A big week for markets with Trump rally driving through. Some big casualties in value on the climate change agenda and exporters to US in the holdings

Portfolio News

In a week where S&P 500 rose 4.75% and Europe dropped 1.37%, my pension portfolio rose 0.17%. The drags were stocks likely to be affected by Trump policy changes - less climate change, tariff impacted stocks like steel and Europe automotive. Biggest specific drags were De Grey Mining (DEG.AX) down 5.7%, ASX and Canadian uranium, Invesco Solar ETF (TAN) down 9.4%, Posco (PKX) down 6.5%

Big movers of the week were CleanSpark (CLSK) (31.4%), Lightbridge Corporation (LTBR) (24%), Pantera Minerals (PFE.AX) (23.8), Northern Dynasty Minerals (NAK) (22.9%), Marriott Vacations Worldwide Corporation (VAC) (21.4%), NANO Nuclear Energy (NNE) (18.5%), Articore Group (ATG.AX) (15.4%), Mayne Pharma Group (MYX.AX) (15.1`%) Beamtree Holdings (BMT.AX) (13.3%), Oklo (OKLO) (12.9%), Centrus Energy (LEU) (12.9%), Energy Fuels (UUUU) (12.7%), ASP Isotopes (ASPI) (12.6%), Lightning Minerals (L1M.AX) (12.5%), Tokai Carbon (5301.T) (12%), AML3D (AL3.AX) (11.4%), Marvell Technology (MRVL) (10.6%), Silex Systems (SLX.AX) (10.6%), Mitsubishi Heavy Industries (7011.T) (10.2%)

A short list of only 19 stocks in the big movers list. From the top there are signs of the Trump rally - Bitcoin (on top), US lithium from old oil wells (one stock), Alaska oil (1 stock help up by Biden limts), nuclear technology (3 stocks), uranium and uranium enrichment (3 stocks). The more concerning was the stuff at the bottom - silver mining, gold mining, rare earths, Europe car making, Korean steel, solar power, electric vehiches and battery technology.

The week started a little nervous in US markets ahead of the US Election and then went boom as the result emerged a a sigh of relief as markets look ahead to a world of less regulation and tighter fiscal management.

Crypto booms

Bitcoin price surged on the US Election result clearing the all time highs ending the week 19% higher with a trough to peak range of 22.5%

Ethereum price took a while to move but move it did ending the week 29% higher with a trough to peak range of 37.5% - bit not enough to clear all time highs

A few other altcoins were in the act too - Cardano (ADA) up 104% against USD at at one point.

