Legacy finance is complicated

And I often ignore it expect when I feel as though it directly applies to crypto. Convertible bonds are what Microstrategy is offering to the market and then using the proceeds to buy Bitcoin, so understanding them is quite relevant to the space at this point so I'm trying to get to know them better. Here's what Grok, the Xitter AI has to say:

Carbon Copy:

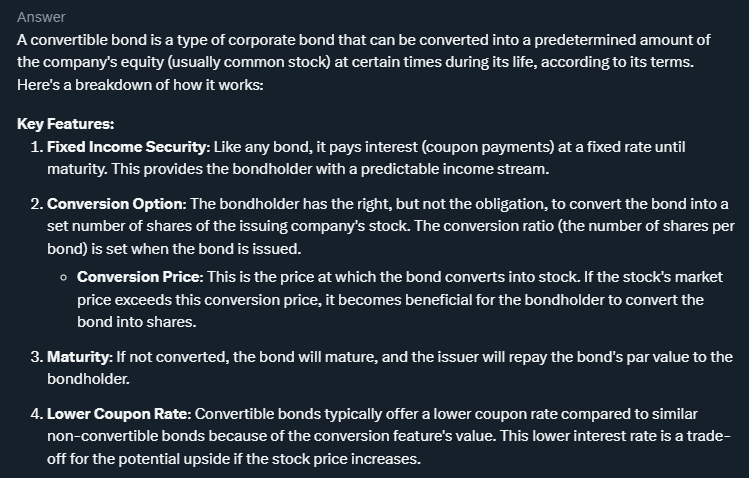

A convertible bond is a type of corporate bond that can be converted into a predetermined amount of the company's equity (usually common stock) at certain times during its life, according to its terms. Here's a breakdown of how it works:

Key Features:

Fixed Income Security: Like any bond, it pays interest (coupon payments) at a fixed rate until maturity. This provides the bondholder with a predictable income stream.

Conversion Option: The bondholder has the right, but not the obligation, to convert the bond into a set number of shares of the issuing company's stock. The conversion ratio (the number of shares per bond) is set when the bond is issued.

Conversion Price: This is the price at which the bond converts into stock. If the stock's market price exceeds this conversion price, it becomes beneficial for the bondholder to convert the bond into shares.

Maturity: If not converted, the bond will mature, and the issuer will repay the bond's par value to the bondholder.

Lower Coupon Rate: Convertible bonds typically offer a lower coupon rate compared to similar non-convertible bonds because of the conversion feature's value. This lower interest rate is a trade-off for the potential upside if the stock price increases.

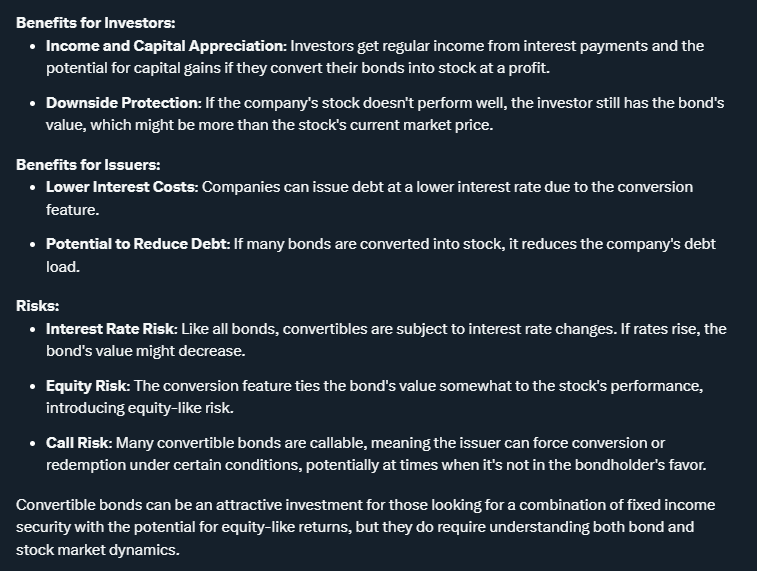

Benefits for Investors:

Income and Capital Appreciation: Investors get regular income from interest payments and the potential for capital gains if they convert their bonds into stock at a profit.

Downside Protection: If the company's stock doesn't perform well, the investor still has the bond's value, which might be more than the stock's current market price.

Benefits for Issuers:

Lower Interest Costs: Companies can issue debt at a lower interest rate due to the conversion feature.

Potential to Reduce Debt: If many bonds are converted into stock, it reduces the company's debt load.

Risks:

Interest Rate Risk: Like all bonds, convertibles are subject to interest rate changes. If rates rise, the bond's value might decrease.

Equity Risk: The conversion feature ties the bond's value somewhat to the stock's performance, introducing equity-like risk.

