A beginner's guide to Hive crypto (HIVE). Answering what is Hive crypto and all other questions related to the hive.io blockchain.

Hive is a Delegated Proof of Stake (DPoS) blockchain that acts as the backbone for a diverse range of dApps and tokenised communities.

With fast, free transactions, DPoS allows Hive to continue scaling into the best blockchain for Web3 social dApps and games.

The governance coin and primary cryptocurrency of the Hive blockchain is HIVE.

Following Justin Sun’s 2020 acquisition of Steemit Inc and the ninja mined stake that came along with the company, Steem was essentially centralised.

To combat the centralisation of Steem, the community forked Hive from Steem and replaced Steemit’s ninja mined stake with the Decentralised Hive Fund (DHF).

While the Hive blockchain is technically a fork of Steem, Hive’s accession proved its censorship-resistance in the face of attack.

Thanks to its birth as a unique community fork featuring no pre-mine or regulatable entity, Hive is one of the only truly decentralised, immutable blockchains in existence.

To see what all the fuss is about, click the get started button at the top right hand corner of this page and create a free Hive crypto account.

What is Hive (HIVE)?

Introducing Hive the blockchain and cryptocurrency.

Before we get started, please note that within this guide, we refer to the blockchain itself as Hive, while the cryptocurrency as HIVE.

What is Hive? - The blockchain

Hive is a decentralised DPoS blockchain that is designed to scale for widespread adoption.

It features fast, fee-less transactions, with a future-proof resource-bandwidth and storage system.

With its lightning-fast processing times, transactions on Hive take less than 3 seconds.

Additionally, Hive has been battle-tested for 5 years by hundreds of dApps, communities, and projects around the world.

Hive remains unregulated and has even survived a sybil attack from a billionaire, proving the censorship-resistant capabilities of the blockchain.

Overall, Hive is an innovative and forward-looking blockchain that has the potential to become one of the leading Web3 hubs used by people globally.

What is HIVE? - The cryptocurrency

HIVE is the native cryptocurrency and governance coin of the Hive blockchain.

By staking HIVE, you’re afforded the ability to transact and influence governance on a truly censorship-resistant network.

With no pre-mine and an excellent token distribution that sees no single account currently owning even 5% of the total supply, HIVE is growing organically while remaining secure.

In order to give the best chance of spreading Hive's governance token as far and wide as possible, it employs a unique stake-weighted voting system on content to distribute inflation via a rewards pool.

HIVE crypto will always have value as long as HP gives you the ability to operate on this immutable network.

How does Hive work?

We touch on the backend tech, while focusing on how Hive works from a user’s viewpoint.

Hive uses a consensus mechanism called Delegated Proof of Stake (DPoS).

This algorithm secures the blockchain by ensuring a representation of transactions within it.

A DPoS system is an implementation of technology-based democracy, which protects blockchain from centralization and abuse by utilizing voting and election processes.

As for how this pertains to Hive, the voting process is weight-based on how much Hive Power (HP) you have staked to your account.

Stakeholders elect witnesses to operate a Hive server which produces new blocks and keeps the overall network running and secure.

For the purposes of this Hive guide however, we’re going to focus on how Hive works from a user’s viewpoint and only touch on the backend tech.

How Hive works from a user’s point of view

After getting the Hive blockchain tech out of the way, let’s now move onto the things that you need to know in order to best use Hive.

Your unique Hive account

Your unique Hive account is your gateway to the Hive blockchain.

Unlike Bitcoin or Ethereum, Hive accounts aren’t string based and instead they’re easy to remember usernames that are simply in the format of @forexbrokr.

Your Hive account allows you to seamlessly interact with Hive based dApps, make money blogging on the various front-ends and manage your Hive crypto balances from your fully integrated wallet.

How to get a Hive account:

The easiest way to get a Hive account is to click the get started button at the top right corner of leofinance.io and sign up via Twitter.

