There are different techniques and market signals out there that can be a telling for what's to come during a new year in the financial sector. And one of them is extrapolating the results by the end of the month to if this will be a good or bad year overall. And behind this stands the is called January barometer which considers that the performance of the stock market in January, foreshadows it's annual movement.

January barometer

There are some stats behind it that provide some evidence in this belief, even if this might be at a more superficial layer. A fact supporting this is the analysis made by Christian Galipeau of Putnam Investments between 1950 and 2000, which revealed that S&P 500 provided a +17.6% return during the year when it rose in January.

January 5-days trend

Another technique, but even more radical, considers only the first five days of the trading in the beginning of the year in order to signal the overall market direction for the entire year. The stats are telling us that when S&P 500 rose during the first five days, the results were of +14.3% return for the whole year. Not too shabby either in my opinion.

Accuracy

With the tumultuous social and economical context, the indicator seem to have lost from its accuracy, but still providing positive returns when applied. It seems that getting into stats in between 2000 and 2023, when we saw a rise in January it resulted in a +9.7%, but this including counting dividends earnings.

Overall I think that the January barometer can still be a good indicator for what's to come for the rest of the year. This applies as a whole, while we can see extremes from one stock to the other.

Stocks and crypto correlation

In the same considering that nowadays there is a strong correlation between stocks and crypto, the January barometer can be used also as a trend for the crypto space for the year. Of course there are also big events that can boost these trends - like the Bitcoin ETF which was approved, Bitcoin halving and Ethereum ETF - but we need to start from somewhere. Reading the market is not an easy thing, but using such indicators might help along the way.

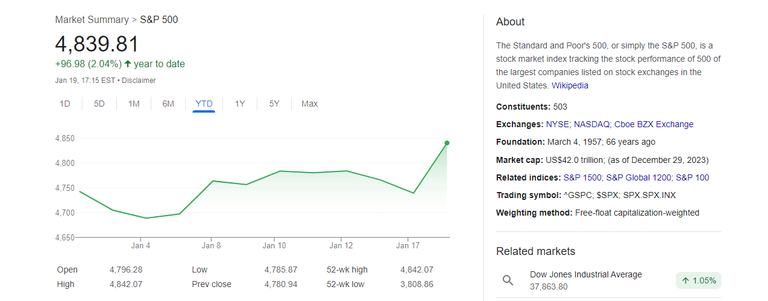

Some news fresh out of the oven tells us that the S&P 500 just reached a new All Time High, which might pave the trend that we'll see for the year. Some say that the bull run (in crypto, but also in stock) is to come next year, but seeing such spectacular results at the beginning of the year I cannot but wonder if that will come earlier. I see quite many positive signs that could support that, but the entire macro space is quite difficult at the moment to anticipate anything. But there is hope nevertheless.

As I stumbled upon this new financial notion, I felt that it would be useful to share it with you. In addition to that I wonder what indicators or signals you are using to anticipate market movements. Feel free to add your comments to strategies in this regard. Sharing is caring!

Posted Using InLeo Alpha

Hmmm, never considered this - thanks will dig into this more.

Yeah, one more instrument to be minded about in the financial universe.

I was also shocked the way Ethereum went so high in price. January might truly be a great and strong pointer

Let's see how the rest of the year will unveil itself, I have big hopes.

S&P 500 just made a new ATH yesterday, seems like a good year is in from of us. 😉

True, S&P 500 is rocking at the moment!

I think it's good to add this barometer as a general tool to gauge the overall market performance. With the S&P 500 hitting an all time high yesterday, it looks like this year will be better in terms of market performance :)

That's what we all hope for and analyzing some indicators might enforce our trust in the direction we are going.

I think those are some effective tools for accurately predicting the movements of the stock markets each year especially the January Barometer and the Correlation between stocks and crypto. But I hardly think the ETF approval had even the least effect on stock price appreciation this month. Maybe I am wrong. Thanks for sharing this info.

I’m sure that the Bitcoin halving will bring about more pump

Let’s watch out and see what happens

@tipu curate

Upvoted 👌 (Mana: 0/48) Liquid rewards.

!DHEDGE

That's how markets work, now the stock market has gone up a lot and people who are now will put all their money into crypto after a while.

Let's see the direction the Crypto market moves after the bitcoin halving