What seems to be one of the worst years in the modern crypto is almost behind us. Countless bankruptcies and fallen projects. What’s interesting is that throughout the year, the Bitcoin mining power aka hash rate kept growing. Even with lower prices.

But this trend seems to be finaly ending as we are seeing the hash rate going down and miners capitulating in the last month.

Let’s see how this has impacted the key network metrics.

We will be looking at:

- Total number of wallets

- Active wallets

- Hash rate

- Number of transactions

- Fees

The data presented here is mostly gathered from the blockchains charts.

Number of Wallets

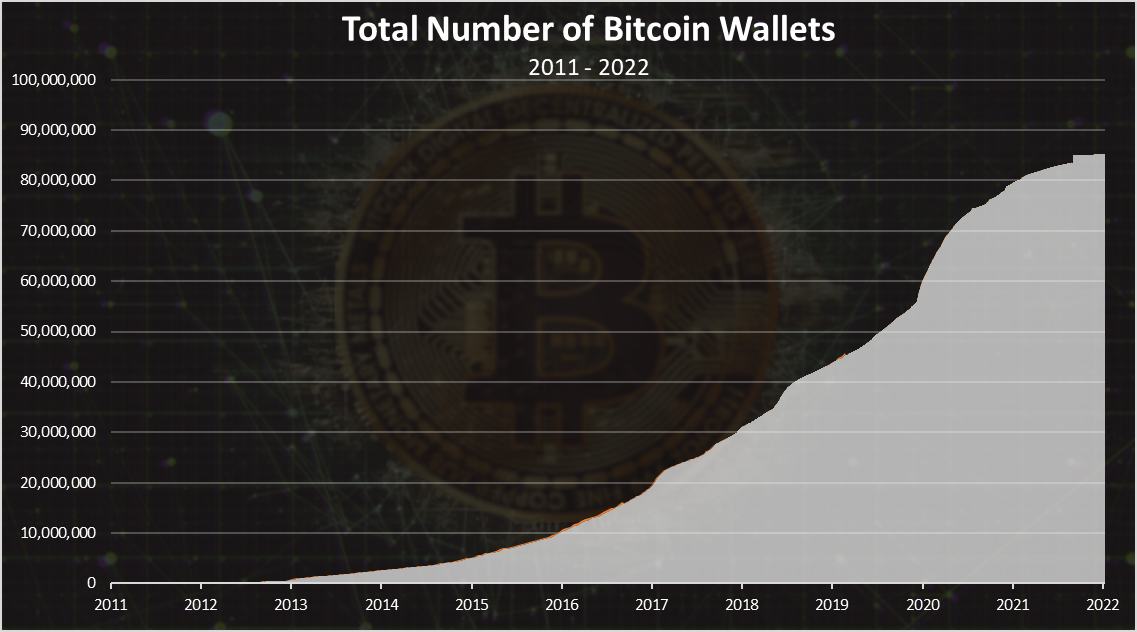

Here is the chart for the total number of Bitcoin wallets created.

Bitcoin stands at 85.2M wallets now.