All you need is a Twitter account and they instantly will be given a Hive account to use on any Hive front-end or app.

From here, you’re able to download your private keys and take full ownership of your Hive account.

Hive crypto - HIVE, HBD, HP

Hive actually has 3 different cryptocurrencies:

- HIVE

- Hive Power (HP)

- Hive Backed Dollars (HBD)

Each of the Hive cryptocurrencies is linked and perform a different role for users of the blockchain.

1. HIVE:

HIVE is the main currency used on the Hive blockchain.

It’s the standard, liquid cryptocurrency that you can use, earn and instantly transfer to other Hive accounts for free.

2. Hive Power (HP):

Hive Power is HIVE that has been staked to your account in a process called “powering up”.

It’s the illiquid version of HIVE crypto as once you’ve staked HP, it cannot be transferred without first unstaking it over a 13 week period with 1 equal payment per week.

The more HP you have, the more RCs (replenishing, non-transferable credits on your Hive account that allow you to transact on the blockchain) you will have

HP allows your account to endlessly transact for free on the Hive blockchain.

3. Hive Backed Dollars (HBD):

Hive Backed Dollars (HBD) is a Hive’s own stablecoin pegging Hive to the USD.

1 HBD should always equal $1 USD of HIVE and can be instantly converted using the network’s internal market.

The major advantage of HBD is for Hive-based eCommerce stores to price products in the more stable HBD, rather than the more volatile HIVE currency itself.

Distribution of HIVE via the Hive rewards pool

The Hive rewards pool the blockchain’s way to distribute new tokens via inflation.

It’s important to understand that your upvote’s value comes from newly generated tokens within the rewards pool and not from your own stake.

If you have a staked HP, then you have a say in how the daily rewards pool is shared via your upvote.

The more HP you have, the bigger your upvote will be worth.

The rewards pool offers content creators and curators an incentive to use Hive based front-ends for their blogging, with the aim of populating front-end domains with quality content.

Put simply, the Hive rewards pool is constantly fluctuating based on price and other factors and its total can always be viewed via a block explorer.

Final thoughts on how Hive works

There are a few more technical aspects of Hive that you should also be aware of including the Hive dev fund, otherwise known as the DHF.

But as we mentioned above, this particular Hive guide is designed to be a more user focused view of how Hive works and that stuff can wait.

If however, you’re after more detail on how Hive witnesses work to produce blocks and secure the blockchain right now, then leave a comment and we’ll try and go into more detail.

What gives Hive value?

Hive is one blockchain that has real world use cases which give it value. Let’s explore what gives both the Hive blockchain and HIVE crypto value below.

The Hive blockchain’s value comes from it being a truly decentralised, efficient blockchain built for Web 3.0.

Through a myriad of social applications, Hive’s primary value is that the network offers freedom of speech for all users, no questions asked.

In a modern digital world where increasing censorship by governments and big tech continues to be an issue, Hive fixes this.

Why should the public allow the heads of publicly traded companies who answer only to a tiny subset of shareholders, dictate what is morally right or wrong?

This section of the LeoFinance Hive guide will help you see that the success of the HIVE token price, is inherently linked to what the blockchain offers users the ability to do.

Value of the Hive blockchain

Let’s first expand on what gives the Hive blockchain value, walking through the major value-adds below.

Fast and FREE transactions on the Hive blockchain

Before we explore Hive accounts themselves, we need to start by saying the Hive blockchain allows decentralised applications to run by quickly processing transactions, with zero fees for users.

Yes, transactions on the Hive blockchain are FREE for users.

If we consider Ethereum to be a leading blockchain for decentralised applications, let’s use it as an example comparison here.

Can you picture Ethereum with free transactions and without Vitalik asserting control over network governance?

Well, the blockchain you’re actually picturing here is Hive.

No single Hive witness has the control of a Vitalik and the blockchain is robust enough to be able to handle whatever traffic increases are thrown its way.

There is no CryptoKitties driven network congestion on Hive and you’ll never have to pay $80 USD to send $5 USD to a friend.

