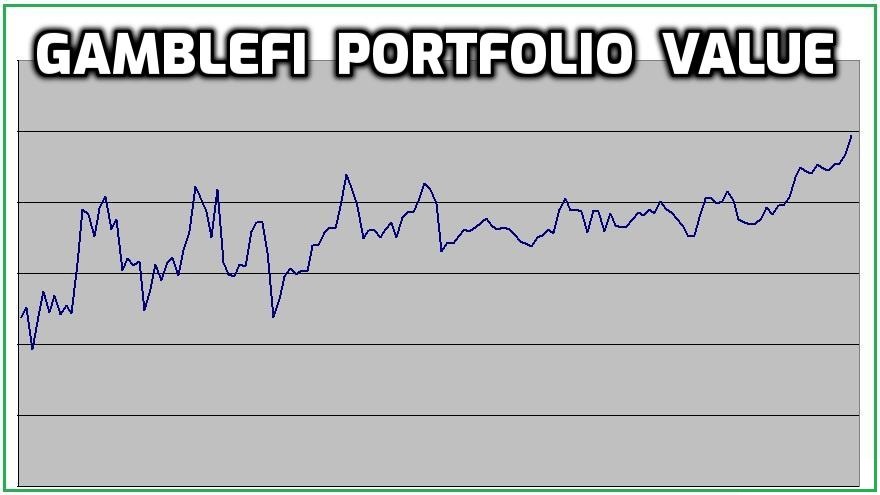

GambleFi Projects tend to be quite stable in price compared to the rest of the market as there is a direct link to actual revenue that is made unlike all the speculative stuff out there. So it tends to overperform during the bear market and underperform during the bull market. I like the stability and the fact that I'm earning a good amount of dividends weekly so I just let it ride and continue to build. With the crypto market pumping so hard, gamblefi also saw a bit of a pump and my portfolio value right now is reaching close to 50k which always was my goal.

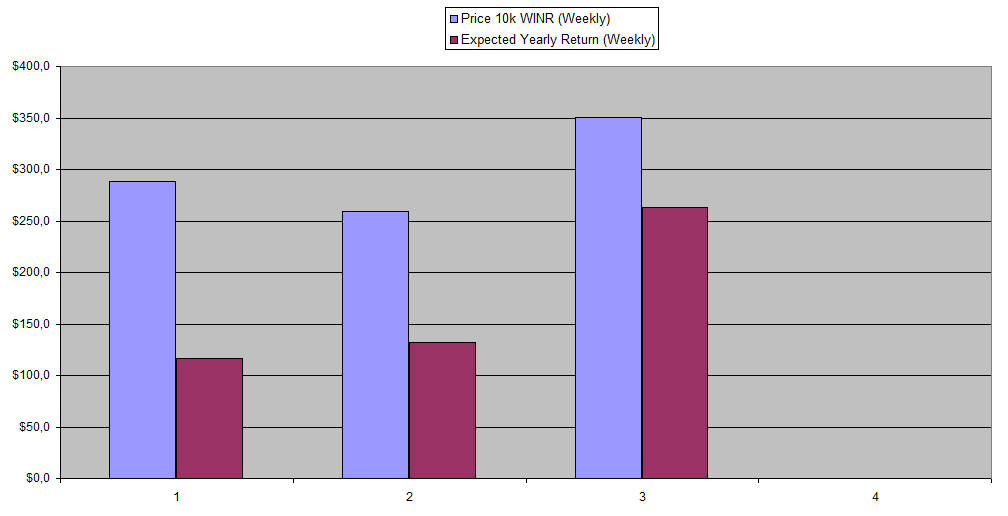

I plan to make a full guide to WINR Protocol maybe this or next week as I'm increasingly getting more comfortable with it. The price of WINR is going up and it's now well above my average entry level. At the same I kind of want to buy some more as I'm by no means overinvested and I like the fact that it pays some ok dividends now all in a decentralised way.

