Jon Rice is the founder of the Koinos Federation, an alliance of projects building on the free-to-use Koinos blockchain. He was previously editor-in-chief at Cointelegraph, Blockworks and Crypto Briefing.

Interesting resume!

Pay-to-Use Blockchains Will Never Achieve Mass Adoption.

This is definitely one of the better articles you're ever going to find on Cointelegraph or any other crypto news outlet for that matter. Those of us with experience with these outlets know that for the most part the posts focus on shallow content like ETF speculation and spot price. Even the ones that do report on important issues are usually like 2-minute reads and barely glance off the surface of the issue.

This one is built different, and even though I disagree with a lot of what's being said it does open up the conversation to be discussed and mulled over. The topics that get brought up are ones that most people outside of our tiny ecosystem aren't even considering yet.

Blockchain projects should learn from Google and Facebook by monetizing users without directly asking for their money.

The very first sentence starts off with a bang and is already hugely problematic. Technically on the base level I agree with the statement. People need jobs and the ability to provide value to the network while also getting paid by the network. However, comparing that to WEB2 ecosystems just doesn't translate and is super toxic. We should not compare symbiotic WEB3 ecosystems and sustainable circular economies to the WEB2 parasites that came before us. Still, I understand why the comparison was made (because there are no other options or references) so I have to let this one slide.

No contest

We’re perfectly happy to open wallets, engrave seed phrases on steel cards we bury in the ground, find exchanges we haven’t been blocked from yet, wrap some assets to leverage yield, and become OpSec professionals while we pray to the blockchain gods that the North Koreans aren’t online right now.

The article continues by stating the obvious (but prerequisite fact) that mass adoption requires a certain level of simplicity that is painfully far away from being attained. We all know this to be true. Onboarding sounds easy until you actually try to do it and it takes 2 hours to onboard a friend and even then they still don't really understand what's going on. The WEB3 crash-course is so easy in hindsight and so comically difficult in real-time.

And so convenience becomes king, and along with convenience often comes centralization and the bastardization of all the ideals we were trying to uphold in the first place. We have to walk a fine line in order to blend convenience into a trustless environment.

Take something like "Lite-Accounts" or "Ceramic-Accounts" for example and I would argue that we are actually doing a pretty good job on this front. People want to log in with their Facebook or Google account: let them. Build the bridge; the bridges are very important during these early stages. It doesn't matter if someone uses a trusted custodian to secure their account if their account is currently worth very little and they simply want to tinker with the platform in a low-overhead stress-free manner in order to determine if they want to continue the journey or not. When they choose to continue the journey is when they seize control of their own assets and secure their own property.

This is actually the least risky way of doing business. Would you try to teach someone to swim by throwing them in the deep-end and forcing them into a highly stressful situation? Literally: Sink or Swim. Some teachers would, and certainly there is some success to be had with that strategy. But what if you traumatize the person and make them never want to even look at another [liquidity] pool ever again?

That's what we call a permanent fail state. It's simply not a good mainstream strategy even if it might be a very good not-so mainstream one. Those who cut a path through the jungle with a machete do not expect the ones that follow behind to do the same. Eventually the path gets paved over and becomes exponentially easier to navigate. That's just the way of the world. Not everyone is a pioneer, and that's fine.

If permissionless blockchains are to become the backbone of our online experiences, three major changes need to happen:

- They need to be free.

- They need to be frictionless.

- They need to be familiar.

Right now, we are zero for three. In fact, we’re so far away from where we need to be that we’re not even trying to address these problems seriously — we’re busy making small, incremental improvements to dysfunctional tech rather than addressing the root of the dysfunction itself.

Certainly there is some truth to this, but the message also contains sweeping generalizations and assumptions that are provably false. The most glaring error being a topic that I bring up often: using a blockchain will never be free. Ever. Never.

“Free” means free for the user

There's another word for this, and it's called "subsidized". Another word with a much more negative connotation within the political climate would be "socialist" or even "communist".