But the real value of Hive is offered at the account level.

Censorship resistant social media accounts

Hive accounts aren’t string based like other blockchains, but instead they’re easy to remember usernames that are simply in the format of @forexbrokr.

But possibly the biggest value add to Hive is the ability for literally anyone on the planet to create a censorship resistant account of their own.

Your Hive account allows you to access and publish content to Hive front-ends such as leofiance.io or peakd.com.

The key however, is that while your content is displayed on a regular web server hosted front-end that’s controlled by a central entity, your content is also published to the blockchain using your censorship resistant account.

So while a front-end community, server host or government may not agree with the content that you’re posting and choose not to display it, it is still published to the blockchain and immutably tied to your account.

If you’re posting something that simply doesn’t align with the interests of that front-end community such as illegal content, then they can remove you from that front-end.

But the difference between this and say a Twitter ban, is that you never lose your content, your followers or your ability to speak.

Only the front-end can choose how to display your data on the blockchain.

You’re still free to take your content and followers to another front-end that better fits your ethos.

You can even think of your account as an NFT.

There is only one of your account, with all its value (rep, followers, your wallet) all tied into that account.

It’s your account, so just like any other asset, you’re able to sell it as is by simply transferring the private keys to a buyer.

Immutable communities using Hive

By offering censorship resistance at an account level, Hive therefore allows you to build immutable communities.

If you have an online business that relies solely on your centralised social media account to attract sales, the risk is immense.

If it’s based on Twitter or Facebook for example, you’re literally at the mercy of that network pulling the plug on your entire business at the stroke of a key.

It’s not your account, so it's entirely up to their discretion as to why or when they do this.

Being at the mercy of centralised social media companies is a business risk that can no longer be ignored.

Hive’s censorship resistant accounts offer the ability for business owners to build immutable communities that completely remove this risk.

Take the largest, most popular community currently built on Hive - LeoFinance.

Using Hive’s second layer, LeoFinance has built its own tokenised community on top of the Hive blockchain exclusively for trading and investment chat.

By launching their own front-end at leofinance.io and their own second layer token called LEO, they’re able to choose how niche content is displayed in their own community.

For example a piece of cooking related content may be highly rewarded and visible on Hive itself, but on LeoFinance it isn’t displayed or rewarded in LEO.

Alternatively, a Bitcoin analysis piece may have zero HIVE rewards, but due to being published to the LeoFinance community, is highly visible and rewarded in LEO.

Value of the HIVE crypto token.

But from an investors point of view, how does value transfers from the Hive blockchain to the HIVE token?

HIVE and LEO token demand

Let’s continue to use the LeoFinance community example from above.

If you’re a business in the crypto niche, you now have an immutable community full of eyeballs in your specific niche.

Eyeballs that you want to be on your specific content.

Remember you can’t just spam the community, because the front-end is still centrally hosted and the community has a number of mechanisms to not display your content.

If you want to succeed, you have to be smart and provide actual value to the community.

Getting community eyeballs on your content is best done by to your stake in LEO.

Do you want more attention?

Then buy and stake more LEO so your content is more prominently displayed.

You’re showing the community that you’re invested by taking a stake in the token’s success and building true value through quality content that isn’t spam.

The incentive is there to provide value because if you’re simply spamming, then your investment in the token is not going to make money.

As for HIVE, remember that you’re still using a Hive account running on the Hive blockchain.

You require a stake in HIVE to transact on the network and not to mention that all second layer community token purchases such as LEO are denominated in HIVE which creates demand that way.

As you can see, the success of the HIVE and LEO token prices are inherently linked to the success of Hive based accounts and communities.

How to make money blogging on Hive

As Hive uses a consensus mechanism called Delegated Proof of Stake (DPoS), you make money by contributing content to the platform.

In essence, this is called Proof of Brain (PoB). By using your brain to create engaging and informative content, you attract upvotes from users with staked Hive and receive a portion of the reward pool for your content.

