Boom week for uranium and nuclear technology stocks had more additions being made. Revisited a few old holdings to start again.

Portfolio News

In a week where S&P 500 rose 1.67% and Europe rose only 0.08%, my pension portfolio rose a massive 3.34%. An example when contrarian investing works - driven by uranium and nuclear technology and gold/silver mining The largest individual lift was from Nano Nuclear Energy (NNE) contributing 12.5% of the lift on its own. Next largest lift was the surprise in the list of big movers below, Fiverr International (FVRR) finally showing its true potential. Did promise last week an analysis of the income trades vs the capital. In the pension portfolio unrealised loss is $15k and realised loss is $2k - income trades not counting the ones still standing are $15k. Fighting back since first entry in November 2021. Managed portfolio story on Fiverr is profitable.

Big movers of the week were NANO Nuclear Energy (NNE) (54.8%), Oklo Inc (OKLO) (40%), Bayhorse Silver (BHS.V) (28.6%), TechGen Metals (TG1.AX) (28.6%), DevEx Resources (DEV.AX) (26.1%), Centrus Energy (LEU) (23.8%), Lightning Minerals (L1M.AX) (20.6%), NexGen Energy (NXE) (20.3%), Stroud Resources (SDR.V) (20%), Silex Systems (SLX.AX) (18.2%), Stuhini Exploration (STU.V) (18.2%), ASP Isotopes (ASPI) (14.7%), Fiverr International (FVRR)(14.5%), Fission Uranium Corp (FCU.TO) (14.3%), Denison Mines (DNN) (14.3%), Uranium Energy Corp (UEC) (14%), Lotus Resources (LOT.AX) (13.9%), Elevate Uranium (EL8.AX) (13%), Starr Peak Mining (STE.V) (13%), Loop Industries (LOOP) (12.8%), Vulcan Energy Resources (VUL.AX) (12.7%), Paladin Energy (PDN.AX) (12.5%), Lifeist Wellness (LFST.V) (12/5%), IsoEnergy (ISO.TO) (12.3%), Hercules Metals (BIG.V) (12.2%), Cameco Corporation (CCJ) (12.2%), AdAlta (1AD.AX) (11.8%), Gevo (GEVO) (11.2%), Deep Yellow (DYL.AX) (11%), Stem (STEM) (11%), Forsys Metals (FSY.TO) (10.9%), GoGold Resources (GGD.TO) (10.8%), Sprott Junior Uranium Miners ETF (URNJ) (10.3%)

A stronger list of 33 big movers dominated by uranium and nuclear technology. From the top nuclear technology (4 stocks), uranium (13 stocks), alternate energy materials (3 stocks), gold/silver mining (5 stocks), other alternate energy (3 stocks), cannabis (2 stocks). The outliers in the list - one in biotech and one in internet services

Markets are keen to move higher in a week with no words from the Federal Reserve. The big move in Bitcoin does suggest some rebalancing happening - cash moving into markets

The small headline from Bloomberg highlights small caps moving too - not just a large caps and AI tech story

Crypto booms

Bitcoin price kept moving higher and then gave back a little ending the week 8.3% higher with a trough to peak range of 11.5%

Ethereum price started lower and then found buyers finishing the week 7.5% higher with a trough to peak range of 15.4% - maybe the mojo is back

There were some strong moves mostly starting from midweek - Polkadot up 65%

Stellar (XLMBTC) popping 215% into the weekend. There is no doubt there is a lot of positioning out of cash

Cardano (ADETH) adding to the momentum from the prior week with another 50% pop but giving half away.

Harmony (ONEBTC) breaks a long downward slide and pops 106% in two days and still going.

