Did El Salvador president Nayib Bukele just bend the knee to the International Monetary Fund (IMF) and surrender his nation's independence, or is he just playing a game of 4D chess?

Some slightly embarrassing news has surfaced that El Salvador made concessions on their Bitcoin law in order to receive a $3.5 billion dollar loan from the IMF.

What does this mean? Is Bitcoin no longer legal tender in El Salvador? Will the country stop their daily purchases of Bitcoin? Will the people be forced to pay their taxes in the filthy US dollar?

This Article's Key Takeaways

- The Bitcoin legal tender law was never actually enforced in El Salvador, and businesses were never afraid to reject it as payment.

- If you choose the right businesses, you can still pay for groceries, meals, coffee, and cell phone service with Bitcoin, and the overall payment process has improved.

- El Salvador will continue to buy Bitcoin, despite the IMF's demand that the country limit their purchases. Meanwhile, the national Chivo wallet will be sold or wound down.

- The government will take a $3.5 billion dollar loan from the IMF, despite their recent debt buybacks, and promises to stop borrowing.

- The best way to get people to accept crypto may be through token incentives, rather than by passing laws. SoFi and DePIN projects are proving this.

The IMF's Press Release

In order to qualify for the $3.5 billion loan, the IMF is demanding El Salvador make the following changes to their Bitcoin law:

- Acceptance of Bitcoin by the private sector will be voluntary

- The government's involvement in Bitcoin will be restricted

- Taxes must be paid in US dollars

More concretely, directly from the IMF's press release:

The potential risks of the Bitcoin project will be diminished significantly in line with Fund policies. Legal reforms will make acceptance of Bitcoin by the private sector voluntary. For the public sector, engagement in Bitcoin-related economic activities and transactions in and purchases of Bitcoin will be confined. Taxes will only be paid in U.S. dollars and the government’s participation in the crypto e-wallet (Chivo) will be gradually unwound. Transparency, regulation, and supervision of digital assets will be enhanced to safeguard financial stability, consumer and investor protection, and financial integrity.

In this article, we'll discuss the impact this deal will have on Bitcoin in El Salvador, how it affects the country's independence, and some potentially more effective ways to achieve cryptocurrency adoption.

Changes To Bitcoin Legal Tender Law

Technically speaking, Bitcoin is no longer legal tender in El Salvador. That means businesses are no longer required to accept it as payment, and taxes must be paid in US dollars. What impact will this have on Bitcoin adoption on-the-ground?

Not much.

Having lived in El Salvador for more than two years, I can confirm that the majority of businesses do not accept Bitcoin consistently, and the legal tender law has not been enforced. Therefore, while the employees are certainly friendly and helpful, they aren't afraid to decline your request to pay with Bitcoin.

There are plenty of reasons why businesses may be unwilling or unable to accept Bitcoin. Here are some common replies I get from workers when asking to pay with Bitcoin:

- "We haven't integrated it yet"

- "We can't find the tablet/phone"

- "The device isn't charged"

- "The person who accepts Bitcoin isn't here"

- or a simple "no, (sorry)"

What can we foreigners do, besides graciously accept their answer?

Perhaps if enough people were to request to pay with Bitcoin, businesses would get the message that there's sufficient demand, and implement a consistent process to receive Bitcoin payments.

Unfortunately, a lot of Bitcoiners are just HODLing their Bitcoin while still using traditional bank cards or cash to make payments, which is stifling adoption.

Benefits Of Authorizing Cryptocurrency

A lot of people in the crypto sphere argue that El Salvador's Bitcoin legal tender law is unethical. While I agree that crypto acceptance should be voluntary, we have to acknowledge that most people won't use it without permission.

The majority of the population aren't rebels, and will only do something when the authorities permit it. Therefore, having federal, state, municipal or (preferably) community leaders telling the people that its okay to accept crypto can hasten adoption.

Thanks to the Bitcoin legal tender law, a lot of Salvadorans opened up to the idea of cryptocurrency, who would have otherwise avoided it if the government had taken a negative stance towards the industry.