This section of the Hive guide will outline the three ways to earn money through the Hive platform: Authoring content, commenting on content or curating content.

1. Authoring content

Many users create posts to author new and informative content on Hive.

This is the main way to make money on Hive. Informative, relative and engaging content is the best way to ensure you attract the most upvotes and reward for your time.

Make sure your content is informative and connects with people.

You can write one average post a day with relevance and most users will understand, send some votes your way and engage.

Author 10 posts a day and they are all average/mediocre, then readers will start to skip over your content and not read any of it.

Be cautious about what you post and understand that others might not see the value in what you post.

In the beginning, your content may not attract the attention and reward you feel it deserves, but by connecting and persisting, you will find that, in time, if your content is high level, you will reap the rewards for your efforts.

Authors can also add hashtags to their content so that topic content is easily found.

For example, if I wanted to read about any content regarding HIVE crypto, then I would search the #hive tag for content.

As there are many posts authored on a daily basis, the tag methodology enables an easier way to navigate the content on the Hive blockchain.

2. Commenting on content

The second way for users to make money through rewards is to read and interact with authors.

On the Hive blockchain, you are able to comment and provide feedback or commentary on a post.

This enables users to interact with the author and ask questions or provide further information that is relevant to the original content.

If these comments are deemed to be relevant to the original post, users can upvote comments and reward these in the same way posts are rewarded.

Just keep in mind that as it’s less work and provides less value, comments will usually attract lower vote percentages than posts do.

3. Curating content

Rewarding content involves upvoting posts and comments with a percentage vote.

Upvote amounts are relative to the amount of staked HIVE you have in your wallet.

The greater the staked Hive in your wallet as Hive Power, the higher value your upvote will have.

To reward users for staking, reading and upvoting content, curators are given a percentage of the rewards for curating/upvoting content.

Rewards are split 50/50 between curator and creator, so if you receive $1 for your post, 50c goes to curators and 50c goes to the author.

Each post or comment is only open for voting to earn on for seven days, at which point it will close and the earnings for creator and curators will be paid from the rewards pool into individual accounts.

Final thoughts on making money blogging on Hive

All HIVE earned through blogging can then be sent to and traded on popular exchanges such as Binance and Bittrex.

Once it’s in your wallet, it’s your money to do with as you please.

How can I keep my HIVE crypto safe?

The best way to keep your HIVE crypto safe is to power it up and stake it on your account which you control the private keys to.

While the best way to keep Bitcoin and certain other cryptocurrencies safe is to store them in a cold wallet, this isn’t the case for HIVE.

To put it simply, the process of powering up HIVE to Hive Power, is the blockchain’s lingo for staking your coins.

Remember, Hive uses a Delegated Proof of Stake (DPoS) blockchain protocol and is designed to reward users who stake their Hive as Hive Power.

In this section of the Hive guide, we discuss why powering up your HIVE is the best way to keep it safe, as well as going over a few key account safety checks that are often overlooked.

Powering up your HIVE

As we mentioned above, the best way to keep your HIVE crypto safe is to power it up.

This is done on your own account wallet, of which you control the private keys to.

“Powering up” refers to moving HIVE to Hive Power (HP) within your wallet and locks it away for 13 weeks.

To unstake your coins and turn HP back into liquid HIVE, the process takes 13 weeks over which you receive equal weekly payments.

If someone gets a hold of the keys to your account, this gives you time to realise and begin the account recovery process hopefully without suffering too much damage.

Powering up keeps your HIVE safe by giving you time.

Advantages of powering up your HIVE:

Keeps your HIVE crypto safe: While nobody else should gain access to your account’s private keys, mistakes happen. By having your HIVE powered up, you can minimise any potential damage.

Get a bigger upvote: The more HP you have staked, the bigger your upvote on the Hive blogging platform is. Have a bigger say on how the rewards pool is divided up via your upvotes.