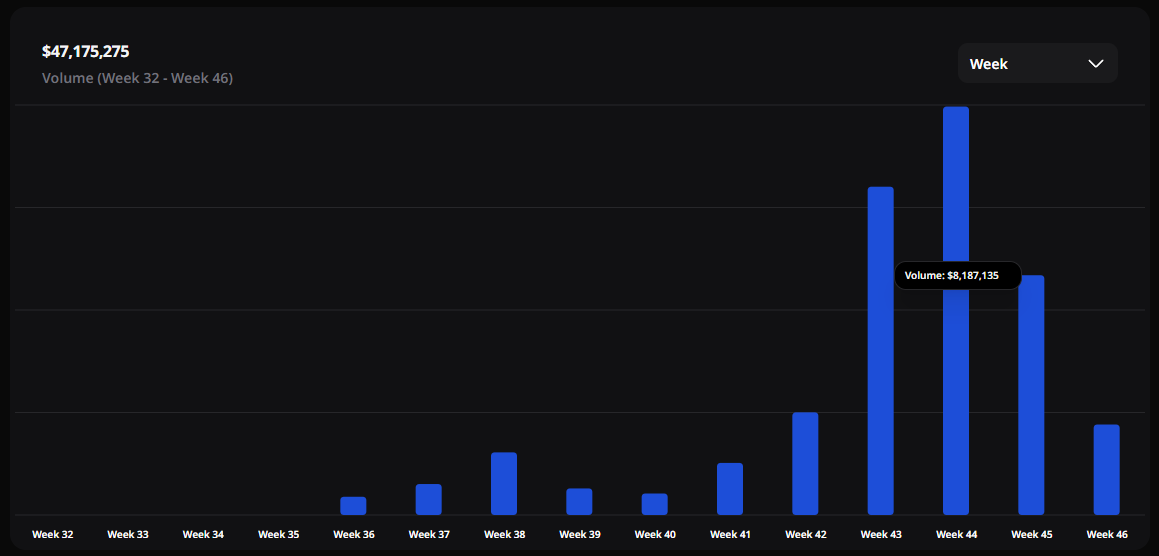

The earnings were quite good last week also but I am keeping in mind that a lot of vWINR yet has to be merged. The overall volume was down a bit compared to last week but still very respectable at 8M+

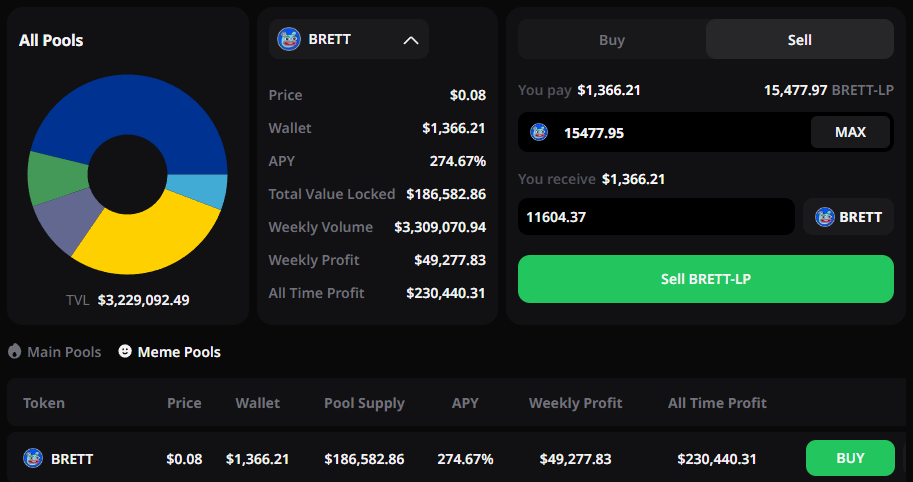

I also increased my BRETT liquidity position from 6000BRETT to tow 10000 BRETT and I will keep tracking how much that earns (or loses)

| Date | Brett Pool | Brett Staked | Brett Now | Earnings |

|---|---|---|---|---|

| 12/11/2024 | 186582$ | 10000 BRETT | 11604 BRETT | +1604 BRETT |

Brett now also is part of the WINR Staking earnings and gave the most last week for currently my 50k WINR Stake

