A week for digging deeper into uranium opportunities with a focus on stocks with options markets

Portfolio News

In a week where S&P 500 rose 2.47% and Europe rose 1.94%, my pension portfolio rose only 0.2%. Drags were a few ASX resources (esp., Blue Star Helium (BNL.AX) down 17.4% and Latin Resources (LRS.AX) down 9%), German stocks apart from Deutsche Bank (DBK.DE) and Volkswagen (VOW.DE), lithium stocks in US. Uplift came from Japan and Canada (uranium and silver mining)

Big movers of the week were Delivra Health Brands (DHB.V) (33.3%), Nickel Industries (NIC.AX) (25.8%), Castillo Copper (CCZ.AX) (25%), Peninsula Energy (PEN.AX) (21.7%), Deep Yellow (DYL.AX) (20.4%), Solid Power (SLDP) (16.4%), Kairos Minerals (KAI.AX) (15.4%), Standard Uranium (STND.V) (15.4%), NuScale Power Corporation (SMR) (14.6%), Azincourt Energy Corp. (AAZ.V) (14.3%), Honey Badger Silver (TUF.V) (14.3%), IsoEnergy (ISO.V) (14.2%), Sprott Physical Uranium Trust Fund (U-UN.TO) (13.4%), Paladin Energy (PDN.AX) (11.8%), Stroud Resources (SDR.V), Denison Mines (DML.TO) (10.5%), NexGen Energy (NXE) (10.3%), GTI Energy (GTR.AX) (10%), Bayhorse Silver (BHS.V) (10%).

19 stocks on the big movers list - not hard to find the big theme - uranium with 10 stocks. Also two stocks supplying critical materials for alternate energy (nickel and copper) and a nuclear power reactor builder. Notable also are 3 silver miners - maybe they have uranium in some of those tenements. The leader is in medicinal cannnabis and is a penny stock - 1 cent move is a big percentage

The market shrugs off the Federal Reserve going quiet about rate cuts and focuses on earnings. Comes along a super strong jobs report and the market celebrates with new records - never mind the Fed

Headline writers keep playing their games - one day weak tech shakes markets and another strong tech drives markets. Tech is driving the US market - no doubt. Explains the relative underperformance in my portfolios - not enough tech stocks

Uranium Booms

Kazatomprom (KAP.IL) announced stuff in the week the market already knew that they were not going to be able to reach the 90% production targets - closer to 80% - with delays in the build of a sulphuric acid plant.

This reinforced the upward momentum in spot price of uranium with Australian broker, Shaw and Co projecting spot price of $150/lb in 2025/26/27

