Funny Story:

The other day I had a question about the Rune lending protocol so I typed my question into Google. Guess which link was at the top of the list? Not sure if this is embarrassing or a flex. It was the post I had written on October 28th after Rune had just climbed from $1.50 to $2.50 in a week and I was trying to figure out why. Now Rune is over $9, and I still think it has a small chance of going x100 from here.

In any case the question I was trying to get answered was how liability gets measured when it comes to these loans. You basically get paid in stable-coins, but how are those stable coins measured? I can see that USDC is one of the options. Is that a threat to the network?

Apparently the answer is a made up asset called called TOR. This TOR token is an untradeable internal ledger asset that represents the debt issued by the ThorChain network. It looks like you can't actually buy or sell TOR tokens directly, and instead it's just used to generically represent how much someone owes back to the network.

TOR (thor.tor) is a non-transferable unit of account within THORChain designed to match the value of $1 USD and has been in use since ADR 003. It cannot be exported anywhere and always has a market cap of $0. TOR is valued by taking the median price of the active USD pools.

The reason to do it this way is so that there is more than one way to pay back the debt. For example, maybe you plop $4000 worth of Bitcoin onto ThorChain and extract a $2000 loan out of that Collateralized Debt Position. Maybe you get paid in USDC. However because of the existence of TOR accounting you'd be able to pay that debt back using a different stable coin like USDT. In fact, it looks like the debt can be paid back with potentially any L1 asset when we read the docs.

We can also see that they're using the MEDIAN average, which means one of their stable-coins could experience complete systemic failure and crash to zero and this would have no affect on such a price feed because of the nature of outliers. The Hive price feed uses median averages for the exact same reason.

Users can repay loans at any time, with any amount in any asset. Repayment is converted into TOR.

This is very important and kind of cool.

The ability to pay back the loan using any asset on the platform is very useful. This functionality is not possible on lesser platforms like MakerDAO. The previous iterations of these protocols allow the user to borrow stable-coins (like DAI) while the expectation and requirement is that the loan must be repaid using the same currency. The fact that ThorChain is more far fluid then this is nice to see. This will almost certainly prevent bloat on the chain and avoid unnecessary transactions, fees, and slippage across the board. Any asset can be borrowed, and any asset can pay back that debt because everything is measured with the TOR unit-of-account.

All loans have 0% interest, no liquidations, and no expiration.

Just like I said it should be.

Years ago when I was studying MakerDAO very diligently, I correctly pointed out that they were doing it wrong. Charging users APR interest rates on their own money is not only predatory, but stupid. The only reason they could get away with it is because they were the only game in town. Now, ThorChain will blow them out of the water with a superior product. Love to see it. Welcome to the attention economy and actual healthy competition based on the borderless free-market.

The goal of this protocol is obvious. They don't care about petty things like charging APR or liquidating collateral to ensure debt doesn't go underwater. This is crypto; we don't have to do any of that. Following the rules is for suckers. We make our own rules. It's all about winning the attention economy and making number go up.

Number go up

The reason why Rune is up so bigly lately? Well, this loaning protocol almost mathematically guarantees number will go up, especially during the bull market. Of course nothing like this has ever existed before so a lot of speculation is required in order to guess what it might do during the bear market. Never fear frens, I have you covered.

Open Loan Flow

1. The user sends in collateral

(BTC.BTC -> RUNE, RUNE -> THOR.BTC)

So why does number go up? Because these ThorChain Chads are shorting the collateral being received and dumping it into their own token (lol). When you open a loan here your Bitcoin gets sold for Rune, and then that Rune gets destroyed and converted for a... "Derived Asset". In this case the derived asset is simply a liability on the ThorChain ledger's balance sheet that is owed back to you later when the debt is repaid.

Derived assets are for accounting and there are no plans for them to be exportable or held by users.

So yeah, it is indeed as crazy as it sounds. Rune gets destroyed when loans are taken, and Rune gets created when loans are repaid. If this sounds like a systemic risk to you, then you'd be absolutely right. The obvious followup question to ask from here is: What is Thorchain doing to mitigate these risks?