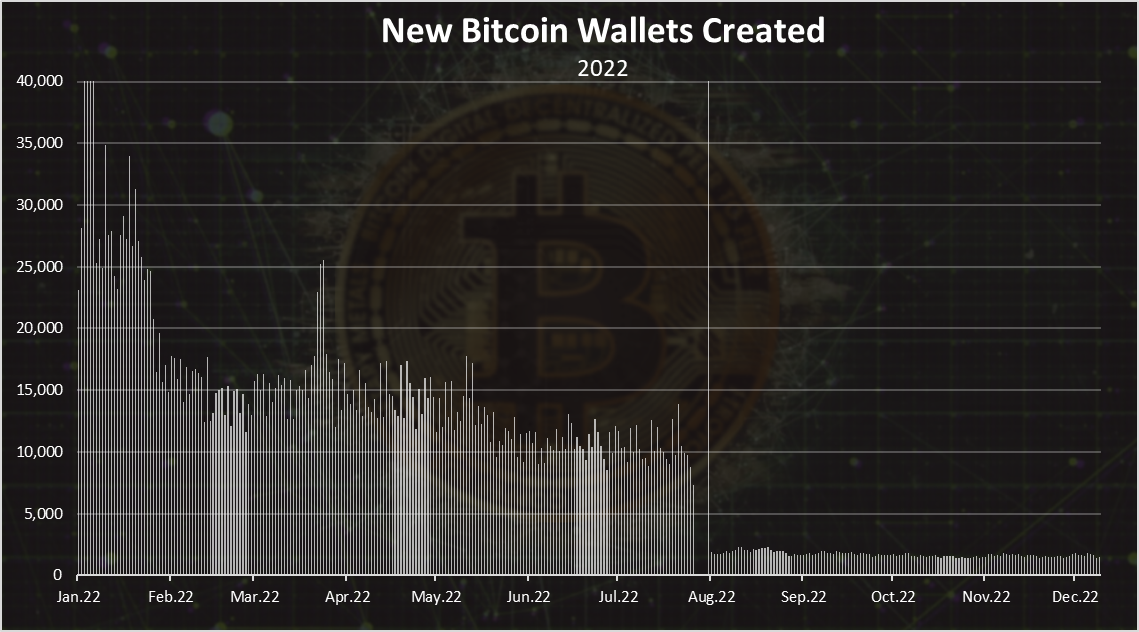

When we zoom in 2022 we goth this.

This chart is a bit odd, but that how things stand.

At the begging of the year there were more than 40k wallets created daily. These numbers have dropped since then and the low was somewhere in August. Since then the number of new Bitcoin wallets is around 2k daily.

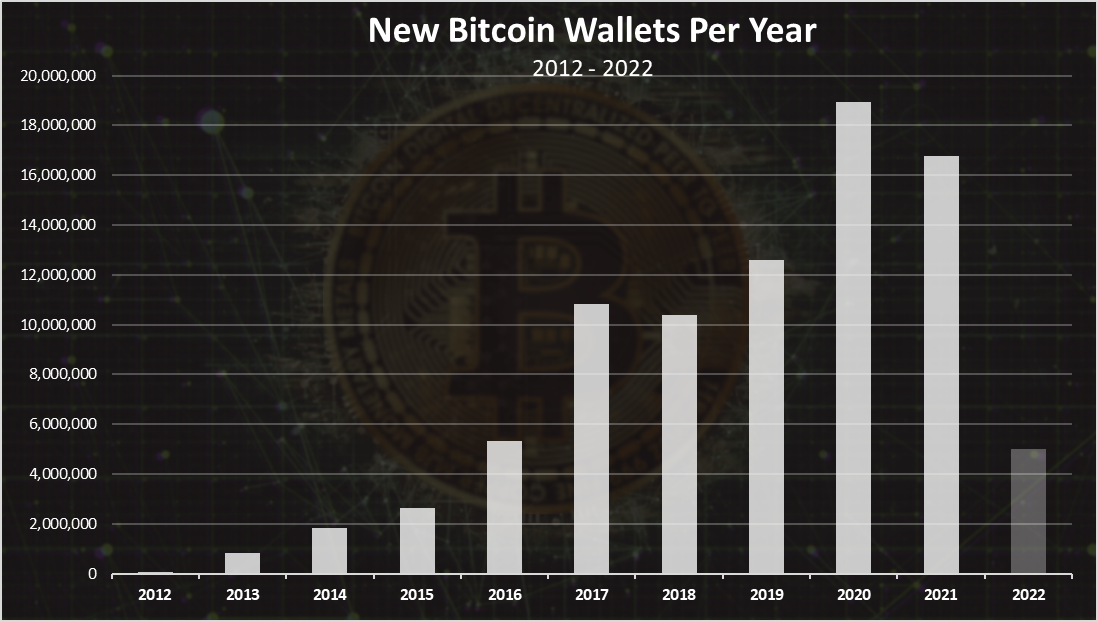

The yearly chart for new bitcoin wallets

The chart for the number of new Bitcoin wallets per year looks like this.