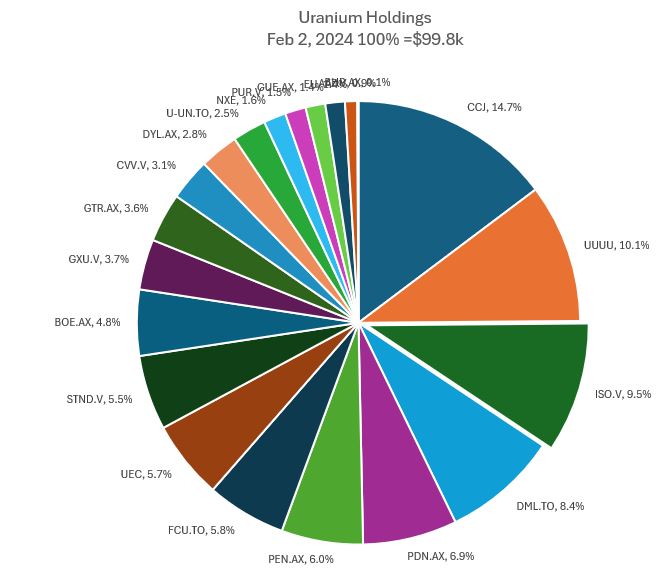

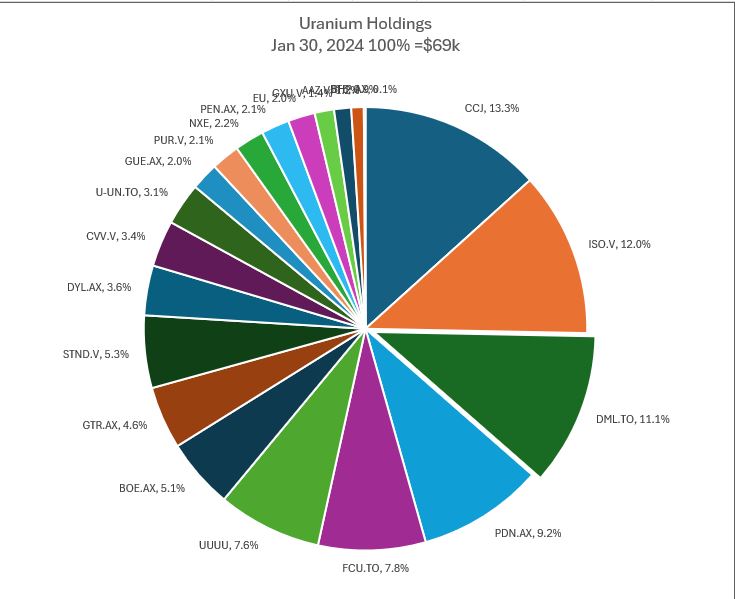

Next iteration of uranium snapshot for my portfolios - now closer to 5% of total portfolio value - increased a few positions and price did the rest. The chart does not reflect the potential of the few new options trades made this week.

The total portfolio is 21 stocks. Of course one could get the same exposure holding one of the uranium miners ETF's (details below). If Shaw and Co are right and there is sustained and growing demand for uranium, a strategic approach is to construct a smaller portfolio of stocks selected on capacity to produce and timing of planned capacity. Add in a few wildcat opportunities for speculative upside.

The holdings do reflect something of that - Cameco (CCJ) and Energy Fuels (UUUU) and new entrant Uranium Energy Corp (UEC) are in production. A few miners are working toward reopening care and maintenance operations - think Paladin Resources (PDN.AX), Peninsular Energy (PEN.AX), Denison Mines (DML.TO). In the next week, will do more work to get those timeliness better understood. Then will start the process of rationalising the portfolios into fewer stocks.

Crypto Drifts

Bitcoin price went sideways all week ending 0.7% up on the week with a trough to peak range of 5.1%

Ethereum chart is much the sae with a 1% rise on the week and a wider trough to peak range of 7%

Chainlink (LINK) found buyers with a pop of 29% and holding into the new week. Price is not far below last entry

Internet Computer Protocol (ICPBTC) popped 20% and appears to be building a basing support formation. Might be time to look at averagin down entry price - 66% below last entry

Bought

Been building positions in uranium for several weeks now. Stepped back and tallied up the holdings across 4 portfolios to see the mix and the total. Decided that the total of $69k across all my portfolios was too low given what is expected in the next 3 to 10 years.

I am thinking that uranium can go as high as 10% of my portfolios - aim for 5 to 7% (currently less than 4%). Have been choosing stocks with a view to holding stocks covering a wide range from in production to in development to in exploration to more wildcat.

The chart shows the mix from the week before at current prices - largest holding is in production - Cameco (CCJ). Will do some detailed work to put data into who is producing what and when they will start.

Pension portfolio and managed portfolio are least exposed. Started the week topping up and adding a few holdings. For the most part started with the laggards in this chart and worked upwards (apart from buying the benchmark - Cameco (CCJ)

CanAlaska Uranium (CVV.V): Uranium. Scaled in.

GoviEx Uranium Inc (GXU.V): Uranium. Scaled in. Opened new position in managed portfolio. Mines in Niger and Zambia.

Cameco Corporation (CCJ): Uranium. New holding.

Energy Fuels Inc (UUUU): Uranium. Average down entry price. Somehow the trade got duplicated on different days at vastly different prices

Standard Uranium Ltd (STND.V): Uranium. Opened new position in managed portfolio

Uranium Energy Corp (UEC): Uranium. Started the exploration for options opportunities and cycled back to UEC which have previously held stock in small managed portfolio

has two production-ready ISR hub and spoke platforms located in South Texas and Wyoming. These two production platforms are anchored by fully operational central processing plants and served by seven U.S. ISR uranium projects with all their major permits in place. Additionally, the Company has diversified uranium holdings including: (1) one of the largest physical uranium portfolios of North American warehoused U3O8; (2) a major equity stake in Uranium Royalty Corp., the only royalty company in the sector; and (3) a Western Hemisphere pipeline of resource stage uranium projects.

