There are many situations in crypto that have or will end up turning out the opposite of how we expected them to. For example, many people think that physical cash is going to be eliminated soon™. Everything is being pushed towards a digital reality so it makes sense.

I think this is 100% inaccurate.

Cash isn't going anywhere (no matter how much some people may want to get rid of it *cough* Big Tech *cough*). This is a supply and demand issue. The demand to use cash has gone way down over the last decade and many assume it will simply continue to dwindle. Yeah, well... it's not going to: the demand is going to go back up.

Why will demand for physical cash increase?

Because it's literally the only good thing left about fiat currency. Crypto has a lot of potential to outperform fiat across every single metric except when trying to exist in the physical world. That's a place that cash will shine for quite some time, so it's very clear to me that the demand will increase.

It only takes a single catastrophic banking event to make this a reality. We are already half way their with the velocity of money hurdling off a cliff and bank "bail ins" on the table. What do you think is going to happen when banks legally steal their client's money (haircut) and force them to be investors in a failed business? Yeah, people are going to exit. They will exit to cash and crypto and whatever else.

Whatever else.

Speaking of gold, this is another asset that crypto folks seem to think will be eliminated by crypto superiority. Call Bitcoin "Gold 2.0" and all of a sudden Bitcoin and gold are in competition. They aren't.

If anything, Bitcoin gives gold even more value. People who like crypto also tend to like the idea of gold as well, and again, gold is a physical asset. There is no competition they exist in completely separate universes.

Am I saying gold is a good investment? No, crypto is the best investment of any investment hands down period the end. Nothing can compete with crypto when looking at long-term gains. Even though gold is a bad investment: so is housing. So it food. So are solar panels, water, and all other forms of prepping.

DECENTRALZATION IS AN INSURANCE POLICY

Should I not get car insurance because it's a bad "investment"? Yeah, no shit, because it's not an investment at all. Growing your own food, building your own products, and being self-sustainable isn't an efficient or profitable thing to do. It's a thing you do in case shit hits the fan and you need a Plan B. We no longer need efficient systems with high output. We need redundant systems with multiple failsafes.

Crypto is the insurance policy used to fund all the other insurance policies. So while everyone is running around talking about Lambos, try to remember that this clusterfuck of an economy could implode at any moment. The money isn't so you can increase your social status and blow it on stupid shit. Grow up.

But that's off topic!

What I really wanted to talk about in this post was the fact that Bitcoin has everyone believing that deflationary economics are a good idea. They are not. Deflationary economics are unstable, reward the users that got in first way too heavily (at the cost of new users), and are just all around known to be inferior to inflationary economics.

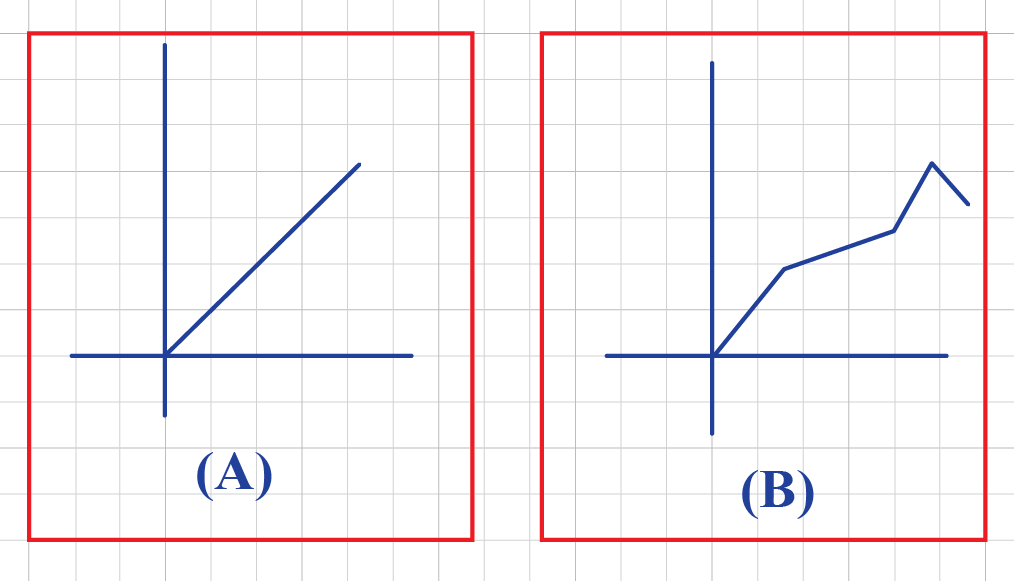

We've seen this firsthand multiple times with defi, and for me, the CUB launch. What happened when CUB launched with x3 inflation? It mooned. What happened when we lowered inflation to x2? We dipped. What happened when we lowered inflation to x1? We dipped HARD.

This is the ultimate form of economic irony.

When you want the price of your crypto to go up: INCREASE INFLATION. When you want to bring the price back down to where it needs to be: lower inflation.

As I work on my own token I feel like I have the secret recipe for a screamingly successful network. This secret sauce is so crazy that even when I try to tell people about it they are immediately like: "No, that will never work you're an idiot."

Increase inflation to increase token price? You're a moron!

LOL, am I though?

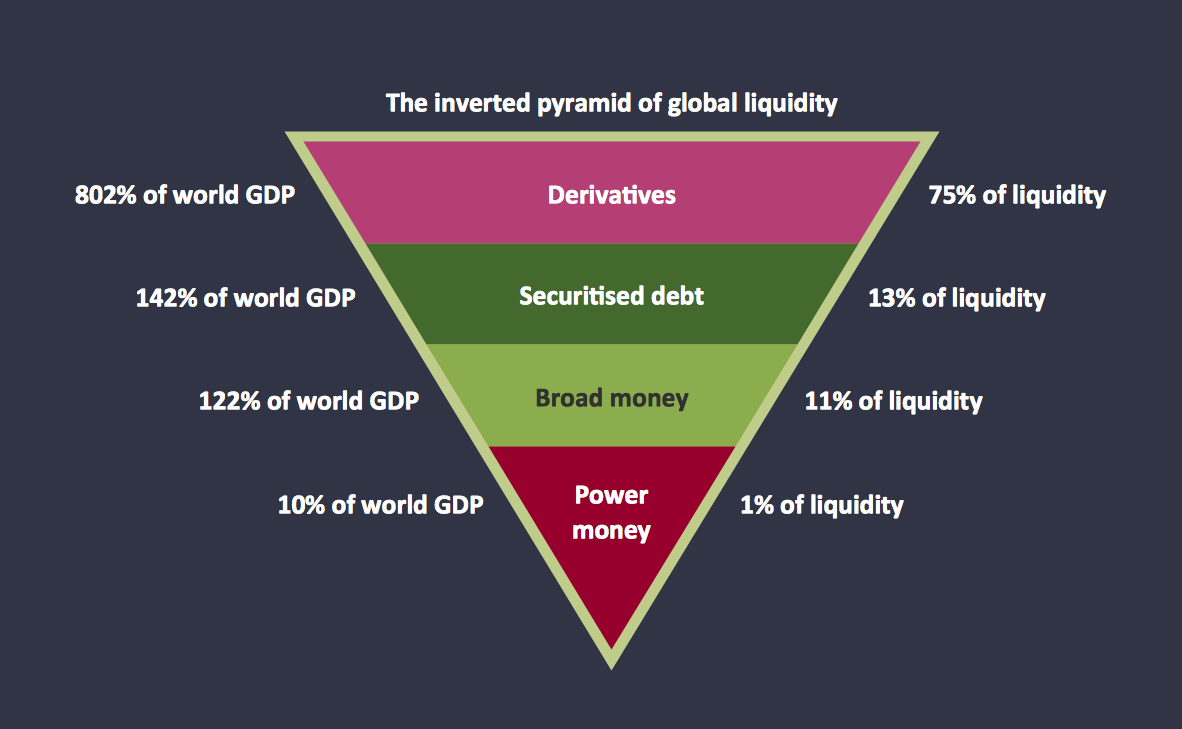

Every economists knows that inflation creates growth. But never before have we been able to control inflation in such an insane and decentralized way. When the FED promotes inflation, they give more money to retail banks, and those retail banks then give out more loans. This is a pyramid of debt-slavery, as all the money is owed back to the level above it with interest. That interest doesn't exist until they print more debt that is also owed even more interest.