We can see that the ATH for new wallets is in 2020 with around 19M Bitcoin wallets created in that year. In 2021 there is almost 17M bitcoin wallets created, even though BTC has seen a massive run-in price especially in the first half of 2021. Most likely because new users are using custodial wallets.

2022 is not over yet, but the numbers of new wallets are quite small. At the moment around 5M.

I find this surprisingly low, and it seems like a trend that started back in 2021, when the number of new wallets just didn’t corelated with the price increase. As mentioned, it might be because of new users using custodian wallets. Another speculative thing I can think about is that previously someone was creating a bunch of new wallets just to pump the numbers. There have been cases like this for other projects, and with the decentralized nature of Bitcoin, everyone can do it.

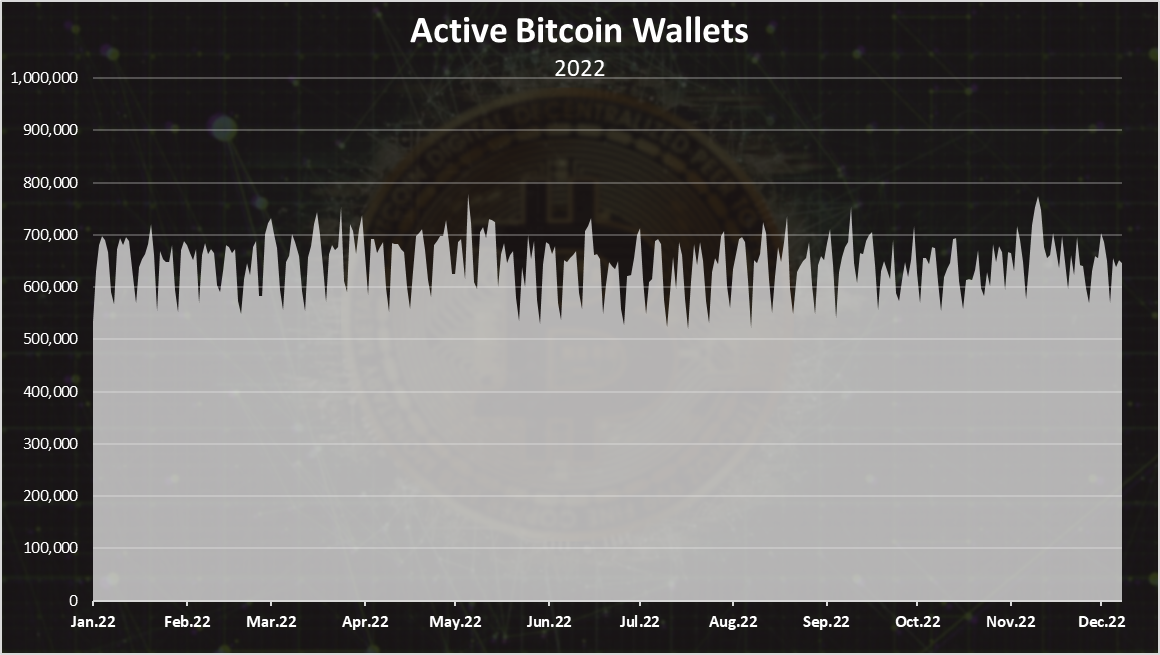

Active wallets

How many of the are being used?

