Staking your assets is a good way to mitigate the decrease in value during a bear market but it can also be a good choice when the trend is pointing upward again.

I've been doing some spot trading and to me, staking some of my assets is sort of a way to prevent myself from making hasty decisions. It's a psychological thing really. When a token is staked, you don't react to every pump and dump way too soon.

It can also be because it is locked for a certain time, because of the fees, or simply because it is too much of a hassle. To me, staking during or before the bull market is locking in a plan or a decision to hold an asset for a longer time.

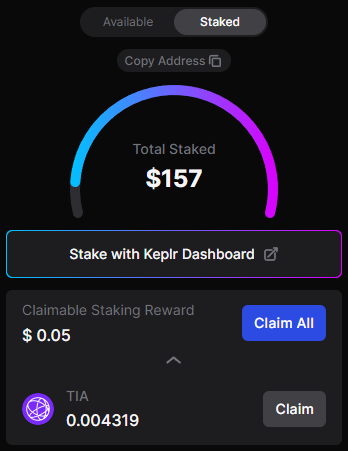

Staking $TIA

Yesterday I received some $TIA, a native token of the Celestia blockchain which is a so-called modular network. For those interested more in the technical side of Celestia, I've attached a link here to a post explaining in more detail how Celestia works.

As for the token side, the price of $TIA has seen some remarkable upward movement in the past month(+175%) and just during the last 24 hours, it has surged a good +20%. Still, I believe $TIA has much more room to grow during a full-blown bull market and therefore it is marked as a long-term hodl asset in my books.

Be whatever wallet possible, I don't like the idea of letting my tokens just lie there idle on the bottom of it. Instead, I'm always looking for attractive opportunities to make my assets work for me. In other words, I'm looking for ways to stake them.

With $TIA, this is as convenient as it gets as the staking can be done right on the Kepler wallet interface. Here's how to do it:

Download Kepler wallet from their official site.

Install using Google sign-up or the seed phrase method.

Add Celestia network onto your list during(or after) the process.

Buy and transfer $TIA to your wallet. $TIA can be bought on many exchanges including Coinbase, Binance and CoinEx.

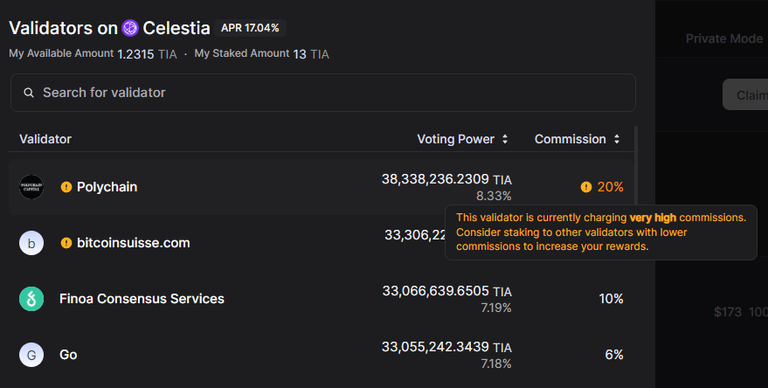

Once you are set, open the Keplr Dashboard on your wallet, choose Celestia chain and choose a validator.

Validators charge a certain commission percentage that is taken from your staking rewards. As seen in this picture, the interface helps to let you know if the commission is too high.

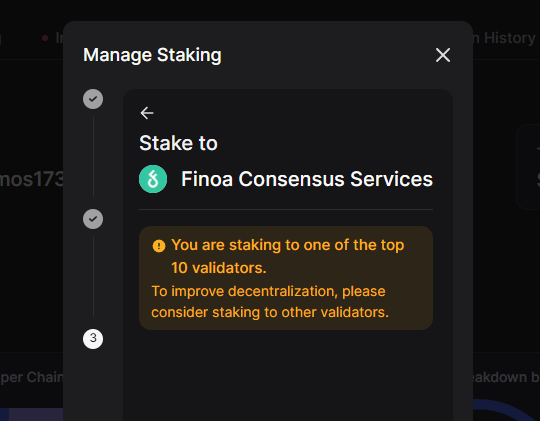

Choosing a validator will then define the APR of your stake. For me, it's 17.04%. I chose one with only a 5% commission and one outside the top 10 validators. This is another thing, Keplr will also encourage you to do so as it helps to decentralize the network.

Here's a note that I got when I rushed to delegate to one of the validators with a very large voting power.

Before signing and completing the staking process, it's good to note that there is a 21-day unbound period when you decide to unstake.

You can now monitor your claimable staking rewards on your wallet interface and claim any time you like.

Some Thoughts

APR of 17% is pretty good for a single stake and when it's done without a third-party platform it's convenient and a bit safer I suppose. As I mentioned, I consider $TIA as a long-term investment so the unlocking period isn't a thing for me.