One of the biggest drawbacks of WEB2 architecture stems from the fact that it is free to use. Many sacrifices were made in order to morph this strategy into an actual functioning business model that generates profit.

The biggest drawback of free service is almost certainly the Sybil attack. If you provide free service, then anyone can come along with a bot and exploit that free service.

WEB2 bends over backwards to prevent these attacks.

CAPTCHAs are ANNOYING. They provably diminish the user experience on every platform that implements them, and yet they are used almost everywhere because they have to be to prevent instant systemic failure. How many more months before AI completely obliterates this shield, twists the knife, and reopens this threat vector to a level we've never seen before?

Point being that trying to mimic WEB2 is... not going to work. At all. Period. The End. Guaranteed. WEB2 simply does not belong within this emergent new tech stack of crypto, AI, 3D-printing, metaverse, etc. We have to run to where the ball is going rather than where it is now; Such a simple concept that so few seem to understand.

Luckily Koinos and Hive aren't actually free.

If you want to see what happens when blockchains actually allow users to post for free: look no farther than Blurt; the result of the contentious hardfork of Steem into Hive.

https://peakd.com/@holger80/blurt-is-under-heavy-spam-attack-right-now

https://peakd.com/@edicted/happy-block-50m-blurt-under-attack

You see people on blurt were either delusional or intentionally bad actors. Rather than fork away Justin Sun's toxic stake they simply hijacked the entire governance structure and promised that they'd give back power later. Anyone who was around back then knows that emotions were strong and often very irrational.

It's not hard to see why some users got tricked into thinking that this was the way to go. After all: "stealing is bad" and "censorship is bad". Clearly these are not absolute statements, as stealing and censorship are pretty good options for dealing with criminals like Justin Sun. We just needed to make sure not to set a toxic & corruptible precedent, and from what I can tell we succeeded.

Point being that there was some kind of bug with resource credits when Blurt created the fork, so they scrapped the entire system.

My post December 29, 2020

Blurt has come under attack by an "unknown entity". When they scrapped the Resource Credit system, they started micro-charging users to post on the platform. In making this change, the opened up the network to a number of attack vectors. Some of the operations on the Blurt blockchain don't have this associated microcharge, so the attacker is spamming transactions and filling up the entire blockchain with garbage without running out of resources to do so.

Uh yeah, I know who the hacker was. I had front-row seats to that shitshow. It was glorious. I can tell you with 100% certainty that the "hacker" was totally whitehat and tried to warn the Blurt devs multiple times that what they were doing wasn't going to work. When it was clear the Whitehat was being blatantly ignored they got frustrated and started filling up all the blocks for free with random ass completely valueless transactions.

Then when I reported on this the Blurt guys tried to cancel me and say that 'clearly' I was the 'hacker'. That was really icing on the cake, that. What a crazy time to be alive. Yes bruv, I am the leetzors hackooooor. lol

When a blockchain offers data to be posted for free the result is always going to be systemic failure, even if there is nothing to gain by attacking the network. If it can happen: it will happen. Even centralized agents have a very hard time providing this kind of service. Such models become untenable given a decentralized platform that redundantly stores all the information for every node that exists within the network.

Luckily Koinos and Hive aren't actually free: part 2.

Hive has Resource Credits and Koinos has proof-of-burn. These are real costs, but because neither blockchain actually has enough adoption to fill up the blocks: we market this cost as "free" because the value of the derivative bandwidth asset rounds to zero. There is currently no market for bandwidth because bandwidth is extremely abundant and exists everywhere. No market means no demand; no demand means no price; no price is marketed as 'free'. Easy. Until there actually is demand for bandwidth.

Given the coin distribution of any network (there are rich and poor people everywhere in the world) it is not possible to suppress the value of the bandwidth derivative forever. It's easy to make an argument like, "Well if people want bandwidth they'll just power up Hive or burn Koin," and that will be true during that phase of the market. It's the phase that comes after that most people do not anticipate.

