You hear people say "I can't believe it's been that long!". Believe me when I say "I can!"

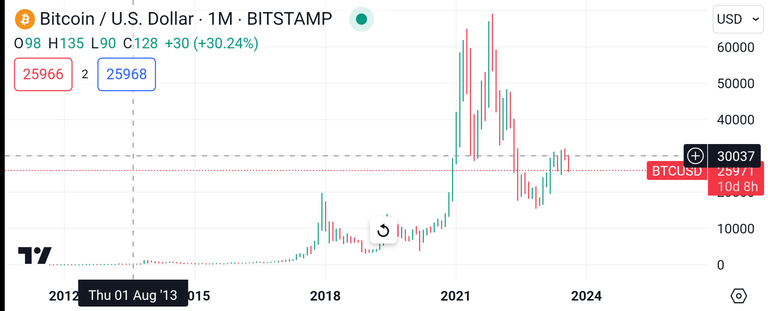

When I got in the game I knew Bitcoin would be a game changer and I've been an evangelist even before this date ten years ago. What I didn't know was the toll it would take on one's nerves. Yes, the exhilaration and joy of seeing something you believe in rise exponentially in price, however it's the flash crashes and crypto winters that bring you tumbling down! Pun intended. The FOMO. Oh the FOMO! Lol. The learning curves and aggravation of putting up with naysayers. I can't count how many times that I've read that Bitcoin is dead. I think in all these years the obituary has been written over 300 times.

Remember, for those of you that have been into cryptocurrency for awhile, constantly checking the market. Your account balance.

Then there's the talking it up at work, family functions, etc. and finally persuading people into buying it after explaining to them that you don't need to initially know more than having a Bitcoin wallet, buy it on an exchange, transfer it to a wallet and what happens? The market collapses, an exchange is hacked, or the SEC decides to flex it's muscle and the market is frightened. Later, you have to face these friends or family knowing what the market did! They turn negative and tell you they've sold at a loss.

Looking back, to the very beginning of Bitcoin there have been critical events and dates that have shaped it's history:

October 31, 2008: The Bitcoin whitepaper was published by an individual or group using the pseudonym Satoshi Nakamoto. This laid the foundation for the cryptocurrency.

January 3, 2009: The Bitcoin network went live as Nakamoto mined the first block, also known as the "genesis block," marking the birth of the Bitcoin blockchain.

May 22, 2010: The famous "Bitcoin Pizza Day" occurred when a programmer named Laszlo Hanyecz paid 10,000 BTC for two pizzas, marking one of the first real-world transactions using Bitcoin.

November 28, 2012: The first Bitcoin halving took place, reducing the block reward from 50 BTC to 25 BTC. This event highlighted Bitcoin's deflationary nature and its controlled supply.

December 2017: Bitcoin's price reached an all-time high of nearly $20,000, leading to widespread public interest and media coverage, as well as the entry of institutional investors into the market.

December 22, 2017: The Chicago Mercantile Exchange (CME) launched Bitcoin futures trading, providing a regulated platform for institutional investors to trade Bitcoin derivatives.

2018-2019: The "crypto winter" set in, characterized by a prolonged bear market and declining prices, testing the resilience of Bitcoin supporters and the broader crypto community.

March 2020: Bitcoin's price experienced a sharp drop in the midst of the COVID-19 pandemic-induced market crash, leading to discussions about its status as a safe-haven asset.

May 11, 2020: The third Bitcoin halving occurred, reducing the block reward from 12.5 BTC to 6.25 BTC. This event reinforced Bitcoin's scarcity and its halving schedule.

2020-2021: A significant bull market emerged, driving Bitcoin's price to new all-time highs, partly fueled by increased institutional adoption and interest.

Elon Musk's Influence: Throughout this period, Elon Musk's tweets and public statements about Bitcoin led to market volatility and discussions about the environmental impact of cryptocurrency mining.

2021-2022: Regulatory scrutiny increased as governments worldwide began exploring ways to regulate cryptocurrencies, leading to debates about privacy, taxation, and the future of the crypto landscape.

October 2022: The launch of the Bitcoin-focused exchange-traded fund (ETF) provided easier access to Bitcoin for mainstream investors.

These events, among others, have shaped the landscape of Bitcoin over the past decade. It's incredible to reflect on the journey and growth of the cryptocurrency.

Overall I wouldn't take anything for the experience and lessons I've learned. I will say to those new to crypto that if you stay in it long enough you will finally be at peace during the crypto winters and flash crashes. You'll no longer stare at you account balance or scream at a chart you have pulled up on coinmarketcap or trading view because you see your investment tanking.

I still accept Bitcoin tips

3GdFEYFL47pYjybbGEABm2MWJSUGCnEtrF

Wow, I can only imagine how cool it would be to buy bitcoin 10 years ago and hold it until today. 😃

It's had its temptations to sell

I can only imagine...

Respect! 10 year into Bitcoin is a „felt century“! 🤯 If you’re up thousands of percent it’s indeed easier to Hodl through the current volatility 👍🏻

Yes it is