How else could the national debt get so high ($20T+) but the system still works? It's because it's supposed to be unsustainable by design. Do you think the Federal Reserve gives a shit that the national debt is high? Of fucking course not: they are laughing all the way to the bank. How do we think this shit works anyway?

https://www.thebalance.com/who-owns-the-u-s-national-debt-3306124

Public Debt

The public holds over $21 trillion, or almost 78%, of the national debt.1 Foreign governments hold about a third of the public debt, while the rest is owned by U.S. banks and investors, the Federal Reserve, state and local governments, mutual funds, pensions funds, insurance companies, and savings bonds.

The Bottom Line

Many people believe that much of U.S. debt is owed to foreign countries like China and Japan. The truth is, most of it is owed to Social Security and pension funds. This means U.S. citizens, through their retirement money, own most of the national debt.

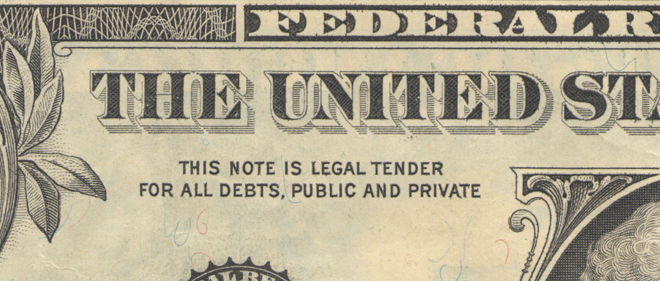

THIS NOTE IS LEGAL TENDER FOR ALL DEBTS, PUBLIC AND PRIVATE

Yeah, jackasses.

YOU OWN THE DEBT! YOU DO... lol. When you to work and get that paycheck, what are you getting paid with? Debt. The money in your pocket, the money in your bank account, every single dollar you've earned and spent, is debt.

When you get paid you are trading your labor for debt. The system promises to pay you back. Pinky swear! We promise! Don't worry about it. The entire way this system works is a complete mindfuck. You don't own your money: the money owns you. Quite literally.

So you would think that if USD and other fiat is debt value is owed to you... well then you should get paid interest on that debt, yeah? Well that used to be a thing, but now even negative interest rates are rolling in and making you pay interest on the debt that's owed to you. Sure, why not.

Grossly off topic again.

The point is crypto is totally different and not comparable to the old system in any way. Trying to say that crypto inflation is bad because fiat inflation is bad is totally ridiculous and foolish. Yet that's what everyone is doing, and it is basically Bitcoin's fault.

Ah, Bitcoin Bitcoin Bitcoin

So you might be thinking: inflation can't be good for crypto, Bitcoin mega-bubbles x20 every 4 years because of the halving event and it's amazing. Without the halving event Bitcoin wouldn't have made such massive gains. Right!?

Wrong.

So many things wrong with this ideology it's hard for me to even begin. First of all, volatile price is BAD. Bitcoin spiking x20 every 4 years is TERRIBLE (unless you swing trade it, but that's gambling). The volatile price of Bitcoin cuts new users out of the system who want to enter, and those who do enter get wrecked and swear off crypto for another 4 years.

The halving event has been hamstringing Bitcoin and turning away new users that would otherwise be extremely valuable to the network. Pretty impressive actually when we consider that the network is still expanding exponentially even in the face of this flaw.

It would be much much much much better for Bitcoin if it could just maintain the doubling curve and double in value every year.

| 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|

| $25.6k | $51.2k | $102.4k | $204.8k |

| 2025 | 2026 | 2027 | 2028 |

|---|---|---|---|

| $409.6k | $819.2k | $1.6M | $3.3M |

Bitcoin should only cost $20k right now. How many people would buy Bitcoin at $20k if they knew for a fact it would be worth $3.3M at the end of 2028? Everyone would do it, because that's the best investment of all time.

Ironically, this is exactly what causes the mega bubbles in the first place. People see what an amazing investment it is, the supply shock hits (especially when paired with the halving event) and we get a bubble all over again.

Who controls the inflation?

This is the only thing that matters. That's why people on Hive who want to reduce inflation have no idea what they are talking about. Everyone on Hive that says we need lower inflation... well those are actually the same people who control the most inflation. They are literally trying to take away their own power thinking that's going to help the network. It's not. Investors want higher inflation.

The people who control inflation are the ones who sap value away from the users who don't control it. When we are talking about fiat, it is a very small centralized group that controls inflation. That's the problem. It's literally the only problem. Fix that and all the problems go away for the most part.

