I've been really busy today...

Didn't even think I had time to write a post but I'm gonna crank through it super fast. Expect grammar errors to be abysmal because when I don't proofread my stuff it becomes an abysmal disaster.

In any case I've been having to shuffle a bunch of money around. My CUB LPs became way too diluted and hamstringed by the new pools, which I was super fucking annoyed by; I basically had all my yields cut in half within a couple days. Classic reminder that all these DEFI projects are unilaterally controlled by the dev team that issues the token.

It is nice that there are plans in place to decentralize things like this a bit. Voting on yield allocations is already a thing on pcub, and that code will obviously be ported over to cub soontm. Still, the core of the project will be centralized for the foreseeable future and requires a lot of trust, which isn't ideal in crypto but it is what it is. There are also perks to centralization: like the ability to fix a critical error quickly without permission. Again, these are basically testnets that may or may not become decentralized later. We'll see.

bHIVE and bHBD

It's funny because I remember when CUB first launched and I was like, "Where's the CUB/HIVE pair", and was told that would counterproductive. Now we have that pair... and it's the highest yield... and I have no LP tokens. Time to get some. Only costs half a percent to wrap/unwrap the tokens... not too bad, and it generates income for CUB.

Grossly overextended.

On both Hive and CUB... yikes... I have way too much. Luckily this makes it easy to have a huge cub/hive position. Need more Bitcoin but it's hard to bite the bullet and make the safe play. Especially true considering the community. The only Bitcoin community is basically a bunch of hypocrite maximalists. We are not the same. They're toxic and they can't scale up with that attitude.

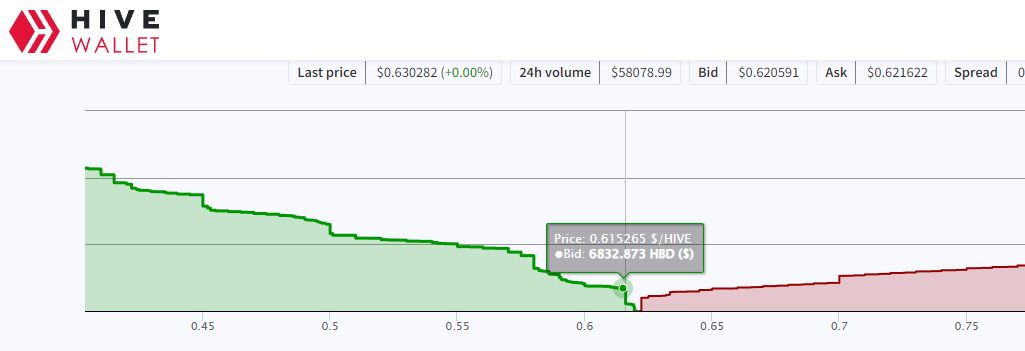

HBD liquidity is really really good right now on internal market.

@smooth is obviously doing some very good work with the stabilizer. Within just a couple months, we've gone from $100 of liquidity on either side to thousands of dollars.

Hm yeah that's looking pretty sexy.

Credit where credit is due. There's $10,000 worth of liquidity with only a 1.5% gap in between. Pretty damn good. Buying HBD on the internal market in bulk now is a viable option, which is a very good thing considering the 0% trading fees (aka RCs) and all the liquidity that cub/pcub are bringing in. Combined with the 20% APR on the savings account, HBD is moving up in the world.

What if 20% becomes unsustainable.

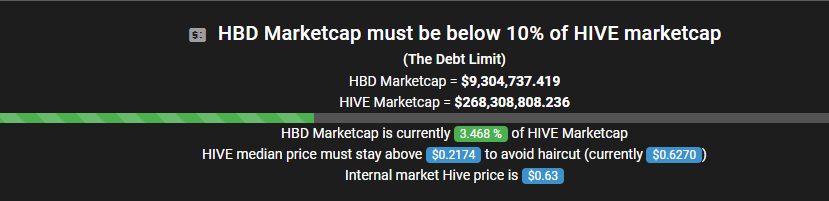

Then people like me will be calling for witnesses to lower it. But if we actually look at the numbers... lol. No. HBD is absolutely not overbought and 20% is a great place to be at what is potential a reversal in the market.

https://hive.ausbit.dev/hbd

The debt ratio is only 3.5%, which is really good, especially considering we just had that Upbit HBD pump/dump recently. We were able to syphon quite a bit of gains out of that from the Hive to HBD conversions. Pump/dumpers get rect. You deserved it.

Important to note here is that as price of Hive goes up, debt ratio will automatically go down unless more HBD is being minted. However, more HBD being minted means Hive is being burned, which means price of Hive goes up even more. We may be on the precipice of a pretty sweet run up considering all the upgrades coming in the next hardfork.

I haven't looked at the chart in a while...

Look at how good that looks... wow. As predicted like a week ago, both the MA(25) and MA(50) did a golden-cross past MA(100). Super bullish. It's also interesting to note that the MA(200) is 73 cents, which is below my fair-value estimate for Hive of 80 cents, making it that much easier for all three averages to cross above the big-dog and start another massive rally (talking like $4 Hive). Economy is still shit, so we'll see. Might have to wait a year for something like that to happen.

It's also pretty wild that as soon as the MA(200) dipped lower than 80 cents (my idea of a fair value price)... that's exactly when all the golden crosses started kicking in. Coincidence? Maybe. But also wow, so many reversal signals. I'm feeling some very strong FOMO to move out of stables and all into Hive and Bigcorn. We can still get a nice bull-trap rally before the economy implodes for realz. Just gotta DCA carefully as the fake bull market moves in.

In the short term price of Hive looks very weak and I fully expect to be testing one of the averages soon. Best case scenario is the MA(25) at 57 cents, but expecting more like 50 cents which is where both the MA(100) and MA(50) are at. I would consider that a very good entry point at this juncture. I'll probably FOMO in early like I always do. YOLO!

Posted Using LeoFinance Beta

That deeper liquidity in the internal market snuck under the radar :)

Would a deepening of the pHBD and bHBD pools have played any part in this?

Posted Using LeoFinance Beta

I mean it's possible pHBD and bHBD played a huge role.

It depends on who is running the bots and how money is moving around.

If there is a new bot in town that provides a lot of HBD liquidity and arbitrages the derivatives, then yes, the derivatives would then be adding even more liquidity to the internal market.

It seems things are going on truly smoothly internally on the Hive chain. I expect a strong performance by year end in terms of both price and activity

Posted Using LeoFinance Beta

All Things bright & beautiful!

Waiting for MA 200 to be a support level if the crypto market can go up for a while. So far the chart looks sweet to me ✌🏼

Posted Using LeoFinance Beta

Busy bee! Keep up the hustle! It’s crazy all the different ways one can make some bank here on Hive!

In every market there are winners and losers. In the case of HBD, I believe if it will not be sustainable the 20% interest will have not started.

Thanks for the post