Call Risk: Many convertible bonds are callable, meaning the issuer can force conversion or redemption under certain conditions, potentially at times when it's not in the bondholder's favor.

Convertible bonds can be an attractive investment for those looking for a combination of fixed income security with the potential for equity-like returns, but they do require understanding both bond and stock market dynamics.

Seems like a decent explanation at face value.

So MSTR is offering these bonds that can be converted to MSTR stock, but because the funding is being used to purchase BTC and MSTR stock is going up it's created this flywheel of massive gains. As we can see in the description these types of bonds have a lot of variables like forced conversion or redemption if the corporation that issues them starts drowning in their own debt. I have no idea what the details of MSTR bonds are in this regard but perhaps the nitty gritty is a moot point.

BritishHodl: Bond Endgame

~~~ embed:0iNazR51ysU youtube ~~~

Trading volatility without risk using bonds.

MSTR is borrowing billions at 0% APR... how is that even possible? Why are all these people letting MSTR borrow their money at 0%? How are they making money? Well it seems complicated and I still don't fully understand it, but I do believe that it is happening nonetheless.

There's also the issue with MSTR getting listed on stock indexes which feeds into all of this.

Oh look at that everything the SEC has been doing the last 4 years has been illegal

Shocking.

~~~ embed:1879200946363990206 twitter metadata:bWFydHlwYXJ0eW11c2ljfHxodHRwczovL3R3aXR0ZXIuY29tL21hcnR5cGFydHltdXNpYy9zdGF0dXMvMTg3OTIwMDk0NjM2Mzk5MDIwNnw= ~~~

Can you believe this asshole?

These other thousands of projects need to show their usecase and show that they actually have fundamentals underlying them.

Get... out...

Did he really just say that the SEC requires assets to have "fundamentals"?

Show me that in the case law.

Show me how Bitcoin has legally better "fundamentals" than any other clone of it.

Thanks for the salad-talk one last time.

Now fuck off forever.

~~~ embed:1865771014472577498 twitter metadata:bG9wcHx8aHR0cHM6Ly90d2l0dGVyLmNvbS9sb3BwL3N0YXR1cy8xODY1NzcxMDE0NDcyNTc3NDk4fA== ~~~

~~~ embed:1879166132172857851 twitter metadata:SUlJQ2FwaXRhbHx8aHR0cHM6Ly90d2l0dGVyLmNvbS9JSUlDYXBpdGFsL3N0YXR1cy8xODc5MTY2MTMyMTcyODU3ODUxfA== ~~~

This is a pretty great video

In this one it's explained how dollars can basically be printed out of thin air to buy BTC in the current environment we find ourselves in. This is something that was totally scoffed at before. "Well the government would never print money to buy BTC, that's hopium." Yes, well, the Federal Reserve is a private bank, and we can see with this explanation that even retail banks and corporations have a lot of leverage in finding sources of liquidity and expanding their balance sheet.

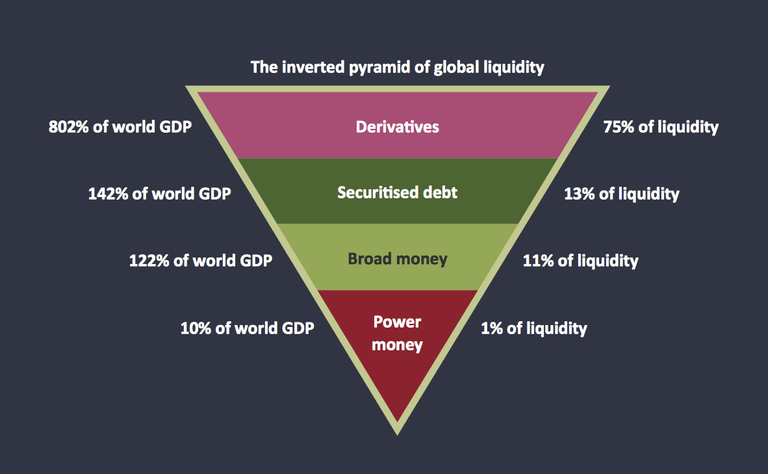

It was originally thought that Bitcoin was going to suck up liquidity from other sources, but after watching a video like this it's very obvious that a lot of these institutions are just going to expand their balance sheets and take on more debt to get what they want. This is the standard play in legacy finance. Where does that debt come from? Dozens of sources. Mostly derivatives.

Conclusion

Other corporations are going to start issuing these convertible bonds in order to buy more BTC (and maybe even other crypto). META is currently on deck for a strategic reserve. In fact companies like Marathon (mining company) are already doing it. However MSTR is the most pure play in this regard as there's no way for any other corporation to catch up to it. Blackrock may have more coins on their balance sheet but they don't legally own the coins and can't leverage them like MSTR can. They are liabilities, not assets.

