EVMOS launched with much fanfare and promise, with the concept of full EVM compatibility combined with the benefits of a chain linked to the Cosmos and IBC eco-system. So far, however, it is fair to say that the DeFi scene on EVMOS has been underwhelming. With only $2.5 million current TVL, and the only protocol showing any signs of life being SpaceFi, which I had not heard of before looking at the DeFiLlama page for EVMOS.

So what's the problem?

In a word, yield. Yes there has been issues with projects, and a pesky bridge hack that stalled any momentum, but the bigger problem is tougher to resolve. Staking yield on the EVMOS native token is still insanely high. It becomes incredibly difficult to attract liquidity to a Dex, when the simple staking yield is so high. The only way really for a protocol to effectively buy TVL is through very large token emissions of its own native token. These result in the token being inflated into oblivion as farmers dump rewards as fast as they can.

High yield incentives for LP's is trap. The rewards token supply is rapidly inflated to generate an APR that is sufficient to entice people to provide liquidity instead of simply staking their tokens. The reward token is generally sold off by the majority of farmers, pushing the price on an ever downward trajectory. Eventually, TVL declines as the farmers move on to the next shiny new thing with huge APR, and the Dex fades away.

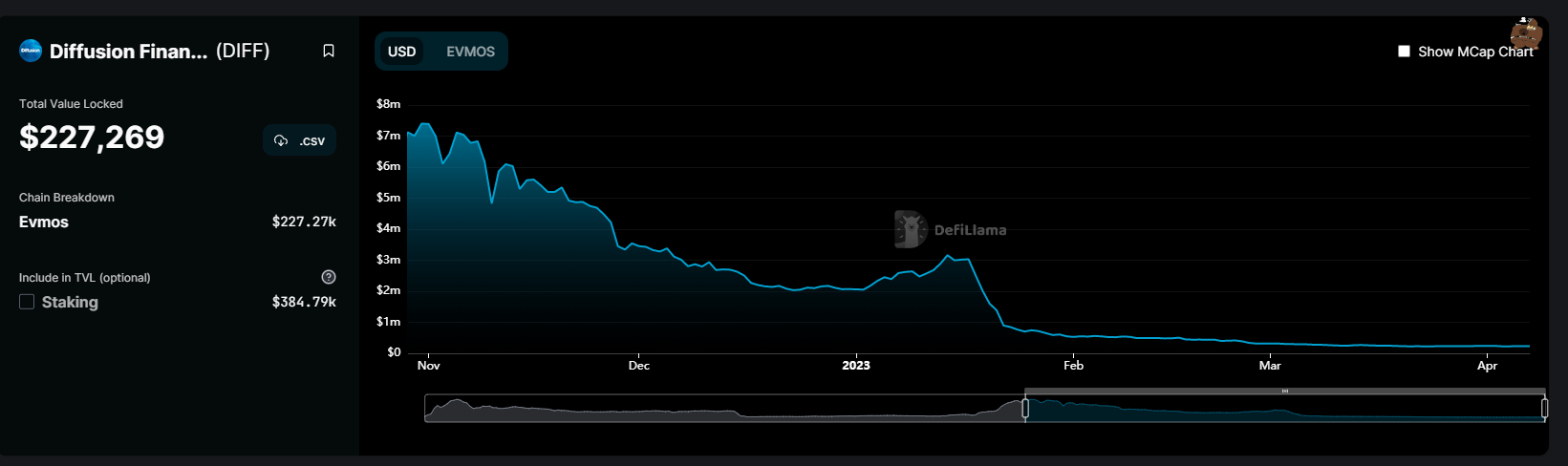

Lets look at Diffusion as an example. As a Dex on EVMOS, it suffered from the bridge exploit, and never really recovered. The native token, DIFF looks like most farming tokens.

A look at the TVL on the protocol tells a similar story;

So, what's the answer?

The EVMOS team have funded the development of a new Dex, to be built as a public utility, rather than a separate dApp. The fruits of that decision are going live on mainnet in a few days. ForgeDEX will be a Uniswap V3 fork, with a focus on the LSD versions of major Cosmos eco-system tokens. Announcing a partnership with STRIDE, the leading liquid staking protocol in the Cosmos. Forge will use the Stride liquid staked version of EVMOS - stEVMOS - as its base token. To get an insight into Stride, here is a recent post of mine.

The focus on LSD tokens greatly reduces the liquidity incentives needed. The stTOKEN's accrue their own staking rewards, so the foregone income from pooling liquid tokens is no longer an issue. Any incentives are just an additional yield, so don't need to be anywhere near as inflationary. The other part of the plan is the use of Uniswap V3's concentrated liquidity pools. This should also reduce the amount of incentives required, in theory.

Personally, I think this is definitely an improvement for EVMOS. Having a primary dex for the chain, focused on LSD tokens will make this Dex an appealing alternative. Their are no plans for a native token of its own (no FORGE token), EVMOS (and/or stEVMOS) will be the focus.

Who benefits?

The EVMOS community. A native Dex with decent liquidity is sorely needed for EVMOS. Other attempts have been unsuccessful, but Forge offers the best hope for success imho. Improved liquidity, LSD adoption and utility should give EVMOs a new base to build from.

Stride. The Liquid staking provider could be a huge beneficiary if this platform becomes a success. This use case for LSD tokens will drive adoption, helping build Strides TVL and boost income for STRIDE stakers.

Other protocols. Success of this Dex could feed other Cosmos eco-system projects. Mars in particular could be a beneficiary, as a strong and reliable Dex on EVMOS would make launching a new Mars outpost (similar to their one existing on on Osmosis) attractive.

Overall, I see this as a very positive move for EVMOS. The chain needs a solid Dex, and current options have fallen short. A Uni V3 option, with concentrated liquidity, and liquid staking derivatives as its primary focus is a smart move in my opinion. My hope is that is succeeds, and gives a boost to both my EVMOS bag, and my STRIDE position.

Stay tuned for an early review once it launches on mainnet in a few days.

Thanks for reading,

JK.

Posted Using LeoFinance Alpha

The rewards earned on this comment will go directly to the people( @jk6276 ) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

https://leofinance.io/threads/@jk6276/re-leothreads-2tkcne4ze

The rewards earned on this comment will go directly to the people ( jk6276 ) sharing the post on LeoThreads,LikeTu,dBuzz.

I am not sure what caused the birth of Canto and the free public infrastructure DEX, but it sounds like the issues on EVMOS caused the Canto fork... Good on EVMOS to steer in a better direction. I have been LP'ing on Canto for a while, I might need to jump into EVMOS at this juncture as well.

Thanks this is really interesting and a good letture...as we are waiting for the early review on Mainnet

Hey, I noticed you used Threads back in [MONTH in the spreadsheet]. The User interface works better now, maybe you want to give it another try!