Gold and Silver have had a spectacular run of late, but is the party over? Markets never go up in a straight line and when they go parabolic for a while it’s pretty normal for there to be some kind of correction as with a bit of mania they can become “Overbought”. Is that what we are seeing now? It could be that we’re just taking a breath, ready for another leg higher or the sharp reversal after a parabolic move could be signalling a top. If so, we might now be in the zone of a “Bull Trap”

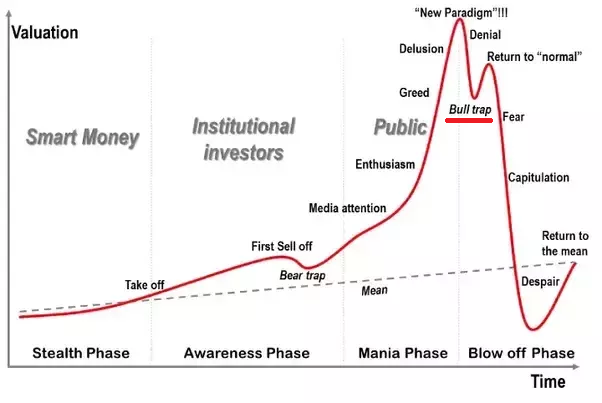

What’s a Bull Trap? According to Investopedia it is defined as follows :-

A bull trap is a false signal, referring to a declining trend in a stock, index or other security that reverses after a convincing rally and breaks a prior support level. The move "traps" traders or investors that acted on the buy signal and generates losses on resulting long positions.

It’s a bit wordy so here is a graphic that shows the Bull Trap in the context of a broader market cycle.

Personally, I think the fundamentals for Gold and Silver are still excellent. We have a lot of funny money (fiat) being printed up and injected into the global economies. Governments around the world are desperate to prevent deflation so they are doing all sorts of crazy stimulus to try and get money velocity moving. These stimulus packages would normally be very inflationary on their own, but in the context of a COVID-19 induced economic crisis they are being considered a necessary evil.

Source

The big question is have they done enough, or gone too far? It’s possible that the precious metals markets have gotten ahead of themselves. Or they might still be playing catch up as the Sheeple start waking up to the currency devaluations going on around them. I think it’s a good time to be cautious and I’ve been expecting another deflationary wave to hit the markets before the US election. Whichever way it goes this 2020 is going to be a year for the record books.

Posted Using LeoFinance

I think it is an Elliott wave ABC correction. We had the big drop 'A', then the run back up 'B', we need the 'C' wave which ends lower than 'A' did. Once that happens, maybe end of this month, early Sept, LOAD up with long dated March 2021 calls. We will likely see $50+ by the end of the year.

If you purchase $32-35 dollar calls, you could see a 7x return at $50. If it goes to $100, then that return is around 35x.

I'm not a huge fan of Elliot wave, but I hope you are right. I suspect the correction might go a bit deeper and longer though. We've had another pretty decent sell-off just in the last few hours.

Metals will moon in the next year, this was a normal correction.

I certainly hope so! The money printing isn't going to be stopping any time soon.

It's sure been interesting watching gold and silver spot prices over the last few months.

It's almost like watching crypto it's been so volatile :)