Added a parcel in personal portfolio and a shorter dated September 2024 8/11/7 call spread risk reversal. With net premium on the 8/11 call spread of $0.76 this offers maximum profit potential of 295% for a 48.5% move in price from $7.40 entry price. Funded the call premium fully by selling an August 2024 7 strike put option = 5.5% price coverage. Breakeven for the sold put is $6.86

Let's look at the chart which shows the bought call (8) as a blue ray and the sold call (11) as a red ray and the sold put (7) as a dotted red ray with the expiry date the dotted green lines on the right margin. This is something of a blue sky trade as price has already moved over 200% from the June 2023 lows. A repeat of the blue arrow price scenario will only reach the newly revised broker target (the green ray).

One more chart to test the blue skyness. Chart compares UEC (dark blue line) to the two Sprott Miner ETFs, Cameco (CCJ - the bars) and Kazatomrpom (KAP.L - purple line). UEC price has already moved 77 percentage points more than the major miners. That might be a bridge too far. The key point is would one be happy to invest in UEC at that breakeven level?

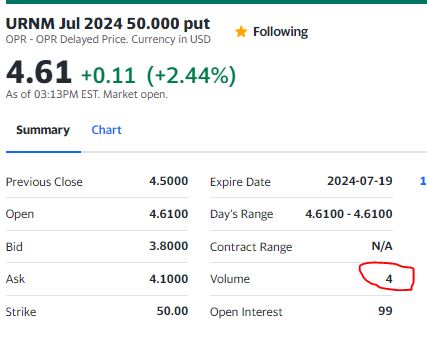

Sprott Uranium Miners ETF (URNM): Uranium. After last week's review of Sprott Uranium Junior Miners ETF (URNJ), took a look at options markets. The major miners ETF has options markets going out to Jan 2026 with moderate liquidity. Junior miners ETF only goes out to Sep 2024. Chose the longer expiry so I could put in a wider price range for the bull call spread. Put in place a Jan 2026 54/65/50 call spread risk reversal. With net premium of $4.39 this offers maximum profit potential of 151% for 22% move in price. The call spread was fully funded selling a Jul 2024 50 strike put with 6.2% price coverage

Let's look at the chart which shows the bought call (54) as a blue ray and the sold call (65) as a red ray and the sold put (50) as a dotted red ray with the expiry date the dotted green lines on the right margin. The chart is a weekly going back to the time the ETF was listed. It is a blue sky situation as price has never been this high - also been a long time since spot price for ranium was over $100/lb. If price follows the move from the lows in 2020, the trade will reach the sold call strike before expiry. The more important factor is will price stay above $49.78 (breakeven) until July expiry. There is very little techncial support for the level other than the top of the range over the last 6 weeks

Options chain shows I was the market on the sold puts - broker paid me the commission.

Peninsula Energy Limited (PEN.AX): Uranium. Jumped into share purchase plan at 4 times the levels I normally do. Got scaled back to 37% - scaled in my holding in a huge way - paper profit off the bat is 73%. And the plan came with free standing unlisted options with an exercise price that is now below the market - will exercise those soon.

Sixt SE (SIX2.DE): Vehicle Rental. Average down entry price in personal portfolio. Dividend yield 4.56%. Wrote covered call for 1.08% premium with 1.6% price coverage - for two weeks.

Pantera Minerals Limited (PFE.AX): Base Metals. Newsletter from Next Investors discussiong the potentail to extract lithium from old oil wells in Smackover field Arkansas - next door to Exxon Mobil.

Concept is to access the salt brines from the disused oilwells. The attraction is brine development can be switched on and off as prices rise and fall.

Sold

Vistry Group PLC (VTY.L): UK Construction. Closed out at 52 week high for 27% profit since February 2023. Stock screen idea.

