Bear markets are UGLY! We all hate them. They bring about a wild range of negative emotions, project haters and more. It's pretty terrible to experience a bad bear market but what makes it even worse is if you aren't prepared for it.

Is anyone really prepared for a bear market?

On Bear Markets

Ouch, there's a -20% drop that nobody wanted to see! We've all been watching with close eyes as BTC fought to hold $40k - $42k.

The latest breakdown saw us drop to $34k at the lows. Some people like @scaredycatguide who spend a lot of time with Technical Analysis say that BTC will bounce off of $30k like a tennis ball.

It may be an incredible bounce, but none of us want to sit here at $35k and wait to find out. We'll see what happens but I know that I've set some orders to buy BTC down there if/when we see that final breakdown and bounce.

Bear markets tend to catch everyone (99%+) by surprise. I think many of us knew that it was on the horizon at some point... I mean, BTC has run from $10k to $70k in less than 2 years. We've now reverted back to the mean and to me, that makes it a great time to re-accumulate.

Not too long ago, I wrote a post called "$10 a Day Keeps the Central Bankers Away" for LeoPedia. In that post, I outlined the strategy that I handed to family and friends who all asked me how to get into Bitcoin over the years.

In it, I simply describe DCA - Dollar Cost Averaging - and the numbers behind buying $10 per day worth of BTC... Regardless of the price.

Anyone who followed that strategy back when I published the post to present day would have accumulated $10 worth of BTC autonomously (using auto-buy features on Coinbase, Cash App, etc.) regardless of all the ups and downs.

That person would still be well in the profit zone right now. They would've been sitting at a monster 10x profit at one point in the height of the bull market. Right now, likely sitting around 3-5x... Despite everyone else running around saying the bear market ate their lunch.

What does this teach us?

It teaches us that timing the market is a fool's errand. Time in the market is what matters. When it comes to long-term investing, pick the best horse and accumulate shares in it slowly and consistently. That's how the wealthy do it. That's how I tell friends and family to do it.

Bear markets will catch everyone by surprise... Even if you know they're coming. You can never really be prepared for a bear market. You just have to prepare the best you can and when it hits, instill your plan that you laid out before it started.

On Cash Flow

I learned a hard lesson in 2018... Putting all my eggs into the Crypto Basket. One of the ways I've prepared for the bear market this time around is diversifying my cash flow.

These days, we have DeFi, Liquidity Pooling, Thorchain, CubFinance.... So many ways to deposit capital and earn yield.

There's no excuse to not have a portfolio of liquidity pools of some type. On CubFinance Kingdoms, I truly believe that we've made it easy to have a nicely diversified chunk of assets LP'd into various vaults that generate yield.

The yield on Kingdoms is outsized compared to most platforms. Personally, I've built a mix of BTC, ETH, BNB, CUB, bLEO and Stablecoin positions in the CubFinance Kingdoms and Farms. I check-in on it every now and then to see that it is, in fact, doing it's job and accumulating more hard assets for me via autocompounding.

Remember I said I learned the eggs in one basket lesson in 2018?

Even with this incredible opportunity to earn yield, I've diversified into less attractive but uncorrelated forms of cash flow. There are a lot of them out there, you just have to look and educate yourself on them.

Why is Cash Flow Important in a Bear Market?

One big reason is that you can support yourself (especially if you live off of your cash flow). In the context of this post which is directed to investing, generating returns and building a portfolio of assets, the importance of cash flow is the ability to DCA.

When you have cash flow from external sources, you can continually leg into the crypto markets, for example. This works for any investment asset that you want to accumulate over long-time periods.

Walk through an experiment in your head: if you reliably earned $1,000 per month from XYZ external source of cash flow (uncorrelated to your crypto portfolio), how would you be able to deploy that $1,000 every month to your advantage?

With BTC down 20% in the last 24 hours, it seems logical that you could buy some and feel pretty good about that.

With altcoins similar (and many down even more than 20%), that also seems like a logical step.

Taking your $1,000 per month and continually reinvesting it during the bear market. That's how you do well in the bull market.

DCA principles are timeless. Just make sure you have the external cash flow to consistently buy-in on a regular basis with fiat (or stablecoins).

On Free Capital

The other factor in all of this is having free capital on the sidelines. Uninvested (or at least, highly liquid and uncorrelated).

Again, it's important to have some mechanism for this on the side. If you want to stay fully invested all the time, then stay fully invested in uncorrelated cash flow generating assets.