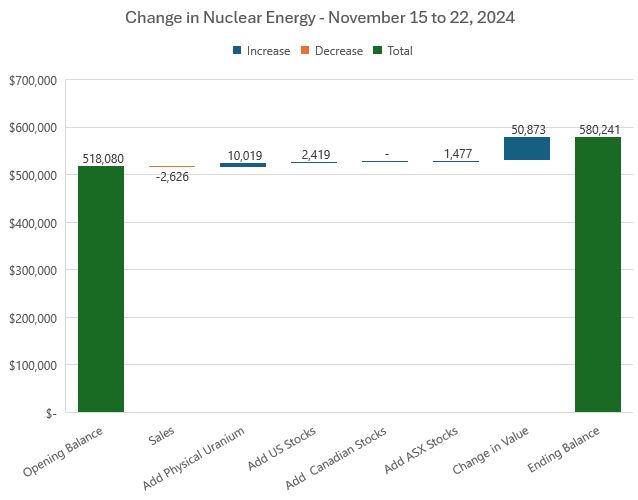

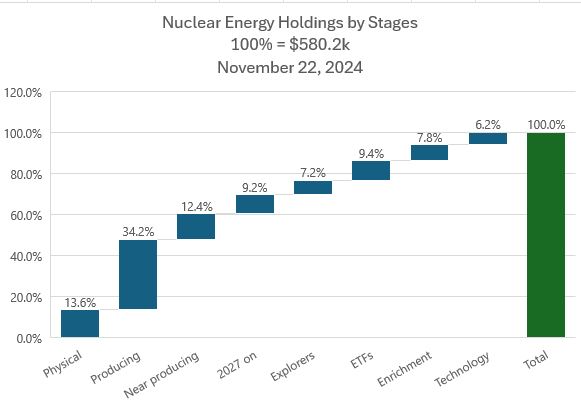

Nuclear Energy Holdings

The week before feels like the lull before the storm with the response to the Russian ban on enriched uranium fizzling out. The second half of the week this all changed even with spot price drifting lower - was there a news trigger?

You bet, NexGen Energy (NXE) announced that the Canadian Federal technical review of the Arrow project had completed - permitting is sure to follow. And the rumbles on the street is this clears the path for other Athabasca Basin permitting.

A few additions and one sale and a monster 9.8% increase in valuation driven especially by nuclear technology. The sale was at 52 week high for one of the explorers. That's the plan running forward - set sales taargets at 52 week highs for anyone not producing or near producing other than NexGen (NXE) which will run.

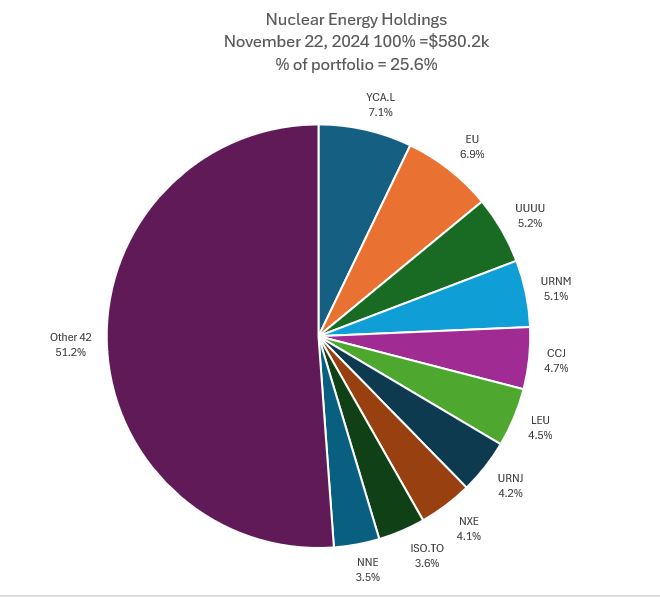

Additions to YellowCake (YCA.L) push it up one place into slot 1 displacing Encore Energy (EU). Addition to Sprott Junior Uranium Miners ETF (URNJ) pushes it up a place into slot 7, IsoEnergy (ISO.TO) comes into slot 9 and Nano Nuclear Energy (NNE) comes into slot 10 displacing BHP Group (BHP.AX) and Sprott Physical Uranium Trust (U-UN.TO). Share of portfolios rises just on 2 points to 25.6%.

