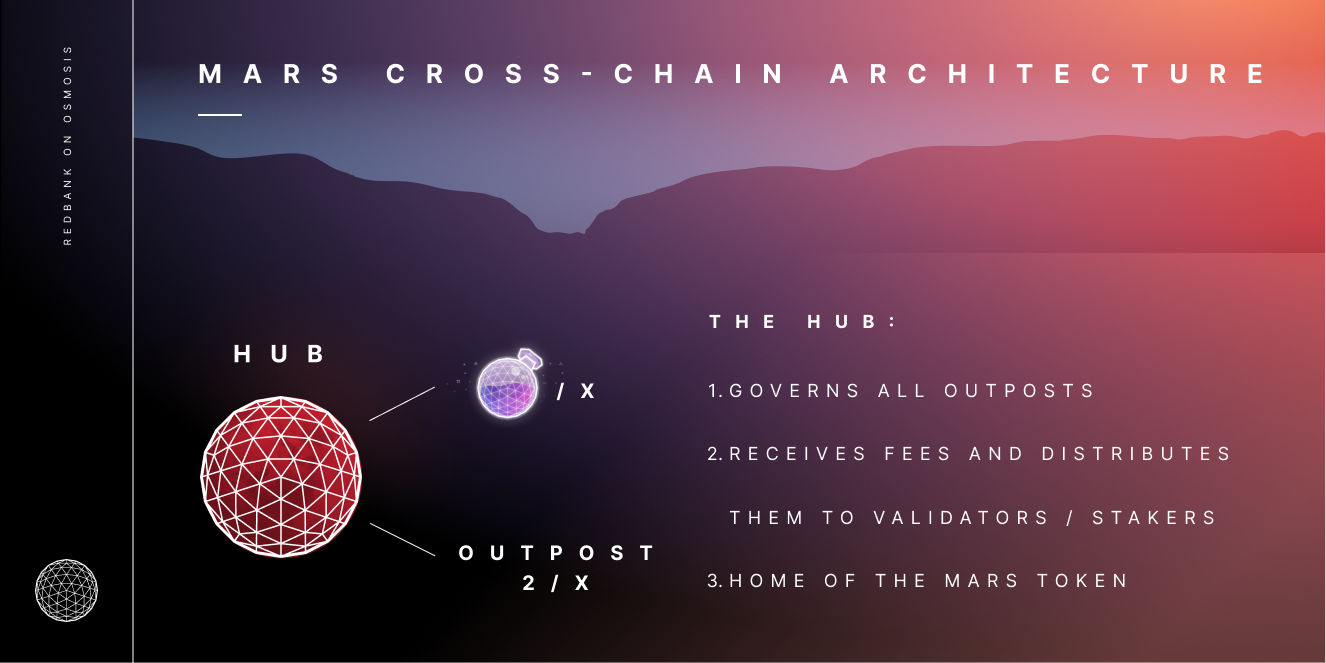

MARS Protocol is a lending and borrowing platform for the Cosmos eco-system. Originally built on Terra, the team behind it went back to the drawing board after the collapse of UST/LUNA. Deciding to launch their own chain, and adopt a Hub and spoke model, the first outpost in this new MARS design is based on Osmosis.

The MARS blockchain.

Launching their own Cosmos SDK based, IBC enabled chain gives MARS stakeholders a home base. The MARS token's utility is similar to most in the Cosmos - governance and staking rewards. The MARS Hub blockchain launched at the end of January this year, with an airdrop for users of the original MARS platform on Terra.

The plan is to launch the MARS platform as "outposts" on multiple chains with liquidity, dex's and so on, to add a borrowing and lending platform. Obviously borrowing on these platforms brings in interest revenue to the protocol. 80% of this will be returned to the lenders, as interest on their deposits. 10% will go to MARS chain and build a "safety fund" to be used in the event of a major issue, breach or so on. The remaining 10% will be used as staking rewards for MARS stakers.

Obviously, the more these outposts get used, and generate revenue, The more stakers will earn rewards. For the first 12 months, this staking reward is supplemented from funds from the community reserve, as staking is important for chain security and protocol revenue in the early days will likely be insufficient to adequately entice stakers.

