I frequently observe adults, both young and old, acting like children. Being an adult doesn't merely mean reaching a certain age; it signifies achieving a level of maturity that allows one to call themselves an adult or a mature person.

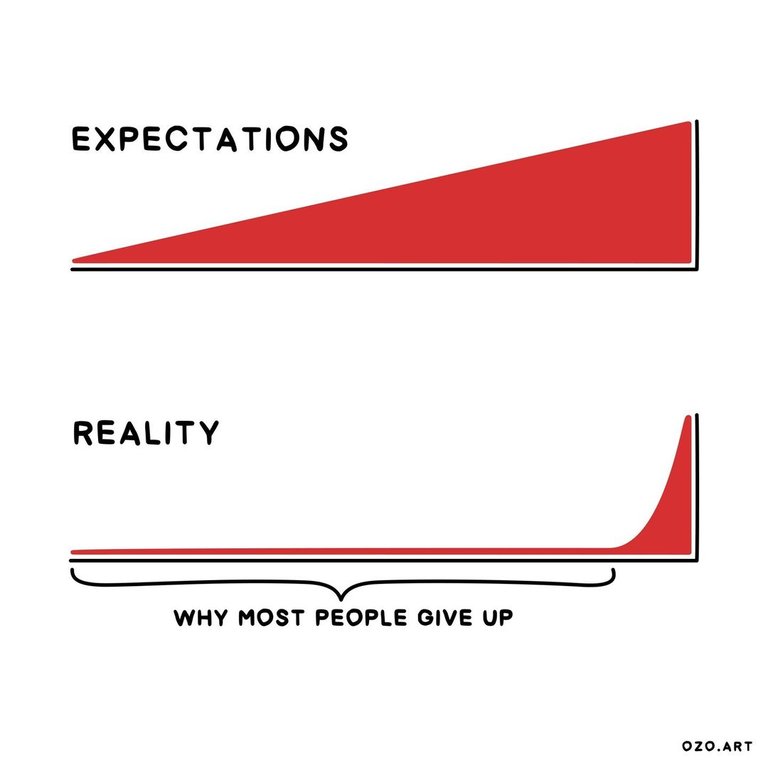

In my opinion, one of the key attributes of a mature individual is patience and attitude. Patience plays a significant role in the life we live.

There's a well-known test involving children where a child is placed in front of a muffin and told that if they can resist eating it for around 10 minutes, they will receive two instead of one, but if they give in to the temptation, they will only get the one in front of them.

Most children fail this test. It's understandable that they are not yet mature enough to have self-control over their senses and desires, but as I mentioned earlier, there are many adults who would fail this test as well.

In the world of crypto, we often daydream about buying a particular coin near its ATL (all-time low) and selling it near its ATH (all-time high), but how many of us can actually pass the muffin test of holding a coin from our entry point to 100X or higher?

A coin changes hands numerous times, metaphorically speaking, from the bottom to the top. Rarely do investors buy the bottom and hold all the way to the top, actually selling at the peak. I would advise against trying this, as it would likely result in holding an underwater bag during a bear market.

The investors in the example above won't realize it's a bear market because they would have already been trapped and blinded to the harsh reality. It's challenging to achieve a 100X in crypto, and it's even more difficult to pass the muffin test of a mere 10X.

We often talk about turning a thousand into a million, but who has the pedigree to do that? As you'll see in the coming months, there will be a lot of volatility, wild emotions, and insane price targets in the crypto space, and many investors will get caught up in excessive trading, wild swings, or the super cycle hype once again.

Dollar-cost averaging (DCA) is king, and although I wouldn't say DCA is a way of passing the muffin test, I'm sure it's my go-to strategy. I have no idea where the market will go, so I need an achievable exit plan involving gradually selling coins all the way to the top.

Once the top is reached, it's easy to look back and calculate, "If I had bought this coin at $1 and held it all the way to $100, I'd have made $100,000." What if it tops out at $50, and you sell nothing until the next bottom, which might be around $3? Wouldn't it make more sense to gradually exit positions as the market becomes more volatile?

The muffin test in crypto is much more complex than the one involving children, but very few pass it. Make sure to be one of those who do.

Thanks for your attention,

Adrian

Great analogy!

Thanks.

Patience and reward must have an equitable connection, currently the web3 industry is in the evolution phase to become a matured industry, that can maintain this equibilirium

Web3 is just getting started.

Well written article.

Thanks.

I'd eat the muffin immediately because I don't want 2 muffins :D

Got that.

Yeehaw, this here post is as refreshing as a cold drink on a hot day! It takes grit to navigate the crypto terrain, partner. Remember, patience and steady hands win the race. Keep riding, but always mind your reins to avoid getting bucked off!