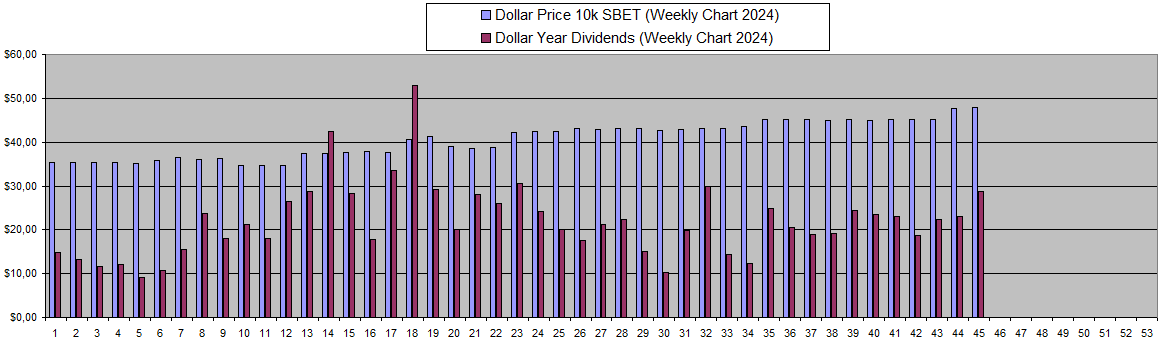

Sportbet.one (SBET)

The price of SBET fully depends on someone actually buying more on coinstore which eventually will happens if dividends continue to climb. Not much is needed also to move the price and most importantly, the dividends remain solid and reliable.