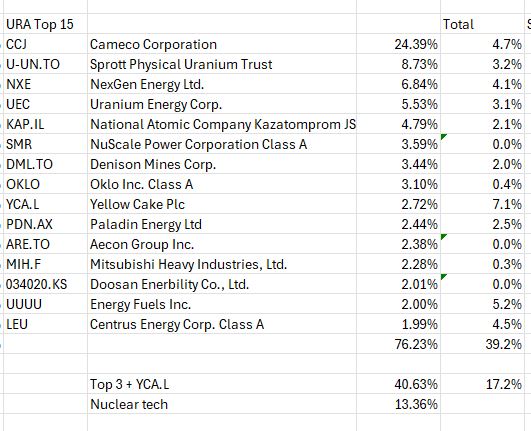

After bringing nuclear technology into the analysis a few weeks back taken a while to draw the comparison of the holdings to Global Uranium ETF (URA) which includes these too. The notable part of the Top 15 is 5 are engaged in nuclear technology or building nuclear plants and account for 13.4% of holdings.

The other notable thing is the Top 3 market caps plus YellowCake account for 40.6% whereas they are 48.9% in Sprott Uranium Miners ETF (URNM)

The mapping of portfolio holdings against the ETF shows significant under-investment in the Top 15 with only 4 holdings more than the ETF weight. This is part of the rationale for streamlining down to a shorter list at 52 week highs. Maybe slot the profits into credit spreads on the likes of Cameco (CCJ) and Energy Fuels (UUUU) and other producers. Of note, the analysis does not cover options trades held.

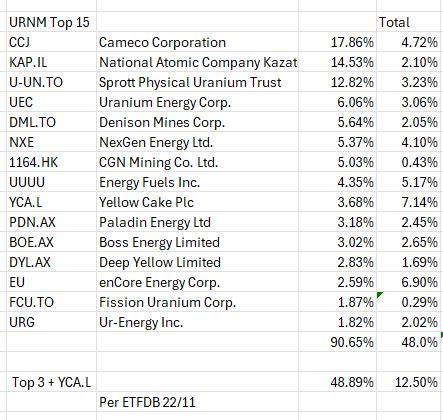

For completeness include also the comparison to URNM where representation is a bit closer at 48% vs 90% for the Top 15.

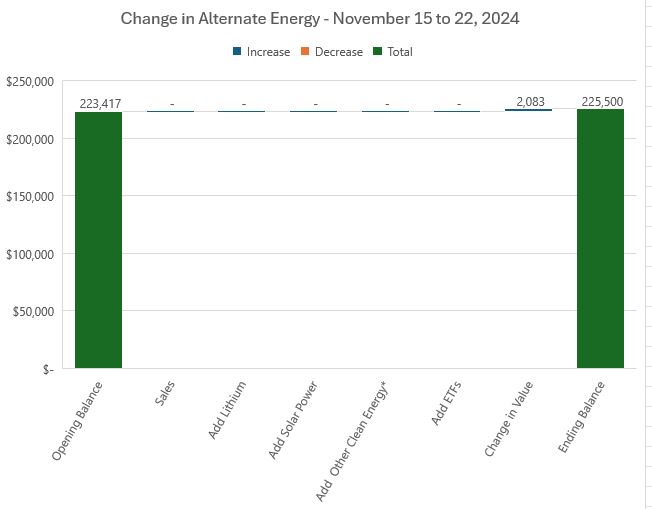

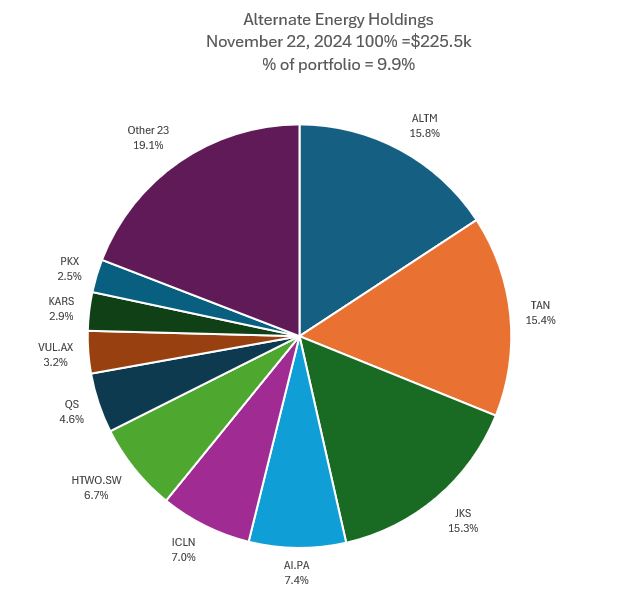

Alternate Energy Holdings

No change in holdings and a modest 0.9% increase in valuation - given overall portfolio value went up this is a solid move in a week.