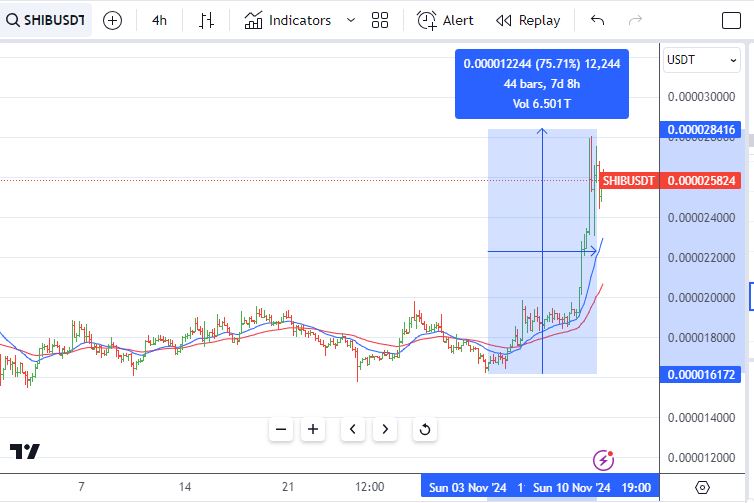

And Shiba (SHIB) up 75% also against USD

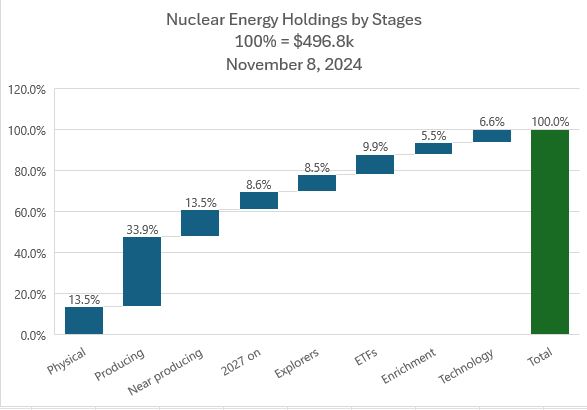

Nucellar Energy Holdings

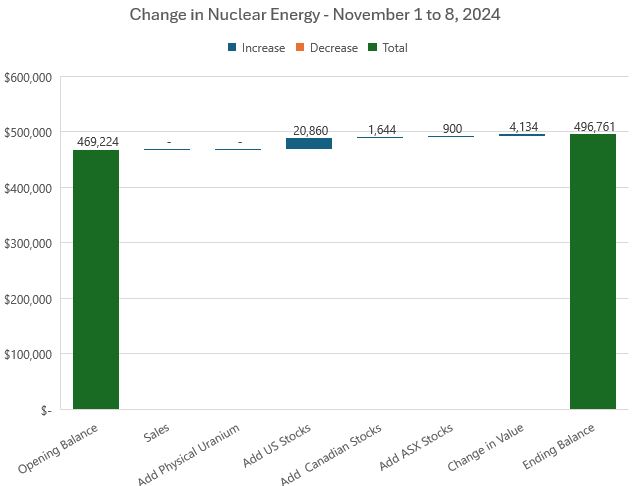

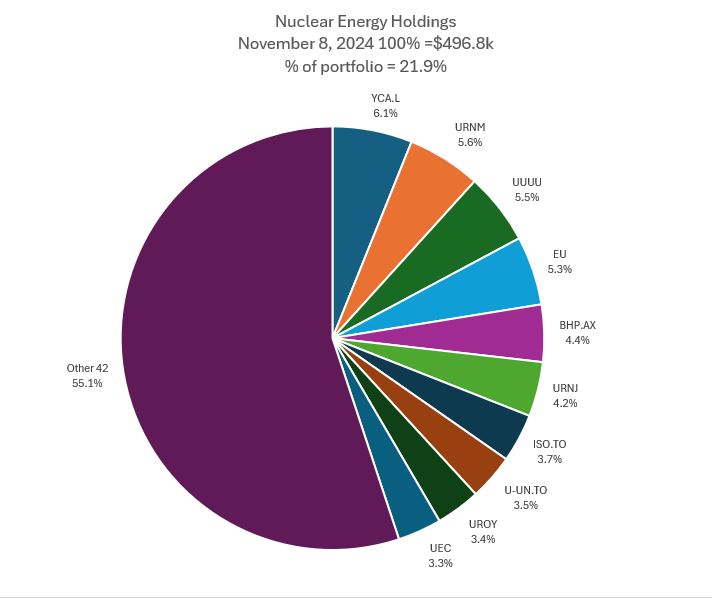

Having written last week about not making any more additions, was prompted by a challenge to add to holdings if Donald Trump won - he did and I added $10k to US uranium holdings. There were a few more additions too - overall value went up 0.88% mostly on the back of the nuclear technology names in the big movers list.

Pop in valuation for Energy Fuels (UUUU) moves it up one place to slot 3. Sprott Junior Uranium Miners (URNJ) also moves up one palce to slot 6. Boss Energy (BOE.AX) falls out the Top 10 from slot 9 and Uranium Energy Corp (UEC) comes in at slot 10. Nuclear energy is now 21.9% of portfolios - feeling a bit high.

The additions moved producing up 0.7 points and near producing up 1.3 points. Explorers came off a bit and enrichment was up just shy of 2 points and technology rose with the value improvement there.

