Alright so it basically took me like an hour to hash this out so I figured I might as well share with the class.

https://blog.bancor.network/beginners-guide-to-getting-rekt-by-impermanent-loss-7c9510cb2f22

Essentially if you provide liquidity to a Uniswap pool (AMM Automated-Market-Maker algorithm) you'll suffer something called "impermanent loss" if the value of the underlying assets change. If the underlying asset's value returns to "normal" you'll recapture those "temporary" "losses".

For simplicity I'll use the DAI/ETH pool as an example so we can assume a constant $1 value for DAI and eliminate that side of the equation.

The reason it took me so long to understand this concept of impermanent losses is because I actually already figured it out on my own without doing the research on it. However, the conclusions I made in those posts a few weeks back ran contradictory to what I was reading today. What are the chances that I'm right and everyone else is wrong? Not good.

Definition

The precise definition of impermanent loss is very important. It's actually quite simple. Impermanent loss in the difference between your holdings as an LP provider VS simply holding those same assets in a wallet (not for sale & no fees collected).

Examples: Uniswap as hedge.

I used the extreme example of ETH either going x4 or losing 75% of its value. This makes the numbers easy. When ETH goes x4 the Uniswap pool halves the current amount of ETH, and doubles the supply of DAI because users are dumping DAI into the pool to swap for ETH. Conversely, when ETH loses 75% value users are dumping their ETH and buying DAI, increasing ETH by double and decreasing DAI by half.

In this scenario, if ETH crashes 75% an LP provider only loses 50% of their value, while if ETH goes x4 they only gain x2. Therefore, I concluded being an LP provider to this pool helps lower volatility and save money in the long run (contrary to this whole concept of impermanent losses).

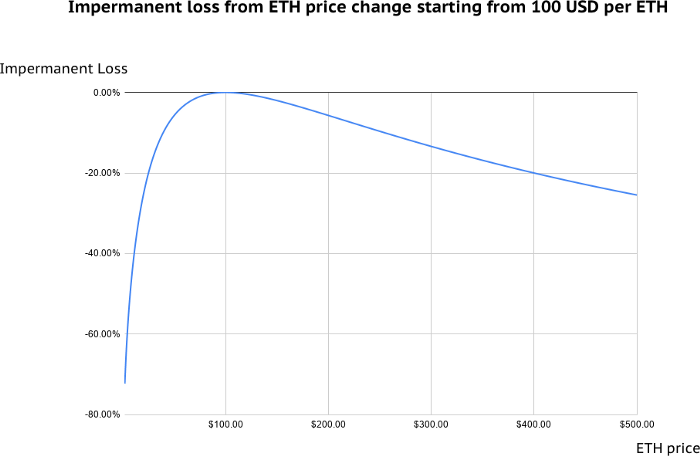

This graph assumes $100 ETH starting value.

When presented with this new information I was extremely confused. This clearly shows that if ETH goes x4 or drops 75%, LP providers will suffer 20% impermanent loss no matter what. These numbers made very little sense to me in the context that I had previously come to understand the issue.

This confusion was caused by the definition of impermanent loss, which compares the assets being held within LP tokens against those contained inside a liquid wallet. Meanwhile, I was comparing someone who was holding 100% of their assets in ETH vs the LP provider (half of who's value lies in a stable coin).

For example, say ETH crashes 75% and I had $2000 in the DAI/ETH pool. After the crash my LP tokens would now be worth $1000, while someone with $2000 worth of ETH would be sucking down a $1500 loss down to a total value of $500. However, impermanent loss looks at someone who was holding $1000 worth of ETH and 1000 DAI, who's value after the drop would be $1250. Therefore, these guys are making the claim that you lost $250 because your money was in the Uniswap pool.

In addition to this confusion, the number that I came up with was 25% loss and not 20% loss. Turns out, this is just a matter of perspective. The difference between $1000 and $1250 is both 25% and 20% depending on what side you're coming at it from. If you have $1000 and you could of had $1250 you missed out on a 25% gain, but if you have $1250 you avoided a 20% loss. Semantics.

