It has been ages since I have made a post. Not entirely sure why, but I have just fallen out of the habit of posting regularly. In an attempt to get back to posting, I figured I'd start by looking at the various Hive Engine Income tokens that I am working on accumulating.

Before I start, this post is by no means exhaustive - in fact most tokens will not be in here as I am not overly familiar with what is around. If you have experience or knowledge around tokens I am overlooking, I'd love to here in the comments so I can broaden my options.

THIS POST IS NOT FINANCIAL ADVICE - DYOR.

Image Source: Pixabay

DAB

Image Source: This post by @daildab

The newest entry to the Income token options, DAB is a collaboration between @spinvest and @brofi. The DAB token is currently mintable by holding staked DBONDS, which recently concluded a pre-sale and will become available to buy on Hive Engine soon. DAB will reward holders with a daily HIVE "drip", which should grow over time.

To me it appears DAB is modeled on another similar token called EDS, but with some tweaks to the system. Funds raised from the sale of DBONDS are powered up, then delegated to bring in income. Much of the income is then shared to holders DAB, with a portion used to grow the asset base.

I completely missed the boat early on with EDS, and only recently changed that by starting to accumulate thanks to the second EDS mining token (EDSMM). Fortunately I've learned from that mistake, and got a good sized stack of DBONDs staked, and minting DABs. Here for the long term, to accumulate as much DABS as possible.

Check out @dailydab account for more info.

EDS

Image Source: This post by @eddie-earner

As mentioned above, I completely missed the boat early on with EDS. Saw it come out, from the @spinvest fund that I am a part of, but just didn't really get the token set up. EDS had some very humble beginnings, it took ages to sell the initial token offer (many month if memory serves), to more recent success where the second EDS mining token sold out fast, and if another one gets released it will likely sell out in no time.

Holding EDS tokens provides a weekly HIVE "dividends" and its tokenomics are designed to grow this income over time. The other nice thing about EDS is that there are multiple ways to mine the token. The EDS mining tokens on HIVE Engine are all sold out, and hard to come by at reasonable prices. EDS can also be bought directly on HE, but is also trading well above its nominal 1 HIVE price. There is also a delegation program, where HIVE delegated to @eds-vote will mine EDS - albeit at a fairly low APR.

The nice thing about EDS is that the @eddie-earner account has built a little community of savers, with the "Saturday Savers Club" initiative run by @shanibeer proving very popular. A great initiative coupled with a very well designed income token.

Check out @eddie-earner for more information.

