing slow down in the FMCG segment? The youth with disposable income would not be shy in spending money on these low-cost basic consumer goods.

hmmm... Notice, that question had Nirmala slightly stressed as she drinks water and for that also she is helped by another junior Minister seated next to her.

She is not answering questions to the point at all in any of these video clips. She has almost ducked answering these questions through different responses!

Crypto Enthusiasts are pained as well, mistreated under Nirmala's Government!

Allright, so we saw the frustration of the Middle-class Indians who want relief from the heavy burden of tax. We also saw that traditional finance investors are having a hard time because of taxes on their investment earnings.

Add to this, there are visible signs of the Indian Economy facing distress with economic slowdown, job losses on manufacturing units especially in the automobile sector and there being less demand for FMCG goods as the consumption appetite of Indians have declined.

But there is more...

Crypto holders are unhappy too, because under Nirmala Sitharaman the Government's attitude towards crypto has not been progressive, it's been regressive. And the tax burder on them is 30% and more on plain profits not even long-term capital gains. It makes crypto enthusiasts depressed feeling that they are ill-treated by the Government.

Ofcourse, Indians are glad crypto is not banned in India, but crypto enthusiasts want crypto-friendly legislation, we have borne Government's harsh treatment of us for long.

That's all folks!

Posted Using InLeo Alpha

I can feel the pain of the Indian people. We are facing something similar in our country, Nigeria. It seems there is a conspiracy among the ruling class to milk the citizens dry. It is so sad.

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating to @indiaunited. We share more than 100 % of the curation rewards with the delegators in the form of IUC tokens. HP delegators and IUC token holders also get upto 20% additional vote weight.

Here are some handy links for delegations: 100HP, 250HP, 500HP, 1000HP.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @bhattg by upvoting this comment and support the community by voting the posts made by @indiaunited.

!LOL

lolztoken.com

A masta-Don.

Credit: deanlogic

@mintymile, I sent you an $LOLZ on behalf of memehive

(4/10)

Delegate Hive Tokens to Farm $LOLZ and earn 110% Rewards. Learn more.