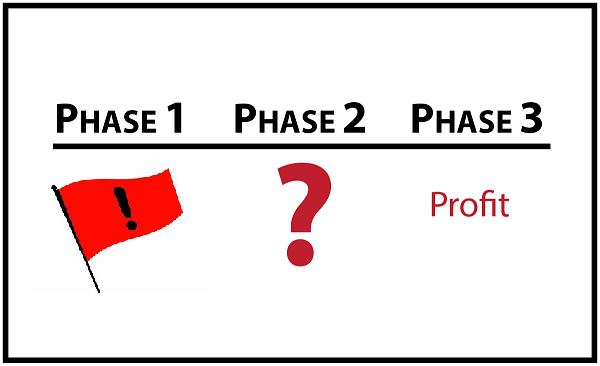

- Phase 1: free bandwidth / low token price

- Phase 2: free bandwidth / high token price

- Phase 3: derivative market / very high token price

Given actual adoption, it is impossible to stop a bandwidth market from popping up. All of a sudden the thing that was free is no longer free, and it's MUCH MUCH less expensive to buy bandwidth straight up than it is buy the governance token and leverage it into bandwidth.

The second this happens the market becomes flooded with bandwidth coming from whales who now realize they have access to a 'new' asset they're farming for free but can sell at a non-zero value. The inflation to the derivative market will be a thing of legend, driving up the costs of operations on the chain 10x or more. The governance token price would have to 100x or more considering the history of crypto.

After all, the governance token can do many other things besides just creating bandwidth. Bandwidth farming is simply the crunch that squeezes liquidity out of the market and makes it even more volatile and harder for new users to purchase. Not only are more people buying: but also no one wants to sell in an environment like that, even as the spot price moons during the bull market. We've seen this play out enough times to know exactly how these things go down on a psychological level.

"This time is different."

The gift that keeps on giving.

Google serves you ads. It monetizes you indirectly. Facebook monetizes your data, but it doesn’t charge you to use its platform. Apple’s store takes a 30% cut from developers and publishers, not from you.

In all cases, you’re paying — just not with cash.

Again with another comparison to WEB2, and the logic simply does not translate. You would pay a penny to do a Google search if the charge happened in the background and you never had to think about it. You'd gladly do it if that same Google search paid out 2 pennies in return. That's just basic math. You spent 1 penny and you got 2 pennies. You're in the green and turned a profit even though the system monetized you directly.

The reason Google can not monetize its users directly is because such a thing would create an ABYSMAL user experience and make people rage. Google does not have direct access to their own cryptocurrency. What are they going to do? Ask you for your credit card number so they can charge you a penny? Oh and then also ask the credit card company to refund the account 2 pennies for good searches?

That's a resounding 'no' from both the user and the credit card company. The overhead cost of that system is insane. What happens if there's a hack and a billion credit cards get leaked to the darkweb? Crypto doesn't have that kind of liability because the user is responsible for securing their own keys, not Google. On Hive if you get hacked you recover your account and hopefully learn your lesson and change your behavior so it doesn't happen again.

In crypto the worst hacks always occur when users pool their liquidity together within the same account or contract. These are the honeypots we actually need to watch out for.

The gift that keeps on giving: part 2.

No matter how small their fees get, thanks to incremental reductions from the likes of Solana or the myriad layer 2s out there, it’s still a fee that most people won’t pay.

Again, this is the wrong mindset. All bandwidth across all chains has value. Chains with less adoption or more centralization are cheaper to use. Just because one chain has a higher fee than another chain doesn't mean everyone is automatically going to use the cheaper option. We have to ask ourselves what we are actually getting for the price we pay.

On Bitcoin the price is 100% security. If you value massively high security or are transferring around huge sums of money, use Bitcoin. Pretty simple. It might be 100x more expensive to use BTC over Litecoin, but Litecoin doesn't have the same security guarantee or the same liquidity pool depth. Something something gold and silver.

What if you could mint and sell an NFT on Ethereum worth $1000? Wouldn't matter if the operation fees were $100: you just made $900. Fee on BSC might be $1 but if the NFT is only worth $10 then why would you even bother? Stick to the big-boy chain. The total quantity of the fee is irrelevant by itself. What matters is the ratio of the fee when measured against the value one can extract out of the data being stored on chain.