Small change in rankings with Vulcan Energy Resources (VUL.AX) moving up one place into slot 8 and Posco (PKX) coming into slot 10 displacing Latin Resources (LRS.AX). Share of portfolio valuation drops a few points to just under 10%. Got to say this looks a lot more like an ETF should with Top 10 holdings accounting for 80% of the holdings.

Bought

Peninsula Energy Limited (PEN.AX): Uranium. Had missed in the Lance project update that the CEO had announced he would be stepping down. Long believed that he is part of the problem. Added a further parcel 6.9% below the previous purchase levels. Will not be surprised to see Peninsula being acquired as they are producing and in the US. Not sure how much of their contract book is at fixed prices below current spot.

Yellow Cake plc (YCA.L): Uranium. Spot started drifting after the hype of the Russian ban lifted and that dragged Yellow Cake price down - averaged down entry price. Cannot help but think this has to bust higher sometime. Also noted the big difference in discount between this and Sprott Physical Uranium Trust (U-UN.TO) currently at 1.97% vs 9.9%. Feels like a no brainer to me. Scaled in later in week - everything was going green but not YellowCake.

Did set up my own NAV calculator. YellowCake publishes their NAV calculation each month - that gives latest inventory and number of shares. Spot price from Numerco app. Slot in GBP/USD and bingo.

FMC Corporation (FMC): Food Products. Saw a tweet about FMC and one about investing back into US consumer. Got me looking at the charts on a stock that has been held previously - added a parcel of stock. Dividend yield 3.95%

Chart shows price bouncing off the bottom of the channel it has been in all year - this is not my normal buying signal. There is a broker target 40% away from where the entry was - good enough for me (green ray)

Honeywell International (HON): US Industrials. Revisited Honeywell as one of their businesses, ConverDyn is engaged in uranium enrichment. With the ban on enriched uranium from Russia looming am going to guess the pressure is building for ConverDyn to enhance capacity (and get Federal grant funding to do it). Bought a small parcel of stock and a December expiry 225/215 credit spread with ROI of 27.2% and price coverage of 0.7%.

Chart shows the trade is a bit blue sky but the credit spread is probably safe as price could well cycle again to take out that high. Dividend yield 1.97%

I did do some digging through their businesses. Not surprised to find that Elliott has taken a stake and written a letter suggesting a breakup similar to what GE and United Technologies did. There are a bunch of businesses inside that could stand alone like GE Vernova - see the comparison chart since it listed. That is what Elliott is on about

Invesco Ltd (IVZ): Asset Management. While I was reviewing FMC had a look at a few other stocks that were once held. A few weeks ago added a credit spread on Robinhood (HOOD) to drive value from the Trump trade. Might as well do the same with Invesco. Dividend yield 4.62%

Chart shows price cycling along the 50 day moving average (red line) and testing along the bottom of a smaller parallel channel. The query on the trade is can it break past those highs? It will if markets keep moving up.

KeyCorp (KEY): US Regional Banking. Saw a headline reporting Stanley Druckenmiller was buying US Regional Banks - he bought the ETF. Falling rates are good for banks? Bought one stock as a previous holding - did not look at charts. Dividend yield 4.18% - ex date Dec 3

The comparative chart with SPDR S&P Regional Banking ETF (KRE - purple line) suggests I might have bought a leader rather than a laggard. Time to revisit the whole US banking sector and look for laggards

Oklo, Inc (OKLO): Nuclear Technology. With price opening at $20.75, put in place a January 2025 22.5/30/17.5 call spread risk reversal woth a view to scaling in my holding. With a net premium of $1.71 the call spread offers a maximum profit potential of 339% for a 43.2% move in price. The call premium is fully funded by the sold put with price coverage of 16.5%. Breakeven levels are $21.82 if the bought call is assigned and $16.82 if the sold put is assigned.

Quick look at the chart which shows the bought call (22.5) as a blue ray and the sold call (30) as a red ray and the sold put (17.5) as a dotted red ray with the expiry date the dotted green line on the right margin The start of the rays is trade date (Nov 20) - so now in-the-money. The sold put is below the last reversal - happy to buy at breakeven below that. The blue arrow price scenario is borrowed from the last move in Nano Nuclear Energy (NNE). A repeat of that and the trade ends in-the-money - a bit more and it shoots over the top.