For all intents and purposes, Bitcoin already has ZERO inflation. There's already 19M coins in circulation out of 21M possible. Only 2M left to distribute. And who does that inflation get allocated to? The miners and only the miners. All inflation on Bitcoin is used to secure the network.

So even comparing Bitcoin to other cryptocurrencies is a huge mistake, let alone fiat. You can't compare Bitcoin inflation to DeFi yield farming. Why? Because only Bitcoin miners receive Bitcoin inflation, while anyone can farm liquidity pools. These are 100% completely different scenarios.

So when I say inflation is the killer dapp (which it is) it's coming from a place where the entire community controls the inflation. Not a centralized bank, not the miners, everyone.

When I say that increasing inflation will increase price and promote growth, while deflation will reduce price/growth, that view is also coming from this context where all users in the network have access to controlling inflation.

Okay, well, if hyperinflation is so awesome why don't we just increase it to infinity and see what happens!

Uh huh.

Hey, yeah, if food is so awesome let's eat 20 pounds in a day and see what happens. If getting a tan is so awesome lets stand in the sun for 12 hours and see what happens. If money is so awesome lets give a billion dollars to someone and see what happens. Yeah I'm sure the result will turn out great.

Too much of a good thing.

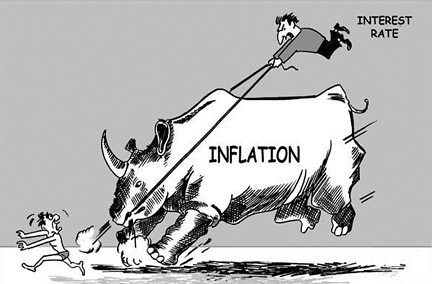

Inflation is a tool, a tool used to stimulate growth and get the network back on track. If you stimulate the economy when it's already doing well, it's going to moon like a crack addict on steroids. We know what happens then: we fucked up and there is nothing we can do to stop from crashing into the mountain.

My target is x2 per year.

Bitcoin has already shown us that gaining x2 every year is easily possible. This is a great baseline for new networks that want to perform even better than BTC. When the economy is doing well, meaning it is above the doubling curve, we REDUCE inflation to LOWER the price.

How can REDUCING inflation LOWER the price? Easy, we've already seen it happen time and time again. When yields dip users sell. When the price dips under the doubling curve we raise inflation to increase yield and stimulate the economy. You know: stimulus. Printing money out of thin air to promote growth and money velocity. That thing that governments are doing right now because it works. It will work for crypto as well.

It's easy to say that central bankers have no idea what they are doing because fuck them they are so corrupt, but how do you think they've been keeping this charade going for so long? Because they know exactly what they are doing. Stimulus promotes growth. However, the legacy system again is a crack addict on steroids. There's going to be an overdose sooner or later.

So what happens if we raise inflation and the price goes down? Well, that means we fucked up. It means the network wasn't gaining x2 value every year and we set the target too high, or there is some other problem.

Many would try to tell me that the price went down because there was more supply and that increased supply diluted the value of the token. Again, wrong, you haven't been listening. When inflation is increased and yields go up, yield farmers are going to get greedy and compound their gains even more to get more tokens. They aren't going to sell until the yields go back down.

What happens when we lower inflation and the price goes up? Again, that means we fucked up. The price target was set too low and the network is actually gaining more than x2 per year. Now we are experiencing a supply shock because new users want to enter but there aren't enough coins in supply.

Now... we could increase inflation and beg whales to sell into it... that would probably fix the problem... but people are greedy, why would they sell when they know the price is gonna go up... especially when inflation is being raised and compound interest is going to skyrocket. Just as good a chance of everyone doubling down and buying more in order to yield farm more because again: increasing inflation increases the token price.

How has the FED maneuvered around these problems?

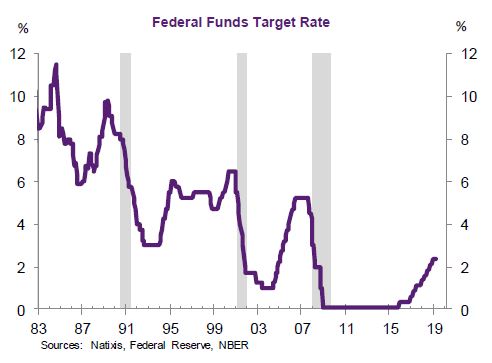

Simple: constant inflation, interest rates, and more recently quantitative easing. Back in the 80's when technology was really taking off inflation was massive. Just look at those insane numbers: almost 12% interest in 1985? Holy god. And now we are totally fucked and sitting at zero with the only recourse left to print money out of thin air.