If you want to have a more round-about approach, then have some free capital on the side in addition to your cash flow assets.

Today is a great example of having free capital on the side for me. I bought some BTC at $35,600 with some extra capital that I had sitting on the sidelines, waiting for a re-entry. This is actually capital that was freed up from selling BTC around $60k.

Now I'm getting nearly twice as much BTC as I had originally for the same amount of fiat.

Conclusion: Be Diverse, Have a Plan

My conclusion for surviving the bear market is be diverse. Enter the bear market with strategy and be prepared for the worst but hope for the best.

I'm hoping we rebound off $30k. Everyone seems quite confident that we will drop to $30k but have a lightning fast rebound and be headed back toward all-time highs once again. That would be awesome and I'm hoping that plays out according to plan.

BUT if it doesn't, I have my cash flow set up and I have some "dry powder" on the sidelines, waiting for a re-entry.

I've managed to prepare according to my plan before this bear market started and that's what will allow me to continually push forward on my primary ambition which is to continually expand LeoFinance and our developments. Having a diverse portfolio of income-generating assets is what allows me to continually bootstrap development and fund this whole project.

Portfolio construction is a fascinating subject to me and one that I've spent a lot of time thinking about. How are you feeling today? Did you prepare for this bear market? Do you have any plans in place?

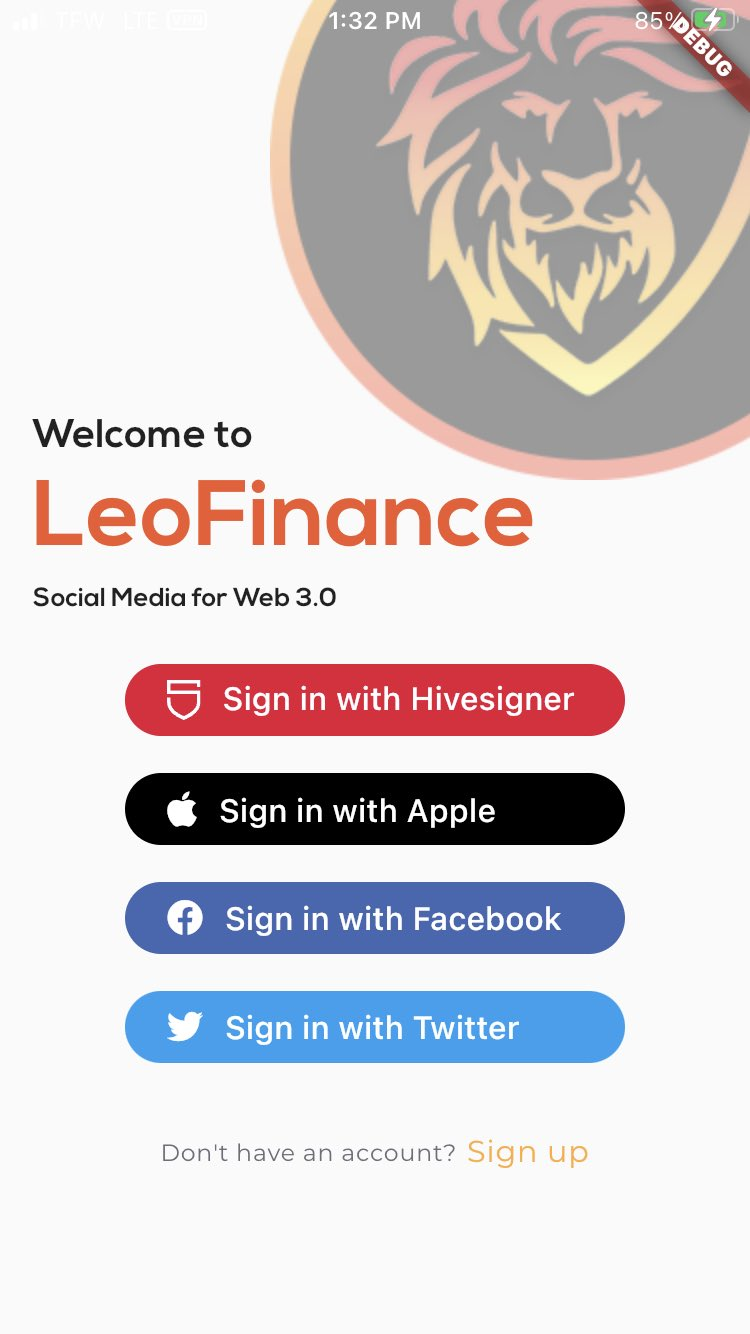

Want to earn 16% APY on your HIVE POWER during the bear market? Delegate HP to @leo.voter and earn 16% APY paid daily via LEO while supporting our LeoInfra onboarding efforts. We've just added Facebook Hive Lite Accounts to LeoMobile and we have a need for account creation tokens! Delegate today 🦁

Posted Using LeoFinance Beta

The dip look so deep right now,but honestly it I wasn't not too surprise to seeing this at all,I honestly expect this to come at a point.

