Most of the crypto world is familiar with the UST stablecoin ant its amazing 20% APY on the Anchor protocol.

Thanks to this the UST supply has expanded to 17B in just over a year, while the LUNA token has also increased in value multiple times.

But the thing is we are in some form of mild bear market in 2022 and the Anchor yield reserves are depleting at fast rate. Recently there was a proposal on Anchor to change the way APY is determined, and it passed. Let’s take a look at this and what does it means going forward.

The simplicity of the Anchor protocol and the fixed 20% APY has been one of its key drivers for adoption.

The Anchor protocol is paying 20% APY fixed, while in the meanwhile it holds yield reserves that are being used to accumulate any excess funds that the protocol makes, or if the current APY is lower then 20%, then it uses the yield reserves to make up for the difference.

Where Does Anchor Yield Come Form

To better understand the whole picture first let’s take a look how the Anchor protocol is generating yield and where does it comes from.

@forexbrokr has an excellent post on it. The Anchor yield comes from three places:

- Interest charged to borrowers

- Staking rewards earned from borrowers’ collateral

- Liquidation fees

The first point is basically the standard way how the financial system works, it transfers the interest that borrowers pay to the one who have deposited funds in form of UST.

The second point is something new. The protocol takes the deposited UST and reinvest it into other assets that bring in yield, mainly Luna and Ethereum.

The third point are fees from borrowers who don’t have enough collateral for their loan, and are getting liquidated.

Is this enough?

As many things in crypto, when the market is in a general uptrend, then everything seems to work, and all is going fine. The yield reserves seems to be even going up back in November 2021, meaning that the protocol was making even higher APY then the 20% that is has been paying and was able to accumulate those excess funds in the reserve.

But 2022 has been challenging for crypto and the yield reserves have been constantly going down.

In February 2022 the Luna Guard Foundation LFG, made a top up to the yield reserves with additional 420M UST. This basically means that the 20% APY is at the moment subsidized. Some of the reasoning behind doing this is that it will drive expansion of the UST that will then leads to its mass adoption.

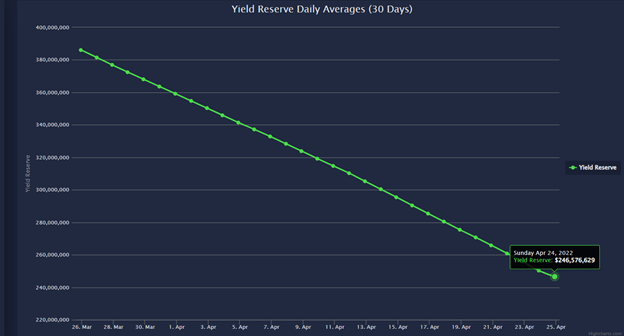

But even with this, the yield reserves are going down fast at a rate of 120M to 140M per month.

source

With this pace of depletion of the yield reserves there will be funds to maintain the 20% APY for only about two more months or up until June 2022.

Note that not all 20% of the UST APY is coming from the reserves. Some part of it is coming from the protocol earnings. But since the reserves are going down, it means that the protocol is earning less then 20% and it need additional funds from the reserves. I can’t really tell what are the current earnings of the protocol, and those are basically changing by the day, but there are some estimates that they are somewhere around 7%. Again this number is just approximation and is changing every day. As mentioned in the past it was above 20%.

Introducing Semi Dynamic Earn Rate

The proposal for this is described here:

From the description above we can see that what is proposed is basically to change the APY on a monthly level depending on what is the change in the yield reserves.

The formula looks like this.

(% Earn Rate Change) = min( abs(1.5%, ((YR % Change) ) )

What this means if the yield reserves are reduced for 20% in a month, the protocol will choose the minimum value between 1.5% and 20%, ergo the 1.5%.

The same goes in both directions, meaning if the protocol increases it reserves for more than 1.5%, the change will again be just a 1.5% on the upside.

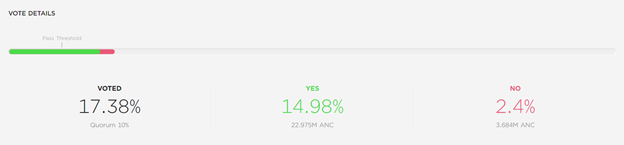

The proposal passed as we can see on the Anchor governance tab with a 15% voter for yes and 2.4% against.