Sprott Junior Uranium Miners ETF (URNJ): Uranium. The ETF's lagged the move up in other uranium stocks. Added to holding in managed portfolio to scale in.

Sold

CanAlaska Uranium Ltd (CVV.V): Uranium. Pending order hit at 52 week high in pension portfolio for 28.1% blended profit since June/August/September 2024. The plan will to be scale down the explorer holdings as they hit 52 week highs. Partial fill.

ASX Portfolio

The segment reports trading in ASX fractional share portfolio. Trade entries are made based on stock screens looking for undervalued stocks (price to book, price earnings, price to sales) that are showing technical signs of breaking a downtrend. Exits are made at 35% profit or 25% if 52 week high is lower than 35% advance. New buys are in $500 lots. Scale ins and top ups in $250 lots

New Buys

Tabcorp Holdings Ltd (TAH.AX): Gaming. Tabcorp fits the strategy - beaten up stock showing signs of life. Price has tumbled continuously for over 18 months and found a floor off a support level that comes from the Covid-19 collapse in March 2020. Dividend yield 3.00%

Chart shows price making two cycles higher and 40% profit target is around the level of the mid 2024 highs.

Top Ups

Nufarm Limited (NUF.AX): Agriculture. Dividend yield 1.60%

Chart shows price making two cycles higher after the first entry and then falling and finding support with a double bottom off a level that goes back to the bottom of the Covid-19 collapse. This now looks like a beaten up stock - bad news is there is a broker target at $4 - below where price is now.

Johns Lyng Group Limited (JLG.AX): Engineering. Dividend yield 2.12%.

A chart showing how not to execute the strategy of looking for breakouts. Price has been chopping along in a 20% wide band from Q3, 2022. First trade entry comes after earnings and proves to be not far from the top of a cycle in that band. Next entry comes two cycles later which proves to be just another cycle in the band. Trading then tightens into smaller cycles in 2024 and next entry comes on one of those but was averaging down. Latest entry looks way better. Price has made a reversal after gapping down ahead of the last earnings. As it happens earnings were surprisingly solid. Maybe time for the breakout. New broker target does not fit that hope (lower green ray)

Sold

Ansell Ltd (ANN.AX): Closed out at 52 week high target for 26.9% blended profit since August/November 2022/July/November 2023/February 2024

Chart shows the challenges of the strategy. The broad idea of the strategy is to identify stocks that are beaten up and showing signs of life. First signal was a bit late with the run up from the reversal very quick. Next two signals came as price traded to tops of the consolidation zone. 4th entry was a break up of a beaten up stock with the signal after confirming the rise. Strategy is to put in place an exit when 52 week high is imminent - and not buy any more. That explains why there no more purchases at each new one month high after the 1st 52 week high came along in June 2024.

Hedging Trades

iShares Silver Trust (SLV): Silver. Used pullback to add to holding in pension portfolio. Wrote covered call for 0.78% premium with 11.8%price coverage. Love being paid to hedge.

Cryptocurrency

Polkadot (DOTETH) Top 10 coin hits pending order for 50% profit since July 2024. Chart shows exit was just above the entry before (left hand blue ray)

Decentraland (MANAETH) Rising top 10 coin from a few years back hits pending order for 40% profit since August 2024

Income Trades

Slightly slower start with 45 covered calls written - been a bit more focused on getting 1% premium and using the 10% target for stocks I do not want to sell (UK 5 Europe 4 US 36)

Naked Puts

With cash in hand a busy perdio writing naked puts on stocks keen to won at lower prices

- CleanSpark (CLSK): Bitcoin Mining. Return 13% Coverage 14%

- iShares 7-10 Year Treasury Bond ETF (IEF): US Treasuries. Return 0.5% Coverage 1.4%

- Oklo Inc. (OKLO): Nuclear Technology. Return 9.9% Coverage 30%

- Commerzbank AG (CBK.DE): German Bank. Return 2% Coverage 2.8% - tighter in other portfolios

- Deutsche Bank AG (CBK.DE): German Bank. Return 1.5% Coverage 4.5% - tighter in other portfolios

