Image copyright me. Generated using DALL-E

The federal government here in Australia has proposed a price cap on coal and gas as Australia suffers from the extreme global volatility and demand for coal and gas. Despite Australia being the Saudi Arabia of gas, Australian consumers and businesses have been paying global prices.

You might be thinking, but maybe gas supplies are running out. It's a good thought, but Australia has a treasure trove of gas supplies, many of which have been identified and not tapped yet. Despite supply being abundant, Australians are paying record prices for gas. There is no shortage of gas.

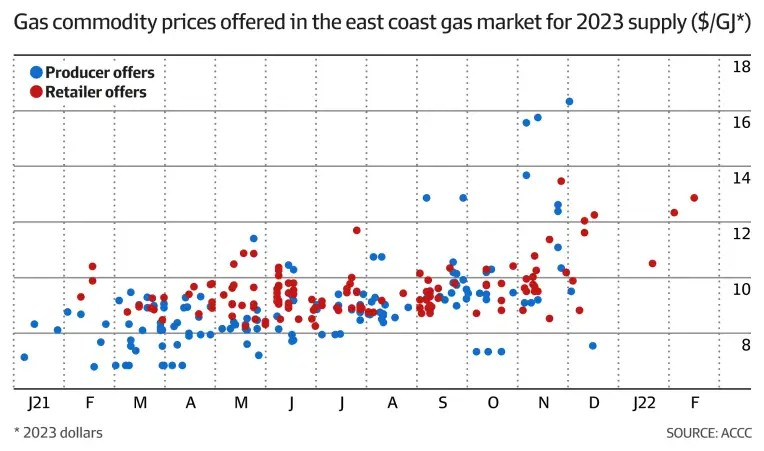

Despite the cost of production remaining at a steady $5 per gigajoule, gas prices have fluctuated widely on the spot market. The ACCC says prices for east coast domestic gas delivered in 2023 have rocketed to an average of $16 per gigajoule from $8 per gigajoule. The price has doubled.

Energy prices are one of the major contributors to inflation, which in turn causes the RBA (Australia's central bank) to increase interest rates, hurting consumers more than greedy corporations. It took companies petitioning the government and begging for domestic gas reservation and price cap policy even to be mentioned. Companies started saying they could no longer be viable at current gas prices and would need to close up shop.

The federal government proposal is simple. A 12-month gas price cap of AUD 12 per gigajoule on new wholesale gas sakes by producers in the East Coast market extends to Queensland, New South Wales and Victoria.

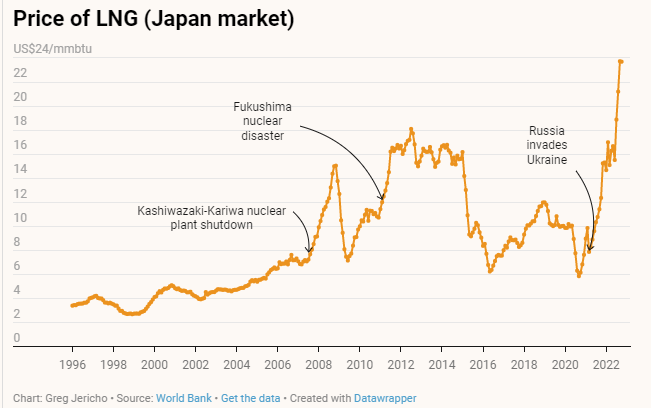

The gas industry is scared. The gas industry which is comprised of just four large producers make up what is dubbed a "gas cartel" due to limited competition, these gas producers have been able to profit from the Ukraine War by exporting LNG at war-inflated prices. As you can see from the below chart, the gas industry profits every time there is a huge disaster or, in the current instance, a war.

If we dive deeper into the profits that gas companies have made the past year, we can see clear as day that gas companies have profited from doing nothing at all. They profited because Russia invaded a Sovereign nation, and gas supplies were threatened. Prices didn't go up because the cost of production (which I pointed out has been stable) went up.

The data paints a horrifying picture. The gas industry got close to $40 billion more in revenue, exporting the same amount the year before. And Australia, due to its lax approach to windfall taxes, has reaped very little from this. Not to say that anyone should be profiteering from the loss of life, but if it's going to happen, should the excess profits be taxed at a rate of at least 70% (or higher)? The former treasury secretary Ken Henry proposed taxing the profits at a rate of 100%.

And some people might think 100% sounds a little steep, but what valid arguments are there against it? The gas cartel did nothing to cause prices to rise. They didn't see an increase in production costs or other overheads. So, the gas companies still keep their $44 billion profit, but the excess after that is heavily taxed or taken entirely. Everything else after the $44b is blood money.

The argument the gas lobby is using to push back against price caps or government interference is it would create "sovereign risk" and make investors think twice about investing in new gas projects, deterring foreign investors and jeopardising gas supplies in the future. Except, there isn't any evidence to support this claim. Other countries have windfall profits taxes and levies, but they seem fine.

While governments like the Australian government generally let free markets operate independently, it has become clear that Australia needed to intervene in the gas market. Free market arguments aside, the only people challenging government intervention are the greedy gas corporations making obscene profits off the loss of human life.

Arguing in favour of temporary government intervention to make energy bills more affordable and stop inflationary pressures is a bid for one of Australia's energy companies Origin. The bid effectively evaporates the argument that government price caps would deter foreign investment.

The one thing people need to remember, no matter how many scare pieces the gas cartel runs in Murdoch-owned press, is: where else are they going to get gas? We keep hearing threats of investment being threatened, but Australia's plentiful gas resources and world reliance on it mean that there will always be an investment. Where else are investors going to go? The gas cartel needs the gas because it's their core business, and there is no alternative. Their threats are shallow.

Posted Using LeoFinance Beta