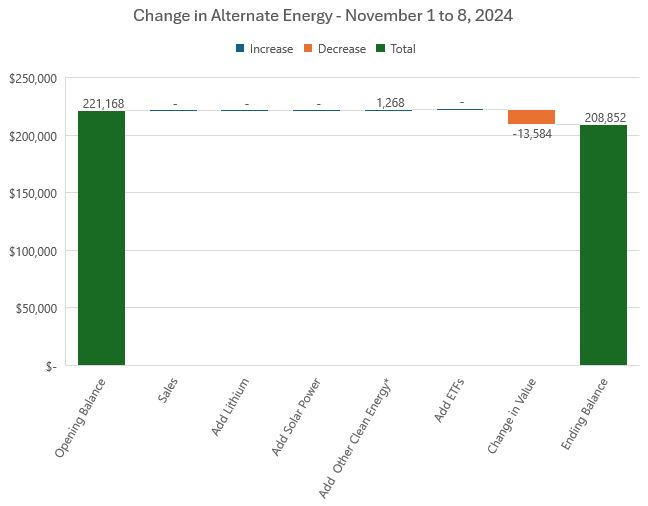

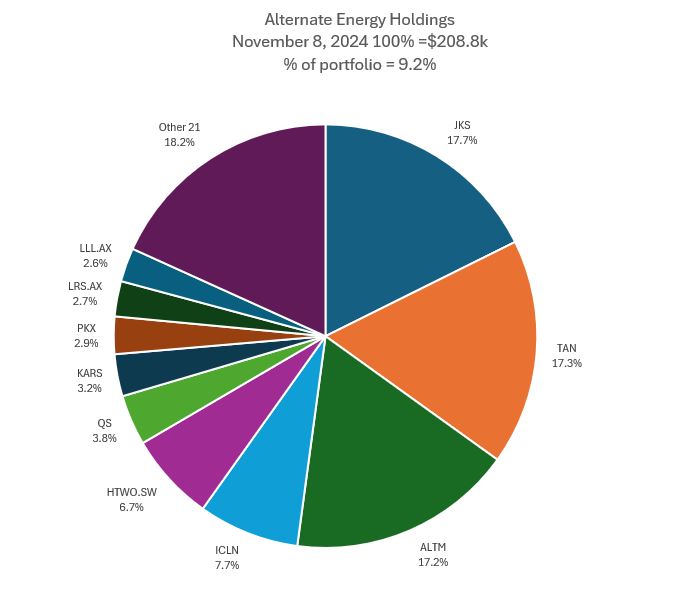

Alternate Energy Holdings

One small change in alternate energy stocks with the addition of Gevo (GEVO). The big move was the valuation drop especially in solar stocks - down 6.1%. This feels like an over-reaction to Trump views on keeping fossil fuels for longer and down playing climate change. The people will keep buying solar in the long run.

Changes in mix start with large drops in share for solar stocks with JinkoSolar (JKS) down 2.1 percentage points and Invesco Solar ETF (TAN) down 0.7. Dropping out of Top 10 is Sigma Lithium (SGML) replaced by Leo Lithium (LLL.AX). This is an anomaly as Leo is currently suspended. Share of Others goes up 1.4 points and is now 21 stocks (was 20). Overall share of portfolios drops 0.5 percentage points - which does bring energy excluding oil and coal down to 30 percent.

Bought

Uranium market was a little soft in the week as spot price kept drifting.

Sprott Junior Uranium Miners ETF (URNJ): Uranium. Added holding to average down entry price in pension portfolio early in the week.

Centrus Energy Corp (LEU): Uranium Enrichment. With price opening at $93.50 (Nov 4) was feeling ready to climb back into holding. Set up a November expiry 85/80 risk reversal in the managed portfolio. This implies buying an 85 strike call (in-the-money) and funding the premium by selling an 80 strike put option. Trade was slightly cash positive giving a breakeven of $84.85 should the call go to exercise and $79.85 should the sold put get assigned. Was not expecting price to collapse 28.8% to close at $78 (Nov 4). Two news items - Centrus announced a $350 million note placement and US Energy regulator blocked Amazon-Talen deal for Amazon to buy power from a neighbouring nuclear power plant.

With the pull back later in the week (Nov 5), took the opportunity to add back a parcel especially given the 65/75/55 call spread risk reversal (showing on the chart below) looks like it will stay traded over the top of the call spread. Got an entry at the bottom of that last green bar.

