Been doing a lot of bull-posting lately.

But it's high time for a bearish one.

What is a CME gap?

If memory serves, the Chicago Mercantile Exchange listed Bitcoin futures in December 2017, and is largely attributed as the catalyst that sparked the 2018 bull market. The ability to short this bubbled asset in on leverage size was more than enough to pop the bubble way back when at the $20k range.

A gap in the futures market occurs when the price of the asset on Friday is significantly different than the price of the asset on Monday when legacy finance reopens its doors after the weekend. Why is this significant? Because these gaps tend to "fill". Meaning if price goes up over the weekend and there is a big gap at a lower level, Bitcoin almost always revisits that lower level to "fill the gap". It's relatively rare for these gaps not to fill, especially considering normal volatility of the most risk-on asset class.

Scary Blue Band!

The range from $77k-$85k is not a CME gap, as the pump occurred on Monday November 11th and into the 12th, but it is a liquidity gap nonetheless. This is exactly how I was able to determine that $58k was a highly significant level that we would return to when we were still trading at $72k and greedily eying the mythical $100k six-figures unit-bias level way back in March 2024.

The reason why it was so easy to clock this gap was that $58k was massively significant in the previous 2021 cycle. So significant in fact that a group called the $58k Gang materialized to meme this price-magnet to death. We hit $58k dozens of times in 2021, but on the run up from $50k to $74k a year ago we only traded at $58k for about 15 minutes before blasting past it. This is what made it so obvious to me that we would return to this level. A liquidity gap was forged here that almost no one was paying attention to. Even the $58k Gang was like "wow that was fast I guess it's over now". Little did they know they were about to be reborn in the months following: May, June, July, August, September, and October all flirted with $58k mercilessly as we suffered the 8 month crab market.

$77k-$85k...

All of these levels were only traded at for a few hours during the Trump Pump.

- $77k

- $79k

- $80k

- $81k

- $82k

- $83k

- $84k

- $85k

While this gap is not nearly as bad, concentrated, or obvious as $58k happened to be... it still gives me great pause. How many times has a liquidity gap like this not been filled by the spot market? To answer this question we have to look at all the instances that Bitcoin hit all time highs to see if there were any gaps that never got filled.

2021 Cycle

The baseline consolidation was around $20k before going parabolic.

And as we all know the FTX collapse brought us to a brutal $16k low.

In 2021 all the gaps were filled.

Quite handily.

2017 Cycle

The baseline was around $6k before going parabolic.

$6k was the support level for a very long time before dropping to $4k.

In 2017 all the gaps were filled.

Not as strongly as 2021 but filled nonetheless.

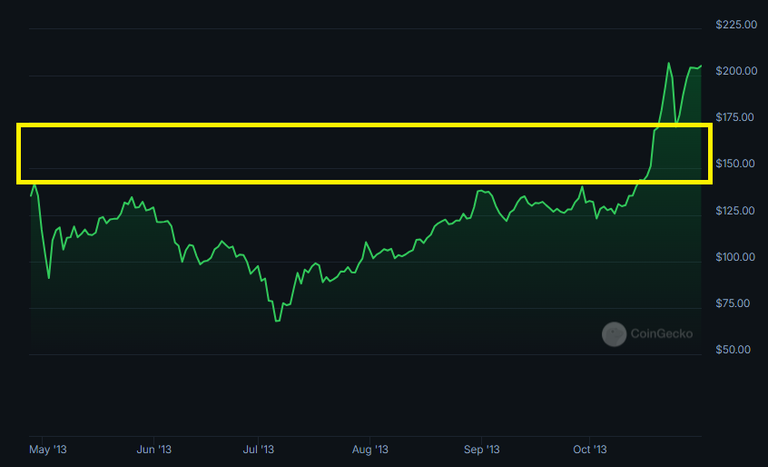

Surely 2013 didn't fill!

Certainly the strongest halving event would have created some kind of liquidity gap that was never returned to! Nope. We can see the baseline was $200 and the market returned to $200 quite easily. FILLED! Once again.

Hm, not good!

So basically if $77k-$85k does not get filled... it would essentially be the first time in history that this has happened. Or is it?

If we look back at the very beginning of where a lot of these aggregators begin we can find a gap from before BTC went parabolic. Of course if you go back one more month to April it cuts into this gap deeply with a peak of $165... leaving only the $10 from $165 to $175 as the gap... which could have actually been filled on the orderbooks of real exchanges like MT GOX because these aggregation sites like to average the numbers and create smoother lines.

At the end of the day it doesn't really matter if this event has happened or not... it is very rare either way. What I can say is that I would rather fill this gap sooner rather than later. If we don't fill it within the next couple of months we might not revisit this range until the bottom of the next bear market. This would seem to imply an absolute maximum peak of $400k during the upcoming bull... which isn't too bad but does completely invalidate my doubling curve trendline. Perhaps this is what's in store for us going forward... unless of course we fill the gap in March or April, which is also very possible... or don't fill it at all, which seems a bit less likely unless we really just are in the easiest of easy-mode bull-markets.

Immediate short term:

Bitcoin looks to be breaking down as we color outside the lines on an ascending wedge. The MA(100) isn't looking like the strong support that we wanted. I still have a long open and keep consider closing it... but also we are almost to the bottom of the descending channel and coincidentally the full moon is tomorrow and all the ultimatum lines seem to converge on February 22nd.

On top of this there is no evidence to suggest that the $100k +/- $8k crab trendline is broken... and we've been floundering in the red during this entire 2-week new-moon cycle. This leads me to believe we have one or zero dumps left before we make at least a temporary recovery over the next week or so.