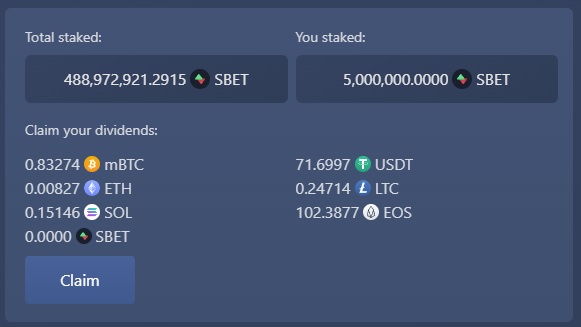

5 Million SBET Stakes gave me these returns last week

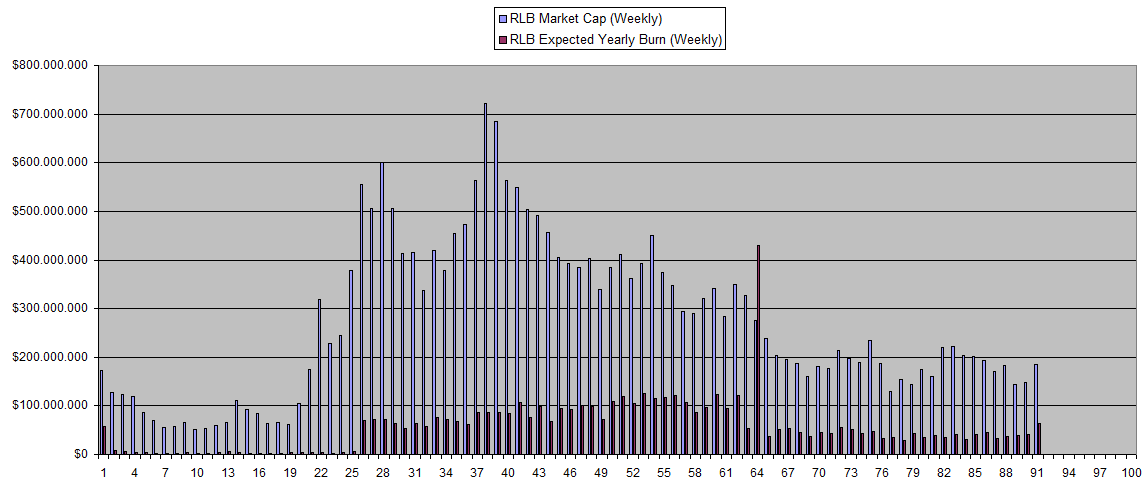

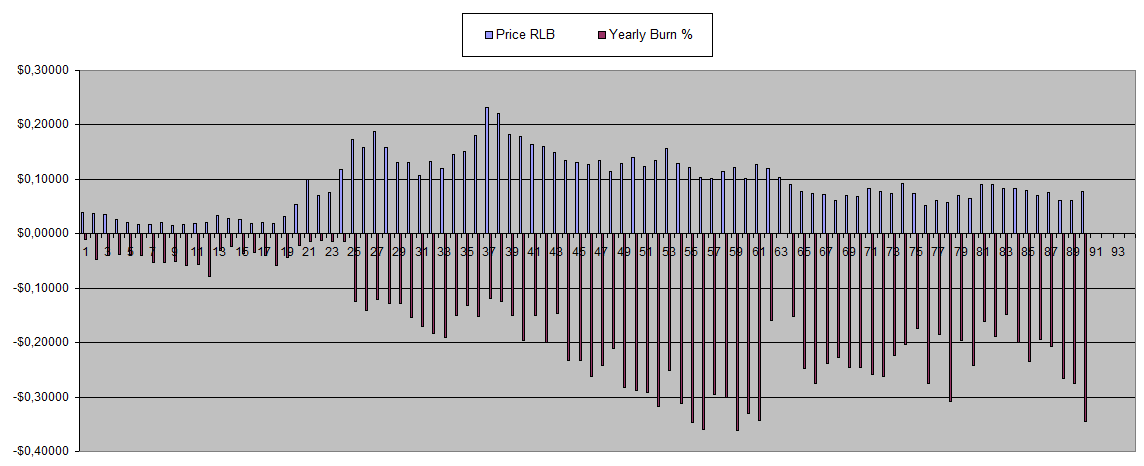

Rollbit.com (RLB) & Rollbot/Sportsbot NFTs

RLB is one of the coins that does go along with the crypto market and there was a nice pump so far after it has been oversold for some time.

So the forced selling of my 2 NFTs which I turned into RLB a couple weeks ago so far played out nicely as a 0.065$ price by now has increased to 0.092$.

I plan to just hold my RLB as long as the burning chart remains favorable. Last week it was at 34% of the remaining supply that is expected to be burned over the course of a year at this pace. off course, with an increased price, this burn will go down a lot unless there is more adoption and increased revenue.

vBookie (NFTs)

No news for as far as I have seen and it likey will be until the 2nd week of next month to know if there actually was some profit. This is also causing the floor price to drop a bit to 0.28 SOL which is still respectable as Solana went up quite a bit.

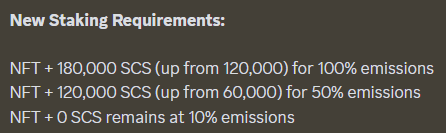

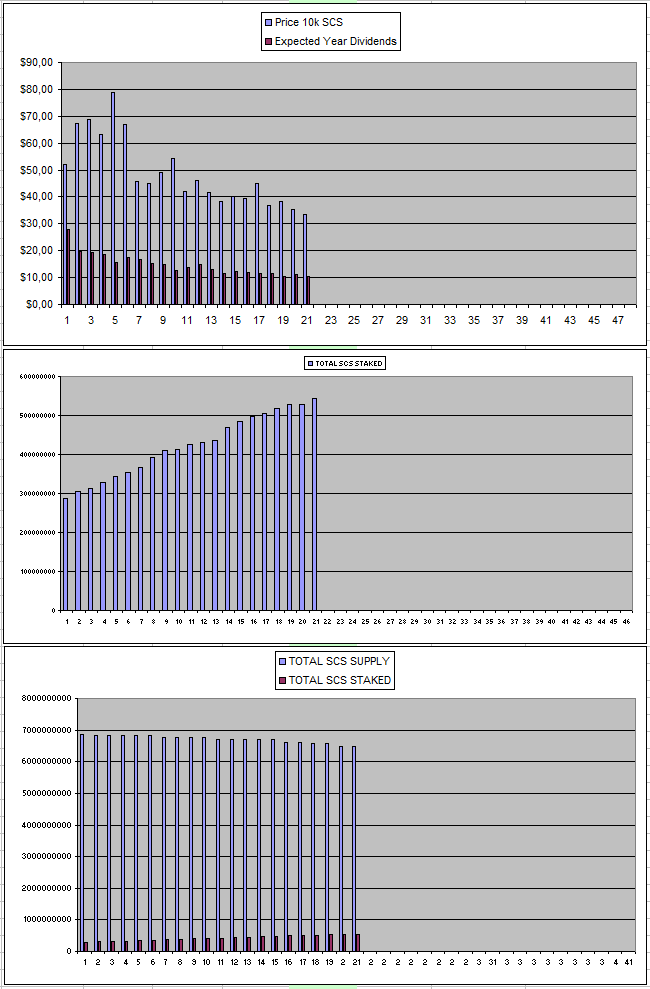

Solcasino.io (SCS)

From the looks of it, they increased the SCS staking requirement for NFT holders which I guess created some demand pushing the price up. However, I don't really like the idea that there are NFTs and that there is a token as once the SCS emission ends for NFT holders, they will have to come up with new ways to make sure NFTs have value and all the SCS that was staked on the NFTs doesn't get dumped. All these are reasons why I'm keeping my SCS exposure low even though I did start to get tempted to buy some more when the price reached below 0.03$.