Bitcoin Payments Improving Over Time

Paying with Bitcoin in El Salvador has certainly improved since the end of 2021, when it was first integrated. Back then, there were more issues with the Lightning Network and the Chivo wallet. For example, sometimes channels wouldn't open properly, or payments wouldn't be received despite your wallet saying they'd been sent.

Since 2021, several bugs in the Chivo wallet have been squashed, and other wallets such as IBEXPAY, Athena Pay, and Blink have been adopted by local businesses, and function much better in my experience.

At the end of the day, if you choose the right businesses you can still pay for your groceries, meals, coffee, and cell phone service with Bitcoin in El Salvador. I've actually been noticing more businesses accepting Bitcoin now compared to just a few months ago.

Restricted Government Involvement in BTC

Another compromise the Salvadoran government will have to make for the $3.5 billion loan is "restricted economic activities, transactions, and purchases of Bitcoin in the public sector". What does that mean?

Recall that back in 2022, Bukele announced on Twitter that El Salvador would start buying 1 Bitcoin per day, and adding it to their strategic reserve. As per the IMF's press release, you might be inclined to think those purchases would stop. But, according to The Bitcoin Office, the buying will continue.

The government will also have to wind down their involvement with Chivo, the custodial wallet that citizens had to install to get their free $30 airdrop of Bitcoin. Chivo may end up being sold to the private sector, or dismantled entirely.

Striking A Deal With The Devil

The most disheartening aspect of the agreement is that El Salvador will be borrowing even more money from the IMF. Not only does this undermine their sovereignty, but the move also reverses the country's recent debt buybacks, and Bukele's claim that the country won't borrow another penny to fund domestic development.

One thing I admired about El Salvador's leadership is their push-back against foreign interference into their domestic affairs. Only El Salvador knows best how to run their own country - not the IMF, nor the United States. Each country deserves to make their own decisions, and this deal puts their autonomy in jeopardy.

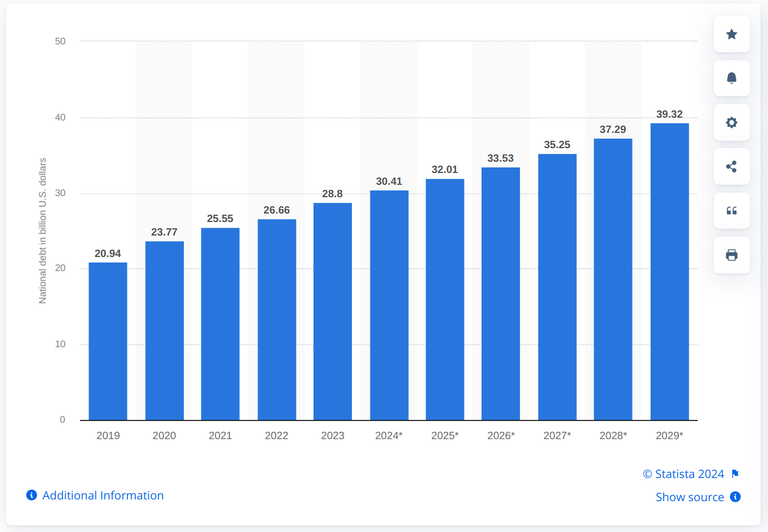

While some are hopeful that Bukele will use the loan to buy more Bitcoin, the IMF's statement makes that outcome unlikely. According to Statista, El Salvador is still heavily indebted to the banksers. The country may be struggling to service this debt, especially considering the high interest rates we are facing today.

Although this deal with the crooked IMF is a disappointment for many of us, some are claiming that Bukele is "playing chess, not checkers," and it's just part of a bigger plan.

Bukele Playing 4D Chess?

Of course, there is more to this story than meets the eye.

Like most nations, El Salvador has been enslaved by bankers for decades. Who knows what kind of secret backdoor deals were made before Bukele was elected president? These agreements have to be maneuvered around carefully. Removing yourself, your nation, or your community, from debt servitude doesn't happen overnight.