It would be very rare for such an aggressive descending channel to break even more bearish before getting some kind of recovery, especially with the slingshot supports we've been getting around $92k. The channel doesn't hit the top of the gap until mid March, so it seems like we still have several weeks of data to look for more confirmations that the trend has shifted and $92k will fail.

The bearish case for Feb 22nd would seem to imply that we will tap $100k one last time before getting punted downward with a complete trend reversal. When I think about this this seems more and more likely considering how much good news we got over the last few months and literally nothing happened. There's decent chance we are floating on air here.

Market Psychology:

A dip down to something like $80k is also exactly what the market needs to mess with everyone's head and add fuel to the fire of all the confirmation bias we've been seeing on social media:

This is the top the bull run is over.

A lot of people are going to panic dump everything if a move like this happens, which is just so classic crypto. And if Bitcoin loses 15% it's safe to assume that the rest of the market is going to drop something like 30% as well. There's a very real chance that I'll be picking up a lot of Hive around the 22 cent range (or at least 25 cents).

Do we even have time to make a move like this?

It's certainly possible if most of the gains and parabolic action of this run come in right at the end of the year like they did in 2013 and 2017. That gives us more than enough time for everyone to freak out. I'm certainly not enjoying the prospect of another 8 months of crab from here. Personally I don't think it will be as boring at that considering all the fundamentals building up during this run but you never know. What I do know is that I plan on selling a little during the summer (May/June) to buy back in come September as this is a strategy that has yet to fail me so far. Sell-in-May-and-Go-Away has been quite a strong mantra. Mid/Late September has always been a killer time to buy and simply wait for Q4 fireworks.

Moving averages

The MA(200) is around $80k right now which gives even more support to the idea that maybe we'll be trading below it soon. More often than not when the market trades above this average for around 6 months it's time to trade below it... and we've been trading above it for 4 months. In addition this this April has proven itself to be a cooldown month on multiple occasions so a lot of these timelines are adding up.

As mentioned earlier, the MA(100) also appears to be breaking down which would usher in the Big Death Cross between the 25/100. This is a cross that day-traders are constantly speculating on, and it can happen quite fast (days) given the current trajectory.

Conclusion

Brace yourself for fuckery!

The max pain event is confirmed when everyone is convinced "it's so over".

While a trend reversal may be confirming in real time...

We can still maneuver around it in the weeks to come.

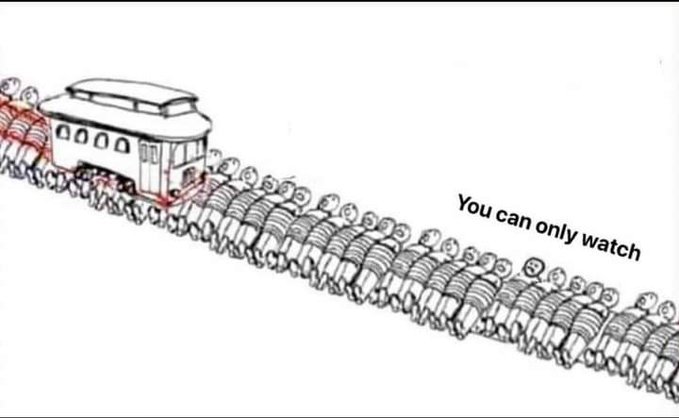

If a train wreck is coming it's happening in slow motion.

Anything can happen in crypto

@edicted, this is some seriously detailed analysis! I've been following the gap theory too and gotta say your breakdown of the historical patterns really nailed it.

The comparison with that $58k gap is super interesting - I remember watching that blast through last year and hardly anyone paid attention to how quick we moved past it. Look how that turned out lol. You really called that one!

What's got my attention most is your point about this possibly being the first unfilled gap in BTC's history if we don't revisit that $77k-$85k zone. The MT GOX early days example is a neat find, but yeah, like you said, those aggregator sites from back then were pretty sketchy with their data.

That Feb 22nd scenario you mapped out sounds pretty spot on , especially with all that good news lately and price barely moving. Classic crypto move would be to fake everyone out right when they're getting comfortable. Wouldn't be surprised to see that quick $100k retouch before things get spicy 😅

Quick question though, if we do fill that gap in March/April like you mentioned, do you think we'd still see that usual "sell in May" pattern play out? Feels like this cycle's timing is getting pretty quirky.

Solid post man, definitely following this one closely!

Your comment is upvoted by @topcomment

More info - Support @topcomment - Discord

It has already become clear that the current cycle is different from those that we have seen before. And this is understandable: the market has become much more complex. Major players and capitals are currently actively involved in it. Therefore, it is becoming increasingly difficult to predict something.

So, is the bull market over?

Yes a standard 30% retracement means the bull market is over.

Hope this helps 🤑

The bull market is not over until RSI goes to 90... Common man, Rektcapital already mapped everything for us :)

I don't think you read this post. 🤓

I actually did.

What were you thinking when you definitely read this paragraph?

I really can't remember...

I've always said I will ride a token down to zero. Egor I sell at the bottom. I think this is one of those cases where that is actually a good thing. Especially with BTC.

Yeah if you aren't willing to take an 80% hit crypto isn't for you, yet.

For sure!

lol a 30% retracement is totally normal

JK the alt market is screwed, huh?

Just stay humble till BTC hits 200K soon!

A dip to 80K is totally normal.. 👨🏽💼

That trump coin though really damaged alot of things in crypto, it made some people rich and wreck some folks

A lot of things can still happen in the next few days

It can still be a rollercoaster ride in the coming weeks

Fill that Gap Baby! yes, we just wait and see.. 😉😎🤙

Bitcoin is almost certainly going somewhere around the 75,000 mark, but it is still unclear when this will happen.