The staked SCS continues to go up week by week and I also visualised how little of the total is staked right now indicating possible big pressure on the dividends which have been going down over time. So as far as tokenimics goes, SCS simply isn't good enough as a lot of the value actually goes to the NFTs instead of SCS holders.

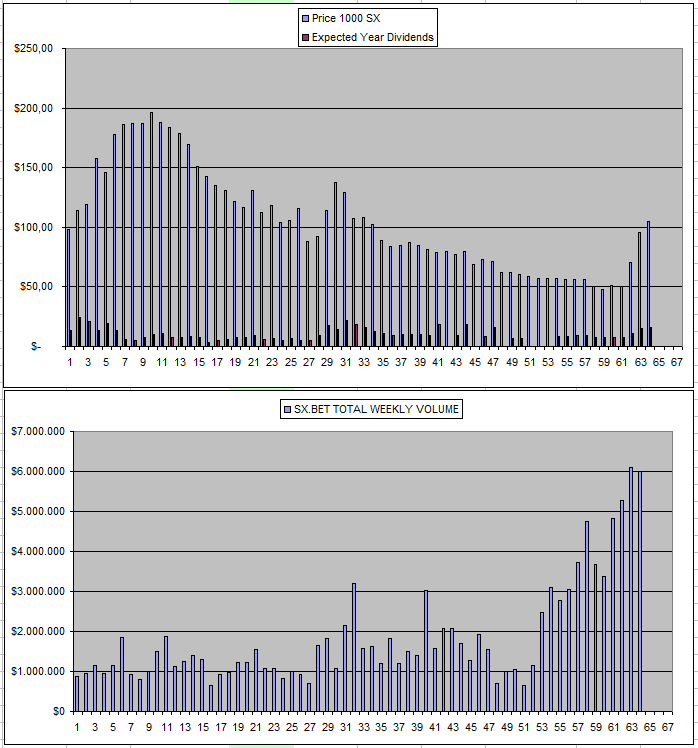

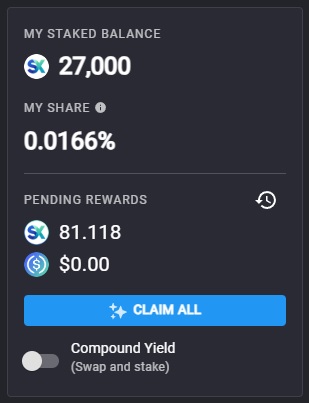

Sx.Bet (SX)

The price of SX went up some more and the volume also remains at higher levels. Everything also works properly and I'm justing claiming my extra SX weekly with the intention to keep compounding it over time.

The compound Yield never really worked for me though so I'm doing it manually every month or so once enough SX has been earned.

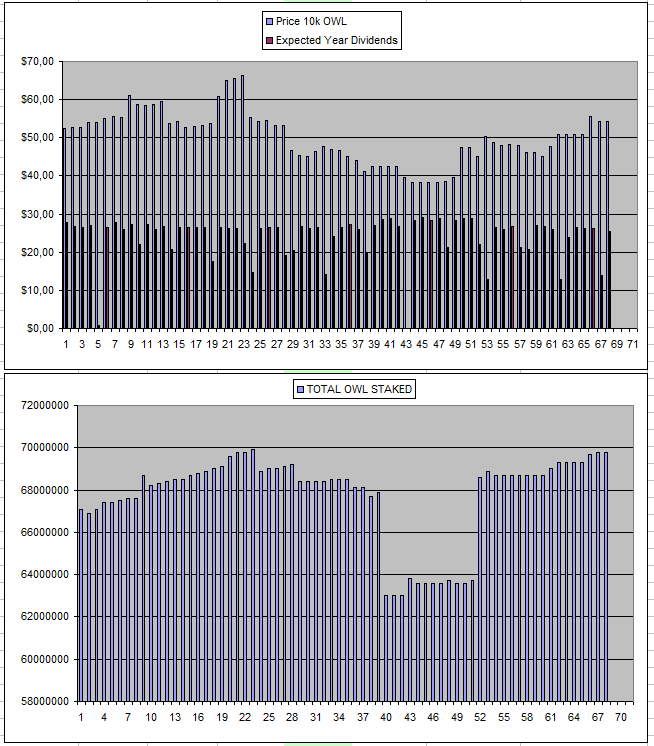

Owl.Games (OWL)

