Yesterday's News:

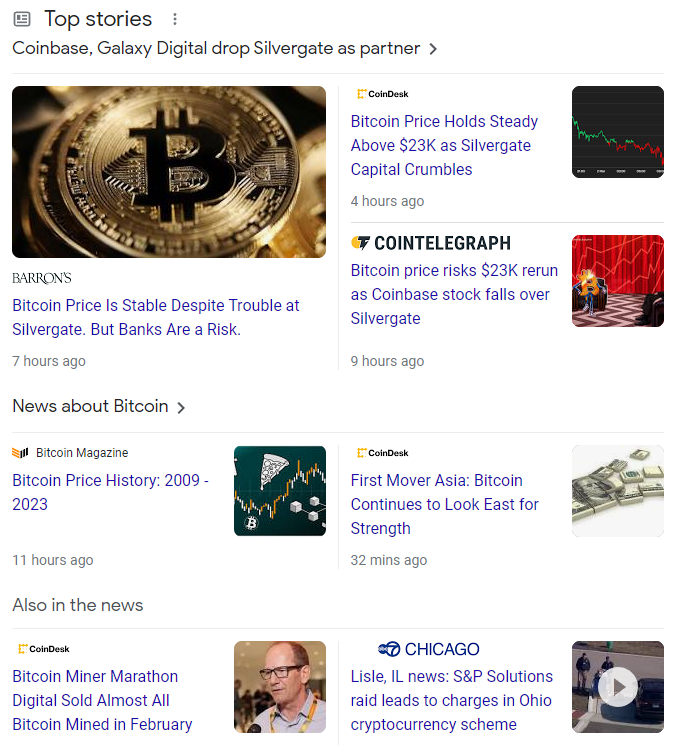

Today's News:

Well that's fun.

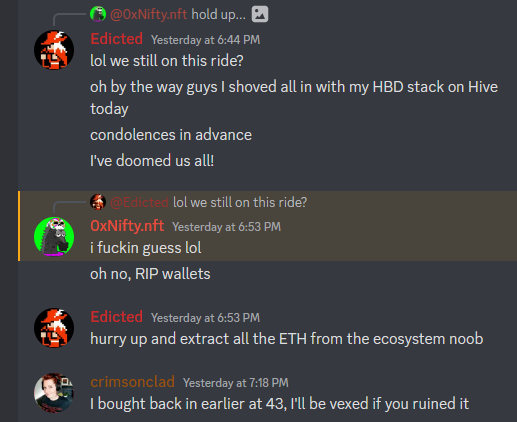

Last night in LEO discord I made a joke about going all in on Hive with my HBD stack. I apologized in advance for the market crash that was about to happen.

Then an hour later what does the market do?

It's actually funny how triggering events like these are.

The market flash crashes 5% and everyone is losing their minds. Clearly there's some major bear-market PTSD floating around even now. During a bull market when price dumps 5% nobody even discusses it; that's just another day ending in 'Y'. Meanwhile this situation is fishtailing in the opposite direction.

Luckily in my last speculation post I was quick to point this out:

I would be remiss if I didn't say I'm a little worried about Hive's position here. The 44.4 cent level that I recommended everyone buy at seems to be doing its job, but we all know how support on Hive can fall away at the drop of a dime.

Interestingly enough, we crashed to exactly the levels I was looking at before. $21k for BTC and 40 cents for Hive. The next support should this happen again will be $20k and 37 cents for Hive. Support at that level should be much stronger than what we are seeing right now. I don't expect to go lower than that.

So what's up with this Silvergate stuff?

Well first of all it's kind of funny that it's even called Silvergate because of the tendency to add the word "gate" after a conspiracy. Watergate, Pizzagate, Gamergate, Donutgate, all the gates.

At the end of the day Silvergate is just a legacy bank that crypto banks use as a middleman for their fiat ramp. Silvergate seems to be another victim of FTX contagion. A delayed reaction to be sure. The end of Silvergate may or may not create some supply chain issues with crypto/fiat ramps used by big players like Coinbase and the like.