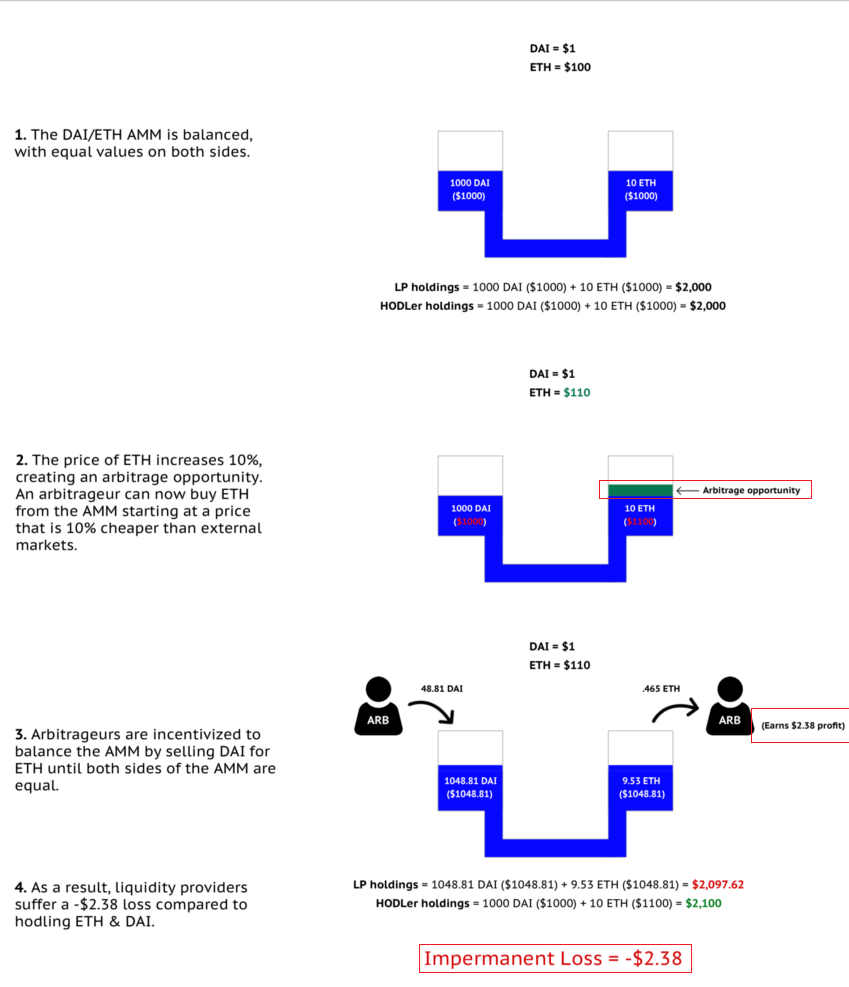

This is the example that the Bancor Network Blog gives, and it is equally confusing. They are making it look like arbitrage traders are siphoning the Uniswap pool and padding their own pockets with gains acquired from the Liquidity Providers. This is 100% false and ridiculous. In this example, arbitrage traders are not "stealing" $2.38 from LPs and putting it into their own pockets.

The logical proof of this conclusion is pretty simple. If arbitrage traders were able to siphon $2.38 cents in this example as the value of ETH rises 10%, then they could also siphon ANOTHER $2.38 cents on the way back down. However, the definition of impermanent loss is just that: impermanent. When the price returns to the initial value, Liquidity Providers on Uniswap by literal definition of "impermanent" have lost zero dollars.

Therefore, how could arbitrage traders possibly be siphoning money from the LPs? Short answer: they aren't. They are in reality siphoning that value from the centralized exchange they are arbitraging and/or other Uniswap traders, not the LPs. Money from the arbitrage traders doesn't just magically appear back into the LPs pockets after the price returns to the original value. This infographic is extremely misleading, and I assume the reason for that is to promote this new Bancor Network system that attempts to mitigate the impermanent loss problem.

Bancor Protocol v2.1 suggests a new way to distribute the risk of impermanent loss insurance in order to offer single-asset exposure and higher ROI from collected fees:

https://blog.bancor.network/proposing-bancor-v2-1-single-sided-amm-with-elastic-bnt-supply-bcac9fe655b

Yeah, that's great Bancor, but in pushing your own "solution" to this "problem" you've completely muddied the waters of the issue in question. In fact, it seems that most of the articles I read on this topic have a very hard time of explaining it correctly.

"Impermanent Loss"

Even calling it that is a complete misnomer. If Bitcoin goes x2 do you run around telling all the Bitcoin holders they lost money because they didn't x10 margin trade it? No, because that would make you look like a complete jackass. In the same way that margin trading is extremely risky compared to normal trading that doesn't involve making bets with money you borrowed, being an LP on Uniswap is much less risky compared to normal trading.

LPs on Uniswap are the backbone of Uniswap. When you provide liquidity to Uniswap, you become the exchange as you bet against the market. The market wants to buy? No problem, you're selling. The market wants to sell? No problem, you're buying. And it's all done automatically via the algorithm.

So of course if you are buying the dip and selling the spike on a sliding scale all the way up and down, you're going to "take losses" compared to someone who's assets are just sitting in a wallet. That's the entire point: LPs are the mechanism of exchange. When traders win, you lose. Simple as that.

The house always wins.

