Whenever the price of Bitcoin spikes and we see BTC all over the news feeds, there is a rush of speculation and new entrants into the market. We can see this happening from a variety of metrics — Coinbase account signups, on-chain transactions, volume or even your personal text messages.

The majority of people tend to take a look at Bitcoin only during these major media coverage moments. The 2020 halving event provided a major moment for Bitcoin as many of us expected. Still, I’m seeing a wide range of people continually asking about Bitcoin & crypto.

The top question on their mind: Is it too late to buy Bitcoin?

After getting some interest again from family/friends, I wrote this post as a response to the question above for LeoPedia. LeoPedia also has the audio podcast version of me answering this question at https://leopedia.io/is-it-too-late-to-buy-bitcoin/

I’m writing this in June 2020. Of course, this question has been asked and answered many times over the past decade and will continue to be asked for the next decade to come. So if you’re reading this after June 2020 and are asking the question “Is it Too Late to Buy BTC?” then know that from a fundamental sense; not much has changed. The principles of buying Bitcoin that I talk about here will remain relevant for the years to come.

Where Bitcoin Stands Post-Halving:

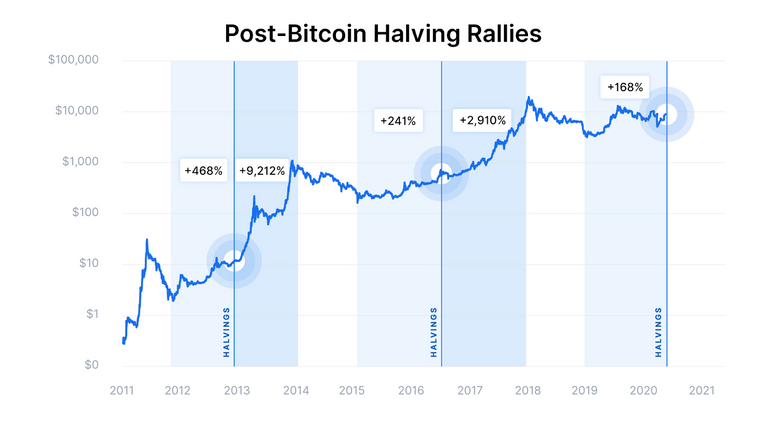

The Bitcoin halving — where the incoming supply of new Bitcoins was cut in half from 12.5 to 6.25 per ~10 minutes — occurred in mid-May 2020. These Bitcoin halvings occur once every four years (so the next one will be in 2024) and bring about a great degree of media attention, data analysis and speculation about the future price of Bitcoin given the positive shock to the supply of incoming BTC via inflation.

Sources: Blockchain.com, Pantera Capital

This chart outlines the price moves following halvings. Notice that when the halving occurs, not much happens. It often takes time for the market to adjust to the inflation-shock event and push to new highs. For example, it took over 500 days for Bitcoin to reach new all-time highs following the 2016 halving event — this is when Bitcoin reached the infamous $20k level at the end of 2017 and kicked off a major boom in the crypto industry.

As I’m writing this, Bitcoin is sitting around $9,500. It’s been relatively stable since the halving and has defended its $9k to $10k price level. Obviously, we could see Bitcoin pop in either direction. I think most people in the space are expecting a pop one way or the other sometime soon.

The question remains: is now a bad time to get into Bitcoin?

My answer continues to be no — it’s always a good time to get into Bitcoin. However, getting “into Bitcoin” means different things for different people. I want to frame the idea of getting into the Bitcoin space in a different way than most people tend to look at it. The rest of this article will explain how and why you should get into Bitcoin today (regardless of whether today is in June 2020 or in June 2025).

Not Just a Speculative Investment:

When you’re coming into the crypto space, it seems to be all speculation. People who’ve been in the space for a while and people who loosely pay attention to the space tend to spend the vast majority of their time focusing on the price of BTC today and the future price of BTC tomorrow. Their goal is to buy it for $9,500 today and sell it to someone else for $12,500 tomorrow.

While that’s great in theory, it is impossible to predict the price of Bitcoin. No matter how many tools you use or how many research analysts back your trade ideas, there is no reliable way of predicting the Bitcoin market. If there was, then you’d be better at printing money than the central banks and you shouldn’t even bother reading articles like this.

For this reason, I push the ideas of treating Bitcoin as more than a speculative investment and also to invest slowly over time (if you invest at all – we’ll explore that more in the section that follows this one).

Bitcoin is a new form of money. It’s a new form of value transfer. It’s a storehold of wealth and it isn’t controlled by any central entity.

It’s a truly non-sovereign form of currency. Therefore, treat it like a currency. Most people don’t go around speculating on the future price of USD (or whatever denominated currency you use locally) – they use it while a niche subset of investors (i.e. forex traders) speculate on the value.

Instead of speculating, the average user has a job. They earn USD and then they deploy their earnings toward investments, bills or whatever else they need to use their money for.