What a lot of people don't seem to realize is that we can transmute bandwidth on the blockchain and turn into even more value. It does not matter how much a fee costs if the value being created has exponentially more value than the fee. Why does this escape most assessments of the situation?

Well, probably because the current infrastructure is very much lacking and all the business models have ultimately been complete failures. On top of that when fees spike it pushes lower-tier users through a meat-grinder of overhead costs that pisses them off and makes them very verbal about it. However it only takes a wee bit of vision to realize that's not always going to be the case. Infrastructure is always improving.

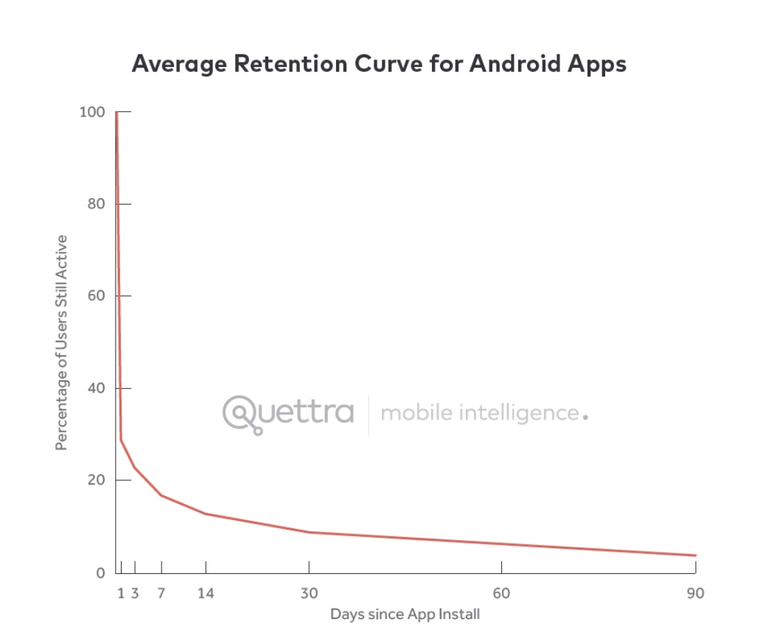

Andrew Chen, a partner at Andreessen Horowitz investing in games, metaverse and consumer tech, shared the following graph. He suggested that “the best way to bend the retention curve is to target the first few days of usage, and in particular, the first visit.”

Oh!

You know as much as I hate to agree with some A16Z venture capitalist I'm actually 100% onboard with this concept. Or maybe I'm just trying to trick you all into thinking I'm not always an entirely unreasonable bastard. One of those!

FIRST IMPRESSIONS ARE ESSENTIAL

Doesn't matter whether we are talking about shaking someone's hand, crypto, or whatever else. The retention curve is important. We want people to be excited by the experience of something new while mitigating any potential frustration that might turn them away. I feel like this is an obvious certainty. What's not so obvious is how to actually accomplish such feats of strength.

Compare the onboarding process of a poorly designed app to crypto onboarding. It may be bad, but it’s not even the same sport. Crypto is the most user-unfriendly technology ever hawked to the public. To those who struggle with tech, it’s the digital equivalent of being punched repeatedly in the face.

Ha... yeah... woof.

No comment.

Over time, crypto has not become much friendlier. You, dear reader, are enjoying a specialist publication. You’re probably a degen with a liquidity position on Uniswap and a Milady in cold storage — but the words in that sentence make no sense to a normal person.

Do you guys know what a Milady is?

I actually was compelled to look it up.

I guessed NFT, and I was right.

So, blockchain has to change. It has to become a frictionless experience, a background technology, like everything else we use — from the internet to our phones to our TVs.

We don’t care how they work. We just care that they work.

Right so I guess this is where the article takes a turn and starts unleashing all these bangers that I 100% agree with. I knew I picked this post for a reason. Good thing too because my long-winded counterpoints have increased the size of my own post to absurd valuations.