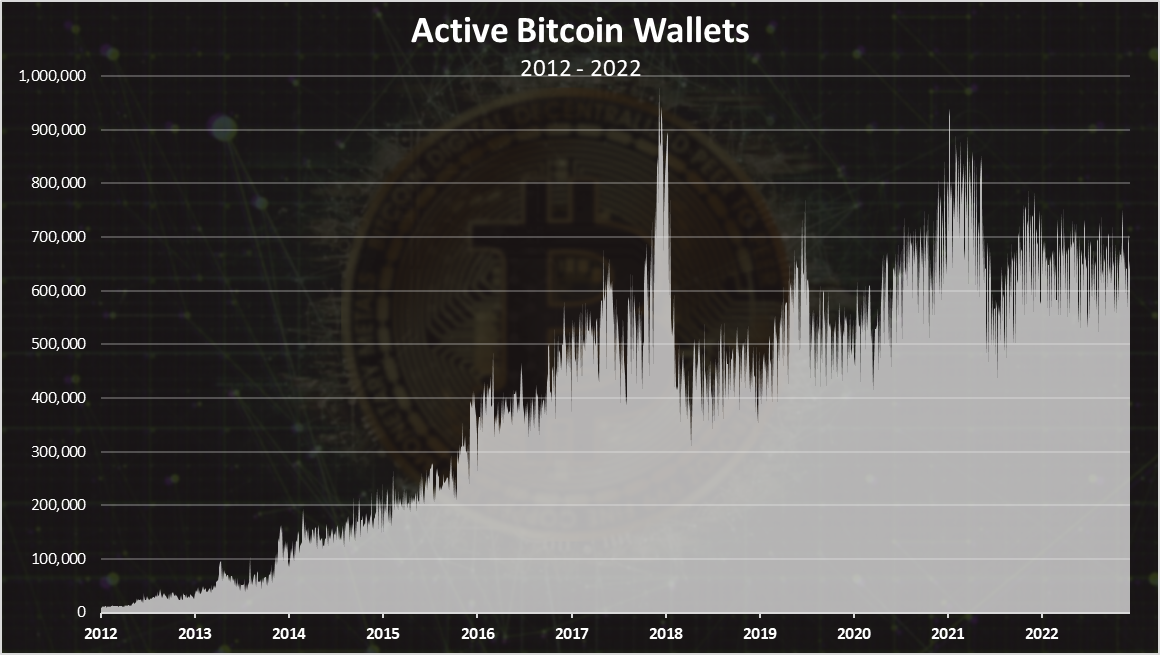

Here is the chart.

The record high numbers for active Bitcoin wallets per day was reached in December 2017 with almost 1M active Bitcoin wallets. A sharp drop in 2018 to the 400k daily active wallets, and a steady growth since then.

If we zoom in 2022 we get this.

A very steady number with around 700k active wallets. The drop in the price didn’t impacted this chart at all. What’s interesting there is some up and down pattern throughout all the year.