Nothing new again from OWL where the pool seems to be fully refreshed and I continue to earn roughly 30$ a week with my 600k OWL Stake.

| Date | Hold | Invested | Value | Week Divs | Total | % recov | Total |

|---|---|---|---|---|---|---|---|

| 08/08/2023 | 395k | 1954$ | 1850$ | 13.76$ | 21.9$ | 1.12% | -82$ |

| 05/09/2023 | 500k | 2636$ | 2437$ | 20.30$ | 83.9$ | 3.18% | -115$ |

| 03/10/2023 | 500k | 2636$ | 2600$ | 21.15$ | 182.99$ | 6.94% | +147$ |

| 07/11/2023 | 600k | 3179$ | 2877$ | 30.43$ | 310.14$ | 9.75% | +8$ |

| 05/12/2023 | 600k | 3179$ | 2851$ | 20.12$ | 421.99$ | 13.27% | +94$ |

| 01/01/2024 | 600k | 3179$ | 3521$ | 25.76$ | 538.76$ | 16.95% | +881$ |

| 06/02/2024 | 600k | 3179$ | 2825$ | 22.16$ | 669.17$ | 21.05% | +315$ |

| 05/03/2024 | 600k | 3179$ | 2464$ | 30.67$ | 784.42$ | 24.67% | +69$ |

| 02/04/2024 | 600k | 3179$ | 2393$ | 31.35$ | 890.48$ | 28.01% | +104$ |

| 07/05/2024 | 600k | 3179$ | 2246$ | 33.40$ | 1040.85$ | 32.74% | +107$ |

| 04/06/2024 | 600k | 3179$ | 2035$ | 33.48$ | 1137.97$ | 35.79% | -6$ |

| 02/07/2024 | 600k | 3179$ | 2098$ | 32.75$ | 1261.09$ | 39.67% | +180$ |

| 06/08/2024 | 600k | 3179$ | 2579$ | 30.66$ | 1398.50$ | 43.99% | +798$ |

| 03/09/2024 | 600k | 3179$ | 2447$ | 23.93$ | 1507.71$ | 47.43% | +775$ |

| 01/10/2024 | 600k | 3179 | 2696$ | 14.77$ | 1614.59$ | 50.79% | +1131$ |

| 05/11/2024 | 600k | 3179$ | 2879$ | 16.13 | 1748.99$ | 55.02% | +1449$ |

| 12/11/2024 | 600k | 3179$ | 2879$ | 29.35$ | 1778.34$ | 55.94% | +1478$ |

** The High 7% cost to go from buying to having it staked and the 5% tax to sell is fully included in the numbers.

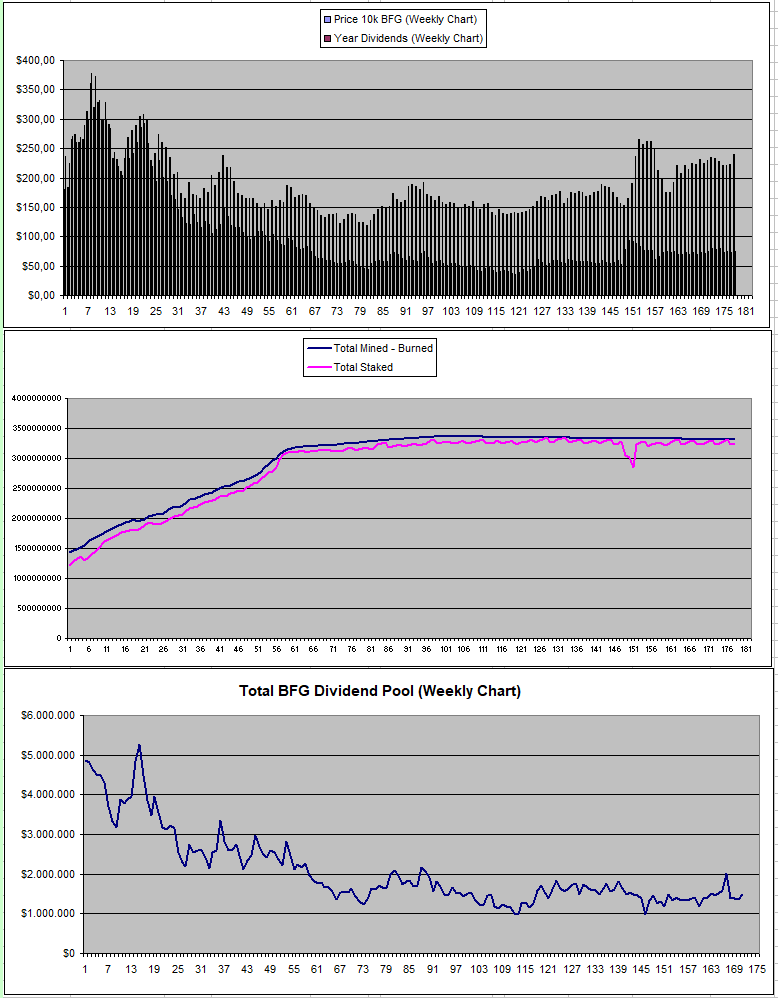

Betfury.io (BFG)