ASX Portfolio

The segment reports trading in ASX fractional share portfolio. Trade entries are made based on stock screens looking for undervalued stocks (price to book, price earnings, price to sales) that are showing technical signs of breaking a downtrend. Exits are made at 30% profit or 20% if 52 week high is lower than 30% advance. New buys are in $400 lots. Scale ins and top ups in $200 lots

New Buys

Qantas Airways Limited (QAN.AX): Airline. Dividend yield 3.09%. Been avoiding buying this as have little belief in the managemenet team even after the departure of previous CEO - Alan Joce. Stock keeps popping on the screens - bit the bullet.

Chart does show enough headroom to hit the 30% profit target - a little higher than the 2023 highs.

Orora Ltd (ORA.AX): Packaging. Dividend yield 5.80%

Chart shows price breaking the downtrend and making a series of higher lows. Some concern from one of the brokers that Orora may have overpaid for a French glass packgaging acquisition (see inset)

Mirvac Group (MGR.AX): Property. Dividend yield 4.90%

Chart shows price reversing off support level from 2020 lows. 30% target is well below the late 2021/early 2022 highs but somewhat above the 52 week high. Softening rate environment will help the recovery.

TPG Telecom Ltd (TPG.AX): Telecom. Dividend yield 3.30%

Top Ups

Humm Group Ltd (HUM.AX): Payment Services. Dividend yield 2.30%. Humm was in the list of big movers last week - added on the signal even though it looks like a "chasing the momentum" trade - keen to hit the exit on what has been a troubled sector (buy now pay later). Trade did average down entry price a little.

Myer Holdings Ltd (MYR.AX): Retail. Dividend yield 5.90%

ARN Media Ltd (A1N.AX): Broadcasting. Dividend yield

Chart shows 2nd entry in two months scaling into a rising trend and still averaging down entry price from the 1st entry

Pepper Money Ltd (PPM.AX): Financial Services. Dividend yield 7.20%. Normally spread investments out but added this on the signal with MA Financial selling (see below)

EBOS Group Ltd (EBO.AX): Healthcare. Dividend yield 3.00%

DEXUS Property Group (DXS.AX): Property. Dividend yield 6.50%

Sold

MA Financial Group Ltd (MAF.AX): Financial Services. Closed at 52 week high for 20.8% blended profit since June/September/November 2023. Averaging down worked well.

Pact Group Holdings Ltd (PGH.AX): Packaging. Pact Group is in the process of beaing acquired my majority shareholders at something of a lowball price. Had in place a pending order above teh lowball price with a view to the new buyers getting keen to sweep up the last few percentages. That happned for a 26.4% loss since March 2023. Lesson learned: do a little due dilligence in the announcements before hitting he buy button - that was on the cards some time back

One update from the trenches - Sigma Pharmaceutical (SIG.AX). it seems that Sharesies does not have established processes to take up SPP opportunities - shares not taken up = double shafted by dilution.

Shorts

Pfizer Inc (PFE): US Pharmaceuticals. With price opening at $27.52 (Jan 29), 29 strike sold puts are in-the-money. Am also decided that there is more downside potential. Started the process of trading out the sold puts by rolling out the February expiry to March. Locks in 29.8% loss on the buy back but was 7.4% cash positive. Will be watching price closely and will close out the short put if and when price recovers.

Also put in place an Aug 2024 expiry 27/25 put spread. Chose to do that as a ratio put spread to make the trade cash positive. Net premium for the put spread was $0.81 which offers maximum profit potential of 146% for a 9.2% drop in price. Quite happy to be exposed to buying the stock at $25 as the portfolio is short from $40.

Hedging Trades

Agnico Eagle Mines Limited (AEM): Gold Mining. Sold a February expiry 50 strike put option in managed portfolio. Not sure what that was about - late night ideas. With price opening at $49.32 (Feb 2), selling an in-the-money naked put does not make sense. What it will do if it goes to exercise is reduce average cost for the holding in this portfolio.

A quick look at the chart after the event. Price did trade above $50 the day before. The 20 day moving averaging (blue line) has dropped below the 50 day (red line) - that says the trend is turning down after 3 higher low cycles. The momentum indicator (MACD - bottom chart) is negative the the signal line has turned. Basically that all says the trade is a problem. But it is a hedging trade - they do not always look right.

The inset is two reports from Reuters on the same day - only one can be correct. This chart is clear - this gold miner went down.