This is the first cycle in which debt will be printed out of thin air to pump the price of BTC. They are using the money printer to buy out the asset, just like we were all talking about years ago but were never totally sure. But they are doing it in a sneaky way right under everyone's nose. Classic bankers.

Is $100k the top?

Not even close.

We still have a full year to go to complete the cycle.

not gonna lie that picture is exactly what I think of when I hear "convertible bond" lol

100k short time might be the thing as many people often think in the short term. This cycle I'm pushing $170,000 now I don't think we will see a crazy breakout to $250,000 - $1,000,000 like some are predicting. But you know what? I'm still going to stack and hold my bags hoping they prove me wrong!

Considering I was predicting $250k in 2021 I feel like we are almost guaranteed to hit that level in this environment. You should consider that 2023 went x2.6 and 2024 pulled an x2.4... so a prediction of $170k directly implies that the bull market year of the 4-year cycle is going to significantly underperform the two previous years.

Legacy financial system is entirely based on printing $ out of thin air. This may be the first announcement that $ will be printed to buy BTC, but it is not the beginning of that inflation.

Because BTC is being accepted by legacy financial system, it is wholly acceptable to that system in terms of the ancillary features of money that system is imposing. The original claim BTC and crypto enthusiasts made about BTC is that it was a means of avoiding those ancillary features of money, the control of the uses for which money had that we define as CBDC today.

The digital ledger will be used to enforce compliance with CO2 budgeting, with antiterror financing requirements (in a market in which dissent is defined as terrorism), probably biometric ID, vaccine passports, all the aspects of CBDCs that made people want different kinds of money than fiat to begin with.

Do understand what utility you expect to gain from having more zeroes on your CBDC.

Thanks!

The boy has been crying wolf on CBDC for an entire 4-year cycle and they still don't exist.

I can not acquire these phantom tokens nor are they connected to anything in crypto.

It does not take this long to spin up open source code and be in full control of the asset.

Random devs all across the world do it every single day.

A team of 100 programmers could crank it out in a couple weeks.

The politics of the legacy system do not allow for CBDC to exist.

In fact we are seeing actual Ripple XRP adoption instead which is insane to me.

The XRP community isn't going to allow more coins to be printed.

"There will only ever be 100B XRP."

That's not a CBDC even though this is how many are framing it.

The money being printed out of thin air in this case is corporations expanding their balance sheet and taking on more debt to buy an asset that goes up much faster than the debt costs to service. This conversation is about dozens of corporations copying the MSTR strategy because it's working better than anyone's wildest hopes, just like the Blackrock ETF worked better than anyone's wildest hopes.

To say that "well this has always been happening because all USD is printed out of thin air" is not accurate. Or rather is 100% accurate but completely missing the point of the original message. Corporations are printing the money by leveraging their stock, not banks.

The entire extent of history.

The OP is about them. Define a duck by it's attributes, walking, talking, and looking like a duck, etc. If a currency is embraced by the entities advocating - dependent on - imposing CBDCs on the population, they think it's a CBDC. Believe them. What's the alternative? BTC has forced them to capitulate? They have abandoned their centuries long plan to conquer the world, because BTC? Who is Satoshi Nakamoto, anyway?

Conquering the world is a generational enterprise. Henry Kissinger infamously pointed out that if you control the food, you control the people. If you control the oil, you control countries, and if you control the money you control the world. How long does it take to conquer the world? If the Fed just created FedCoin and ordered you to buy it, exchanging all your fiat, gold, silver, and crypto for FedCoin, would you? What would convince you to buy FedCoin?

What is.

There is only a megacorporation (you can skip through to find specific supporting citations, or just skip to *~3hours to see the ownership summary. I saw a brief condensation of this presentation that I can't find atm, however an 'ancient'(from prior to the current 4 year history of the world) document can be found here you can review (or not. You do you) at your leisure). However, I don't think spending 4 hours on education is unreasonable when it involves securing your principal.

'The boy' has also pointed out how I was edumacated by the successful taking of my property by the mechanisms you are trusting before you wore long pants. My purpose has been explained: the first rule of investing is to keep your principal, and my purpose is to enable you to keep your principal. If you spend your principal on CBDCs, you will lose your principal.

We can only become right if we can learn we are wrong, and it is our statements that reveal whether we are right or wrong because they reveal whether our understanding accommodates the factual evidence. I am providing evidence. Attack the evidence. I am irrelevant.

*edited to provide the timestamp for the relevant portion

You keep operating under this premise that the best way to control a population is totalitarianism and absolute control. That's not how it works. The best means of control is propaganda, having the prisoners build and maintain their own prison, and then make them think it was their idea and the ideal scenario.