To me this is the perfect time to buy more and keep right now

I was never superise to see this at all, even though some token as actually gone dip beyond my expectations right now.

But honestly I still think this is just the very best time to earn,buy and Staked for everyone now.

The dip won't last for long and it is an opportunity for everyone to accumulate now, before the market picks up again.

Posted using LeoFinance Mobile

When you have been in the market for a while and you have a good level of experience, crashes won't surprise you that much because you know that it's a normal thing.

It is what you do during market crashes that counts. Do you panic sell? Do you hodl? Or do you accumulate?

Posted Using LeoFinance Beta

Time in the market will always beat time in the market. Cub Finance has given us an easy avenue to compound against the market dip. We just have to HODL strong and keep earning.

Posted Using LeoFinance Beta

I just keep stacking in the cub kingdoms! That’s been a great way for me to easily track and grow my liquidity portfolio

Posted using LeoFinance Mobile

Was expecting this dip at some point so I wasn't really surprised. It is important to know the time and season. I also believe right now is a great time to accumulate. The DCA, cashflow and diversification strategy is a great way to survive terribly from times like this.

Posted using LeoFinance Mobile

Yeah you’ll never know when the dips are coming and how hard they’ll be. If we knew that, we’d all be billionaires!

DCA, diversifying and building cash flow through any uncorrelated means possible is the key

Posted using LeoFinance Mobile

Accumulation is the word but how many of us are really accumulating. It takes a lot of courage to buy the dip; only the brave buy dips.

So, believe me that majority won't buy because right now, fear is the order of the day. But if you can overcome your fears and go in, you'll certainly smile in the days ahead.

Posted Using LeoFinance Beta

I bought the dip. I believe it's best to buy when others sell. Those who have the right mindset wouldn't fret because of this correction. Smart whales should be loading up. Fear will only cause more losses. You don't lose if you don't sell. Fortune favors the brave

Posted using LeoFinance Mobile

Apt! You don't count losses until you have dumped your bag. Instead of panic selling at poor prices, accumulate more and hodl. It's a thing of knowledge and experience though

Posted Using LeoFinance Beta

It is no new thing that we will definitely experience inflation and deflation of price because it's certainly what we are going to experience in the Crypto world and I believe now is the best time to invest for future purposes

Posted Using LeoFinance Beta

Exactly! Pumps and dumps are the nature of the crypto market. It is left for a trader or investor to take the right decisions in any of the scenarios. Dumps present us with the opportunity to fill our bags.

Posted Using LeoFinance Beta

To be honest, I never had a real bear market in crypto. I did invest in Bitcoin already before 2018 (I guess, I bought my first Bitcoins back in 2016 or 2017), but my position was too small to make me nervous.

But I lived through the 2007-2008 financial crisis, with most of my money invested in stocks. And to be honest, I always had the feeling, that those are the days, when money is made.

Although BTC is down a lot, it is still positive in the one year view - not talking about 3 or even 5 years. This feels like eternity in crypto. But to be honest, it isn't. With more and more institutional investors investing in the bigger cryptos, especially Bitcoin, ETH and some others, the laws of the broader market apply more and more. And a three year time horizon is completely normal in stock investing.

If we compare todays BTC price, we are still around 10x of 2018s low. And even with BTC dropping to 20k it would be above almost everything we've seen in 2020. And this is just a bit over a year ago.

But yes, bear markets can last for quite some time. And they can feel desperate. In 2008 many people believed that it could be the end of the financial system as we know it - or even capitalism itself. It took quite a while to recover. Same goes for the Dotcom bubble in the earlier years of this century.

And yes, the S&P 500 didn't have had a lot of positive returns in the first decade of the 21th century.

Be brave. Don't invest everything at once. Don't loose hope. There is always a light on the horizon.

@andy-plays

That tip of dollar cost averaging in at $10 per day is so good. As simple as it is, that is the best tip you write in here. I always tell that to others and always try to follow it myself, as much as possible.