Star Minerals Limited (SMS.AX): Uranium. Star Minerals announced a renounceable rights issue to fund developement of their earn into Cobra Uranium Project in Namibia. Rights price is appreciably below market price and rights can be sold. Added to the small holding in personal portfolio. Keen to build exposure to uranium in Namibia - a friendly jusrisdiction with plenty of uranium experience. Rights price is 20% below this entry price - surprised there was not an avalanche but it is on the ASX.

Saw this tweet - before the engagement farming notice went up and suggested I would buy $10k of US uranium stocks if Donald Trump won. He did and I did add 4 US stocks in equal shares in penion portfolio plus one parcel in enricment.

enCore Energy Corp (EU): Uranium. Averages down entry price. South Texas producing with other fileds coming on stream in 2026.

Uranium Energy Corp (UEC): Uranium. First time holding in this portfolio. Wyoming ISR.

Ur-Energy Inc (URG): Uranium. Averages down entry price - 2nd tranche of the week. Producing with extesions on stream in 2025/26

Energy Fuels Inc (UUUU): Uranium. Averages down entry price. Producing with extensions on stream in 2025/6

After the event chart to map the 4 against Sprott Physical Uranium Trust (U-UN.TO - the bars) suggests that it might have been an idea to weight the purchases by relative performance rather than equal weights. With 30 percentage points difference between worst and best, there are gaps to be made up.

iShares 7-10 Year Treasury Bond ETF (IEF): US Treasuries. Assigned early on sold put on the back of the surge in yields after the US Election news broke. Breakeven after two months of naked puts is $94.93 = 7.8% above $94.20 close (Nov 8). Fully expect yields to soften further as the Federal Reserve reduces rates. Yield 3.42%.

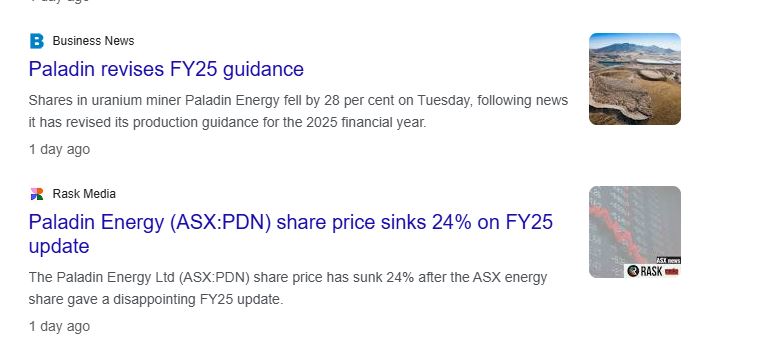

Fission Uranium Corp (FCU.TO): Uranium. A tweet reminder that at $0.90, price is a screaming buy relative to implied value of Paladin Energy (PDN.AX) takeover offer. Added a parcel in pension portfolio. News the week after after Paladin cut guidance for 2025 production brings a different screaming buy price (beaten down to $0.71)

Gevo, Inc (GEVO): Specialty Chemicals. With price opening at $1.60 after a big dip on earnings (Nov 8), November expiry 2/1.5 risk reversal looks like the call (2) will not go to exercise. Added back stockholding at 21% discount to level assigned at in October and below level originally bought then. Not going to rely on the options trade to get the stock replaced. Options trade is cash neutral other than trading costs (see TIB728 and TIB730). US Election result has put many alternate energy stocks on the nose as market believes that Trump will roll a lot of the climate change agenda back. My sense is people will go ahead with the agenda anyway when everything settles down.

Gevo is commercializing the next generation of renewable gasoline, jet fuel, and diesel fuel with the potential to achieve zero carbon emissions, addressing the market need of reducing greenhouse gas emissions with sustainable alternatives.

Sold

ProShares UltraPro Short QQQ (SQQQ): Nasdaq Index. Sale of fractional share after consolidation triggers a 99.3% loss since May 2019. This holding is a hangover from a time when this portfolio was allowed to hold long positions on stocks short the market. Got 2 shares left after two consolidations. Big lesson - bear instruments are designed for short term holds - close them out when they are not needed or when market goes the other way.