But crypto is not debt

Crypto is new money owed to no one. The tools in the chest are infinite in comparison to legacy central banking.

Conclusion

Irony: it's not what you'd expect. I believe the key to these economies is to set realistic price targets for token price and try to manipulate the system in order to get closer to the price target. That means raising inflation to stimulate growth and increase prices, while deflating to crash back to the doubling curve. Does this sound like the ramblings of a madman? What if I'm right? What if we've been doing it wrong this entire time? I think we have been. I know it.

Everyone thinks they are so smart these days by investing in deflationary mechanics and touting it as the best thing ever. Guys, we already tried that: it doesn't work. Seriously: it doesn't. We already know for a fact that it doesn't.

At the end of the day the number one goal is STABILITY. Mooning token prices are a disaster unless they are sustainable. The key to forging a new currency is to make the token as stable as possible while also gaining as much value as possible over time. Those two variables get in each-other's way. We often will have to pick one over the other, but hopefully we reach a good compromise.

I also know for a fact that every defi token also needs its own stable coin. Being able to manipulate the stable coin with the yield farm is a tool that no one in the world has figured out yet. I am literally working on it right now. Gonna get back to it I already feel like I've used up too much of my time today.

Posted Using LeoFinance Beta

Stability is so important to the widespread acceptance of crypto. Till then it will keep scaring new investors and giving critics a voice to criticize. Am glad you're working on something along the lines, can't wait to see it when it launches.

Damn

You keep writing this over and over.

I need to sit down and wrap my mind around it when I am not so damned tired.Surely I will understand it then.

Posted Using LeoFinance Beta

Nickels are worth .06usd, pre-1982 pennies are worth .03usd.

Hoard your coins.

Every dollar of coins you have is a dollar out of the federal reserve's pocket.

Whereas every note in your pocket is a result of somebody else not being able to pay back their debt.

I got plenty of junk silver.

Silver nickels have been below melt for some time.

Cool, you collect silver dollars?

I think these are a cool form of art, art money or money art, I should be able to say that cooler...

I am sure there’s a post on this inside our heads!

LOL! 😂

Posted Using LeoFinance Beta

... this clusterfuck of an economy could implode at any moment.

Try telling that to a normie. 😎

Last year’s toilet paper crisis is going to pale in comparison to what’s coming.

LOL I almost forgot about that shit.

Pun intended.

I hope your project will run this experiment to see how stable you can keep a token on a growth trajectory that is set from the start. If you could pull that off, you will be satoshi x2.0.

I don't know all that much about the mechanics of finance, either fiat or crypto, but I was able to follow this post pretty well. What you wrote does make some sense.

I hate that we use the dollar as a reference point, even though it is the reserve currency it isn't a static or stable entity wrt. to other currencies, commodities, etc. Thus any notation of true stability is psychological at best. Anyways, I think controlling currency in spite of the psychology of the sheep is a tall order. Central bankers have been trying to figure out the stable growth for awhile now.

One area that is perhaps not taken into account is how one determines the value of some system (whether its an economy, community, cryptocurrency, etc). Although value is a hard word to define, too many people tie it back to USD, maybe something like purchasing power is a closer definition. Anyways, wrt. to value of a system, one issue that inflation tends to bring about is mal-investment and a lack of creative destruction. Sure it spurs growth, but not all growth is good. Things like zombie companies and corporate / government bureaucracies are examples of inefficient / toxic growth. The value of the system given enough technical debt may stagnate or even decline. More time and more time is spend on trying to maintain mal-investments and maneuver through the intertangled mess of it all. Given the weight of that debt, people are too lazy to really do anything about it, especially since in some cases, on an individual short-term level, it's the best thing to do. Ignore it.

Back to psychology again. No matter how much you try and herd the sheep there's an odd attraction they have to grazing nearby cliffs.

Wow! Pretty strong opinion. 💪

I Love some passion.😊

I am heading to your blog now to see what you write!🧐

Posted Using LeoFinance Beta

Yeah the level of perceived competition is just ridiculous.

By all accounts people like Peter Schiff should support Bitcoin.

He attacks it to his own detriment.