Risk is mitigated by:

- Limits on collateral for the network and each pool

- Slip-based fees when opening and closing loans

- Dynamic collateralization ratio

- A circuit breaker on RUNE total supply

So the reason why Rune is absolutely murdering it right now is because recently they just increased the debt cap ratio. They were at 100% for a while during the initial testing phases and no one was allowed to acquire more of these loans. Now the money printer is back open for business and I must admit I'm seriously considering dumping some Bitcoin in and testing it out for myself. Hell I could even use this feature to avoid selling crypto right now and use the USDC to pay my rent and food bill for the next couple months or even a year. Strongly considering this right about now. The real bull run is 2025.

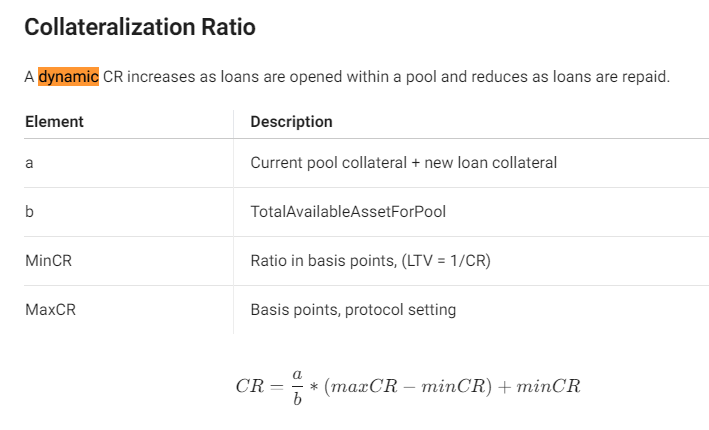

What does all this gibberish mean?

I can't say for sure without doing more research, but it looks like as more users take out loans the collateral ratio should get higher and higher. This means less debt will be minted for larger amounts of collateral. The current deal being offered now is a 50% CR, meaning users can borrow half of what they put in. Another way of saying this is that the position is 200% overcollateralized. Increasing this number balances the protocol and makes it more hedged against Black Swan events.

As more loans are taken out, the collateral limits are increased and so does the CR. The higher the collateralization ratio, the safer the system becomes.

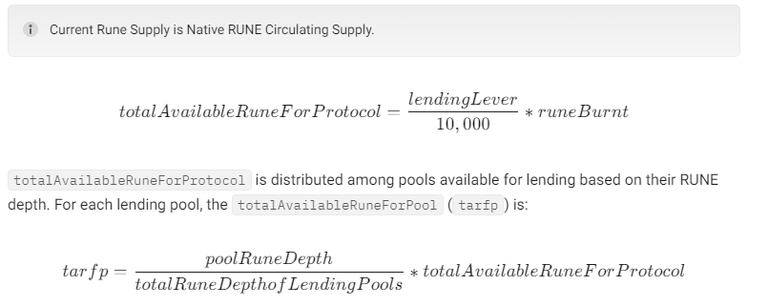

Dynamic Lending Cap

Again these equations are confusing when presented without much comment, but combined with statements made on Twitter it appears that the lending cap should go up if Rune moons in comparison to the collateral. The collateral in question is currently limited to BTC and ETH, which I think is a mistake, but it's also a new protocol being tested for the first time in the field. Give it time.

The problem with increasing the cap dynamically like this is that Rune is almost certainly going to moon in relation to BTC and ETH during this bull market. It was probably going to outperform even without this lending protocol, and with the protocol it will likely skyrocket during the bull. This will almost certainly give Rune a false sense of security as their own automated system allows itself to be saddled with debt during the best part of the market cycle... which will almost certainly lead to a massive pump and dump. The only question is: wen?

Thorchain Chads think they have it all figured out and believe that they can mitigate or completely avoid the next bear market with a protocol like this, and they'd probably be correct if they were actually doing it right. What they truly need to be doing is loading up on debt during the bear market when everything is crashing. From what I'm seeing I highly doubt they'll be able to do that because they're going to be fully leveraged up at the tippy top and riding high on fumes during peak FOMO. Couldn't be me.