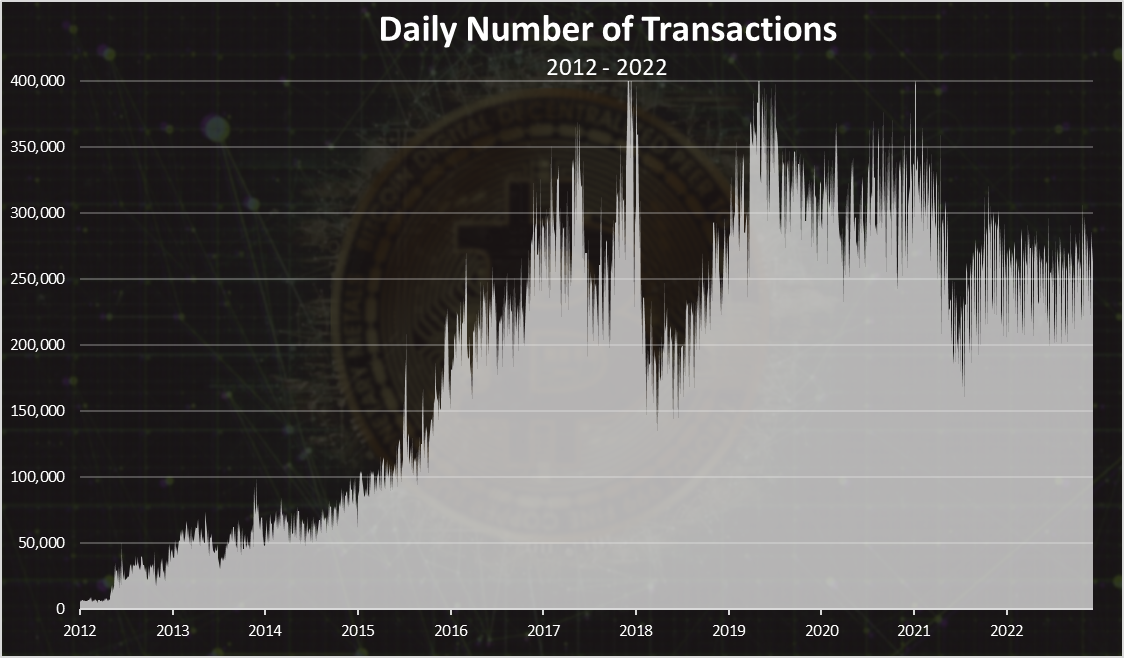

Transactions

The activity on the network is mostly represented by the number of daily transactions.

A steady number of transactions in the last year with around 250k transactions per day. The ATH for network transactions is just above 400k per day.