The proposal closed on March 27, 2022.

What this means that April should be the first month when this mechanics are put in place, and if everything is according to the statement above from May 1st we should already have a smaller APY for UST, somewhere around 18%. We can see that the yield reserves have went down from 386M to 246M in the last 30 days, a reduction for around 36%. Far below the 1.5%

What Happens If The Yield Reserves Goes Down To Zero?

This was one of the questions asked in the forum link above and probably something that a lot of people are thinking about.

The original answer goes as follows:

It goes to a completely dynamic money market until the yield curve starts to build a balance again

What this means is that if yield reserves are zero, the APY for UST will be what the protocol earns at the moment. If the protocol earns 5%, then it will be 5%, if the protocol earns 7% then it is and so on. Up until some point when the protocol starts earning more and accumulate funds in the reserves again.

Final Thoughts

Having a buffer that will serve as a stabilizer for a yield is actually a great idea. It should accumulate excess funds in period of a bull and use them when the times are not as great. But this being crypto everything seems to happen at faster rate.

Anchor now has 13B deposits in UST. At 20% APY it should pay around 200M per month. At the end of November 2021 when the protocol was making surpluses, Anchor had around 2.5B or five times less. The protocol didn’t had time to accumulate enough reserves for the amounts that it needs to pay now. In the last 30 days 140M were taken out of the reserves or 70% of the yield was subsidies.

These are huge numbers and the only thing that can revert them is a nice bull market, lasting for months.

If this doesn’t happen the total depletion of the yield reserves is almost inevitable despite the efforts like the above that try to create a sort of soft lending for the APY. It’s just a matter of time, will it be two more months or maybe four months.

The other way for the APY to be sustained is more subsides from LFG, but after the 420M round in February I’m not sure how willing they are to repeat this.

Ok, so the APY for UST goes to 7%, not that big of a deal!

I agree with this, but the other far more concerning thing for me personally would be the UST peg. If the APY of UST going down creates a pressure on UST and people start getting rid of it, it will inevitably reduce the UST supply, meaning more conversions to LUNA, putting pressure on the LUNA price, the underlining asset UST is backed on. Now we have heard that they have been buying Bitcoin for condition like this, so if the price of LUNA falls a lot of Bitcoin to be used as a asset to support UST. This gives some confidence in the project, but still if all the crypto market dumps for a long period of time it can be challenging.

Terra has been doing some interesting stuff with UST and it seems to continue to do so. However, some form of caution is always welcomed and be sure to not overexpose yourself to a project. I personally have some UST on Anchor, but not all of my stablecoins.

All the best

@dalz

Posted Using LeoFinance Beta

and so the circle jerk begins, justin's offering a 30% return on his USDD ponzi lol

Thats not entirely how the APY works. You're not actually earning anything. aUST is appreciating at a 20% APY rate.

This is one of the things people get wrong about the entire protocol. All that vote does is change the rate that aUST appreciates and will slow it down.

The reserve gets topped up by TerraFormLabs they have done it twice now. It has nothing to do with fees.

Posted Using LeoFinance Beta

Yes, when you deposit UST you get aUST.

When you withdraw you echange aUST for UST.

The end result is after some time you do get more UST :)

Not sure what do you mean by it doesnt work that way ...

While we are on the topic do you know that you are not earning any HP as staking rewards... that 2.8%. When you power up, you actually get VESTS and the only thing that is changing is the ratio HIVE to VESTS... but not a lot users know VESTS.... they power up hive, and receive hive when power down ;)

Yes I am aware of how Hive works. UST is similar but if you deposit into Anchor now it is not 1:1 it was at the start but 1 aUST is I think at 1.23 ust now.

So if you put 1ust in when Anchor launched it would be worth 1.23 ust. You get more UST when you sell but the protocol doesn't give you more UST.

What I'm trying to say is that the mechanics aren't how people think when it comes to Anchor yield. There is no fund to "run out" per say as no one is being paid UST.

It's like buying say Hive and knowing it will to up 20% each year. So when heaps of people are buying aUST there are no massive price spikes as the system is keeping them. I.e. pump and dumps make tokens values go up and down but on aUST that is prevented. The price is being manipulated.

