Hey All,

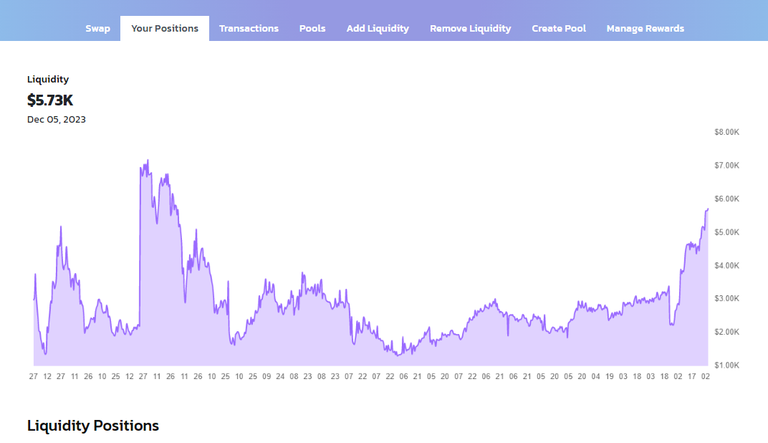

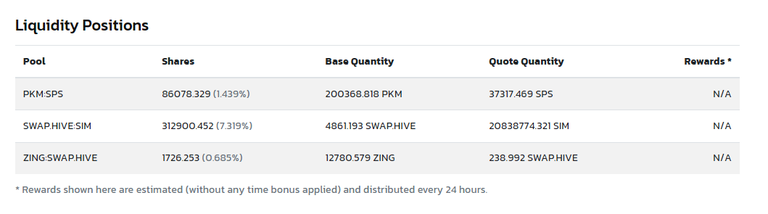

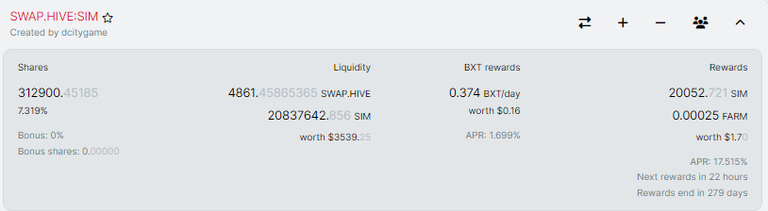

Who says that we don't have a Decentralized Finance (DeFi) system here on HIVE? Platforms like Beeswap and Tribeldex is our go to place for providing liquidity of second layer tokens that are associate to the HIVE Blockchain. At present, I am providing liquidity for 3 pools which are ZING/HIVE SIM/HIVE and PKM/SPS and here is the snapshot of it which is taken from tribaldex.

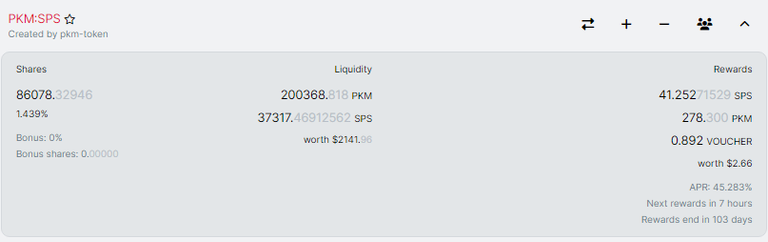

My total stake in all these pool is almost touching $6K+ and the plan further is to keep building it and bring it to a level where it reaches $10K+ mark - that's the GOAL I have set for myself to reach at that level. What normally I am doing is staking the rewards back to the pools. For example for the PKM/SPS pool - I am earning 270+ PKM and 40+ SPS tokens daily and they get redirected back to the pool.

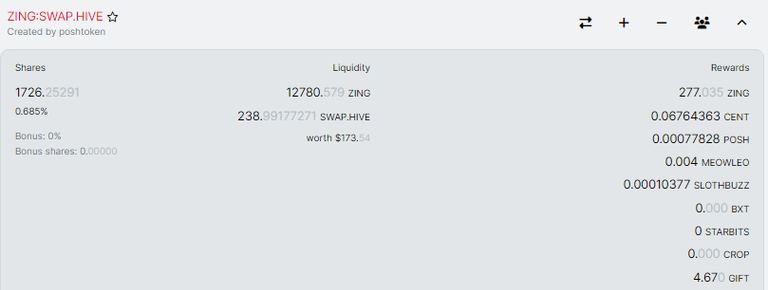

I have been providing liquidity to the PKM:SPS Pool from day ONE on Beeswap portal. And as seen from the above image you can see my current share in the pool which is around 1.43% and this share gets me around $2.5+ of rewards daily; sweet isn't it? Till date, I have been pooling in all my PKM and SPS rewards to the LP pool and have been trying to get to a point where I have 250K+ of PKM tokens. There is still a long way to go as I need another 50K+ of PKM tokens to be added to the LP pool. Which, I am quite confident off that I should be able to get there in a couple of months time frame. And Yes, I did join the party by entering the ZING/HIVE liquidity pool and here is my current state with 12K+ ZING and 240+ HIVE in the pool which is worth $180+ as of writing this article

The target here that I am targeting the 20th spot for that I would need to almost double my stake in the liquidity pool; which means adding another 250+ HIVE and 10K+ #ZING tokens. So would be working gradually to enhance my investment here at the moment I am looking for an opportunity to buy #ZING in bulk and with regards to the daily rewards all of them are being redirected back to the pool for now. And finally what should I say about SIM/HIVE pool investment, I guess I have talked about it much n many of my posts here -

one such example is the - From No where to Somewhere - Strategizing 20 Million #SIM in Liquidity Pool SWAP.HIVE/SIM almost accomplished - this is already accomplished at the moment and this is getting me close to 4+ HIVE daily along with 20K+ #SIM tokens daily which is again worth 5+ HIVE. I am targeting the 3rd spot in the SWAP.HIVE/SIM liquidity pool so need to invest further but for now I have kept it on HODL at the moment. I started from no where and it feels like gaining that 3rd spot would be a big achievement. The best part is that this is not only getting me an APR of above 20% but at the same time daily $HIVE earned is being used to powering up my HIVE account -- so its helping me to build my HIVE POWER stake as well. That's all about it on My Position in Liquidity Pools here on HIVE Blockchain approaching $6K+ & My Strategy Ahead.... cheers

Have Your Say on Liquidity Pools here on HIVE Blockchain..

Are you building your stake here on the HIVE platform? Selling Vs HOLD - second layers tokens #HIVE? Which is your favorite liquidity pool? What are your general thought around the platform #HIVE? Please let me know in the comment section below...

#hive #liquid #hodl #liquidhive #liquidity #lp #passive #defi

HIVE - Can I PowerUp 10 #HIVE Daily? My Strategy Ahead for 100K+ HIVE POWER...

Image Courtesy:: pro canva, peakd, tribeldex, beeswap

Best Regards

PS:- None of the above is a FINANCIAL Advice. Please DYOR; Do your own research. I've an interest in Blockchain & Cryptos and have been investing in many emerging projects..cheers

Those are big numbers for liquidity pools. Congratulations.

I especially like the SIM/SWAP pool.HIVE takes a long time and is profitable.

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @bhattg by upvoting this comment and support the community by voting the posts made by @indiaunited.

How's yr impermanent loss doing in that SPS-PKM pool - worth pulling out for a while with SPS on the rise, can't see the other following anywhere near as hard! I just pulled 50% of mine a couple days back.

That is actully a very respectable sum! Do you have any pairs with DEC, Vouchers and SPS outside of the PKM one? or no interest in doing those? Personally this is an area I want to focus a bit more on as well.