Guess what? On average over time we all know that traders lose their money. Guess where that money goes? Into the pockets of the people collecting exchange fees. On Uniswap as an LP, that's you! Good deal! Trying to make it look like it's not a good thing with this whole impermanent loss thing is pretty silly.

In addition, show me that guy who holds $1000 worth of ETH and DAI in the same wallet? Where is he? I don't see him. It's a silly example because the vast majority of people out there do not maintain a balanced position. Most traders are gamblers and min/max their bets in an attempt to scoop as much gains as possible. More often than not, this strategy backfires, as most of us well know.

Trying to compare an LP provider with a trader who's holding the same assets as an LP provider is a fool's errand. You can't isolate one moment in time and then tell people they made a mistake in retrospect. That's exactly the kind of thing a BAD GAMBLER does. Spoiler alert: when you see a slot machine that hasn't hit the jackpot in a while, the chances of it hitting the jackpot do not go up. Previous outcomes of chance to not affect future outcomes of chance; that is a fact.

Here's a more realistic scenario:

Bob and Sally both have $1000 worth of ETH and DAI. Bob decides to FOMO all-in and trades his 1000 DAI for ETH. Sally enters the Uniswap pool. ETH crashes 50%, and now Bob feels trapped and hunkers down and holds, hoping his luck will change. Meanwhile, Sally still controls a bunch of DAI due to her Uniswap holdings. She exits the pool and FOMOs all in to ETH after the big dip. Now she's way farther ahead in the trading game than BOB is.

In the opposite scenario, where ETH goes x2 rather than losing 50%, the risk taken was EXACTLY the same. Bob took more risk than Sally and his stake will reflect that depending on chance.

One of the biggest problems with this concept of impermanent loss is the need for humans to isolate and simplify the variables for easier understanding.

- Are we taking into consideration that the vast majority of traders do not maintain a balanced position required by Uniswap LPs? No.

- Are we taking into consideration that LPs are yield farming exchange fees? No.

- Are we taking into consideration the psychologically adverse affects of trading vs the set-it-and-forget-it nature of Uniswap pools? No.

- Are we taking into consideration that traders do just that: trade? And each trade incurs a fee that goes directly into the LPs pocket? No.

Instead, we are simply looking back into the past, hindsight 20/20, and saying to ourselves, "Oh shit I could have made more money if... XYZ."

Coulda, woulda, shouda.

These are the thought processes of a bad gambler. Yeah, you know what would have made you even more money? Is if you correctly longed/shorted the market using x10 leverage. That doesn't mean this is the correct play, only that it is more risky. Nobody can see the future.

Conclusion

This concept of "impermanent loss" is extremely misleading right down to the title of the phenomenon. Lowering volatility is not a loss. Buying the dip slash selling the spike algorithmically is not a foolish play, it is an extremely pragmatic one that puts us in the drivers seat as partial owner of the exchange. It is decentralization at its finest.

Anyone who says otherwise either does not fully understand the issue or suffers from the commonly extreme FOMO in this space that leads to gambling addiction. I know the feeling; We all do.

Of course, that being said, it is good to know that this issue exists, as many clearly do not. What do people think, that they can charge exchange fees and farm the Uniswap pool without actually trading the assets they put into the pool? I suppose that must be the case. Just remember: as a Uniswap LP you're betting against the market; you are the house. Traders win, you lose. Good thing for us that traders always lose on average over time as a whole. That is a mathematical fact.

Posted Using LeoFinance Beta

I’ve been trying to wrap my head around this concept for weeks. You somehow made it a little bit more clear

Posted Using LeoFinance Beta

I know what you mean... the concept is so simple yet... such nonsense.

Dude. Literally me. My concept of impermanent loss was basically akin to your simple definition of it. That is until I started to get all heady and researching into it.

Fantastic. I've read this blog about 3 times through now. It is making a lot more sense to me now.

Very good analysis. But you forgot to mention one small detail.

When the hack happens all the math is worthless.

Pufff, and it's all gone.

Posted Using LeoFinance Beta

Seriously though there are two different attack vectors:

Technically if collateralizing DAI fails the system could get wrecked without even being hacked.

Just need a lovely black-swan event to rear its ugly head.

DETAILS!

That's why I keep you around...

I wouldn't want to steal your thunder!

LOL that's hurt but so true

Posted Using LeoFinance Beta

Isn't it a change in perception? Hodling and watching coin values rise and fall can be a nightmare. Better as a Hodler to just not even look.

I jumped in a 60/40 BAL/wETH pool. BAL keeps trying to find its bottom, but at least I decided to provide LP instead of just Hodling BAL.