SPI

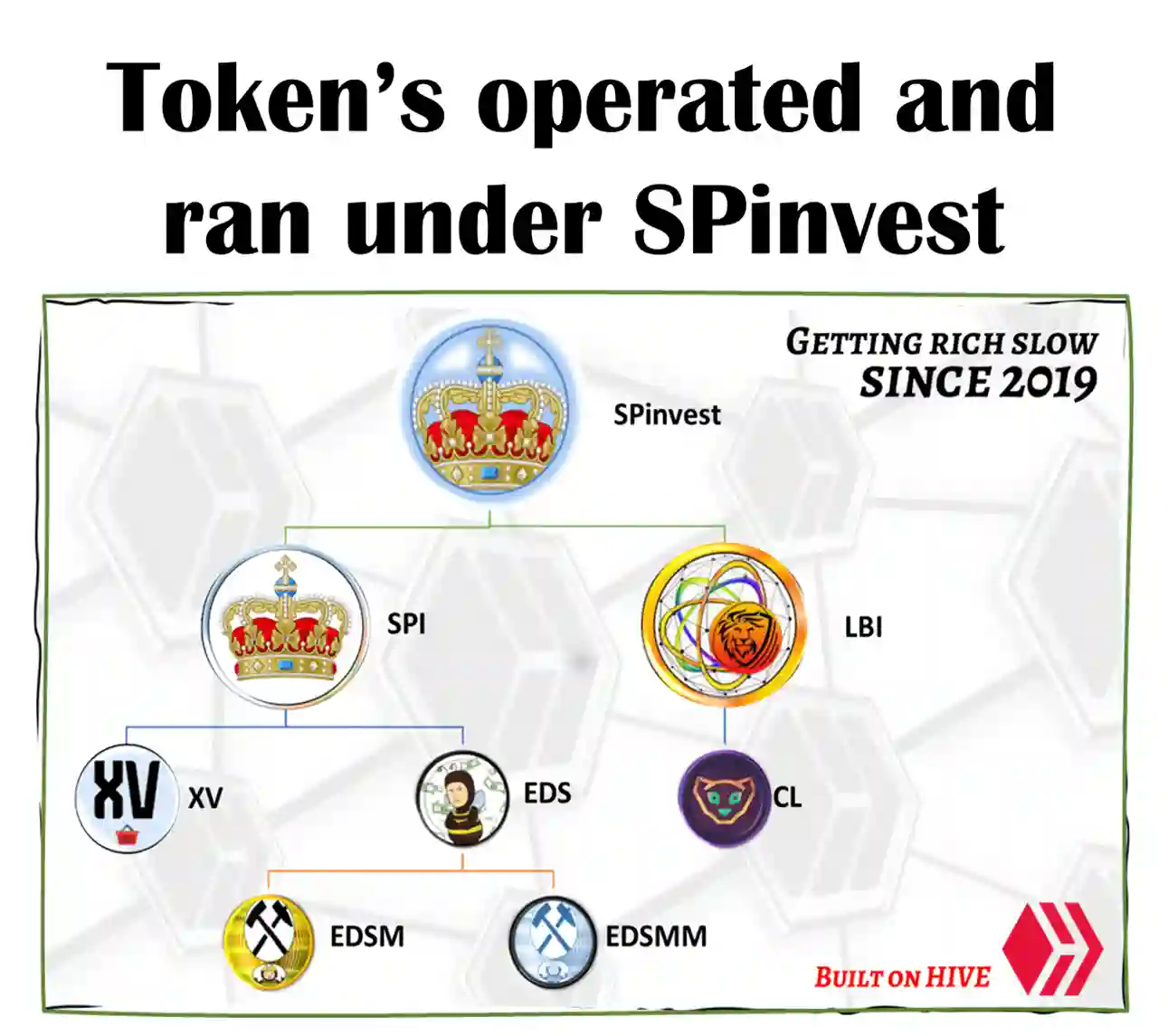

Image Source: this post by @spinvest

@spinvest is one of the original investment tokens that started before even HIVE existed in its current form. Originally on the chain that shall not be named (ST**M), then moving with the community to HIVE. SPI has been (along with BRO) largely responsible for ushering in a range of other tokens.

There are a number of spin-off projects, but SPI is the original. Paying a weekly dividend to holders, but focused on asset growth for the long term. This is mainly a growth investment, with a mid to long term time preference, and a little yield on the side. With a proven track record as a reliable custodian now in its FIFTH YEAR of operations.

SPI tokens can be hard to come by, and the market has periods of low liquidity as holders tend to cling on to their tokens for life. Personally, due to poor fiat financial situations, I have sold most of my holdings. But I am now in a better position, and can return to growing my stack by working and contributing to the project.

To learn more about the original "get rich slow" project, check @spinvest

BXT

Image sourced from tribaldex

Finally, to a token that is not connected to the Spinvest project, BXT. BXT is the native token for the beeswap platform, a HE front end, with its own HIVE/swap.HIVE conversion facility and a focus on swaps through the diesel pools.

The BXT token, when staked, generated a daily HIVE yield which ranges from 10% to 16% APR roughly depending on the token price and activity levels. The nice part is this is "real yield" from income generated by the platform rather than inflationary token rewards. Having said that, there is some BXT token inflation, which is used to provide some rewards to certain liquidity pools.

My strategy.

My plan is simple, accumulate as many of the above tokens into a seperate account creatively named @jk6276.holdings. As I grow the token balance of this wallet, it will produce a completely passive, liquid HIVE income, which should steadily grow over time. That income will become my "cash-out" funds. One thing I have learned over the last 6 years in crypto is to make a plan during the bear market, and then stick to it during the bull. Having failed to do that effectively over the last cycles, I'm trying again this time around with a more cautious, and long term focused approach.

If you have suggestions of other tokens I may be interested in, feel free to shill them in the comments. I'm looking specifically for HIVE income - daily or weekly, not income in the form of inflationary rewards, things requiring active "work", or curation or whatever, or shitcoinery. There is a place for those things, but for this post I'm looking for "real yield" and liquid HIVE income from sustainable sources.

Thanks for reading, I hope you enjoyed this post.

Cheers,

JK.

Posted Using LeoFinance Alpha

Thats such a good idea!

I just have it all of those tokens on my main account and it can be a little hard to see it all sometimes :P

But why don't you have Dbond and Edsmm on your holding account? Is it because they are staked??

Other tokens which produce swap.hive is COM, BBH and Drip.

COM and BBH (Does also gives out Leo if you have more than 10k), have been here a while, but Drip is fairly new.

Drip is interesting. I have had a quick look, but have not deep dived in to figure out how it works yet.

With the Dbond and Edsmm, I kept them in my main account for a couple reasons...