Earn bigger curation rewards: With bigger upvotes, comes the potential to earn bigger curation rewards on the back of your efforts. To maximise curation rewards, find good quality content and upvote early.

Ability to delegate HP: By powering up your HIVE, you then have the ability to delegate your Hive Power to other accounts. This can be to accounts offering payouts such as @leo.voter’s 16%, or simply to help others.

Gain respect within the community: Hive is a community first and foremost, so don’t underestimate the respect (and upvotes) you will receive by building a stake in the community. You want to get noticed? Power up your HIVE.

Setting your recovery account

When it comes to keeping your HIVE safe, one often overlooked aspect is your recovery account.

Your recovery account is another Hive account that is able to initiate the recovery process for your account, in case it has been compromised.

A lot of old Hive accounts saw their recovery account reamin automatically set to Steemit which is obviously no help here.

Instead, change your recovery account to a second account or someone you trust via the permissions section of your account on PeakD.

Understanding Recovery via PeakD:

If your account keys have been stolen and used by someone else, first try to use your own OWNER key to change your keys.

However, the thief could change the keys themself (if the OWNER key or MASTER password has been stolen) and locked you out.

If this happens you will need to recover your account.

A recovery account should be:

- Someone you personally know and trust to verify that your account was compromised and

- They can validate that you want to "recover" the account and

- They are unlikely to also be compromised at the same time.

Don’t keep your HIVE on exchanges

Our final tip to keeping your HIVE crypto safe is to keep your Hive off centralised exchanges.

Not only are you sacrificing curation rewards by not powering up your HIVE, but you’re opening yourself up to a whole raft of other issues.

To put it kindly, centralised exchanges are not your friend.

Consider Justin Sun’s hostile takeover of the Steem blockchain.

In order for Justin Sun to gain control, he convinced his friends at exchanges (like Changpeng Zhao at Binance), to power up all of the STEEM tokens in customer’s hot wallets in order to vote for network witnesses.

Now obviously this is highly unethical, but code is the law and all you need to vote on the governance of a DPoS blockchain, is stake.

Something that leaving liquid HIVE on exchanges gives them if they choose to power it up.

Remember the old saying: Not your keys, not your crypto!

TO keep your HIVE crypto safe, don’t leave it in hot wallets on exchanges.

Keep it powered up on your account which you control the private keys to.

Hive pros and cons

We've created a list of pros and cons pertaining to both the blockchain and HIVE crypto itself.

Hive pros

Lots of opportunities to earn

- Blogging

- Vlogging

- Live Streaming

- Commenting

- Gaming

- Decentralized Finance (DeFi), yield farming

No fees for transactions (Resource Credits based upon staked HIVE of users pays for transactions)

Censorship resistant

Legacy as the first and most active decentralized blogging platform

No centralized authority

All topics welcome

Cooperation and interfaces with other blockchains

Constant development

No initial investment required

By staking your tokens, you can compound over time

Even dividend tokens or delegations tend to have over 10% APY which is greater than the returns you tend to get on the stock market index fund

Hive cons

Steep learning curve

Not currently well known

Takes time to get recognition and is NOT a get rich quick scheme.

Curation system doesn’t always reward the highest quality content.

13 week period to unstake HIVE (1/13 of your entire stake every 7 days)

Should I buy HIVE crypto in 2022?

These are some reasons to buy HIVE crypto but we encourage you to do your own research and find out if they also work for you.

Keep in mind that these recommendations are all based on the experiences of a single HIVE investor and should not be treated as financial advice.

We discuss these key reasons to buy HIVE crypto in the section below.

HIVE token price

While this is not the main reason we take into consideration when we decide to buy Hive crypto, we understand it is an important factor to many people.

We believe that HIVE and many of the 2nd layer tokens, such as LEO, STEM and a few others, are still very underpriced.

Hive is still a young community but we think that all the development that's taking place is really going to bump the value of most tokens in the future.