Thanks to you and Leo, diversifying is easier than ever! I am well invested into various Kingdoms, and when Polycub comes around I will spread out there too. Leo is giving us all incredible power and opportunity. Thanks for everything you do to make this stuff available to all of us!

Posted Using LeoFinance Beta

Very well put, written, a lot of people need to read this. It is refreshing to read a positive post in a bear market. And people need to learn what you are saying.

Thanks for this post.

!BBH

Posted Using LeoFinance Beta

The inflation and deflation of the price experience on the crypto market is what we need to experience because the price for now is the best time to invest on certain coins. Thanks

Posted using LeoFinance Mobile

Great article! Though I dont hate bear markets myself...great time to go shopping. those that buy during a bear market are the one who make the real money.

Good read 👍🏽 Gotta grab my sideline bag and go shopping! 🖖🏼😎🤙🏼

Thats what I am saying! Just bought another $3000 worth of XHV (has Monero privacy and the first ever private stablecoin + in-wallet no-KYC trading). And I will buy some more ETH + BTC if they hit below $32k/$2k.

Very interested in learning more about this XHV, It is a monero fork or a ERC20?

Yes, it is a fork of Monero (which I also own, of course), so it has the same gold-standard privacy features as XMR. Basically it works like this:

It has a main coin, XHV, which can be used on its own just like Monero. What the Haven guys added was an exchange that is completely built-in to the protocol, where you can convert right in the wallet, so your coins always stay in your control, that was what I really loved about this project, I hate putting my coins at risk every time I want to trade! Your keys, your coins! It uses the "mint and burn" system, so if you have $100 worth of XHV, you can convert it to their 100% private stablecoin called xUSD, and it burns the XHV and mints 100 xUSD (small fee of 0.5%: this fee is split between miners, some goes to fund development, and the rest is burned). The best part is that there is 0% slippage, and there is essentially unlimited liquidity, since the asset you are swapping to is being minted at a set rate, plus it doesnt create any inflation this way.

Then, once you have xUSD, you can convert it back to XHV any time, or you can convert it to other private xAssets such as xBTC, xEUR, xCHF, xAU/xAG (gold/silver), and a few more. So its like a savings account that is completely private, that you can hold in the currency of your choice. A few small exchanges have a small amount of trading pairs for xAssets too, but it is pretty early, so its still very low volume. You can of course send and receive xAssets just like Monero or haven coins too. And everything being in one place right in the wallet is really convenient.

Anyway, I hope that helps! The project is still rather early, they just got everything working without issues a few months ago, but I am slowly seeing people mention it more, and am very excited about it. The haven and Monero community also seem to be very friendly with one another, and in fact the Haven devs even helped with some Monero development, they recently reported a critical Monero bug a few weeks ago that was a big help, someone mentioned it in the Monero reddit page.

You can find their website here if you are interested: https://havenprotocol.org/

Interesting, thanks for the info 🖖🏼😎🤙🏼

No problem bro! I am glad it was helpful to you. puts on sunglasses, ha ha

Well dam that project really changed and took off, After SEO seeing the name I noticed I mined it way back when it forked.

Thanks for sharing all this going to have a look at it now. Is it still GPU CPU mining?

I havent looked into mining it, but I think it is GPU or CPU mined, yeah. I believe they use a slightly tweaked the mining compared to Monero, but its been a while since I read up on it. Their twitter page gives the most current updates (btw if you dont have a twitter account and get blocked from viewing posts, you can always view it on Nitter.net and view anything with no account, thats what I do):

https://twitter.com/HavenXHV

!PIZZA

The most logical strategy is the long term and above all not to panic and emotions.

better close all the charts and take a nice walk

Lol...

At this point, one should just avoid looking at charts and relax till the fear dies down.

Posted Using LeoFinance Beta

The best time to invest into crypto is now. The last time it was the best time it was when BTC had price of a hotdog :D

Don't miss the next chance.

Posted Using LeoFinance Beta

Honestly I don't have any preparation for bear market because I'm still learning and trying to earn good sum of crypto (as much I can via writing) but after acknowledging more I may able to prepare for bear market InshaAllah.

Posted Using LeoFinance Beta

I am actually really new to crypto and investments. But when I see prices go down like this (even though I see also my money go down) I am optimistic and I see this as a great opportunity to buy. Of course, I am using only money that I am ready to lose, and so this is also probably why I am more relaxed than other people.