The drop came late Thursday night, hours after several crypto companies said they’d stopped accepting or initiating payments to or from Silvergate

– including Coinbase, Galaxy Digital, Circle, Paxos and Bitstamp. Silvergate, which has become the go-to bank for cryptocurrency businesses, gave notice Wednesday that it won’t meet an extended deadline to file its annual report and warned it may not be able to operate another 12 months.

"We can't file our annual report & may close within 12 months"

lol that doesn't sound good...

No wonder why everyone dropped them like a bad habit.

I'm honestly wondering if this news is actually the reason that the market crashed though. It was very much a delayed reaction and it doesn't really seem like this development is going to matter at all. There are plenty of ways to get fiat in and out of crypto. Silvergate was a largely unknown entity operating in the background until this failure was made known. I didn't know anything about it until now... did you?

“The bearish turn could certainly be a delayed reaction to Silvergate’s ongoing issues,”

Since when does crypto ever have such a delayed reaction?

Usually the market trades before anyone even knows what's going on.

Just saying.

The only constant in this market is fear.

When I saw the price drop 5%-10% across the board in 30 minutes it reminded me just how badly rooted I still am in the scarcity mindset. As it turns out, this is a very frustrating experience. If I can't practice what I preach, then how can I possibly expect others with even less discipline to do the same?

It quite obvious that my portfolio is woefully off balance if a 5% dip can trigger any kind of emotional response whatsoever. To be fair the 5% dip happened in record time an hour after I shoved my stable-coins into the market, but still. I shouldn't have to worry about stuff like this anymore, and that's a problem. A 'me' problem to be sure.

In hindsight if the market continues downward many will look to this moment as the definitive trend reversal, but honestly it's still a coinflip chance either way. This seemed to be mimicked by the greed/fear index as well. 50/50

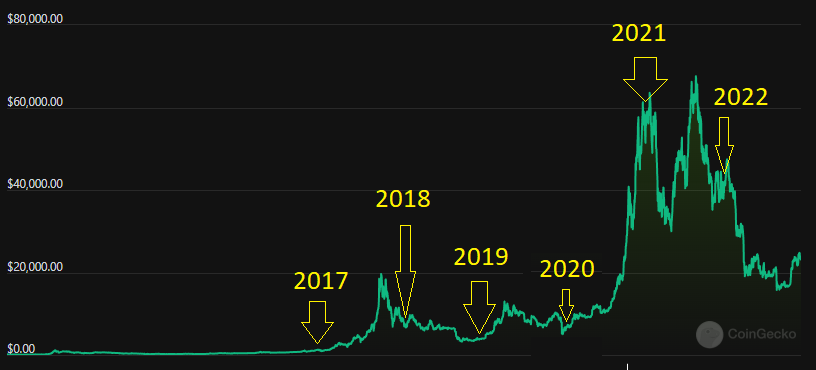

I'm still pretty convinced that this is a bump in the road into an even greater bull trap as we move into the summer. If this is a repeat of 2019, I've already pointed out that it started much earlier in the year than it did four years ago. The 2019 run didn't even start until April 1st. March is very often a pivotal month in which very little actually happens.

Case-in-point, even though March 2021 and 2022 were local tops, the price basically just chopped sideways the entire time. 2017 and 2019 were the base of a massive rally, but again nothing actually happened in March. 2018 was the trough in between two dead-cat-bounces; also a big nothing. The only exception was COVID 2020 which was basically an act of 'god'. I can't believe Hive was born during that same moment how weird is that? Such coincidences.

FTX contagion

Imagine if we could slide over to an alternate dimension where FTX had never collapsed. If we crop out the FTX contagion and the lows of $16k, what are we left with? Basically just boring sideways chop from this moment all the way back to July 2022. What I'm getting at here is that it feels like we had upward momentum because we crawled out of the FTX disaster, but really we've just traded sideways for 9 months straight. It's a lot more similar to 2019 than it looks on paper. But I digress.

Conclusion

As far as I'm concerned my macro outlook hasn't really changed much. I've been talking about a dip to $20k for a while now and nothing has changed. That is still the bullish scenario and a much needed confirmation. At this point any spot price between $20k-$25k is simply chop that should probably be ignored. We've been at this for 9 months now (day traders are very bored and coming up with a new narrative every week). FTX was just a bump in the road. I expect to be out of this range by the time the full year passes. That's a pretty common occurrence given all the consolidation phases we've seen.

2023 is a pretty exciting year for crypto. Looking around on Hive there are a lot of projects and critical infrastructure developments that are about to go live. Bitcoin is still the top dog and the safest bet, but also the most boring it seems. To be fair the two often go hand in hand. Lower risk lower reward.

I have a plan to set up a fund that can carry me through the next 12 months without having to sell any crypto. This will be a very good buffer to have in order to make sure further dips in the market don't have any affect on my stress levels and mental health going forward. Abundance mindset is key. Scarcity mindset bad. More on this some other time.

Posted Using LeoFinance Beta

The "crash" of HIVE's price on the exchanges unfortunately didn't show up exactly on the internal market. As you already know I have been calling for the 40 cents level since the 62 cents pump and I had orders lying at 40 cents. Not a single hive on that order filled. Should have had it on binance lol.

Damn that means value of HBD went under $1...

Did you make sure to undercut that massive order at 40 cents?

Your orders definitely would have filled at 41 cents or even 40.3 cents.

No I didn’t actually. My orders started from exactly 40 cents. But yes, the value of HBD was showing below $1 on the feed in peakd wallet for long times today.

Unfortunately this is a meaningless measurement because HBD doesn't have any exchange listings. UpBit doesn't count because only Koreans have access to it and it can't be arbitraged. I'm not 100% sure how Peakd calculates that value but I do know that it's pretty inaccurate no matter what.

All things being said it looks like if the orders were on Binance they would have for sure popped off.

BOO!

It would be pretty cool if the internal market showed daily or hourly candles so we could monitor the price over a certain period of time. It is quite a hassle to manually go back in the trade history to check how low or how high the prices went during a pump or dump.

You mean... like... this?

https://hivedex.io/

Yes exactly this! Thank you so much for the link, I didn’t know of this tool.

Ouch!!! 😂😂. Well buying at 0.44 or 0.45 wouldn't matter in 2025. #Hive would be above $6.2 by then 😂

Yeah I bought in at 43 and the current price is 42 so it may end up just fine.

Caulk it up as coincidence.

Posted Using LeoFinance Beta

Caulk it up!

!LOL

Caulk ??

Autocorrect is a double edged sword when you draw too quickly you get cut.

Happy #PirateSunday Young Lady

!LADY

View or trade

LOHtokens.@stokjockey, you successfully shared 0.1000 LOH with @kerrislravenhill and you earned 0.1000 LOH as tips. (1/3 calls)

Use !LADY command to share LOH! More details available in this post.

lolztoken.com

But not as fast as his brother Sudden Lee.

Credit: manuvert

@kerrislravenhill, I sent you an $LOLZ on behalf of @stokjockey

(1/6)

Use the !LOL or !LOLZ command to share a joke and an $LOLZ

I enjoyed the fascinating read. It does well to cover several topics with enough information for someone like me who's never caught up, haha. I am still excited about the future of crypto especially in a world where most businesses are trying to move to a subscription model vs. true ownership. I'm maintaining my budget of adding money into crypto whilst adding funds to savings and more traditional investments so I am going to be well rounded. Here's to hope for the future of crypto!