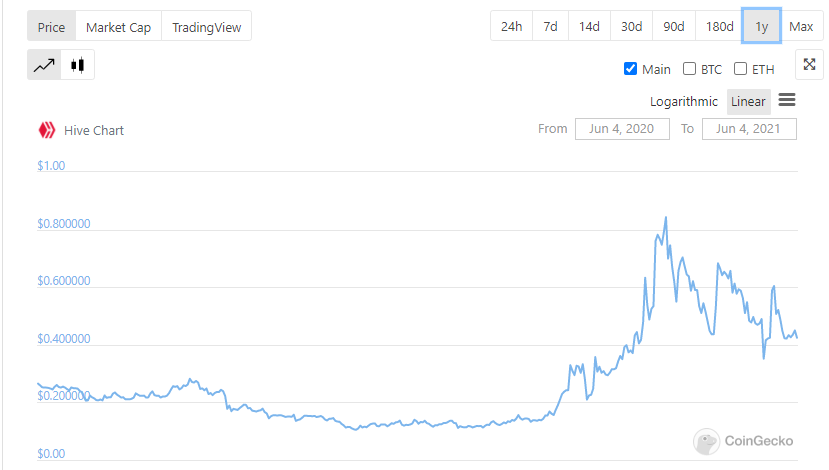

Taking a look in the HIVE chart over the last year, we see an interesting trajectory:

It's been holding its ground around the $0.40 mark, with patterns showing it has the potential to continue to rise.

Hive communities, influence and development

Now these are the main reasons why we keep investing in HIVE crypto.

There are a lot of communities built on Hive already and many more keep coming up.

Whether you are into finance, sports, science, or other particular niches, chances are you'll find a tribe for you on Hive, and owning and staking HIVE crypto is a great way to increase your influence within those communities.

Moreover, we have many new projects being built on Hive and outside Hive that often airdrop tokens for people holding HIVE crypto.

We recently saw this happen with CubDefi for example, which is a DeFi application on BSC that was built by the same team behind Hive community LeoFinance.

They airdropped CUB tokens to all LEO holders when it launched.

There are many others project like that under development now so holding HIVE crypto can really give you a headstart when they launch.

Final thoughts on whether you should buy HIVE crypto

To sum it up, we believe that the value of HIVE lies in the social aspect of it and the many people that are dedicated to seeing it grow.

This is either by actually developing projects or by adding value to the community through their engagement.

We believe that this will ultimately reflect on the value of HIVE crypto.

So, whether you are only interested in the price or you have a real interest in the community and the value it adds to the blockchain, we believe you can find a few good reasons to buy HIVE crypto.

LeoFinance Crypto Guides.

Why not leave a comment below and share your thoughts on our guide to Hive crypto? All comments that add something to the discussion will be upvoted.

This Hive crypto guide is exclusive to leofinance.io.

Posted Using LeoFinance Beta

Thanks going to be using this guide in a video today.

Hey Titus, did you end up making that video?

@ me with a link if you do.

Posted Using LeoFinance Beta

Yes and here is the HIVE post of it: https://hive.blog/howto/@titusfrost/how-to-crypto-for-newbies-captain-frost-s-pirate-crypto-currency-academy-part-1

This was written before I began contributing to later editions for @crypto-guides, and I just got to read it today. Good guide!

It's too late for me to give this guide an upvote, so please accept this slice of !PIZZA instead.

Posted Using LeoFinance Beta

@crypto-guides! I sent you a slice of $PIZZA on behalf of @magnacarta.

Learn more about $PIZZA Token at hive.pizza (2/10)

Thanks mate.

Any links in future posts would be appreciated :)

Posted Using LeoFinance Beta

I link to all guides every chance I get. :)

Posted Using LeoFinance Beta

Hey guys,

I will upvote anyone who contributes content to this guide and transfer all final blog rewards to contributors.

To earn LEO:

Pick any of the subheadings from that template and publish content on your own blog.