I still get the APY from the LP, just like you said. Who cares about the impermanent-loss? Better to worry about keeping your LP long enough to cover fees. And do the research to find a trusty pool. 👍👍

Posted Using LeoFinance Beta

I love that photoshop of bart. lol

Posted Using LeoFinance Beta

Ah yes I forgot about it until I randomly searched for "crash" in my picture archive.

really good research! I still haven't quite fully wrapped it around my head, but I'm getting there. I think this shows too well how cryptos and defi etc. are a big learning game. Maybe one day we'll be "wise" enough to understand it adequately so that we are aware of the risks vs. rewards more fully

Thanks for this! I had read that whole section on the Uniswap blog a while ago, and assumed it essentially boiled down to 'throw tokens in the LP you don't really care about' and forget about them for a bit. I've written down the exact value of what I've thrown in... and will check again later and not take it out until that number value is higher. Your explanation makes a lot more sense and is a lot more reassuring.

There is a concept in economics that describes what I think these guys are trying to convey...opportunity cost:

The thing about this concept is that it is unavoidable. In hindsight there is always a better decision that could have been taken that provides better ROI. But I don't think that they are considering that being a LP on uniswap (using a stable coin like DAI for example) has a lower risk than trying to maximize your ROI by trading directly.

Posted Using LeoFinance Beta

Good summary. As stated in the OP, how many traders actually keep half of their assets in a stable coin? I have literally never heard of anyone doing this or suggesting it should be done, even though it's not a bad idea to keep a balanced position. The theory doesn't mesh up with reality.

Only time it really mattered to me was when I wanted to be sure I had some LEO when it ultimately runs to $10. Need to keep some out of the pool just in case. :)

That. Also people will start powering down their stake to become LPs so those who vest more will earn more from curation...food for thought...

Damn, those Leos...ain't enough...want more

Posted Using LeoFinance Beta

Perfectly explained bud. Had to test it myself for 2 weeks.

I was an LP in the KOIN/ETH pool and despite the low volume lately, big miners have stopped mining and dumping, I did pretty well. And trust me that one was a risky pool. The one in your example, with a stable coin is a much safer option.

Posted Using LeoFinance Beta

And pretty good fees you earned?

Well I can't complain...$20 dollars for doing nothing is a big thing if you ask me.

Ended up with a tiny bit less ETH but koinos might have a great future, so no complains there

Posted Using LeoFinance Beta

This is quite good! I am completely new to this liquidity pool stuff and stumbling my way around it. I am going to save this post later for a second read.

Posted Using LeoFinance Beta

very good and detail explaining but I think there should some control method reduce losses

Posted Using LeoFinance Beta

damn .. brilliant article buddy

Posted Using LeoFinance Beta

This was an awesome article man! Love the detail and gave me an even clearer understanding.

Posted Using LeoFinance Beta

This is most interesting because I'm really looking forward to getting into the DeFi game by becoming a liquidity provider for the wLEO/ETH pool! What better way is there to make money by writing about crypto!

Posted Using LeoFinance Beta

None?

Posted Using LeoFinance Beta

A good read.

Posted Using LeoFinance Beta

Very nice post ed

Posted Using LeoFinance Beta

The fact they have such a problem explaining their product is not exactly a confidence builder.

Technically I haven't seen an official Uniswap explanation. It's basically competitors, traders, and enthusiasts doing the explaining.

... while pulling in billions.

IDK

Muy atinadas tus reflexiones y aclaraciones.

hi @edicted

I think you unmuddied the waters, thanks.

but on to another but related matter for you to ponder.

Uniswap or AMM exchanges have those ponits of failure as you point out and the big issue of swapping your BTC or LEo to contrinbute to the Liquidity Pool, causing the not your keys, not your crypto concern for getting my BTC or LEO back. If it's a trusted provider like Leofinance or Bitgo, we sleep better at night, but what if they get hacked...

So enter Blocknet and atomic swaps, you swap from your wallet at a decentralized exchanged with no need for wrapping/tokenization and you elminate those two points of failure. You pay transaction fees, but not to Liquidity Providers, but to Blocknet blcokchain Nodes run by people who Hodl Block and earn more Block.

So to me the sustaining factor for this atomic swap ecosystem in terms of profit becomes safety for traders and Block earnings for Block nodes operators. But does this profit in Block match the Uniswap profit in ETH? I don't kniow...

Your earning ETH on Uniswap as a LP and bonus tokens, but on Blocknet you performing very safe swaps, but there are no liquidity providers, only blockchain Node providers earning Block, which is worth a lot less then ETH.

If large numbers of traders use atomic swaps,they benefit in safety terms,and the Node providers benefit in terms of more Block as rewards. but would this kill DeFi platforms like Uniswap? Why or Why not?

I thought briefly shallow markets on stomic swaps would mean higher prices, but I guess that's incorrect if price is determined by oracle feeds.

So will this kill DeFi or not?

I think...Probably not.... What do you think?

Am I asking the right questions here?