Hive on the other hand can still go up and down based on the market. aUST does not as it gets gobbled up by Anchor and replenished when the reserve starts to dry up.

I just wish that UST was reported on for what it actually is.

When you dig into it's relationship with Anchor it's not the decentralised, algorithmic stablecoin that it is made out to be.

Posted Using LeoFinance Beta

Very interesting! Thanks for the info!

That Semi Dynamic Earn Rate reminded me of the TorCHAIN incentive pendulum. I know they are fundamentally different but, in a way, also similar as they attempt to keep the network stable.

Posted Using LeoFinance Beta

I intended several times to invest in UST via Anchor protocol. As I don't want to use an extra wallet, I haven't invested yet. One thing for sure is that it is a decent choice for a stable coin portfolio.

Posted Using LeoFinance Beta

In this case you probably mean Terra wallet? I actually prefer using that more than Metamask

I haven't tried Terra Wallet yet, but I will.

It's hard to build a sustainable system but this doesn't really bode well for UST. I think the 20% return was one of the biggest reasons that it was shilled everywhere but reducing it by 2% doesn't really seem like it will solve anything. I guess the HBD stabilizer is quite nice though because it generates a decent amount of Hive for the DHF right?

Posted Using LeoFinance Beta

Forgive my ignorance, Please what does APY mean?

And does it apply to all type of coin or is it UST alone?

APY = annual percentage yield

Its the yearly earnings paid in interest when autocompounding ... there is APR as well :)

Ohhhh.... I only knew of APR.

Thanks so much @dalz

You can use this https://www.aprtoapy.com/ calculator to check how much APY would your APR be

Oh Okay... Thanks so much! @brando28

You're welcome!

Anchor has a big deposit. If they are paying 200M per month, where is it coming from. The reserves are getting depleted. Surely it's not just a matter of printing more UST !

Well I think this is answered in the post, but lets go over it once again. At the moment around 60M is from protocol earnings and 140M from the reserves.

I fear for ust and Luna price at the moment but I believe the proposal will make thing a little bit easier but it might not be for long

Posted Using LeoFinance Beta

It's best thing to always invest in stable coins, I always prefer to invest in USD.

I always thought this 20% was too good to be true - Literally nothing else going on with Anchor other than a stable coin.

I'm actually glad to sell most of mine for my house purchase next month!

It's a relief TBH - I'll maybe keep $1000 in there but mostly I'll just start stacking HBDs instead!

Posted Using LeoFinance Beta

If the APY falls on UST, that will be another positive for HBD as long as we manage to market this properly. These times can be good for a Brave Ad campaign for HIVE. What is the point of having a great product if nobody knows about it.

If someone creates a DHF Proposal with some good ad designs, I'm definitely supporting it whether it is to promote HIVE, HBD or a specific DAPP.

!PIZZA

!LUV

Posted Using LeoFinance Beta

If the APY on Anchor would started to drop dramatically I would move my it HBD savings. I mean why not? Good idea that Brave campaign btw!

I'm more interested in speculation than stablecoin yields. Still I do have the need for stablecoins for loans, trading and payments. Competition in the sector to create better stablecoins is ultimately going to benefit all of us.

!PIZZA

I hear you, good thing about Anchor is having those stables immediately in use without any unlocking periods

@vimukthi(1/1) gave you LUV. wallet | market | tools | discord | community | <><

wallet | market | tools | discord | community | <><

Pains of being a pioneer, it all just shows how young this entire system is.

I think this is a common problem facing every algorithmic stable coins and even HBD?

Posted Using LeoFinance Beta

Absolutely. People are quick to forget this is all new and that mistakes are being made and learned from every day. We've seen lots of projects fall flat on their face already and we'll see plenty more do the same before this space can be considered mature. Personally, I love the creativity and dynamism and just make sure I think twice or more before committing my funds.

!HBIT

I'd guess we should go for HBD :)

!PIZZA

Deffenetly!

PIZZA Holders sent $PIZZA tips in this post's comments:

@vimukthi(1/5) tipped @dalz (x1)

fabiodc tipped dalz (x1)

deadleaf tipped dalz (x1)

You can now send $PIZZA tips in Discord via tip.cc!

!PIZZA

The rewards earned on this comment will go directly to the person sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.