Outpost 1: Osmosis.

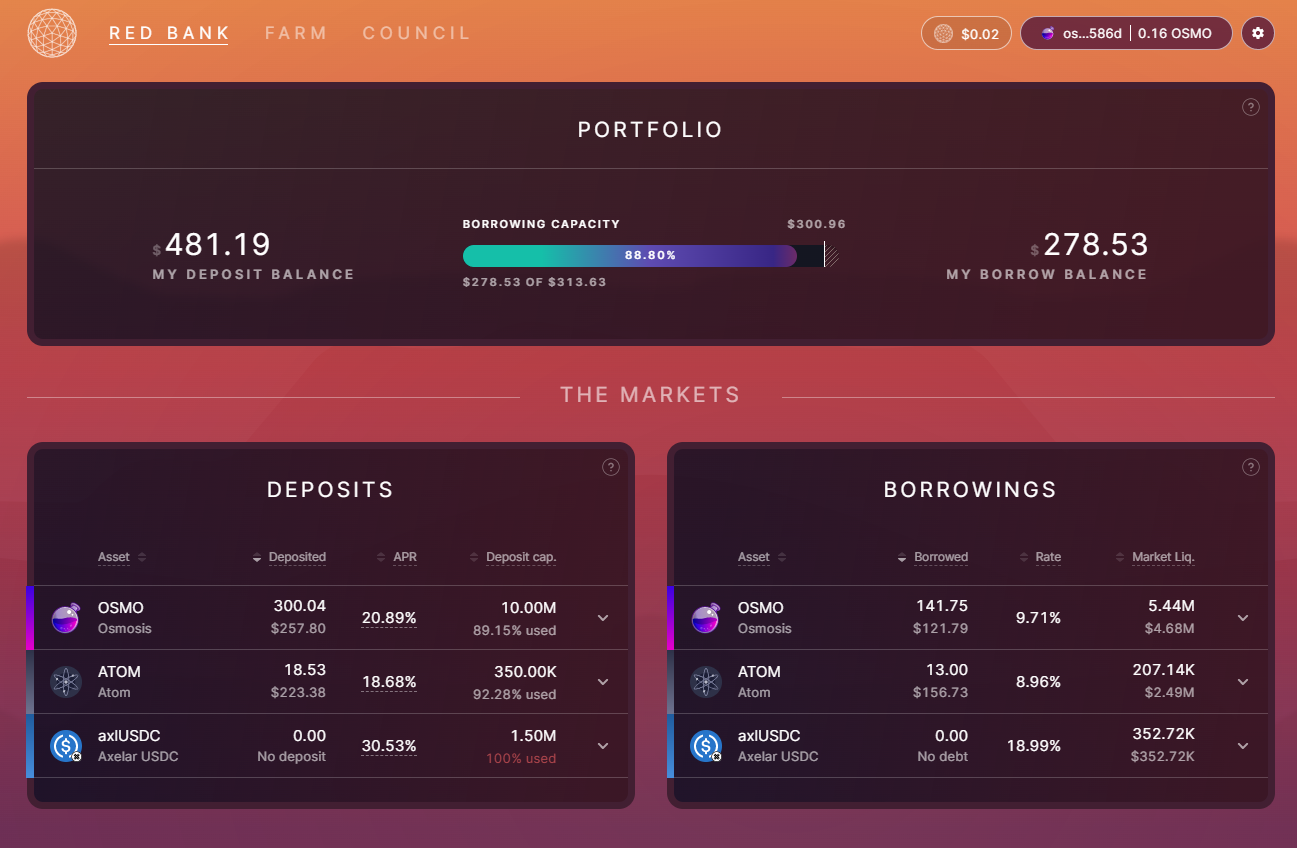

The Red Bank has been deployed on Osmosis. The first outpost has been deployed, and is live now. You can find it here. Initially launched with OSMO, ATOM and USDC as collateral and borrowing options. More tokens will likely get added, with an upcoming governance proposal looking to add liquid staked ATOM (stATOM) through the Stride platform.