How will they avoid the bear market?

Okay so the theory here is that the bear market can be sidestepped because there are no liquidations. So basically the collateral (assets) can be lower than the liabilities (debt) without a bearish flywheel kicking in like it would on something like MakerDAO (where liquidations dump ETH on the market and create more liquidations in a domino effect).

Because there are no liquidations it means that loan positions will just sit there underwater and remain untouched. The collateral will be worth less than the debt required to unlock it, and so nobody in their right mind will ever unlock the collateral due to basic financial incentives. This is good for Rune because when the collateral does get unlocked ThorChain has to print rune and dump it to pay back the user. Chads believe they are safe from the bear market because these redemptions will not occur during the official bear market.

The thing Chads fail to understand:

Rune is guaranteed to fall harder and faster in the bear market than most of the other assets it is paired to. This is simple math. If Rune has a strong liquidity pool to Bitcoin, which it does, then when Bitcoin crashes in terms of USD, Rune will also crash in terms of USD even if nobody sold any Rune whatsoever. Add to this the fact that people are guaranteed to dump Rune during a bear market and we can see that this debt situation they are putting themselves in is going to make it even worse.

How can this be avoided?

Like I said before this loan protocol should be leveraged to create liquidity, elasticity, and prop up the price of Rune during the bear market rather than in the middle of a bull market. The ThorChain community needs to increase their appetite for risk when numbers are going down, not up. I can say with almost 100% certainty that they are going to completely drop the ball on their first try at playing central bank. These things happen, but also their loss is our gain; it won't be very hard to capitalize on something like this. Just buy Rune now and sell it at $1000 or whatever it gets to in 2025. That's how crazy this thing can get.

Looking at the collateral

The only collateral allowed within the system as of late is BTC and ETH. Again, I believe this is a huge mistake. Why? Because BTC outperforms EVERYTHING during the bear market, so that's obviously that last asset you'd ever want to be shorting during that time. Using ETH as collateral seems much smarter in my opinion because it will be easier to outperform ETH with RUNE during both bull and bear markets.

In my opinion the absolute best collateral for this protocol would quite surprisingly be Litecoin's LTC. Litecoin is very cheap to move around and it has extremely deep liquidity pools across every centralized exchange (and decentralized ones as well). It also underperforms which is exactly what Rune should be looking for when picking an asset to short vs Rune. Maybe they'll wise up to this concept soon.

Not shorting USD

A huge difference between this loaning protocol and something like MakerDAO is the fact that it is shorting assets that are correlated to it, which is actually quite a smart and good thing to do. When a user takes out a DAI loan using ETH collateral, that DAI ends up getting spent and owed back to the protocol later. When the USD value of ETH goes down this creates liquidations and makes ETH go down more and potentially creates a death spiral.

Because the ThorChain collateral system doesn't do liquidations they are not short USD, but instead short on BTC and ETH in comparison to Rune. This is amazing because Rune is WAY more correlated to BTC and ETH than it is to USD. In theory the volatility problem of collateral vs debt may have been solved here. The only real threat is if BTC and ETH start to greatly outperform Rune over long periods of time and the network gets hammered by a bad debt ratio and massive Rune dilution. Of course many of the safety mechanics put in place will mitigate this threat if and when it comes along.

A circuit breaker on RUNE total supply

Circuit Breaker

The documents do not explain the circuit breaker at all which feels like a red flag. Only in passing does it say the total supply of Rune is capped. This means that if shit hits the fan all the collateral gets trapped in the system and ThorChain will refuse to print more Rune in order to pay back its debts.

To me this is an unacceptable solution and I much rather like what Hive has done with the haircut on the HBD debt ratio combined with a 3.5 day price average for Hive collateral. I can almost guarantee with absolute certainty that this circuit breaker on ThorChain is going to come into play during the next bear market, and it will not be pretty.

Delaying the inevitable.

It is possible that Rune does succeed in delaying the bear market, but that just pushes it back one year. Assuming the 4-year cycle will play out the same as it always does, this means 2026 will be the bad year with 80%-99% drawdowns across the board. Rune may avoid getting absolutely wrecked here because no one is paying back their loans because they are all underwater.