I earned again around 70$ in reliable dividends from Betfury last week and did do another successful withdraw already re-investing the earnings in other crypto projects.

APY Based on Current Price and Dividends from the last 7 days

All these numbers are based on prices of Monday

| Project | APY |

|---|---|

| Sportbet.one (SBET) | +51% APY |

| Betfury.io (BFG) | +31% APY |

| Owl.Games (OWL) | +46% APY |

| Sx.Bet (SX) | +16% APY |

| WINR Protocol (WINR) | +75% APY |

| Solcasino (SCS) | +31% APY |

| VBookieSports (NFTs) | +0% APY |

Note: Token prices going up or down have a major influence on the actual returns going forward either amplifying them if they go up or destroying them when the price would dip. These are my personal numbers and RLB varies based on the trait of the Rollbot NFTs you own and (*) they are based on the minimum suggested by prices which can be way lower than the actual prices.

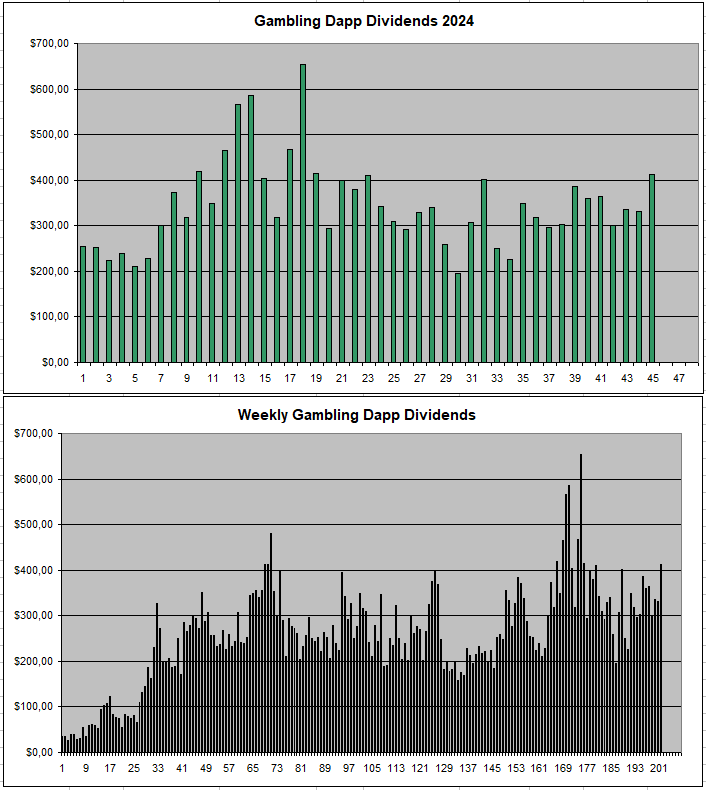

Personal Gambling Dapp Portfolio

Last week I managed to earn 412$ in passive earnings for holding 5M SBET | 500k BFG | 2 Rollbot NFTs | 26 Defibookie NFTs | 600k OWL | 27k SX | 100k WINR | 60k SCS. I'm still looking to diversify with other good gambling dapps that pay the losses or fees from the gambler to those holding a token. Anyone that has tips on this, please leave a comment below...

Crypto & Blockchain-Based Bookies and Exchanges that I'm personally using with some allowing anonymous betting with no KYC or personal restrictions...

Play2Earn Games that I am Playing...

Posted Using InLeo Alpha

!BEER

View or trade

BEER.Hey @costanza, here is a little bit of

BEERfrom @thehockeyfan-at for you. Enjoy it!Learn how to earn FREE BEER each day by staking your

BEER.