Lastly, and perhaps my single biggest critique of the crypto industry, is how utterly nonchalant we have come about asking billions of people to do things they don’t really want to do.

Nailed it.

I also have to give props for not mentioning Koinos or any other specific blockchain.

Conclusion

All blockchains require a fee to use the system. This is a universal fact. Any blockchain that doesn't is simply doomed to fail via Sybil attack, especially if there is a financial incentive in play.

What Jon Rice doesn't seem to understand is that we are simply in a transitional period. When mainstream adoption actually comes a lot of these arguments go straight out the window because crypto users will be more than comfortable jumping through hoops to get what they want.

And what do people want? Well, money of course. People want to work, build value, and get paid. We simply haven't built the infrastructure to support this reality yet, and that's frustrating. It is what it is. At the same time we should not underestimate the amount of work users would be willing to do for relatively low wages. Even a base wage of $5 an hour would be an astronomical feat on a permissionless platform with no one in charge. That's a fact.

Blank-to-earn business models do not work. Play-to-earn doesn't work because playing games doesn't build value. Exercise-to-earn doesn't work because exercise does not build value to the network (within the current ecosystem). It's possible to make these models work using more refined infrastructure, but that currently does not exist: we have to build it. A lot of this is trial and error. Many mistakes will be made.

You bring some good arguments, I have to admit.

owever, I do think you took some of Jon's statements out of context.

Free to use:

This is meant for the user, not for the chain itself. As you pointed out, on HIVE as well as on KOINOS the concept of RC (HIVE) and MANA (KOINOS) is the instrument to control bandwidth. With HIVE a user gets a certain amount of RC for each staked HIVE. I believe (but am not sure), the amount of RC to a specific transaction is always the same, regardless of how busy the chain becomes. At KOINOS, the MANA charge to a transaction is increased when the chain gets busier. When KOINOS gets so busy the increasing number of transactions needs to be reduced, this is intrinsically done by the MANA charge which can go sky high. At KOINOS one gets MANA when holding KOIN; One doesn't have to stake KOIN. The system looks the equivalent KOIN for the MANA consumed. This makes the setup at KOINOS a bit less complex to HIVE, which is a plus IMHO, but that aside the point of 'free to use' ;)

You state: Web2 experience never in Web3?

To get the masses onboarded, even the masses under the young generations, a Web2 UX needs to be offered. The idea is, to onboard peeps using web2 UX and then while they use these Web3 services with the Web2 UX, slowly these users can get familiar with all the Web3 shizzle. I assure you, there will never be a time in the future that will serve the mass market, with the current complexities we have in the crypto space. Never ever. Also, most of the youngsters in crypto, in my country that are a whole lot of them, are using CEX, since DEX and crypto wallets are too complex for them. Therefore, we can safely state that even the young generations will not 'eat' the current state of affairs in cryptoland. Note that in my book: Web2 doesn't mean all for free. However the foundation for free. The service (dApp) pays the TX costs, not the user. However, each service can have its own business, earning model. Funnily enough, with HIVE and its RC delegation, a similar foundation is created at HIVE ;)

Keys in the hands of the user? Not custodial?

I beg to differ. In decades from now, we will see plenty of easy-to-use services using blockchains in one or the other way. Most users will be subscribed to a service that allows them to continue accessing their funds and digital assets, even after the user lost the keys. Some form of custodial service. Likely a service that requires multisig. It is a HOAX to think the majority of people on our planet will ever be OK with the fact when the user loses its keys, the funds are gone forever. And only a small group of those users will ever know how to handle the keys appropriately, like key breaking and sharing among friends/family type of setup. When I'm wrong regarding the latter, we likely will be a century into the future, like a few human generations. But I may be wrong here :) But I dont think I am ;)

People want Money

Again, I beg to differ. In a tiny society I am part of, the Dutch society over in the Netherlands. About 18M people live in this country of the lowlands. 7M of them are working as a volunteer. Does that show peeps want money for all they do? :) I can give you tons more examples. Like Wikipedia. Like a large part of YT, or Soundcloud. Content is uploaded to these services without the user ever making any money, and most of these users do not have any intention to make any money.