The above screenshot is my dashboard on MARS currently. You can see I have added some deposits in of OSMO and ATOM, on the bottom left hand side. Deposits earn in two ways currently, they accrue interest (compounded into the deposit) from the borrowers (the 80% mentioned above). This current earning rate is around 2.5 - 3% for ATOM and OSMO, and much higher for the lucky few that snuck in with USDC before the caps were hit. One user had bots or a contract or something ready, and deposited and pretty much filled the whole cap after an increase with multiple loops in a single block.

On the bottom right of the screenshot, you can see I have also borrowed some funds, again in ATOM and OSMO. Obviously these are secured loans, so you have to be a depositor to become a borrower. My deposits are at risk of liquidation if the position deteriorates due to adverse price moves.

Up the top, next to the address and wallet connection bar, it the mars rewards center. Depositors are incentivized in the early days with MARS token emissions in addition to the interest earned. This makes up the bulk of the earnings for depositing currently.

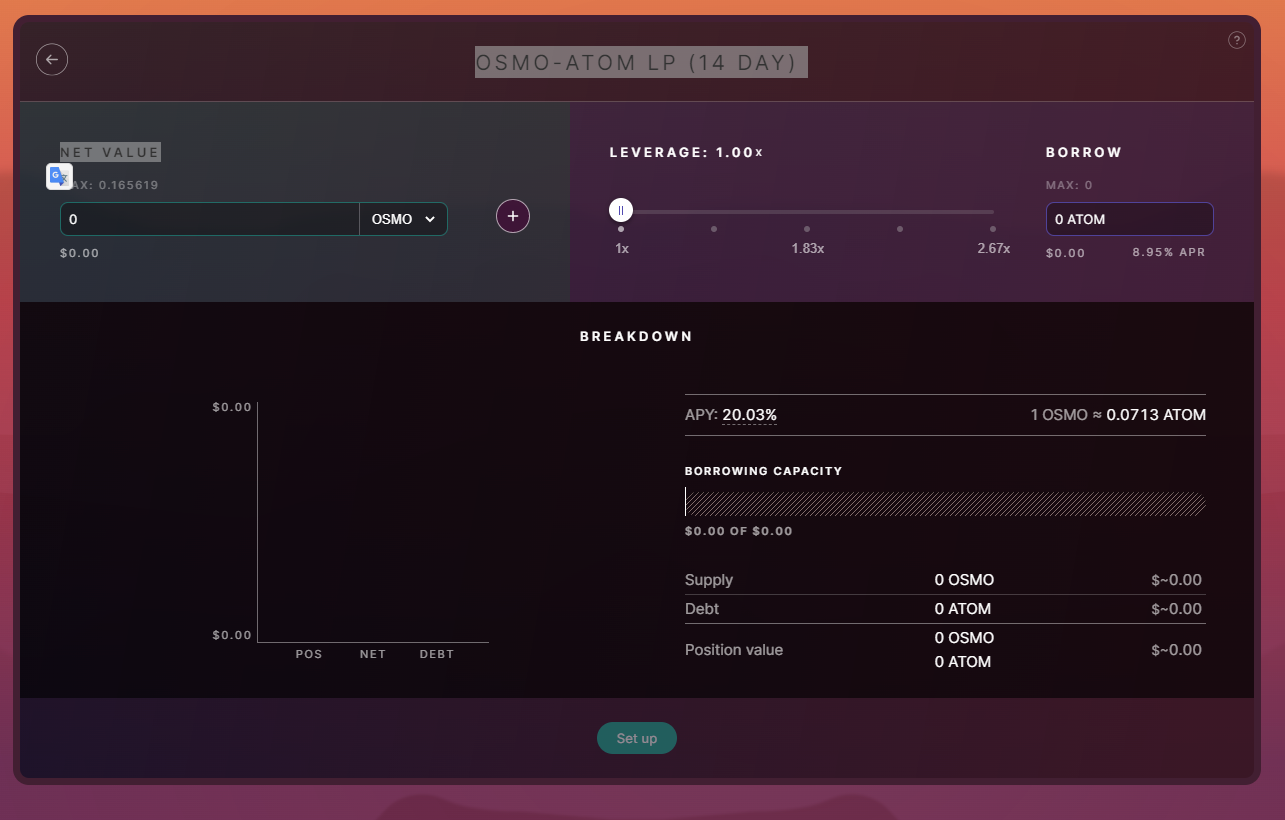

The next addition to the Mars outpost on Osmosis has also recently gone live. The farm tab currently has two LP's on Osmosis that you can leverage, to boost yield and risk. I have not used this, so can't really comment.