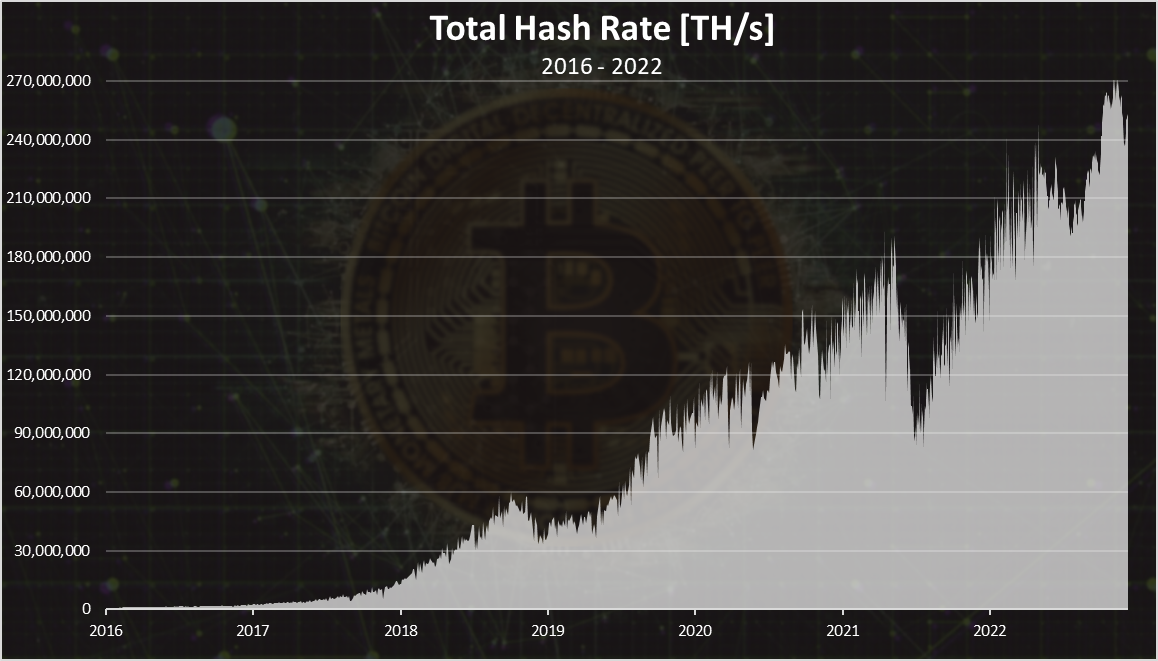

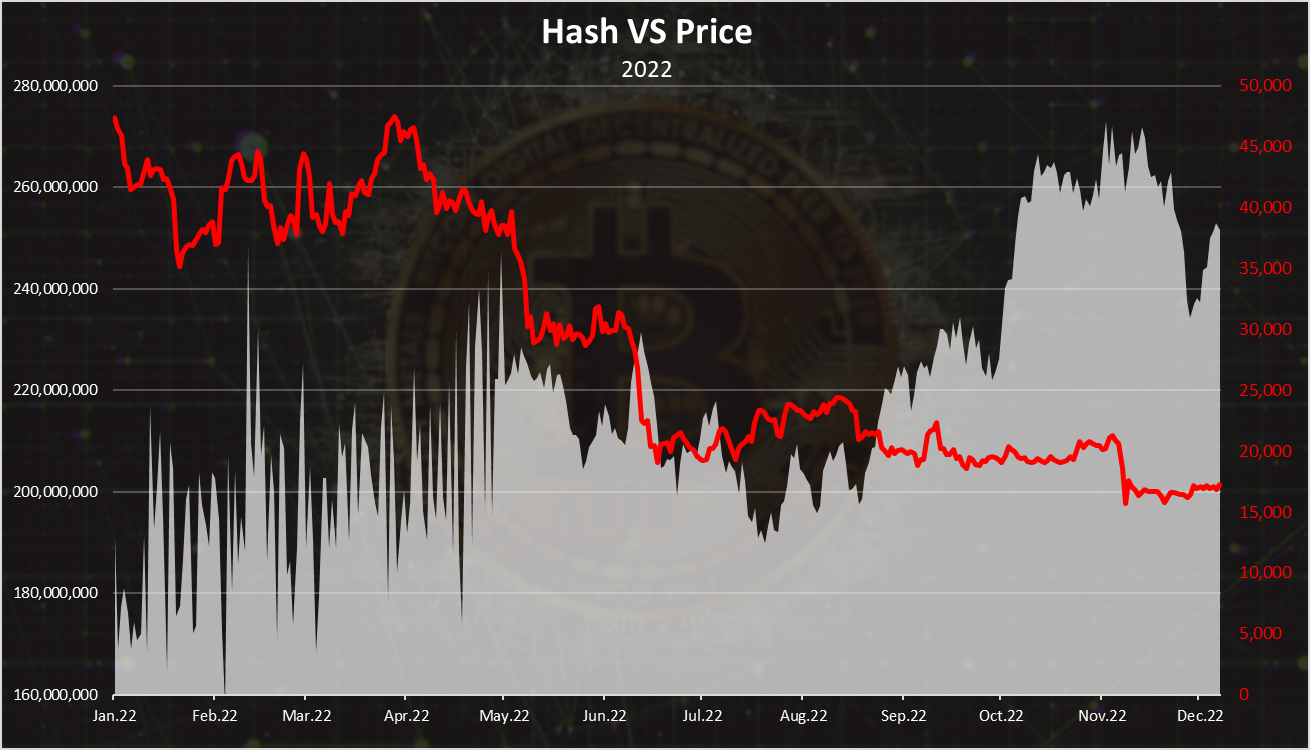

Hash Rate

The ultimate Bitcoin value is the network stability and security. The network security in a proof of work chains is measured in hash rate, or how difficult is to mine. The bigger the completion, the higher the hash rate.

Almost constantly going up with few dips here and there. The most significant dip happened in the summer of 2021 when China banned mining. We can see yet another one just happened recently.