With Web3 I get the impression everything starts to revolve around money, while in essence 'money' didn't do humankind any good. Don't get me wrong, I am not against the concept of money. But we have to face facts: Money itself didn't really make our lives easier compared to when we didn't have any money (I can only assume, since I never lived in a time when we didn't have the concept of money). I would even state: that when money distribution becomes more unequal, more problems it created.

I think this depends on the person who is teaching and the one being taught. It is always good to mentor someone till the end so that the person would not sink so make sure that you create enough time for the person. At the same time, the person being taught should also be a fast learner so that he himself won't sink because when you teach someone and the person does not understand, he or she will get tired quick

You wouldn't compare me to Sun Yuchen, would you? Treat me like a thief, and censor me?

Edit: I mean, I've been a very strong supporter for years, without cessation, of your witness, and not just your posts.

No one can be compared to Sun.

He was the greatest threat to this network by exponential margins.

The fact that a large portion of the network was very upset that we took action shows just how censorship resistant the platform actually is. The overwhelming argument is that the premine was promised to the community. Even a bad-actor with the same amount of stake would be more difficult to censor if they had bought their stack off the free-market.

However, it's almost guaranteed that a billionaire buying 80M tokens off exchanges would not have so flagrantly played their hand like that. It only makes sense for someone to act like that if they are freerolling a premine.

I honestly can't divine why you even asked the question.

Are you just joking around?

Can't tell if serious.

Well, a comment I made was DV'd by what appears to be your witness, and I am kinda wondering why. I'm not on any lists hereabouts I'm aware of, and it just happened out of the blue. The post author was similarly flagged, apparently for their offensive meme game. Here's a couple screenshots.

I've been a constant voter for your witness since you undertook it, and recall strongly encouraging you to undertake it. I doubt you have any knowledge of this, so thought if you knew your witness was opinion flagging your supporters, you might put a stop to it. I really don't see how I can support a witness flagging perhaps the least offensive comment I have ever made. It just seems like idiocy. I hope it stops.

hmmmmmmmmmmmmmmmmmmmmmm

Yeah sorry about that thanks for bringing it to my attention. Rishi decides to do this every once and a while. It's been a thing in days long past. Both Sn0n and I tell him not to but apparently there has been a resurgence.

I must admit that if I put more time into hextech I'd be much more comfortable telling Rishi to cut the shit, but Rishi does indeed do most of the work and upkeep. It's such a needlessly awkward position to be put in. Definitely would not take it personally if you removed your support for the witness. I may have to cast my own votes to reverse some of these... or maybe I'll write a Hive script API (first time in years) that nullifies all downvotes made on a particular account. There isn't a frontend that lists all your downvotes I don't think I can undo them manually without going through the history. I could always give you access to the posting key authority. Just kidding. Kinda.

I appreciate you looking into it. @antisocialist acts to monitor DV trails by joining them, which informs him of which accounts are flagged because he has a record of which accounts he has flagged. He can probably provide specific information how he does it, and if it requires digging through the history. That would enable you to unilaterally resolve the matter per your preferences.

Hehehe. That would bollocks Rishi's plans!

I think opinion flagging and censorship is why Hive's not still in the top 10 cryptos by market cap. Censorship's why Meta's Threads got 100M users in a week looking to escape Twatter, and why it lost them just as quickly when Threads was no better. If Hive was better, we'd have those users.

I've lost everything I owned more than once, and what I learned from that is that it's not what I have that matters, but who I am. @lighteye helped make me who I am by his freedom to speak, by criticising me and convincing me I was wrong, and I'd vastly prefer he be protected from Hextech flags than my author rewards.

Thanks!

The worm is turning.

Normal now is not knowing about the bernster and all that !drama.

The skaters look to be growing in a way that encourages activity irl.