- Fresenius SE & Co. KGaA (FRE.DE): German Healthcare. Return 1.2% Coverage 3.9% - 1.3% return in other portfolios

- ChargePoint Holdings, Inc. (CHPT): Electric Vehicles. Return 9% Coverage 10%

- NuScale Power Corporation (SMR): Nuclear Technology. Return 2.5% Coverage 51.7%

- Uranium Royalty Corp. (UROY): Uranium. Return 4% Coverage 5.6%

- Engie SA (ENGI.PA): French Utility. Return 1.25% Coverage 1.8%

- First Trust NASDAQ Cybersecurity ETF (CIBR): Cybersecurity. Return 1% Coverage 3.2%

- Norwegian Cruise Line Holdings Ltd. (NCLH): Cruising. Return 2.8% Coverage 4.2%

- Marriott Vacations Worldwide Corporation (VAC): Hotels. Return 2.18% Coverage 6.3%

- Lightbridge Corporation (LTBR): Nuclear Technology. Return 10% Coverage 36.2%

- Cameco Corporation (CCJ): Uranium. Return 1.79% Coverage 9.3%

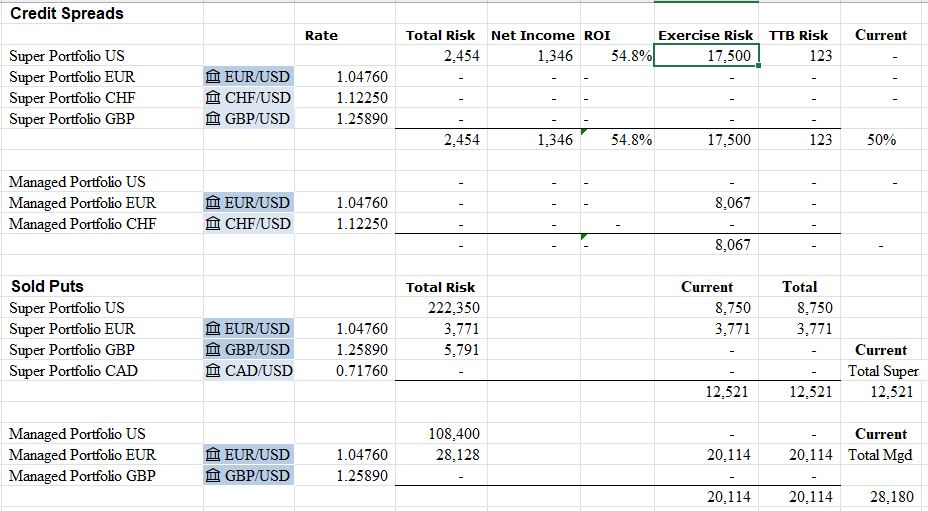

Credit Spreads

No new spreads. Pfizer (PFE) will most likely trade TTB - no matter as there are more bought puts than sold pust = profitable exit. Applied Materials (AMAT) could go to exercise

Exercise risk across the portfolios is well under control

Cautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers. Crypto tickers come from TradingView

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Investing: Interactive Brokers provides comprehensive global markets coverage with very competitive commissions. Open an account to earn up to USD 1,000 in IBKR stock. https://mclnks.com/ibkr

Crypto Trading: Binance offers a wide range of coins to trade, tight spreads and low fees if you use BNB to pay https://mymark.mx/Binance

Kucoin offers a wider range of altcoins than many of the other exchanges. I do like to diversify my holdings in case an exchange gets knocked over. Grab 15% discount on your trades when you open an account on this link https://mclnks.com/kucoin15

Gate.io offers a solid range of coins many of which have been delisted elsewhere. Have chosen to share the commission rebates. 40% is the rate - split 30% for me and you get to keep 10% for any people you invite. https://mclnks.com/gateio

Tracking: Keeping track of your crypto trades is a whole lot easier with CoinTracking.info. Get 10% off all your account upgrades https://mymark.mx/CoinTracking

Aus/NZ Investing Sharesies provides low cost, fractional share investing for Australian and New Zealand residents covering stocks in those countries and US. Start investing with as little as $20 https://mclnks.com/shares

November 18-24,2024

#hive #posh