Hello everyone! I must start saying that its exciting to be writing my first post in LeoFinance after some weeks lurking around.

I have talked about LEO with @brettpullen and @sgt-dan and both of them seemed super excited about both this platform and its token. Maybe without even knowing it, they made me curious about it and my interested has been growing the more I read and learn about LEO.

But enough of talking about myself... what I want to share here today is my short but exciting experience with DTC: Dtube coin.

DTube is a video sharing platform form of social media much like YouTube but with a crypto base: users get rewarded in crypto for their engagement. I started uploading videos in DTube back in 2017-2018 when it used to ran in Steem. I developed a taste for video content creation and I still really enjoy doing it, it´s actually one of my hobbies nowadays.

Then, this 1st of October of 2020, DTube launched its own mainnet: Avalon, together with its own coin: DTC.

DTC is a utility token that offers great return from holding it. First of all, all the rewards that you earn in DTube are liquid, and while this would scare some people to death (Ned & Dan), its not the case in DTube.

Why is this? Well... in my honest and ignorant opinion, scarcity and high demand is making most holders to hold and not dump the coins as they "mine" them. But lets go back to the basics.

How does DTC work? How can you get a return from it? Is it only useful for content creators? Those are all valid questions. Lets go through all of them one by one.

Since the launch of its new mainnet, DTube changed its model to a "curation game" as its described by the team. The value when holding DTC is in the votes that you give. When you upvote some content (video, comments) you distribute DTC from the rewards pool, and some is given to you as curation rewards. Does this sound too similar to Steem? Well... let me tell you, its a lot different.

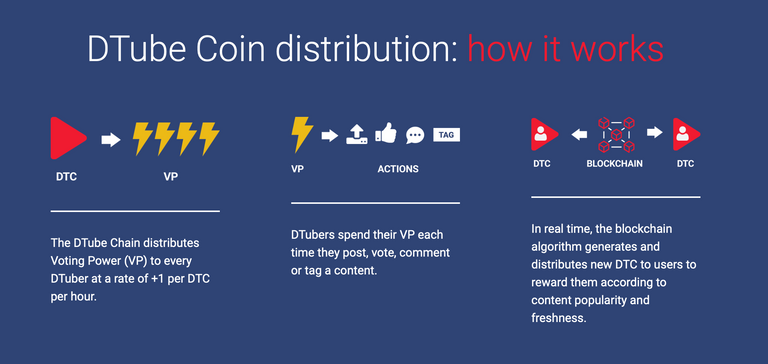

In DTube your VP (voting power) is not capped, if you don´t upvote for days your VP will not stop growing once it reaches 100% because there is no 100%. It rises and rises, and the speed it does so is in relation to the amount of DTC that you hold. holding 1 DTC will generate 1 VP per hour. Holding 2500 DTC will generate 60K VP in one day (2500 x 24).

Users with a big stake may have millions of VP, if they decide not to upvote for some days. I think this is a game changer. Steem forces their investors to be active daily in order to not lose gains, while DTC is a lot more relaxed in that matter. You have a busy week and will not be able to curate content? No problem, come back in seven days and your VP will be a lot higher and you will be able to upvote more content, or just give bigger votes, resulting in ZERO loss of value. Cool huh?

Is it only useful for content creators? Clearly not. If you hold DTC, by upvoting the content that you like, you get some rewards for yourself as well. And the curation works similar to the one in Steem, in the sense that in order to maximize your curation rewards, you need to upvote content that has not been upvoted much, and you want to do it before big votes come. If big votes come after your upvote, your return increases greatly.

Another difference compared to Steem is that there is no 30 minutes (later on 5 minutes) window for curation. You can upvote content 1 second after its creation and your rewards will not decrease due to this.

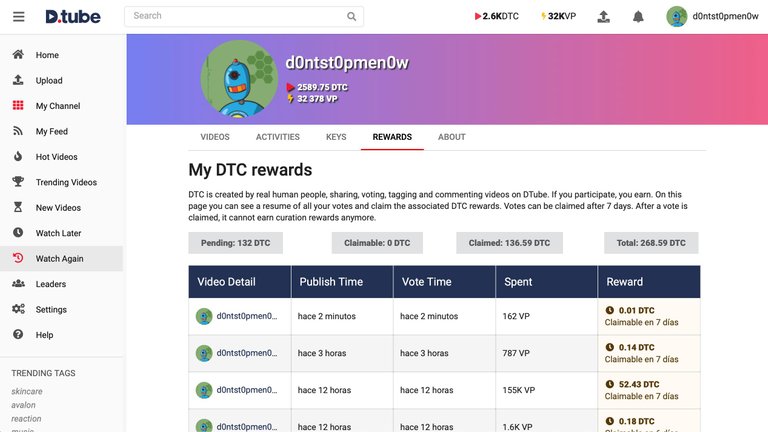

Now lets talk about numbers and ROI. As you can see on my Rewards page on my channel, I hold 2589 DTC and I have generated a total of 268 DTC with it. That is a little over 10% ROI. How long have I been using DTube? Exactly one month today. 10% ROI in one month??!!?!?! Yes. But actually that number is not accurate. Since the first two weeks I only had 720 DTC, later on I got some more because I realized how valuable it is to hold this coin.

Doing some math I think that I can achieve 12% monthly ROI. Any banker would wet their pants with these numbers... and I could not blame them!!

But that´s not all, DTC was worth $0.1 in its ICO (actually IEO, Initial exchange offering) and is now trading at $0.6 just 6 weeks after its launch.

So by playing the "curation game" holders can easily double their holdings in one year (probably more than that) while holding a coin that is doing really well regarding its price.

I hope that you enjoyed the read and please comment whatever you think. Criticism is welcome and questions also. I am no expert but I can ask some friends or even read the whitepaper again in order to come with accurate and serious answers.

Thanks for reading all the way down to here if you did 🤗

Disclaimer: This is NOT investment advice.

Credits: All photos are screenshots from here

Posted Using LeoFinance Beta

welcome!

Posted Using LeoFinance Beta

Do you know the rest of the scheduled airdrop dates?

Posted Using LeoFinance Beta

Yes, 1st of every month until March included.

Posted Using LeoFinance Beta

It's scheduled for 6 months and it's divided and sent every first day of the month, how much airdrop did you get?

Posted Using LeoFinance Beta

I don't know exactly. I'm getting like 200 per month roughly.

Posted Using LeoFinance Beta

Reddit

Posted Using LeoFinance Beta

I think that is not entirely correct. Voting early results in earning curation rewards early and then earning more voting power early and hence compounding faster.

Thank you for the shout-out ! Yes, @leofinance is doing stuff. Cool stuff. Amazing stuff! Time for them to take a bow.🙇