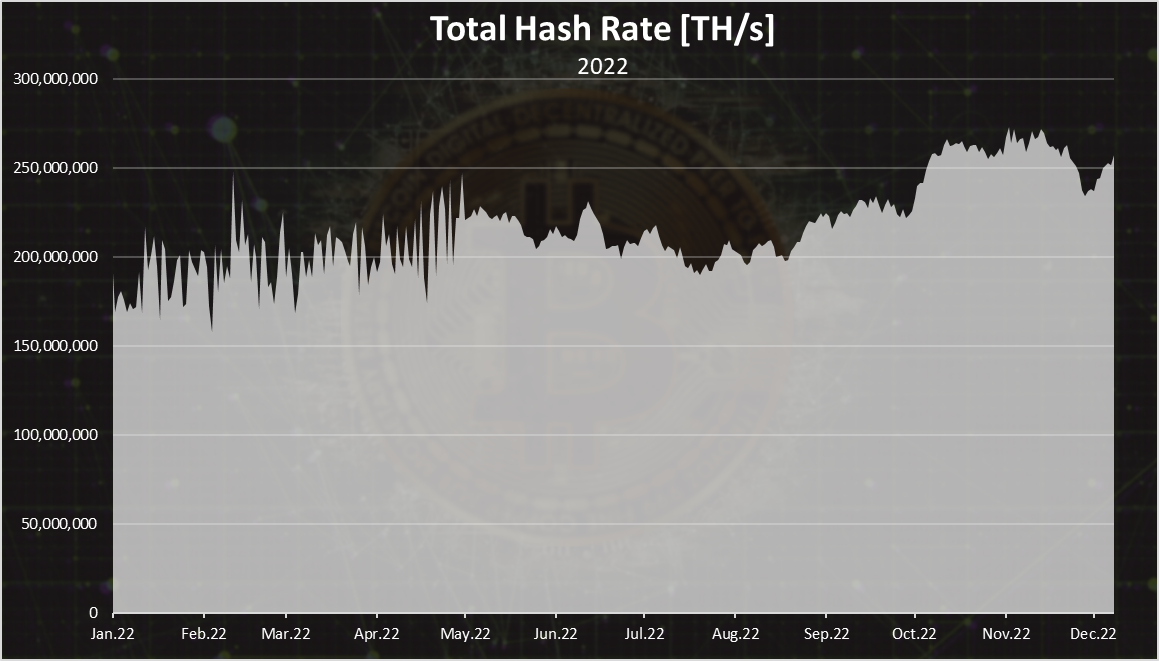

If we zoom in 2022 we get this.

A dip in November from 270M TH/s to around 230M TH/s. But we can see that there is already a recovering from this and the hash is now around 250M TH/s.