This is a very good outlook. I always feel like I "could have done better" when everything plummets. The fact is, I did better than last time the market crashed. But the fact is, it is impossible to time (unless your name is Satoshi). I have a portfolio that is dynamite and it is only a matter of time. I even had some stables on hand.

Enjoy an upvote from a brand new tiger!

Posted Using LeoFinance Beta

educative and enlightening write up I must confess. As a newbie on here I’m carefully learning how the crypto market works especially in terms like this where there is a blood bath. I think with posts like this, I’ll be guided on what to do when the market is bearish . I’m certainly pinning this blog to my archives . Thanks for the heads up!!

Well said!

The What

The Why

The How

This as really shows that their is a season for everything but for every season their is really a chance and opportunities which I believe this is really the best time to get more DCA ...

You names most of the stratégie to make it in Crypto

I wished people will follow these.

I have also PTSD from the 2018 bear market where I did not do these hehe 😉

Posted using LeoFinance Mobile

Using the dollar cost averaging has always been one of the best strategies in crypto investments. It's safer and allows you to buy at different levels of the dip.

Posted Using LeoFinance Beta

I agree and I am buying more this time because buying the dip is always and now when prices are down by over 20% in most of the coins so its a profitable move. Can't say if it will drop further but I have started accumulating in parts. Bear market also fun sometimes to have more stake.

The best buy signal is when there's a dip. So, if you are buying, you are not wrong.

Posted Using LeoFinance Beta

Thanks for the insights. 2021 was my first full year to learn about cryptos and own BTC,ETH and other ones. I didn't sell near the top but ought more. I bought around May lows as well and we went to 69k and never took profit and bought more when we were going down. Learned one thing that it's never too late to buy, if you wait and be patient you will find the opportunity, but always DCA.

Binance just offered AUTO invest option and now i have put my orders to buy daily or weekly basis based on what cryptos I want to accumulate. This seems to be better way. Thank you.

Posted Using LeoFinance Beta

No one knows the exact timing of the bear market but one can prepare for it.

If a person can manage his risks properly then such person won't be a victim of liquidations or large margin losses when a dump occurs. Another way to get prepared for the bear market is to have it in your mind that, market doesn't pump forever. With that understand, you will be able to manage your greed, take profits when necessary and keep them preferably in stablecoins.

This in turn gives you liquidity to take advantage of a crash like this when it comes.

People tend to be afraid of bear markets but it shouldn't be so. The real opportunity to wealth comes when we have dips in the market.

Posted Using LeoFinance Beta

No idea what you are talking about, but I have upvoted and reblogged so that in time I can ask someone to teach me these these things as diversification is indeed very important for our charity.

Have your kind of strategy with $10 per day on alt coins and not Bitcoin. All good as the position I am in now is totally different to 1 year ago and don't really care about price to be honest. All of these will be staked generating more and that at the end of the day is what brings the extra value. Thanks to you guys I am in Kingdoms.

Posted Using LeoFinance Beta

I'm not yet to a point where I feel comfortable DCA'ing into crypto, but I've certainly started identifying crypto I'd like to scoop up if we really are starting the next bear cycle.

Regardless of how that plays out, there's definitely wisdom in understanding when you're making momentum trades, short swings, or accumulating for the long term. I haven't batted an eye at the paper losses my HP took this last week, but I also had no intention of selling to begin with.

The right mindset lets you react appropriately based on what your goals are for each investment.

!1UP

34k is the bottom, you heard it here first 😀

Yes! I actually wrote you a DM in Discord about my bear market plans. They include contributing to the growth of Leo Finance.

Posted Using LeoFinance Beta

PIZZA Holders sent $PIZZA tips in this post's comments:

@skylinebuds(4/5) tipped @anarchistpreneur (x2)

Please vote for pizza.witness!

Oh why thank you for the tip! I am not sure how to claim it though, ha ha?

It automatically goes to your tribeldex wallet,

I use Hive.Blog typically and apparently it is only HIVE and HBD, but I just saw the peakD site that has a wallet for al your HIVE-based coins. Apparerntly a bunch of people gacve me coins and I did not even know, wow!

Yeah the other front ends make a big difference, So with tokens like Weedcash you earn them by using the tag.

When I get on PC I'll link you a post about tags and tribes.

Thank you, I appreciate that. man, the HIVE ecosystem has really grown! I was on it back in the STEEM days (i had a different account and lost the login somehow) waaaay back in maybe like 2016 or something and thought it was cool, but now things are clearly more fleshed out and better designed, plus better post quality too. back then it was more people just writing generic stuff that people would like to get free crypto, so lots of generic crap posts like "really great, awesome post bro", but now I see really detailed conversations and high quality stuff...fantastic stuff! if I had known the posts quality was so much improved I would have come back way sooner!