Link back to 'https://leofinance.io/@crypto-guides/what-is-hive-crypto-hive', anywhere in your blog using relevant anchor text.

That's it.

Help me out here?

Posted Using LeoFinance Beta

How to make money blogging on Hive? - I'll write a post for this section for this guide over the weekend. I'm happy for you to allocate me a section for each guide to write! You can DM on Discord anytime.

Posted Using LeoFinance Beta

Did you write this are you @crypto-guides or is that Gaz?

Just came across this today and love it!

Posted Using LeoFinance Alpha

This post is very informative. Thanks.

I've written similar posts like these, I'll be happy to reproduce some for you from next week when my schedule clears, can I keep in touch?

Posted Using LeoFinance Beta

Of course, you can only do what your schedule allows.

I'll probably have just finished this Hive guide myself by next week, but there'll always be new templates for you and the community to complete.

Posted Using LeoFinance Beta

All author rewards have now paid to contributors of this Bitcoin guide.

Contributors:

Full blogs:

@scooter77: +5.125 LEO

@tfranzini: +5.125 LEO

Comments:

@jfang003: +1.708 LEO

@sgt-dan: +1.708 LEO

Section that had already been completed:

@arslan.leo: +1.708 LEO

Thanks guys.

Posted Using LeoFinance Beta

Howdy Mate. Keep the How to make money blogging on Hive? spot open for me. It's the weekend so I'll write a post for this to contribute.

Posted Using LeoFinance Beta

Sounds good to me!

Looking forward to seeing what you come up with :)

Posted Using LeoFinance Beta

Jjjejs

Posted Using LeoFinance Beta

Well written introduction to the massive world of Hive! I recently wrote an article about entry problems new users might have when joining Hive. You can read it and mention something if you want to :)

Posted Using LeoFinance Beta

I agree that there are still many Hive barriers to entry, but still a lot less than other crypto projects.

Take the highly popular Ethereum for example.

The barriers on ETH are MUCH higher than Hive, yet that network is 1000x more popular.

For now.

I still believe that the social aspect of Hive will allow this blockchain to steadily grow over the long term and be a success.

Exciting times for Hive!

Nice post by the way.

But I'm not really looking to repurpose content that wasn't published with the guide in mind.

If you do another post, focus on one of the subheadings above and include a single link across to the guide using any sort of 'hive guide' relevant anchor text.

Posted Using LeoFinance Beta

Sddvvvv

Posted Using LeoFinance Beta

i think i have made content in the past talking about some of these points.

To add:

-how to move hive in and out of exchanges

-how to use hive-engine

I think these two are valuable additions to the list.

Posted Using LeoFinance Beta

It would be a huge help if you'd re-purpose and edit some of your old content into a new post to fit the template.

Just provide that single link back to the Hive guide anywhere within the post.

Is this something you could do to help?

Also cheers for the suggestions, I'll definitely add them to the template.

Posted Using LeoFinance Beta

Your post was promoted by @amr008

Congratulations @crypto-guides! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

Your next target is to reach 200 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out the last post from @hivebuzz:

Support the HiveBuzz project. Vote for our proposal!

I found this guide very informative. I agree that the learning curve is steep. For reference, I've been a HIVE user for over a year, but I'm only now beginning to understand the vast potential in the blockchain and the communities built on it, like LeoFinance.

Posted Using LeoFinance Beta

Post like this are there to improve us and make us want to do more, well documented and straight forward. I hope more newbies sees this.

Posted Using LeoFinance Beta

i love this is really cool

Posted Using LeoFinance Beta

best

Posted Using LeoFinance Beta

Hive as a decentralized database is underappreciated.

Posted Using LeoFinance Beta

https://leofinance.io/threads/@forexbrokr/re-taskmaster4450le-25akrtxtf

https://leofinance.io/threads/@rehan12/rent-out-or-playing

The rewards earned on this comment will go directly to the people ( @forexbrokr, @rehan12 ) sharing the post on LeoThreads.