Just one more reason to stake $TIA, and I know, these are only rumours but there might be a possible airdrop on its way for those who participate in staking $TIA on Keplr... Not holding my breath but that would be a nice bonus for sure.

All in all, I consider this staking opportunity as a relatively safe, low entry-level option.

Rember to DYOR.

Staking on Solana

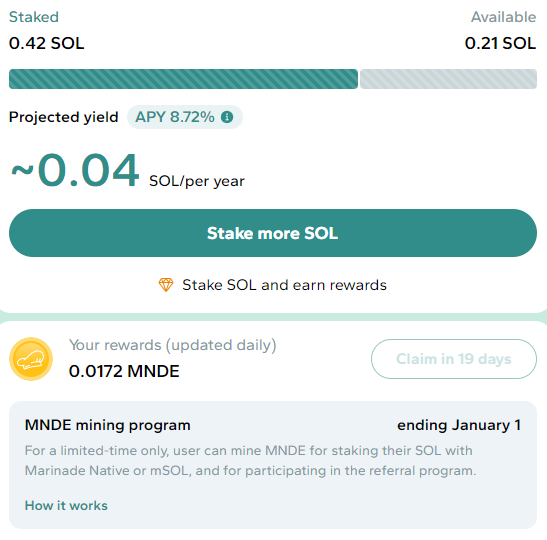

Another way of staking that I recently got involved with is Marinade, a stake automation platform on Solana.

On Marinade there are two single-stake options: native and mSOL. I chose the latter one which means that when I stake my $SOL, I get a sort of a receipt that represents my stake. mSol is a Liquid Staking Token, or LST. It is earning an APY of 8.75% currently but the interesting thing is that while it is staked, it's also liquid meaning I can do other things with it such as lending for example. This would happen on some other Solana platforms and would earn an extra APR on it.

Another difference between the two staking options is how the rewards are paid. While the Native option pays SOL rewards directly after each epoch, with liquid staking of the rewards bearing mSOL token, the rewards are automatically added to the mSOL price. This means you will get more SOL when you unstake.

Marinade is also incentivizing users who stake on their platform with $MNDE which is a governance token of the platform and could very well hold some value in the future.

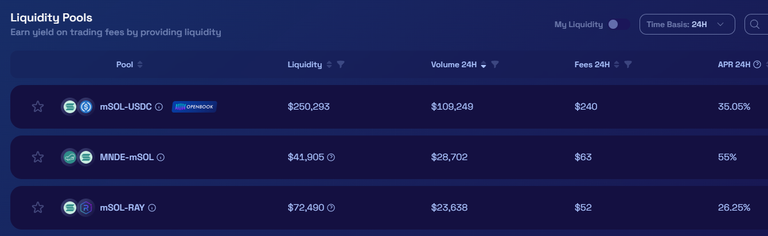

What to do with mSOL?

Margin is a borrowing and lending platform where you can lend your mSOL for an extra APY and then use it as collateral for borrowing assets.

Another idea could be providing liquidity on platforms such as Raydium.

Here you can pool your mSOL with different assets to earn even better APRs but keep in mind that the risk level also increases with this option as you will be exposed to another token and therefore might experience impermanent loss.

Some Thoughts

Even though liquid staking on Marinade is a good solid choice, it gets more risky if you decide to start using mSOL for borrowing & lending and pooling as these are considered more or less degen strategies.

Some users start with Marinade, use their liquid mSOL to lend, use that as collateral to borrow assets and stake those again creating a loop across the ecosystem. This requires a lot of research and calculations to be beneficial. However, there are quite many upcoming airdrops on different Solana platforms and by looping assets like this, users are recording their on-chain activity to participate in multiple airdrops.

For some of these airdrops, there is already a setup points system while some are on a stage, "there probably will be an airdrop". Still, you never know, as some past drops have been based on the user's earlier activity on-chain. The recent JTO airdrop is a good example of this.

As for me, I'm not that keen on going through all that hassle and the only one I'm somewhat taking part in is Jupiter where I do my Solana swaps and hope it's enough to count for the next drop.

Final Thoughts

If you are long-term bullish on a token and decide to hold it, single staking is definitely something to consider. In my opinion, it's a very good way of adding to your tokens passively. Sure, the APRs can't be compared to those when farming and being exposed to two sides but the risk level is also considerably lower.

This article was just a little glimpse of staking options out there but I'm planning to make this a weekly blog post covering all sorts of opportunities in the vast ocean of decentralized finance. So don't worry, there's more to come! Just be sure to follow. 😎

If you have any questions, suggestions or comments, drop them below. 👇

Until next week, thank you for reading!

Disclaimer: All pictures are screenshots from the dapps mentioned. The thumbnail image was made by me with the help of Bing Image Creator.

Posted Using InLeo Alpha

Very informative. Had to bookmark it to read it later more carefully. First time read about Celestia network. Thanks

Thank you very much!

Celestia is the one I'm really bullish on and it did very well during the latest dip. Highly recommend checking it out!

I surely will, thanks