Im with you on the bull trap theory, Im no trader or expert but in my ignorant opinion just by looking at the price seems BTC could reach 27 - 29k to then go back down to 15 - 12k, I have been buying once a month or every 15 days depending on my paycheck but soon will have liquidity to buy more often, we are in that anger stage to then slowly bleed preparing for the disbelief rally, that as long as war doesnt get worst or something global affect the markets

The range I'm targeting is $45k-$50k but it's more about where we are in mid May than anything else.

Summer chop should give us plenty of time to take gains.

If its anything like 2019 then 50k to then 20k range sounds good, dont think it would be the same since there was COVID that drump all markets but still over 50% drop will put many into dispair and medication

Edictgate is full-on, and people are getting obliterated - good. This is it, we're 30-45 days pre official Bullrun then?

Silvergate was built to fail, the moment I learned what they were two years ago, I was suspicious. Any legacy bank that prides itself on being the go-to for an entire industry (before other large investment banks began jumping in) raises eyebrows.

I also made some good money going long with call options on $SI back 2 years ago, thinking those days are never coming back haha.

There was also a large liquidation of $100M longs on Friday that helped push the price down really quickly, but it's never one thing that ultimately makes the USD-denominated price to buy Bitcoin change.

Posted Using LeoFinance Beta

Hive has a great future.

We're holding on!🥂

Hey, I just read your post and I have to say that I really enjoyed it! Your analysis of the recent market crash and the Silvergate situation was really informative and it's great to see your positive outlook on the future of crypto.

It's funny how we can get so caught up in the fear and scarcity mindset when it comes to investing. A 5% dip in the market can be enough to trigger panic and emotional responses in us. But you're right, it's important to maintain an abundance mindset and have a plan to handle future dips.

I also thought it was interesting how you pointed out the tendency to add "gate" to the end of conspiracy names. It's something that I've noticed as well!

Thanks for sharing your thoughts with us and keep up the great work!

I wonder if we are going to see even more FTX contagion victims in the next 12 months. With Binance being shaky and all, scary stuff.

I honestly wasn't expecting the crash. Some analysts on Twitter were expecting it though... It's probably time I should stop throwing forecasts around and simply go with the flow.

Analysts on Twitter are bored as hell and trying to move mountains with sideways chop.

I keep hearing them talk about the "trend" narrative...

But then their view when and how the "trend" changes varies every week.

They are being way too impatient and using small timelines and not enough data.

I'm not impressed :D

There are a few quite different, but just a few. @stockmoneylizzards is one of the.

~~~ embed:1632151735069208577 twitter metadata:MTUxNDk3MTY0MTE4MDI2MjQwMXx8aHR0cHM6Ly90d2l0dGVyLmNvbS8xNTE0OTcxNjQxMTgwMjYyNDAxL3N0YXR1cy8xNjMyMTUxNzM1MDY5MjA4NTc3fA== ~~~

The rewards earned on this comment will go directly to the people( @kalibudz23, @pero82 ) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

In my personal opinion, Bitcoin is stuck in a screwed range that there is no indication that it will break out of for a while. I mention it because all my analyzes lead me to such a conclusion.

If we're talking hard numbers, I'm of the opinion that BTC is in an immediate range from about $22,500 to about $24,650 or so. The good thing is that the Ichimoku indicator shows that there is bullish force, but beyond that, the bad news is that the directionality of the price is undoubtedly to the downside, this is based on daily timeframe analysis. But based on my analysis of the BTC 4-hour chart, the price would range from $22,500 to $25k or so.

Given what we are seeing, I think that up to now the market has been acting in this way, and it is not seen, given the analysis, that the price of BTC is going to exceed $25k at the moment (at least in the next few days or weeks). But who knows, with Bitcoin anything can happen.

Posted Using LeoFinance Beta

This story about Silvergate reminds me of Bitzlato. An entity most people in cryptosphere have never heard of is suddenly dug up as a convenient excuse for price dump with probably has more to do with greed and degen leverage activity.

Posted Using LeoFinance Beta