HBD Savings

It is now almost a year since I started my HBD savings on February 19, 2023. I am reflecting on its performance and gathering insights from the data to explore how I can further grow my savings. This analysis will also aid me in setting a realistic goal for the next few years. Additionally, I considered sharing this information with our community, providing readers with ideas on managing their own savings.

Before I begin, I want to make it clear that I am not providing financial advice. Instead, I am offering a factual analysis of my own HBD Savings based on publicly available data on the blockchain. The goals and actions presented here are based on my personal analysis and objectives.

Revisiting My Deposits

| Date | Deposit Amount | Source |

|---|---|---|

| Feb 19, 2023 | 460 | Hive Gig |

| Feb 19, 2023 | 240 | Hive Gig |

| Oct 3, 2023 | 100.055 | Hive Gig |

| Oct 14, 2023 | 6.094 | Hive Blogs |

| Oct 29, 2023 | 11.667 | Hive Blogs |

| Nov 5, 2023 | 13.114 | Hive Blogs |

| Jan 21, 2024 | 102.58 | Hive Blogs |

First, let us look into my Year-To-Date deposits. All of these deposits are not injected out of my pocket, but rather all are my earnings from making blogs and salary from software dev gigs in Hive.

It is my #1 rule in growing my HBD savings. I must not put any cash from my pocket, at least for the first year until I see how it performs.

Total Deposits Summary

| Source | Total Deposits |

|---|---|

| Author Rewards | 800.055 |

| Hive Gigs | 133.455 |

| Total Deposits | 933.51 |

As of this writing, I already accumulated an amount of 933.51 HBD. 800 HBD from gigs, while 133 from author rewards beginning October 2023.

Currently, I don't have a financial target but only to test how will HBD Savings perform as it is my first time putting savings in Hive. Therefore in this analysis, I will use the data to answer the following questions:

1. Is making a consistent deposit will help the growth of my savings and interest? How?

2. How does my income from each source affect my savings?

3. What is my next target?

4. Is it worth injecting cash from my pocket to HBD Savings?

Performance Review

Now, let's delve into the monthly accumulating gains. The table shows rewards received based on the previous month's deposited amount, year-to-date (YTD) deposits, YTD HBD Savings, and the corresponding interest percentages.

| Date | Reward | YTD Deposit | YTD HBD Savings | Interest % |

|---|---|---|---|---|

| Feb 19, 2023 | 0 | 700 | 0.00% | |

| 26-Mar-23 | 13.353 | 700 | 713.353 | 1.91% |

| 10-May-23 | 17.612 | 700 | 730.965 | 2.52% |

| 22-Sep-23 | 53.466 | 700 | 784.431 | 7.64% |

| 14-Oct-23 | 6.094 | 800.055 | 890.58 | 0.76% |

| 22-Oct-23 | 13.839 | 806.149 | 910.513 | 1.72% |

| 21-Nov-23 | 14.992 | 830.93 | 950.286 | 1.80% |

| 22-Dec-23 | 15.775 | 830.93 | 966.061 | 1.90% |

| 22-Jan-24 | 15.481 | 933.51 | 1068.64 | 1.66% |

YTD Deposit is the amount that I deposited to savings without adding the reward that is automatically turned into savings, which is the YTD HBD Savings column. While the interest is the reward per YTD Deposit (Interest = Reward/YTD Deposit).

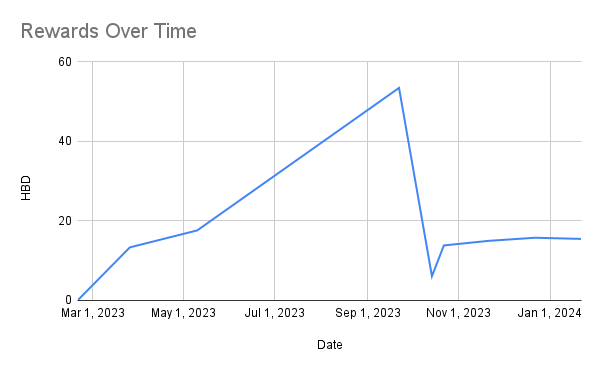

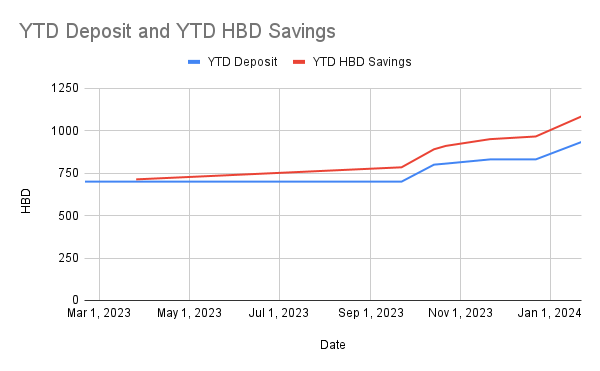

These two charts answer my first question: making consistent deposits will obviously boost your earnings in the next month. I understand that the two charts above might be confusing because I did not deposit consistently on fixed dates, but let me break it down for you.

The Rewards Over Time chart averages at a rate of about 13 HBD per month. I experienced a significant bump in September because I didn't realize that I should set my keychain to auto-claim my rewards.