BTW, do you know of any accounts or groups that focus on crypto conventions, meetup, etc? I would love to finally meet some crypto folks after all of these years..been in crypto since 2010, but only ever met a handful of crypto folks, mostly from P2P trading, and the rest from 1 festival. I do know that Libertarian festivals in the summer time have tons of crypto groups, events and whatnot at their gatherings, but was looking for stuff sooner than that if possible. Plus, they always choose months that are too hot, ha ha.

@scaredycatguide We need to have a HIVE/LeoFinance OR Crypto convention in Orlando! Who do you know in the HIVE community that would jump on something like this?

I know with the right persuading I could probably get @darinapogodina to organize the event since she did our 100 Millionaires Summit and crushed it!

Posted Using LeoFinance Beta

!PIZZA

Other than scalpers that try to "win" the market like gambling, there's really no point in timing the market.

Most times I tell people that ask me if it's a good time to buy Bitcoin to just buy because every time is a good time

Posted Using LeoFinance Beta

You have received a 1UP from @entrepidus!

@oneup-curator, @leo-curator, @ctp-curator, @neoxag-curator, @pal-curator, @pob-curator, @vyb-curatorAnd look, they brought !PIZZA 🍕

Delegate your tribe tokens to our Cartel curation accounts and earn daily rewards. Join the family on Discord.

Your content has been voted as a part of Encouragement program. Keep up the good work!

Use Ecency daily to boost your growth on platform!

Support Ecency

Vote for new Proposal

Delegate HP and earn more

Because this is such an awesome post, here is a BBH Tip for you. . Keep up the fantastic work

. Keep up the fantastic work

It always comes back, always.

There are so many times in one's life

Nice post

Cool post!

Keep up the good work bro👌

Posted Using LeoFinance Beta

The bear market is much that we don't know when BTC will bounce back. Almost all the crypto currency are selling now

Posted Using LeoFinance Beta

The big swings in the price of crypto should not surprise anyone. The industry is still very much in its infancy and thus prone to these erratic price movements. In lots of ways this is good because it is the good, solid projects that will survive and prosper.

Posted Using LeoFinance Beta

Cash flow is good and its interesting to see that, BTC has got new prices and with this fluctuation, crypto got speed and more attraction than most other times.

Good to know the insights of bear and bull market.pretty amazing is the concept, huh.

👍

Great information and I must say that attending Leo Finance AMA and engaging on the platform I've learned to build up also a stablecoins portfolio. While I always had stablecoins in my portfolio, usually I would get rid of them pretty easily. Now I try for these to be around 20-30% from my portfolio to have the overall value be preserved during the bear market and also earn from staking them.

Posted Using LeoFinance Beta

I thought of this but since am too broke in fiat to do that, I have decided to set a goal to earn at least $10 in curation reward on Hive everyday. This way, on days where am lucky and my curation reward exceeds $10, at least I know half is going to be used as Hive power(HP), while the other half, I can use it to do anything I want.

This is the reason I have dedicated my time to blogging everyday, so that I can at least earn $10 of curation HP everyday. I’m grateful to Hive for this opportunity. Since I can’t afford to do it with bitcoin, it’s right I do it with Hive through content creating.

@khaleelkazi this is such an important concept for people to understand. Great job on keeping it simple and shedding light on the importance of having cashflow outside of crpyto!

I love that you mentioned the defi pools, because CubDefi has been one of my favorite ways to earn more LEO!

Seeing all of the development since I've been on this platform is absolutely impressive and it wouldn't be possible if you hadn't made alternative streams of income a priority.

@scaredycatguide is always mentioning how productive you are and I think a lot of it has to do with the fact that you are very good at prioritizing what you do each day so that everything you do builds on itself for your long-term vision!

Big things are coming and I've started getting myself back into a stronger CUB kingdom position for the coming PolyCub airdrop! Also buying the dip on Matic right now to eventually bring it over to CUB once the new version of the bridge is ready!

Posted Using LeoFinance Beta

Portfolio construction is a fascinating subject to me.

poppy playtime

The rewards earned on this comment will go directly to the person sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

If I have the courage to invest, I will have to accept luck, I only like to play basketball stars so I will never be rich.

Posted Using LeoFinance Beta

j