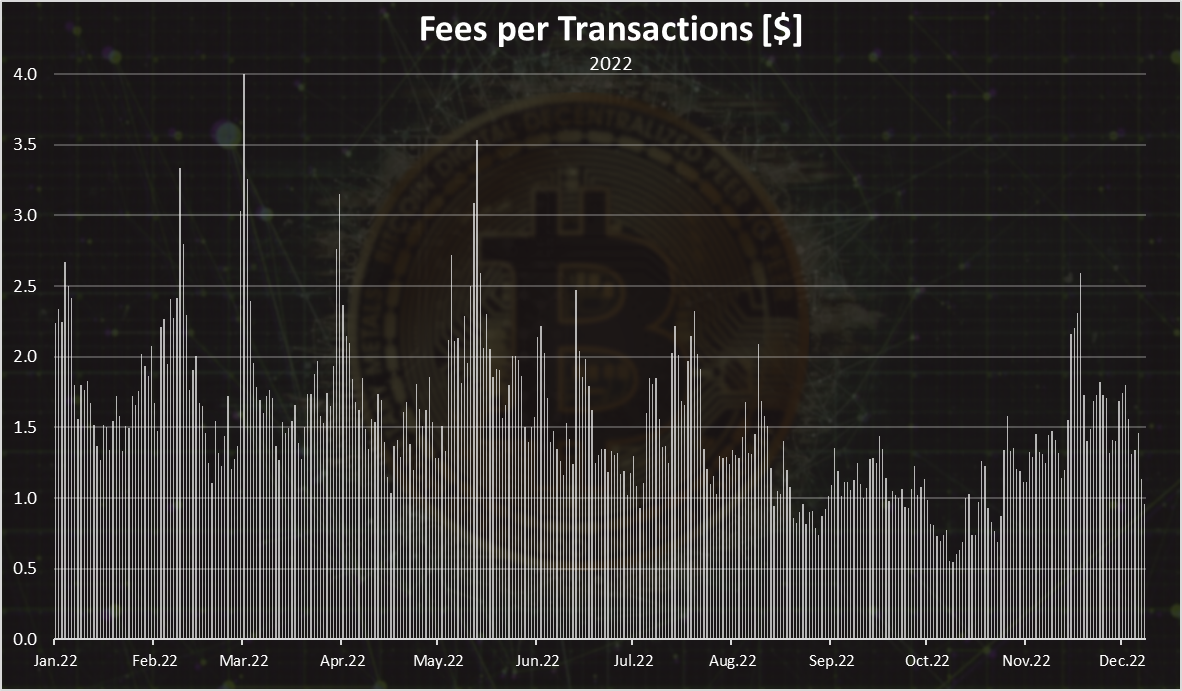

Fees

A bit unpopular topic the fees.

The bitcoin fees are quite low these days, with around a $1 per transactions. They have been going down throughout the year, but were relatively low to start with, $2 at the beginning of the year.

Back in 2021, at one point the fees reached $30 per transaction.

Hash Rate VS Price

When we plot these two together we get this.

Even with the recent dip in the Hash rate the overall picture is still up. The year started with 180M TH/s and we are now at 250M TH/s. On the other hand, the price has went from 45k to 17k. A clear opposite trend for these two metrics in 2022.

The other metrics, like wallets and transactions are quite steady and are not showing much correlation with the price, indicating that new users are either custodial or its mostly institutions.

All the best

@dalz

Posted Using LeoFinance Beta

The drop in new wallets per day suggests that a single entity was creating the vast majority of new wallets prior to August 2022, then for whatever reason decided to stop.

Perhaps a government entity?

Such a dramatic drop from one baseline to another does not appear to be at all organic.

Yea this is strange to me as well. Cant tell what realy was happening but it is an odd behaviour. I'm thinking to look for more data elsewhere.

wen price bottom ? :) waiting to load up on some cheap BTC

This seems a period with quite a low prices ser ;)

most were saying that at 20k ser, I don't think we are there yet ser :)

I have been DCA into BTC for a whole year now ...

Exactly just like there is an expectation that it could go further lower than where we are now.

These statistics are really enlightening...

We indeed have to be focused on investing long term in the Hive bussiness as the fluctuations will always be present.

So we do not get discouraged.

You are saying truth but as we know this is big monopoly when people lose trust and go towards another opportunity after selling there tokens and after that the major holding under the whales it will bounce back. Same in case or future trading when majority talking about pump it will dump and vise versa. It is the game of mind and holding power.

This year have been really challenging In the Crypto world and we hope a positive change come next year.

The rewards earned on this comment will go directly to the people( @dalz ) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

Congratulations @dalz! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 210000 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out the last post from @hivebuzz:

I think the drop in new wallet is probably as a result of the fall in. The price of Bitcoin and since no one knows when the bear market will be over, every one is being care of how they go about their finances most especially when it comes to investing in bitcoin.

Yeah you are absolutely right. This year luna and ftx crash gives many bad effect on market. Now people's scare to invest his saving in crypto but i remember 2010 mtgox crash. Bitcoin 90 persont volume from mtgox. Everyone says bitcoin never going up again. Whales entry in the market and going to 20k. Everyone can't sale his coins in down prices wait for bull market.

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

Please contribute to the community by upvoting this comment and posts made by @indiaunited.

This demostrate a pretty solid coin even with the bear market, btc isnt dying!

Really bad times for the market and its showing everywhere from the number of wallets and the numbers in our wallets.

Nice post!!!