Don’t get me wrong — buying Bitcoin and sitting on it is likely to be a great investment. Akin to buying something like Gold and sitting on it for a few years and waiting for the price to rise with time (but more volatile to both the upside potential and downside potential).

To me, Bitcoin isn’t just about speculation. It’s a way to send money across the world in minutes. A way to store wealth in a vehicle that isn’t controlled by Central Banks or Wall Street. A way to pay for things and a way to receive payment for things.

It’s a global currency that has a predictable supply. We know that there will only ever be 21 million Bitcoin. We also know that Central Banks can print their currencies into oblivion.

When I earn 1 Bitcoin, I know that I’ve earned 1 Bitcoin and that it will be worth exactly 1 Bitcoin in 20 years. In contrast, when I earn 1 USD, I know I’ve earned 1 USD today but I also know that USD has an unpredictable monetary policy and therefore, an uncertain future. 1 USD is never just 1 USD in the future. It is 1 USD adjusted for unpredictable inflation at the behest of the Federal Reserve.

If you take the time to analyze the history of money, you’ll see the great devaluation. Every single currency in history that has been issued by a central authority has devalued over long time frames. Central Banks (or whoever issues the currency) can’t help themselves. They issue too much of the currency and eventually, they wipe out the value that the currency holds.

Bitcoin is programmable money. We know what the inflation rate is and we know that nobody can just go into the system and edit their bank accounts (much like the FED does with the U.S. Dollar — adding trillions of $ to their balance sheet at will).

From now on, when you think of Bitcoin I want you to think Currency. Not just investment. I am an investor in Bitcoin but I am also a user of Bitcoin. It is my preferred denomination of currency — if I pay you for something or you pay me for something, I prefer to transact in Bitcoin.

To sum this section up – when I get paid, I get paid in Bitcoin. I know that Bitcoin is a scarce asset with predictable inflation. In the future, the 0.1 BTC you paid me to do X is going to be worth 0.1 BTC.

Don’t Just Dump Your Money In:

Now that I’ve (hopefully) drilled the idea of Bitcoin as currency-first, investment-second into your head, I’ll address the actual practice of buying Bitcoin.

The practice of buying Bitcoin can be looked at in many ways. I always tell newcomers to the space that they shouldn’t just dump their money into Bitcoin on a whim. They shouldn’t look at the price and try to “time their entry” and then when they think the time is right, dump their life savings into BTC.

Again, I think the best practice is to think of BTC more like a currency for the long-haul as opposed to a short-term speculative vehicle.

If you look at BTC as something that you want to opt-in to — something that you want to use as a currency/storehold of wealth for years to come — then you should be buying BTC with a small % of your “weekly paycheck” on a regular basis.

If you have a job and get paid weekly or bi-weekly or monthly, then I would say pick a small % of that paycheck and buy BTC each week/2wk/month programatically. Don’t overthink it and don’t dump your life savings into it all at once. Many crypto exchanges have even implemented programmatic buying as a feature so you can even automate the purchasing of BTC 1x a week or 1x a month, etc.

Remember that saying? Slow and steady wins the race.

Don’t be the person who dumps their life savings into BTC at the height of 2017 at $20k only to watch it fall to $3k in the following year and feel like you got duped.

Instead, be the person who opts-in to the Bitcoin/crypto ecosystem by taking “1-20%” of your paycheck each “week” and average in at “$6k” throughout 1, 2, 5, 20 years.

We don’t know what Bitcoin’s USD valuation will be tomorrow but we do know that is a scarce asset with a fixed monetary supply. The smartest people in this ecosystem have learned to treat BTC like a currency and pay/get paid in BTC.

The Verdict:

It’s never too late to “get into” Bitcoin. The key is learning the difference between opting-in and buying-in. Rather than try and time the market, aim to slowly and programmatically accumulate a position that you’re comfortable with. Treat it like a currency and combine that programmatic accumulation with a curiosity to learn about BTC and why it matters.

Posted Using LeoFinance

Now this is certainly a $50,000 dollar question, or perhaps in the case of Bitcoin a $20,000 dollar question. I certainly remember the lucky ones who bought Bitcoin when it was pennies, but also the ones who bought at 20,000 USD. I think if your a longterm investor the time is always right to buy, with the caveat that while it’s difficult to predict the bottom, I like to buy during pullbacks. I don’t worry if the pullback continues because I don’t shoot my whole wad at once. I think regular purchases allow price averaging in the longterm for a decently priced basis. Great timing for this article and certainly a very poignant issue!

