Microstrategy and its CEO Michael Saylor has made the news recently for buying a shitload of Bitcoin. They stated that they have possession of over 40,000 BTC.

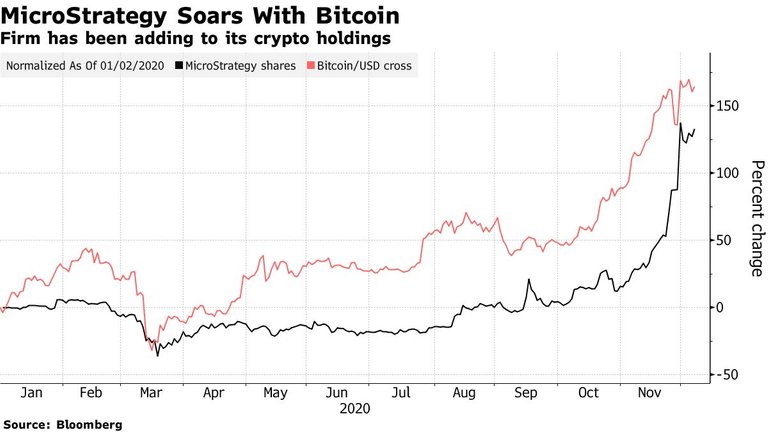

In this graph taken from Bloomberg link we see the spending spree of Microstrategy and the soaring of the price of its shares.

And to be honest, I was happy with the news. Institutional investors and stuff...

This period I am listening to "The Intelligent Investor" by Benjamin Graham. Great book, everyone should read or listen to it more than once. In this book, there is a chapter on "creative" accounting and among others, a name popped... Microstrategy ...

Hey, I remember this name, it's one of the companies that buy BTC by the thousands. And not only that ... They are buying BTC with other people's money. More on that later.

So, I did a small Google research on "Microstrategy fraud" and few articles appeared. This is the most comprehensive from the New York Times link.

In 1999 " ... Michael J. Saylor, the chairman of MicroStrategy, a software company whose share price soared and then collapsed after the company was forced to restate its books and erase all the profits it had reported, was accused of fraud yesterday by the Securities and Exchange Commission.

Mr. Saylor settled the civil charges that were filed in federal court in Washington without admitting or denying them and agreed to pay $8.3 million to shareholders and a $350,000 penalty to the S.E.C. " ...

Microstrategy was accused of overstating its earnings during the years of 1998 and 1999. Let me remind you that this was the Internet Bubble period. Also, during that period the price of Microstrategy's shares reached a high of $333 per share. Of course, after the settlement, the price collapsed.

So, that was the story... They did some "creative" accounting to appear profitable, shares price went up, caught by the SEC, paid a fine and life went on...

Until a few days ago that they announced that " MicroStrategy intends to invest the net proceeds from the sale of the notes in bitcoin in accordance with its Treasury Reserve Policy pending the identification of working capital needs and other general corporate purposes".

image link

In plain English, this means that they intend to buy BTC with debt or with other people's money. One could say that this move is risky and opportunistic. History shows that these usually don't end well.

Let's hope that people won't lose their money. In reality, I give zero f$#%$s about those people's money, but if something bad happens who do you think will take the blame?

These people? Neh ...

Michael Saylor? Not a chance ...

You guessed it...

BITCOIN !!!

I don't know how this will play out...

Just some random thoughts and a small google research...

And until we see BTC pumped ...

Be healthy and smile !!!

Posted Using LeoFinance Beta

This is no surprise. Most large funds and corporations on Wall Street have skeletons. They simply cannot help but to try and bilk the system at every turn.

Posted Using LeoFinance Beta

At least this went public.

If anyone buys these securities is totally responsible for his/hers outcome ...

It's as you say... whenever a scammer pulls out a scam related with altoins, only altcoins will take the blame at the end of the day

Posted Using LeoFinance Beta

well , what you can do.

on the other hand many other institutions have bought BTC so it would be difficult to solely blame BTC.

we are entering "too big to fail " territory.