You can read more about these farm vaults, in this post. The strategies have been developed in conjunction with Apollo DAO, another former Terra based project.

What comes next?

Next up for Mars protocol is likely to be the addition of stATOM (Stride's Liquid staked ATOM) as a collateral that can be deposited in the Red Bank. This is likely to be an attractive option for many, as stATOM deposits will be generating their own yield (the steady growth of the token value relative to liquid ATOM) along with their value as collateral. Over time, I would expect more liquid staking tokens to emerge as options for Mars.

The leveraged vault mentioned above are also likely to expand the offerings and range of options available.

More outposts, on other IBC chains are likely in time. It will be interesting to see what chains they consider. They may launch on their historical home base of LUNA, JUNO, EVMOS or Crescent are other options. I guess it will come down to liquidity available and the standard of Dex's they can link to.

The other big launch expected later this year is of a product called "Rovers". Mars rovers, to my understanding, will be a cross chain strategy with a credit account, represented by an NFT. Here is a quote from Mars docs section which explains it better than I can.

Rover credit accounts enable users to trade and farm with leverage across DeFi strategies & protocols all in one account with a health factor and cross-collateralised assets. Users can draw leverage by borrowing from the Mars Red Bank in their credit account and use it to interact with governance-whitelisted external contracts.

Credit accounts hold a user’s assets and compute a health factor based on the value and riskiness of the user’s positions, as determined by on-chain data and the Martian Council, respectively. In a similar vein to the Red Bank, if this health factor drops below the minimum threshold, a liquidation engine incentivises third parties to repay the debt and keep the system solvent. Mars v2 designs limit the credit account, which is represented by an NFT, to interact only with whitelisted contracts in order to avoid users exfiltrating borrowed funds.

A user can have one or several credit accounts, each of which are represented as an NFT. NFT accounts open up an exciting world of possibilities, which are explored below.

The architecture is modular and extensible, allowing new protocols and integrations to be added easily.

My plans

At the moment, I am building my MARS stake position from collecting and staking the rewards from the above deposits I have made. Slowly I am shifting some assets in to build my deposits. The goal is to keep building deposits, and gradually pay down the debt I have taken out currently. I have been inspired to get involved and focus on growing this position by @khaleelkazi's video about collateralized Bitcoin loans.

I'm personally bullish on the MARS protocol in the long run. Short term I can see the price slowly fading lower, as many cosmos eco-system tokens do. Token emissions and incentives are farmed heavily, and often sold consistently. Once the protocol moves to sustainable, revenue based rewards, it becomes realistic to see growth. During this ramp-up phase, MARS may be weak for a while. In the end, distribution and the above process will move the tokens from farmers to those building long term positions. My goal is to be in the later group.

None of this is financial advice, please do your own research.

Thanks for reading,

JK.

P.S. I wanted to end by drawing attention to two posts from a relatively unknown LEO poster @kaaskop, with some excellent detail about LSD (liquid Staking Derivatives - not the other LSD).

Posted Using LeoFinance Beta

~~~ embed:1633645114491916291 twitter metadata:MTQxMzEzMTY4MjQyMTQ5Mzc2MXx8aHR0cHM6Ly90d2l0dGVyLmNvbS8xNDEzMTMxNjgyNDIxNDkzNzYxL3N0YXR1cy8xNjMzNjQ1MTE0NDkxOTE2MjkxfA== ~~~

The rewards earned on this comment will go directly to the people( @jk6276, @thetyper ) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

Lol - I saw the picture and the title, and I thought that was going to be about building an actual base on the planet Mars - so I was rather excited. Still a good post about the Mars crypto-system, but I guess I'll just have to write the planet post myself !!!!

!LOLZ

Posted Using LeoFinance Beta

lolztoken.com

Luckily my injuries were only super fish oil.

Credit: reddit

@jk6276, I sent you an $LOLZ on behalf of @hoosie

(3/10)