Posted Using LeoFinance

I like to BTFD - as they say. As the world realizes that fiat currencies are failing them, they will look to assets like Bitcoin. I think we're still in the very nascent stages of BTC/Crypto's development so while I think it's a great time to invest fiat into this ecosystem, I also think the least everyone could do is spend some time to learn about it :)

Posted Using LeoFinance

Very true. How was your experience on the MakerDao? I think creditdebtfacilities are just one fascinating aspect of DeFi and I am currently investingating something you may want to learn about. I think this idea is potentially the future of gaming and I like How Satoshi gaming is working with Blockstream to combine several good ideas into one amazing product stream with the game, the store and the platform for duplication of this model.

https://peakd.com/hive-167922/@shortsegments/bitcoin-lighting-network-nft-s-and-financial-opportunities-in-a-new-micro-economy

https://peakd.com/hive-169547/@shortsegments/light-nite-and-in-game-bitcoin-rewards-how-this-works-a-non-technical-overview

Excellent article and I fully agree on your point of Bitcoin is something which you opt-in to. We have seen the various fiat currencies failed over past centuries. In our era, the decline of fiat system started since Richard Nixon took the USD off the gold standard in 1971. Since then, we did not have an alternative currency to fiat and this was finally changed with the invention of Bitcoin.

Not only do I see Bitcoin as a hedge for the failure of fiat currencies, it is also a censorship-resistant way to move value (or money) around the world. This is an increasingly needed service as we see more governments surveillance and censorship on their people.

We are in the midst of the grand "fiat experiment" - as I've heard many call it. I agree 100%. While BTC is not perfect in terms of fees, speed and privacy, it beats the hell out of the current regimes that govern global finance.

I don't even know where you live/what your real name is, but we can send value to each other in a trust-less, transparent and near-instantaneous way. That's a financial revolution

Posted Using LeoFinance

Excellent article @khaleelkazi !Will help a lot of people to get into the world of cryptocurrencies and understand better what happens.Great job!

Posted Using LeoFinance

Well written. Super-well explained. Very good advice (in my personal opinion) though I could speculate the wheels off my own investments and crash it into the floor on a good day. :) I'm getting much better. The first step was a step back from margin trading. SHeesh!

Great post,

Thanks.

Thank you! haha margin trading is a cruel mistress. I prefer to focus on the ultra long-term when it comes to crypto as it's already plenty volatile

Posted Using LeoFinance

Bitcoin Doubling Curve

I dun know... I feel like the doubling curve is pretty accurate.

IMO anything less than 13k is a steal in 2020.

Posted Using LeoFinance

Awesome article khal.

I also think that the best approach is with a 20-30% of your paycheck every month/week.

I also like to think in fixed amounts.

In Spain the minimum wage is ~700-800€

I 'encourage' to try with something small like 25€ every week.

25€ = 1 'medium-priced' meal at a restaurant or a 'cheap party night'.

25*4 = 100€ month = ~15% of your monthly wage.

Everyone can afford that.

Not to mention that you can always recover your money (with profit or losses). You're not burning it.

Kudos to you :)

Posted Using LeoFinance

Solid, sensible advice on investing, not just bitcoin investing.

There is another way to earn some Satoshis without even risking any of your hard-earned $. Note that I did not say bitcoin but Satoshis, but it is free. If you want to earn more than a few satoshis, you can earn more by referring your friends. Long term it will all add up. We are in it for the long haul, aren't we?: https://peakd.com/hive-167922/@successforall/poor-man-s-bitcoin-building-your-own-bitcoin-mining-pool-for-free

Posted Using LeoFinance

Very good insight into the market, keep posting good articles and motivate us and spread more thoughtful information about #Bitcoin which will help all of us :)

I do like the idea of allocating a small part of the paycheck every month.

That's what I've been personally doing since the last year

Posted Using LeoFinance

Very good advice there. Thanks for the insight.

I used to buy every month, then every week, now I wanna buy every time I watch news from the US!

Posted Using LeoFinance

Very sensible advice here, and I must say thanks for actually giving concrete advice, one thing I cannot stand are technical analysis posts that end up saying X could do go up or down thus I advise doing nothing because 'this isn't financial advice'.

Kraken is a real godsend for me for buying in gradually - very easy for me to transfer Euros for no fee! I tend to just send over 50-100 Euros every now and then, which I hardly notice, so happy days.

Also, when you can stake BTC/ LTC etc. for a 5% return on various projects, it's like the fiat interest rates of old, rather than the dismal 1% or less ATM!

If BTC is good for transfers, what dyou think of LTC? The fees are just so much lower - it cost me $13 to transfer a few grand of BTC over to a different wallet the other day, not best chuffed with that rate I must say (had a security concern so I had to do it).

But LTC, I've been holding onto that alongside LTC precisely because I think it's a better transfer coin because of the much lower fees - that hasn't worked out so well in the last months, something like a 15% relative loss compared to BTC.

Overall I agree, it's probably still a good time to keep snaffling up a bit more BTC.

Posted Using LeoFinance

Spread the word 🦁

Posted Using LeoFinance

I think it is not too late because everything in this field is very dynamic. But people need to be very cautious about their investments.

Agree with you there - nobody knows and there are always good and bad times.

I think the best thing we can teach no-coiners is that they should first-and-foremost learn about crypto and then second to buy in very tiny amounts and over long-time frames

Posted Using LeoFinance