ASX Portfolio

The segment reports trading in ASX fractional share portfolio. Trade entries are made based on stock screens looking for undervalued stocks (price to book, price earnings, price to sales) that are showing technical signs of breaking a downtrend. Exits are made at 35% profit or 25% if 52 week high is lower than 35% advance. New buys are in $500 lots. Scale ins and top ups in $250 lots

Auto Invest

Two groups - uranium and index ETF's - $600 each month

Global Uranium and Enrichment Ltd (GUE.AX): Uranium.

Silex Systems Ltd (SLX.AX): Uranium Enrichment.

Elevate Uranium Ltd (EL8.AX): Uranium.

Global X Uranium ETF AUD (ATOM.AX): Uranium.

Terra Uranium Ltd (T92.AX): Uranium.

Vanguard Australian Shares Index ETF (VAS.AX): Australian Index. Distribution yield 3.4%

Vanguard MSCI Index International Shares ETF (VGS.AX): International Index. Distribution yield 3.52%

Top Ups

Stanmore Resources Ltd (SMR.AX): Coal Mining. Dividend yield 3.8%

Chart shows price failing in the last uptrend, falling over and rising again on a short term uptrend. There is enough headroom to the new broker target around previous highs to give a 25% profit.

Hedging Trades

VanEck Gold Miners ETF: (GDX) Gold Mining. With price closing at $39.02 (Nov 8), 36 strike sold put expired out-the-money. Trade was part of funding a January expiry call spread.

Cryptocurrency

Solana (SOLETH): Missed reporting a 50% profit exit at 50% profit target on Oct 24.

Chart shows steady cycling along the 50 day moving average

Income Trades

Covered Calls

Quiet week for covered call writing with only 5 written, all US

Credit Suisse X-Links Crude Oil Shares Covered Call ETN (USOI): Oil. Did add another small parcel in pension portfolio. Yield 20.87%

Naked Puts

Stock likely to go to assignment on covered calls

- Société BIC SA (BB.PA): Europe Consumer Products. Return 1.1% Coverage 4.4%

Stocks happy to own at a lower entry price

- ASP Isotopes (ASPI): Nuclear Technology. Return 28% Coverage 52% - pushed this to April 2025 expiry for a massive discount.

- Cameco Corporation (CCJ): Uranium. Return 3.1% Coverage 13.9%

Credit Spreads

No change in spreads. Spread on Pfizer (PFE) looks like it will go through the bottom with the US Election bringing big pressure onto Big Pharma. As the spread has more puts on the bought side than the sold side, good chance the outcome could be profitable - too bad this portfolio cannot go short the stock. Broker will sell the bought put before expiry.

ResourcesCautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers. Crypto tickers come from TradingView

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Investing: Interactive Brokers provides comprehensive global markets coverage with very competitive commissions. Open an account to earn up to USD 1,000 in IBKR stock. https://mclnks.com/ibkr

Crypto Trading: Binance offers a wide range of coins to trade, tight spreads and low fees if you use BNB to pay https://mymark.mx/Binance

Kucoin offers a wider range of altcoins than many of the other exchanges. I do like to diversify my holdings in case an exchange gets knocked over. Grab 15% discount on your trades when you open an account on this link https://mclnks.com/kucoin15

Gate.io offers a solid range of coins many of which have been delisted elsewhere. Have chosen to share the commission rebates. 40% is the rate - split 30% for me and you get to keep 10% for any people you invite. https://mclnks.com/gateio

Tracking: Keeping track of your crypto trades is a whole lot easier with CoinTracking.info. Get 10% off all your account upgrades https://mymark.mx/CoinTracking

Aus/NZ Investing Sharesies provides low cost, fractional share investing for Australian and New Zealand residents covering stocks in those countries and US. Start investing with as little as $20 https://mclnks.com/shares

November 4-8,2024

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating to @indiaunited. We share more than 100 % of the curation rewards with the delegators in the form of IUC tokens. HP delegators and IUC token holders also get upto 20% additional vote weight.

Here are some handy links for delegations: 100HP, 250HP, 500HP, 1000HP.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @bhattg by upvoting this comment and support the community by voting the posts made by @indiaunited.

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @bhattg by upvoting this comment and support the community by voting the posts made by @indiaunited.