Peakd has filters in 'activities' that allow to filter for votes and in and out.

I mostly just follow downvote trails with a dust vote.

Damn that was well played.

Lol.

It’s certainly an interesting discussion and I suspect the Koinos guy is well aware of the hive ecosystem here. It’s good that he didn’t plug specific blockchains but was talking about the situation overall. Commendable for sure. Hive and Koinos, with some others maybe, are in an interesting phase for how we set things up for future growth. Bandwidth is definitely going to be valuable and I suspect when API calls will cost resource credits, that’s really going to be when things get tested. I hope that’s not anytime soon and we can control it somehow with accounts in a specific criteria get subsidized with not having to worry about that type of stuff.

The crazy thing is that a lot of the actions that Musk is performing on Twitter (like charging for API access) actually make sense within the context of WEB3. This is something I've talked about a handful of times, but it's never going to work on a WEB2 system.

Yeah he's doing some weird stuff with charging subscription fees. It's a weird blend of Web 1 plus 2 but that doesn't equal 3 in this shit at all lol.

The secret sauce that is missing is the ability for users to generate more value than they have to spend and be paid accordingly for their work. That can never happen on WEB2, and it's very difficult to accomplish in WEB3. We need a good template for devs to clone and fork.

Muy buen post increíble, gracias por compartir

!PGM

!PIZZA

!CTP

BUY AND STAKE THE PGM TO SEND A LOT OF TOKENS!

The tokens that the command sends are: 0.1 PGM-0.1 LVL-0.1 THGAMING-0.05 DEC-15 SBT-1 STARBITS-[0.00000001 BTC (SWAP.BTC) only if you have 2500 PGM in stake or more ]

5000 PGM IN STAKE = 2x rewards!

Discord

Support the curation account @ pgm-curator with a delegation 10 HP - 50 HP - 100 HP - 500 HP - 1000 HP

Get potential votes from @ pgm-curator by paying in PGM, here is a guide

I'm a bot, if you want a hand ask @ zottone444

$PIZZA slices delivered:

@torran(4/10) tipped @edicted

You touched on an important point that I had to live through. They taught me to swim by jumping into the water and I had to survive and perhaps that is why I have been risky in many projects, like starting trading when it was not yet well known to lose and recover and live through the closing of Several wallets, Hive, how it works so far, seems to me that although it is not completely free, I think it benefits many people and increases its growth day by day, while Musk's ideas can make many people leave There is a lot to develop so that the platforms give fair and equitable payment for the time we invest in it.

That's what I felt too at first. It seems that Hive is only for the experts. Much of the language here especially on LeoFinance was new to me. I need to do a lot of reading to catch up. I think newbies can relate to the same experience. I wonder what is supposed to be done for crypto to become more user-friendly.

Agree 100% that cryptocurrency currently is to complex for mass adoption, and I had begun to feel like I was the only one who saw this, until I joined Steemit. Then I was relieved to see what I thought was a community devoted to simplifying cryptocurrency. But I think the two Dans started down the road but didn’t finish the job. Very Smart People, but finishing… not a strong point.

I joined Steemleo and left Steem to come to Hive hoping the devs would finish the job, and many strives have been made IMHO towards decomplexity, but still Hive is too complex.

Fortunately, subsequent development on small projects like Leofinance have shown through things like Facebook and Twitter signups that removing complexity speeds adoption, but large scan adoption of those technologies has been slow on other front ends and Hive in general.

Computer types and gamers are still persistent enough to grind through the steps to make a go of this, but regular folks, not so much.

Your analogy of the car is appropo people want to drive the car, not understand how it wotks

Right now too much understanding is required to navigate safely, so many do so un-safely, with predictable results: losses through scams, theft and mistakes.

I loved Khal’s early theme of building simple interfaces which just worked.

I miss stuff that works.

I miss stuff that doesn’t make me forget the big picture of what I want to do , because it doesn’t bog me down in the minutia of everything I need to do under the hood.

But I guess we are still early, even after being here five plus years…