We can only speculate on what Bukele and his advisers are envisioning as a result of this agreement. Perhaps the plan is to completely pay off the debt once Bitcoin is worth $1 billion per coin? Or maybe it's all part of a greater plan to launch CBDCs, with Bitcoin as the base of the new financial system.

Lessons Learned From El Salvador's Bitcoin Experiment

In spite of the legal tender law, Bitcoin adoption in El Salvador has been rather lackluster. We are left wondering, how can we build a sustainable crypto-powered economy, while escaping debt slavery simultaneously?

Although the $30 Bitcoin airdrop to citizens certainly stimulated economic activity, it was only a temporary burst, and the masses went back to using the US dollar after their gift had been spent.

Thinking about it from a business owner's perspective, accepting Bitcoin will only slightly increase their revenue. Is it worth the headache of the technical difficulties, training of staff, and additional accounting?

Perhaps instead of passing laws, we need to reward individuals and business owners for participating in a network, instead of compelling them to do so.

Economies Based on Token Incentives

Bitcoin and Ethereum have laid the foundation for a new economy, based on trustless blockchains. Rewarding people with censorship-resistant tokens for contributing to a network seems to be the most natural way to boost crypto adoption.

Take a look at social finance (SoFi) projects Hive and InLeo, for example. Instead of paying people for articles through an inefficient banking system, the blockchain pays them directly and automatically for creating and curating content. The tokens earned then give them more influence over the network.

Or consider DePIN project Helium as another example. In this case, the blockchain pays HNT tokens to individuals automatically (via smart contracts) for installing WiFi hotspots and providing coverage. Those tokens can then be traded and used to pay for cellular service on the network.

This same concept of token incentives can be applied to mapping data, compute power, storage space, solar energy, AI data, and more. We can stimulate both virtual and real-world economic activity by rewarding individuals with tokens for their contributions.

Perhaps crypto is not merely a replacement for fiat money, but rather the basis of a new economy that embraces both decentralization and individual liberty. Rather than feeling obliged to participate, people will happily volunteer, thanks to the rewards they receive.

Keep in mind that SoFi and DePIN are still in their nascent stages. Plenty of problems will need to be worked out, including the potential for token censorship, and uneven initial token distributions.

El Salvador's Overall Progress

Despite the drama surrounding the Bitcoin law, the fact remains that El Salvador has made significant progress in recent years. Many locals have been referring to what's happened here as a "miracle".

The country has transitioned from the "murder capital of the world", to the safest country in the Americas. Unlike the West, where criminals are imported and allowed to roam free in the streets, El Salvador has taken a tough stance on crime.

The enhanced security has not only increased tourism and immigration, but allowed many Salvadorans to return to their home country. Infrastructure, like roads, highways, and bridges have have also improved over the past few years.

If you want to experience conservative values, pleasant weather, kind people, and beautiful beaches that is enough reason to visit El Salvador, even if the future of Bitcoin remains uncertain in the nation.

Until next time...

If you learned something new from this article, be sure to check out my other posts on crypto and finance here on the HIVE blockchain. You can also follow me on InLeo for more frequent updates.

Further Reading

- Should President Bukele Be Condemned For Buying Bitcoin With Tax Dollars?

- The Uncertain Future Of Bitcoin in El Salvador and Other Nation States

- Will Traditional Nation States Survive As Crypto Adoption Takes Off?

- How El Salvador Transitioned From The Most Violent Country In The Americas To The Safest

- Paying For Chicken Wings, Starbucks, And Groceries With Bitcoin In San Salvador

- More Articles About El Salvador

- More Articles About DePIN

Resources

Statista National Debt Of El Salvador [1]

DePIN Flywheel Image [2]

Posted Using InLeo Alpha

Oh. That does sound disappointing. The last I heard people were saying that El Salvador was going to be the first nation ever to be able to pay back their IMF loans.

Yes, or at least stop borrowing more.

Thanks for this update. Have been moving a 36' sailboat from Toronto Canada to Central America since August. Spending the winter in Halifax, NS.

You're very welcome. Good luck on your journey.