Meanwhile, looking at the YTD Deposit vs YTD HBD Savings chart from March until September, when I only had a stagnant 700 deposit, my savings appeared linear. However, starting in October, when I began depositing regularly, my savings started to increase at a higher rate. It means the compounding technique is working.

| Average Monthly Interest % (9Months) | ||

|---|---|---|

| Total Rewards (YTD) | 150.612 | 2.21% |

| YTD HBD Savings | 1084.122 |

Overall I earned 150.612HBD from an average of 2.21% interest rate for 9 Months. And a total of 16% interest based on my YTD deposit. Which is very good, compared to traditional bank time deposit savings.

Accumulating Through Author Rewards

While it is very obvious that the contribution of my Hive gigs has the highest impact on my savings, it is not a stable source of funds because I don't always have a gig and it is out of my control unless I obtain a full-time job here.

Meanwhile, I have more control over accumulating savings from Author Rewards because it is all up to me if I will put my time into writing content consistently and focusing on better quality. Therefore let's focus on accumulating from author rewards.

Projection for 5 Years of Blogging

Now let me put an assumption that I will keep the same habit of mine blogging and earn the same average amount of 27HBD per month while reinvesting it into HBD Savings. How much will my HBD savings be in 5 years starting from my current balance of 1068.64HBD, assuming that 20% APR won't change?

| Year | Deposits(27/Month) | Interest | Total Deposits & Withdrawals | Accrued Interest | Balance |

|---|---|---|---|---|---|

| 0 | 1068.64 | – | 1068.64 | – | 1068.64 |

| 1 | 324.00 | 265.86 | 1392.64 | 265.86 | 1658.50 |

| 2 | 324.00 | 395.27 | 1716.64 | 661.14 | 2377.78 |

| 3 | 324.00 | 553.08 | 2040.64 | 1214.21 | 3254.85 |

| 4 | 324.00 | 745.50 | 2364.64 | 1959.71 | 4324.35 |

| 5 | 324.00 | 980.14 | 2688.64 | 2939.85 | 5628.49 |

Summary:

Initial balance: 1068.64

Additional deposits: 1620.00

Total interest earned: 2939.85

Future investment value: 5628.49

I used this Compound Interest Calculator to obtain the table above. If it is correct, the projected gains are interesting. And what if just stop blogging or use my author rewards to convert into HBD Savings?

| Year | Interest | Accrued Interest | Balance |

|---|---|---|---|

| 0 | – | – | 1068.64 |

| 1 | 234.45 | 234.45 | 1303.09 |

| 2 | 285.89 | 520.34 | 1588.98 |

| 3 | 348.61 | 868.94 | 1937.58 |

| 4 | 425.09 | 1294.03 | 2362.67 |

| 5 | 518.35 | 1812.38 | 2881.02 |

Summary:

Initial balance: 1068.64

Additional deposits: 0

Total interest earned: 1812.38

Future investment value: 2881.02

Well, it wasn't as good as compounding with my author rewards but earning 1812.38 HBD in 5 years without doing anything is not bad! But imagine, I randomly put my Hive gigs earnings into savings as well, that would be so much better yeah? After all, the judging criterion must be my goal. Therefore I have to set a goal.

Trust

Now, I wanna ask is it worth injecting money from my pocket? I think it will boil down to how can we rely on HBD Savings in the long run.

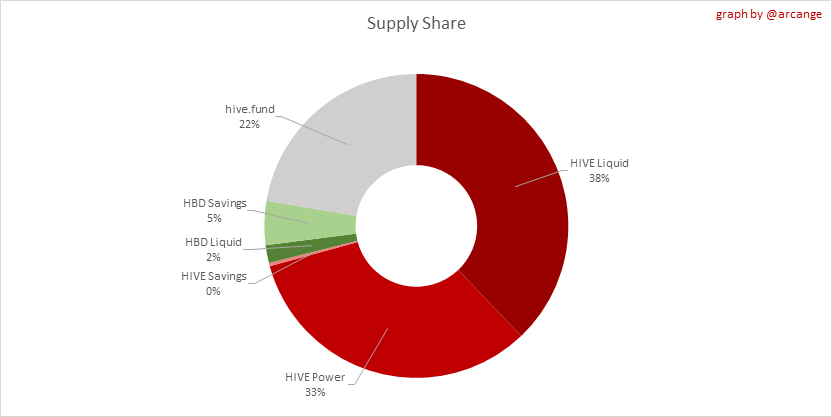

But how can we tell? In my opinion, just like other traditional funds you should look into the company background and historical data. arcange just release another Hive Financial Statistics – 2024.01.21 so let's quickly look into it.

The chart above simply shows that more people are holding HBD Savings than HBD Liquid having a total of 7% share out of all combined.

Meanwhile, more and more accounts are accumulating HBD Savings and it is more distributed than in the past few years.

Aditionally, majority of the witnesses still prove 20% APR.

Conclusion

To conclude, I will go back to answer my questions above:

1. Is making a consistent deposit will help the growth of my savings and interest? How?

A: Definitely yes! I've seen in in my own HBD performance from the past year as well as the comparison of the 5 years projection with and without depositing the author rewards.

2. How does my income from each source affect my savings?

A: Well, obviously author rewards can be more consistent than my earnings from hive gigs while it puts more impact.

3. What is my next target?

A: I guess I'd keep this personal.

4. Is it worth injecting cash from my pocket into HBD Savings?

A: The data looks good and is more bias to saying yes, but it still depends on the upcoming trends and events. If I do, I think I have to keep an eye on the news and be more active in this community which is not really a problem. Let's see. Meanwhile, my 5 year projection by just saving the author rewards is already more than good for me.

Amazing analysis. I just started to keep HBD savings last month Dec 2023.

Thanks! good luck to your HBD savings journey 😊

Congratulations @krios003! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 60 posts.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!