The problem is "The Year of the Maximalist" as I like to call it. This is the year after the bear market, in this case 2027. This is the year that BTC outperforms everything, and that's when Rune will get absolutely fucked by this loaning network. The second BTC goes up in value and is worth more than the debt required to pay back the loan... well Bitcoiners are going to take that deal. They'll pay back their debt to unlock the BTC that is no longer underwater. This in turn dumps Rune onto the open market.

There are going to be a lot of distressed sellers looking to sell as the market recovers just like we saw in 2023. How many people believed that 2023 was a "bear market year" even as the BTC price went from $16k to $44k? Imagine what happens to Rune when it is trading flat while BTC goes x2. Everyone will pay back their debt and force Rune to be dumped onto the market. If it looks like the circuit breaker is going to get tripped there will almost certainly be a bank-run that catalyzes the event immediately. Self-fulfilling prophecy, that.

Again, a scenario like this makes it insanely easy to make absolute gobs of money by volatility trading the market.

- Sell a good chonk of crypto in 2025 and fill up the stable-coin bag (HBD preferred).

- Buy BTC at the end of 2026 during peak FUD.

- Watch number go up in 2027 while everyone calls it a bear market.

- Rotate heavily into Rune at the end of 2027 after it gets completely wrecked by this loaning protocol and loses a lot of reputation and credibility because of the circuit breaker and collateral being locked in the system.

- Do not be surprised if Rune spikes to $1000 and crashes to $10.

Conclusion

What ThorChain Chads have created here is very exciting, but obviously there are some major concerns when it comes to systemically shorting Bitcoin at the peril of the network. A very sharp double-edged sword has been forged by the Chads, and I am almost 100% sure they have no idea how to use it correctly.

Again, their loss is our gain. All we have to do is watch how they wield this deadly weapon of debt. If they hold it like a clumsy child it will be very easy to profit from the carnage that results from that degenerate irresponsibility. If they swing it like a ninja then everybody wins.

It's scary to think what people with big bags can do with this sort of service. I guess that's kind of the way the fiat world works too right? Rich people don't risk their own money, they risk someone else's. :P

How funny! You are the principal reference but unknowingly look for answer somewhere 😃

oÓ just like that, it was that easy.

Really funny! When the student is the teacher in disguise. So you are looking for information when the world sees you as the source 😃🥰

This post is a good example of why I always try to read your posts. Even the silly ones.

You are willing to do a deep dive, think deeply, and put an opinion out there even if it might be wrong.

Very valuable.

Now I must gird my loins and do likewise. My interest in $RUNE has been piqued (again).

If I am gonna get back on that wild ride, I need to know what I am getting into and what the hell I am doing.

So easy that I can barely follow after my second read :D

It will be much simpler when it takes 4 years to play out in extreme slow motion.

⏰

Range from 10 to 1000 is wild, would you happen to be brave enough to create a Cycle Chart 📈 prediction for Rune?

I think a lot of people might be very interested in that. Obviously not as financial advice, but from an analytical perspective.

An asset like this that pumps their own bags like a central bank using derivatives is not really possible to predict. You said it yourself: the road from $10 to $1000 is pure insanity. There's no way to guess how it would happen. I just think that it easily can happen from the fundamentals currently in play.

If we see anything in the rage of 1k, Khal will buy a massive boat 🛥️ or maybe two.

it brings me great joy to imagine Khal reading this post.

can you imagine?

Itll be like.... 1.Michael Saylor, 2.Khaleel Khazi,..... 3. everyone else

it's working in theory

Imagine looking for what you have somewhere else.

That’s crazy

Rune pump is something else, lol

Congratulations @edicted! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out our last posts:

Love this!

Awesome….

Real bull market is in 2025? What?

The fall happens a little at a time, and then all at once. Great article.

This speaks to how staying current in DeFi is MANDATORY! Thanks for the update. I've been using Aave (by way of InstaDapp) for a few years and definitely noticed the fees for my loans consistently increasing...roughly 20% at the moment smh. Thinking about winding down my bag and sending it over to thorchain