Cryptocurrency

Holo (HOTETH): Re-entered trade after profitable exit one month back with price making a reversal off a short term support level along the bottom of a consolidation range (the yellow ray). Exit target is a little higher than the last partial exit (the top red ray)

Income Trades

Only 2 covered calls written across 3 portfolios (Europe 1 US 1)

enCore Energy Corp (EU): Uranium. With price opening at $4.92 (Feb 2) and a hoit uranium market rolled up and out 5 strike covered call to March strike 6 in small managed portfolio. . Incurred 240% loss on the buy back - that premium difference recovered on the replacement contract - so need one more month to recover the loss. Will be writing calls at a higher coverage on uranium stocks from here on. New contract offers 2.4% premium with 22% price coverage

Credit Suisse X-Links Crude Oil Shares Covered Call ETN (USOI): US Oil. Scaled into holding in penion portfolio averaging down entry price. This ETN provides capital exposure to oil markets and writes covered calls - yied is an attractive 26.73%. Takes the work away from writing covered calls but it does change the tax profile as distributions are mostly paid as dividends and not capital gains. There is no US withholding tax for foreign holders .

Naked Puts

iShares 20+ Year Treasury Bond ETF (TLT): US Treasuries. With price closing at $98.24 (Feb 2), covered call could go to assignment. Am keen to remain invested for a falling yiled environment. Sold a February expiry 97 strike put option (same strike as th covered call) for 1.5% premium with 1.2% price coverage. Jobs report strength dragged that directly in-the-money.

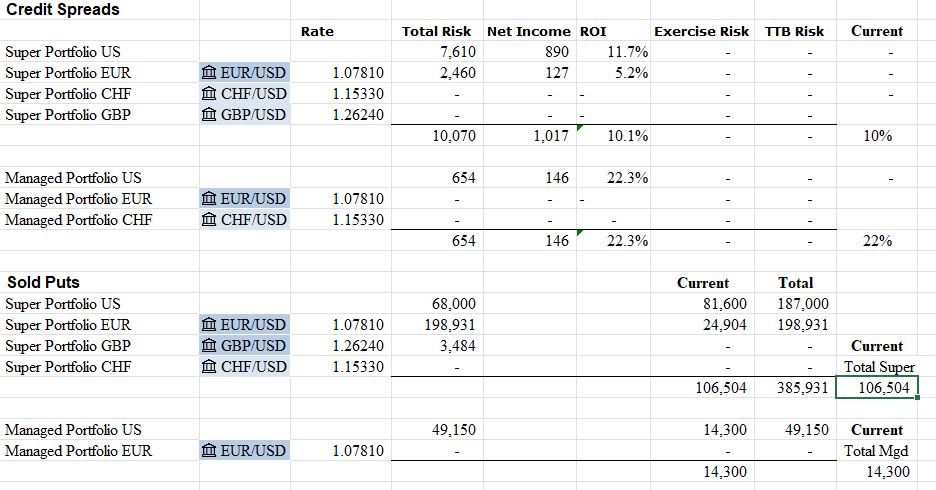

Credit Spreads

No change. Redid the exercise risk spreadsheet to show total risk rather than exercise risk . Current column is exercise risk. Been managing this on exercise risk to date - which is fine unless the market makes a major correction. Will be toning this exposure down even more. Major change in profile is the addition of TLT puts above.

Cautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers. Crypto tickers come from TradingView

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Investing: Interactive Brokers provides comprehensive global markets coverage with very competitive commissions. Open an account to earn up to USD 1,000 in IBKR stock. https://mclnks.com/ibkr

Crypto Trading: Binance offers a wide range of coins to trade, tight spreads and low fees if you use BNB to pay https://mymark.mx/Binance

Kucoin offers a wider range of altcoins than many of the other exchanges. I do like to diversify my holdings in case an exchange gets knocked over. Grab 15% discount on your trades when you open an account on this link https://mclnks.com/kucoin15

Tracking: Keeping track of your crypto trades is a whole lot easier with CoinTracking.info. Get 10% off all your account upgrades https://mymark.mx/CoinTracking

Aus/NZ Investing Sharesies provides low cost, fractional share investing for Australian and New Zealand residents covering stocks in those countries and US. Start investing with as little as $20 https://mclnks.com/shares

January 29 - February 2, 2023

Edit: Feature image changed to reflect the correct dates