You also keep operating under this premise of we could all lose everything we own just like you did back in the day... which also seems very thin... as that is exactly why people come to crypto in the first place. What are these mechanisms I'm trusting, I wonder. How much do you think you know when it comes to my personal operational security?

Blackrock does not depend on Bitcoin being a CBDC they depend on it making them money. Big banks still viscerally oppose it... especially the FED and IMF where there have been testimonials of them swearing and pouting like children over it in professional settings. There's also evidence to suggest Blackrock might legally rugpull their users by forking bitcoin and swapping their new fake asset with the real thing. Again not my problem I would never give Blackrock my money I'm not an idiot... or rather I could never politically condone such an organization.

The Satoshi Nakamoto moniker is not some next level predictive programming implying that the deep state controls Bitcoin... because giving away a tactical advantage for no reason is an idiotic strategy. You must realize that people like Edward Snowden work within the three letter agencies. I would not be surprised to find out that Satoshi worked in the CIA considering SHA 256 is one of the few hashing algos WITHOUT a backdoor. The assumption that he's a bad actor because adoption is happening 15 years later is nonsense. We'd of had adoption a hell of a lot sooner if powerful people were willing it.

That's my point. I'm not recommending totalitarianism. I'm pointing out it's absolutely counterproductive.

No, they don't. BlackRock is not at all dependent on BTC for money. They were contracted to spend newly minted QE funds which basically funded their conquest of the stock corporations of the world. They have a controlling interest in ~90% of the stock corporations of the world, and all that actual wealth that commerce produces, however it's monetized.

Exchanges, banks, physical networks transmitting data, etc. The ones currencies and financial mechanisms depend on to exist.

We'll see. That strange fact of translation isn't the basis for any of my arguments against trusting the legacy financial system to allow itself to be superseded by cryptocurrency that depends on it's assets to exist. However, there is no substance whatsoever for a claim that 15 years is too long for implementation of a plot to conquer the world. There are a multiplicity of lines of evidence showing a consistent progression in accumulation of wealth for centuries, and simply handwaving away the thought that there is an actual goal being pursued isn't convincing.

Beyond my personal assertions of theft by fraud of my property there are myriad examples of banks and corporations committing theft by fraud as far back in history as you care to look, continuing to the present day. I hope my recommendation that you do not leave your principal vulnerable to such proven threats is not similarly handwaved away, but that you do act to ensure your wealth is not vulnerable to criminal fraud through any single vector.

That is my purpose in commenting. I'm not trying to take your money. I'm trying to get you to keep it, and I know damn well criminal scum are going to try to take it, sooner or later. Extraordinary skill will be necessary for you to keep it because the criminals that are going to move to take it are extraordinarily skillful.

Something makes me think that this could end really badly!

Oh it's going to be an absolute fucking disaster but before that happens Bitcoin could pump x20.

I do not really understand convertible bonds at all nor the appeal of a 0% interest rate, but I guess this makes sense:

Source

So it seems less risky than Bitcoin or stock, but you still get the upside if it does well. You forgo interest rates for that reduced risk.

I was curious about the $6B in BTC the US Treasury was cleared to sell and if that might affect MSTR, but I don't think short-term volatility really affects them - the danger for them is a long bear market where they have to pay out lots of loan maturity and don't have the cash on hand.

So if BTC drops and/or the price stock price drops

I think a huge mistake that MSTR investors are making is assuming the value of MSTR is somehow tied to Bitcoin in the first place. It's clearly not because MSTR is already on record as saying they're never going to sell the BTC... and especially not to do stock buybacks. The value of MSTR stock has nothing to do with the price of BTC but the market seems to think it does, which thus far is creating a self-fulfilling prophecy.

Curious to see how long this can continue... I'm guessing MSTR gets absolutely wrecked in the bear... it's basically a shitcoin at this point and people will realize the value of the stock can easily go lower than the amount of BTC they hold... just like Greyscale before them with the 30% discount before spot ETFs were approved and their product was just a vaporous futures contract.

Sooooooo.... if MSTR is never ever going to sell BTC - what money will they use to pay off the investor loans when they mature? Does MSTR have other revenue streams? I didn't think they did.

Damn that’s wild, and it makes the cynic in me think - was the resistance before just feigned playing to make it seem like this wasn’t their end goal? Hard to say but this is what I suspected would end up happening.

I'd say the resistance at $100k is all the people who have been waiting for $100k for the last 5 years.

And also these people do not really work in tandem.

They are very much all in competition with one another.

Nobody wants to be the idiot that buys the top.

Especially big players with a lot of money.

Except of course Saylor is quoted as saying he'll buy the top forever but he's a madman outlier.

For now.

Giddy Up!

That's a nice one

I think it would be hard to predict it it can reach $100K

I hope this goes well as the BTC is strong right now

every extra penny i get now is going into paying back bad debit i wish i can issue a convertible bond like these companies