Just a personal preference, and wallet management to remove some temptations to sell things I don't want to. Trying to be more disciplined.

I have started adding SIM to the wallet also, It yields HIVE also at around 28-30%ish, once you hold it for a bit.

Thanks for the comment mate, sorry for the slow reply.

JK.

Drip is interesting. I have just holding a bit and stakig it, they say the invest into Hive games, so many not that bad. I have a few :D

Understandable not wanting to lose Rewards with the staked miners :D

I also sell a bit of dab and eds sometimes :D

Sim, isn't a bad investment. Do you know you can delegate hp now and earn Sim?

dcrops(crop on HE) also yields Hive daily with a APY of 18%

No worries about the late reply :D

Cheers

https://leofinance.io/threads/jk6276/re-leothreads-3btxqjo3s

The rewards earned on this comment will go directly to the people ( jk6276 ) sharing the post on LeoThreads,LikeTu,dBuzz.

Hi there @jk6276, great to see you.

I love EDS. The model is very simple and straightforward, and so accessible for, especially, new savers and investors. It didn't catch on at first and I don't understand why because, at the time, a guaranteed 12% income (in liquid HIVE, too) was better than anything else around and was before the days of 400% for 2 minutes DeFi projects, although I can understand the appeal of these to some people. Complicated seems to interest folks 😁

It is great that it is still possible to acquire new EDS through delegation to @eds-vote. I agree the return is low - maybe 4%-5% - but still not matched by comparable fiat options and carries no risk: your HP is still your own and can be undelegated at any time. The prices that EDS currently commands are a bit crazy (anything up to twice the pegged value), but for investors looking for short term returns, that's a very good offer and creates a much higher APR on HP delegation.

I'm sorry I can't offer examples of other good investments. In addition to a good model, I look for transparency and clear operating procedures. One of the things I like about the SPI family of tokens is that there are clear boundaries between which assets belong to the respective funds and which assets belong to individuals, and fund function and performance is independent of any private, undeclared, investments or subsidy.

I have a very narrow portfolio of investments: the next stage for me will be investing in projects, initiatives and enterprises that have the potential to add value to HIVE and bring new people in. The trading platform that @spinvest has been talking about is quite interesting and might be one of those things: maybe operating like a co-op (by that, I mean the collective SPI model) with a share token to fund it.

Hey Shanibeer, thanks heaps for the comment, and yes Spinvest tokens are what I feel most comfortable as far as investments on HIVE go. Looking back, I am still not sure why I never "got" EDS in the early days, but no matter, playing catch up now. They are hard to come by, and that shows the value that people place on EDS is far higher than the 1 HIVE asset backing.

Posted Using LeoFinance Alpha

Great to "hear" from you again @jk6276! 👍 I also have not posted in quite some time ... Whenever the urge strikes, I lay down until it passes ... 😂

Seriously ...

Great topic. Where best to invest our hard-earned $$s for a return ... For myself, I have turned all my attention to investing outside the HIVE blockchain, with a keen focus on the upcoming launch of Layer One X, which originated from the efforts of a team consisting primarily of your countrymen ... 👍

P.S. If I write another HIVE post, this upcoming launch may provide me the needed incentive. We'll see ...

The Layer One X launch is interesting, and I'll keep an eye on it, even though I don't have funds to put in. Back in grind mode, have sold so much crypto out to fiat in the last 18 months that I am back playing around with $100 bucks here and there these days. Only way I'm rebuilding my portfolio is through grinding it out - and that means getting back to posting for me.

My Cosmos stuff has also faded badly, and I'm restructuring to focus more on quality rather than shitcoinery, and building up collateral in lending platforms (like Mars protocol), so that when the need arises I can borrow funds to go to fiat, instead of selling things.

Always good to hear from you mate, I do hope the L1X launch is a great success for you.

Posted Using LeoFinance Alpha

Very sorry to hear of the status of your crypto portfolio, but I can relate. Way, way down all over, for most anyone. It's painful, but ... For some silly reason, I still have some long-term hope about its prospects. Delusional? 🤷♂️🙂

Yes, my Aussie friend ...

... I wish I could say otherwise, but ... Nope. All mine is badly faded as well. Very badly hurt by the carnage of the collapse of Do Kwon's "empire" and never really recovered much at all, over a year later.

I just recently elected to exit my 2nd to the last LP on Osmosis, to move that bit remaining over into position for the anticipated opportunities on L1DEX, the "official" DEX of Layer One X.

We'll see what happens, soon enough. I'll keep you posted. Always great to "hear" from you. Until next time, all the best to you and yours, for a better tomorrow! 👋