The sound alarms have been rung, and all of a sudden, we have quickly been reminded of the lesson that we do not have enough Bitcoin. Throughout the last week, it has become more and more evident that not only there is a good chance of BlackRock’s Bitcoin spot ETF being approved, but that it is becoming more of a certainty. When powerful people know information that others are privy to, that is when prices begin to rapidly move.

And that is exactly what has been happening throughout the last week. At first, there was a CoinTelegraph article that was released declaring that BlackRock’s Bitcoin ETF had been approved. Which sent the price of Bitcoin soaring up by thousands of dollars in mere minutes. Only to be discovered to be false, which would send the price plummeting back down to where we started.

There’s a very high chance the article was based on undependable sources.

However, this leak of the ETF being approved sent the market into a state of FOMO. When everyone saw how the price reacted in a short time based on the fake news of the approval, we all quickly realized how bullish the future would be. While that news may have been fake; most of us are in agreement that at some point in the very near future, the Bitcoin spot ETF will be approved.

This small preview that we witnessed sent us all into a panic mode that we don’t have enough Bitcoin, and that our time to accumulate will quickly be coming to an end.

Most people would consider the previous bull cycle a disappointment due to the endless amount of self-inflicted wounds by this industry that clipped the wings on just how high prices were able to go. With that said, there is no denying that the price of Bitcoin, Ethereum, and other cryptocurrencies still became expensive.

People quickly forget this and aren’t appreciating how low prices still are, and how much easier it is to accumulate crypto for your portfolio. If you wanted to accumulate 0.01 BTC today, it would cost you just around $340, but at the peak of the market that would require $690. If you want 0.01 ETH it would cost you around $18 today, but would have cost about $48 near the peak. To reach your accumulating goals, truly began costing an arm and a leg.

And now the bull cycle is beginning to swing its way again.

The rumors of the BlackRock ETF being a near certainty to be approved are everywhere. Crypto YouTubers are spouting talk about a “God Candle” coming to Bitcoin whenever the ETF is finally approved. One thing is for certain. The entire mood of the market has changed, and everyone knows it.

And this is all before the ETF.

Most people aren’t like me and you. Taking charge of our own investing and doing everything independently. Investing on our own, and developing our own strategies down to every detail. Most people just invest through their 401k or IRA. For that reason, until now Bitcoin has been out of reach for them. This goes for companies as well. The Bitcoin ETF being approved in the US will open it to a potential of several trillions of dollars, and that will only be the beginning.

If that weren’t bullish enough; the world outside is crumbling. While everything else has been performing awful. Bitcoin has been soaring. And the world is beginning to take notice. It has returned to being an un-correlated asset.

It seems like everything is lining up to be a perfect storm of events for Bitcoin. The ETF will likely soon be approved. It is performing well while everything else is doing the opposite.

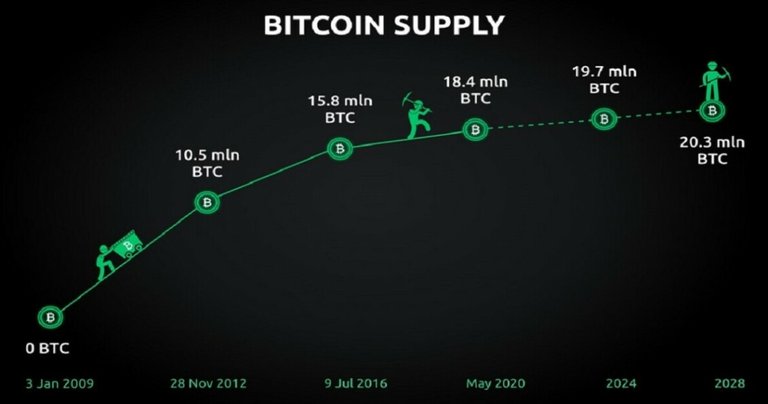

But most of all, the next Bitcoin halving is quickly approaching. Over the history of Bitcoin, the halving has traditionally been the catalyst that jumpstarted each bull cycle. The halving, along with the spot Bitcoin being approved, and also the finance world moving into BTC while other assets are crumbling present a perfect storm set-up that could make this bull cycle something special.

It is always important to keep in mind that nothing is guaranteed in Bitcoin. It has a tendency to be a contrarian and do exactly the opposite of what everyone expects. One such example is how prices never reached the heights that everyone thought they would during the last cycle.

While none of this is guaranteed, there is one certainty that you can count on. Once this bull run gets started, we will all be feeling the FOMO, and wishing that we had accumulated harder. If this is the cycle when Wall Street finally enters the market and Bitcoin goes mainstream; this could result in prices going much further than any of us could imagine. Meaning these next few weeks and months truly could be one of our last chances to accumulate and build a portfolio while everything is cheap.

How about you? What are your predictions for the next Bitcoin cycle?

Read Exclusive Articles 1st on

or

As always, thank you for reading!

Congratulations @johnwege! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 900 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out our last posts: