Important notes and disclaimers

The content does not constitute investment, financial, legal, or tax advice: none of the information contained on this post constitutes a recommendation, solicitation, or offer to buy or sell any digital assets, securities, options, or other financial instruments or other assets, or to provide any investment advice or service.

Remember the time when it was possible to get insanely high yield farming (300+%) on the DeFi protocols just by locking your tokens on an Automated Market Making protocol like Uniswap?

Looking at how much yield the AMMs protocols are generating for the liquidity providers nowadays, it seems that the DeFi summer is over, and you might ask yourself, “Where did that high yield go?”

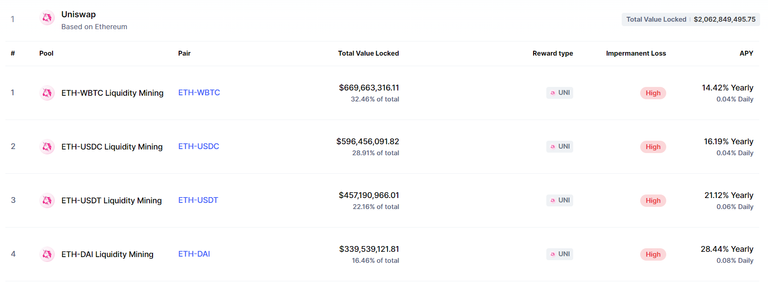

If we take a look at Uniswap pools that reward liquidity providers with UNI tokens, we can see that the APY reduced a lot since they launched the token.

There are two main reasons why this happens:

1 - The token rewarded by the Liquidity Mining has its own market value, and lately, DeFi tokens prices went down by a lot.

2 - It’s really easy to participate in Liquidity Mining on AMMs, and because of that, there is a lot more people competing for these rewards.

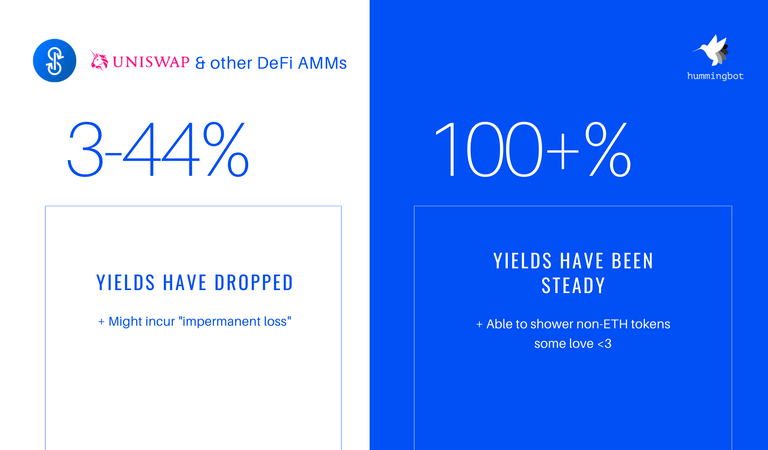

Hummingbot Liquidity Mining is very similar, but with some key differences:

1 - You don’t have to spend a lot of money in transaction fees to lock or withdraw your funds;

2 - There is no “impermanent loss”;

3 - With a good market making strategy, you will also profit from your trades, increasing the effective Yield;

4 - Some Liquidity Minining campaigns are paid in USDT, which also helps to reduce the possible loss due to the value depreciation of tokens rewarded;

5 - More possibilities! Our Liquidity Mining campaigns aren’t limited to Ethereum Tokens. If you look at the current campaigns, you will see the tokens ALGO, COTI, XEM and HARD along with the ERC-20 tokens RLC and MFT.

You can learn even more about it reading Hummingbot Miner vs. DeFi Liquidity Mining Part 2: Considerations for Market Makers/Liquidity Providers.

But what about the Yield?

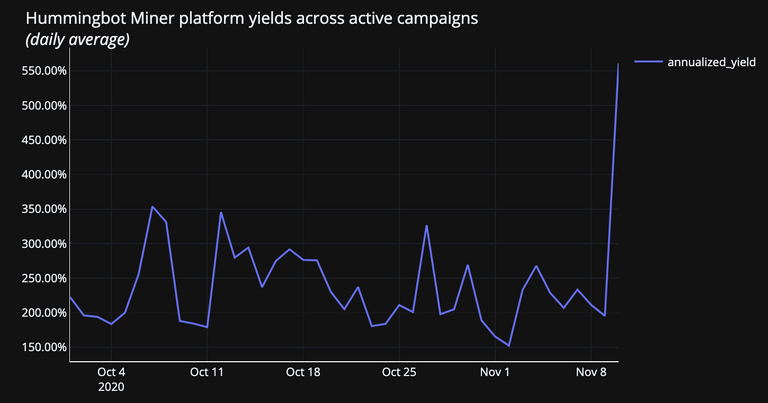

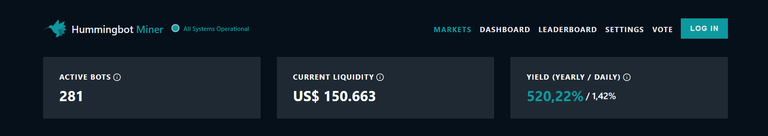

Here is what the average yield of all campaigns on Hummingbot looks like:

You might argue that you can still find 200+% yield on smaller and new AMMs protocols, but you should really consider the risks before locking your funds on a new protocol. Remember the smart contract exploitation that happened to FARM protocol a few weeks ago, or the (in)famous Sushiswap rug pull?

Won’t the Yield from Hummingbot Liquidity Mining also go down over time?

A predetermined fixed reward amount is distributed every day, and if the competition increases (more Liquidity Miners), it is possible that each miner’s share goes down.

But take a look at what happened this week, when a new campaign was launched with KAVA for their new HARD token, adding an amazing 10k USDT to the reward pool for the first week alone, and 30k USDT in the following 11 weeks!

Decentralized Exchanges and DeFi projects are an innovative step towards building a better and more accessible financial system. Hummingbot Liquidity Mining Campaigns are our contribution to help improve the crypto space, allowing anyone to support the projects they like through Market Making. But if your favorite project isn't listed as one of our campaigns, stay tuned because new campaigns are coming!

Happy Liquidity Mining!

Congratulations @hummingbot! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOP