Hello and welcome to this weeks LBI Holdings and Income report. LBI is a pooled investment token based on HIVE with a range of assets backing its token. Each LBI token represents a share of the assets, and the value of that share is published daily on inleo.io as a thread. All you have to do is check our profile page to find the most recent "Asset backed Value" for the token.

LBI has just recently come under new management, and we are working on raising its profile, converting it into a token that shares a portion of its income each week with token holders, while also selecting investments to maximize growth. LBI's roots are firmly planted in the @spinvest ethos of "get rich slowly". We don't chase amazing returns and massive gains, we look for solid investments, long term growth and the magic of compounding.

Welcome to report number two for the new era of LBI.

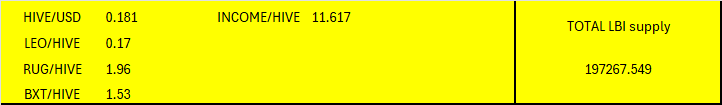

Here are the market prices used in this report:

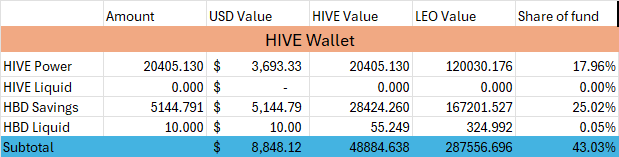

HIVE Wallet.

We are settling in to steady growth after all the reshuffles done in week 1. 64.029 added to our HP tally is the only real move here, from post payouts, curation and inflation. The HBD savings will only jump once a month. Each week I will withdraw a little, being a portion of the interest to go to the income wallet. In response to the recent change in HBD interest, this is now set at 5% for us, so the HBD balance will grow at 10% over time. Details of this plan are in the following post.

https://inleo.io/@lbi-token/hbd-interest-and-lbis-plans-mg

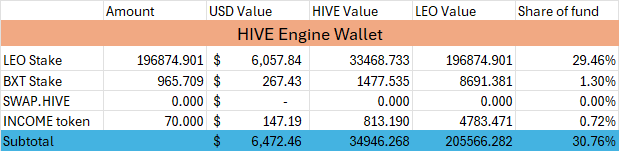

Hive Engine Wallet.

Leo stake is the big chunk here, and it will steadily grow with our @leo.voter delegation. This week, 246.146 LEO came in from this source. I've added a little BXT and Income, and will continue to as the income wallet sends funds back to this wallet. If that does not make sense, the "Income section of this report below will explain.

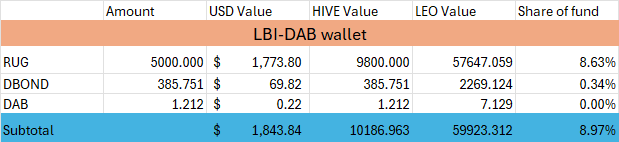

@lbi-dab

Awesome growth here, with our DBOND payout from the RUG investment being over 200 DBONDS. Those are valued for simplicity at 1 HIVE each, so that is fantastic growth. We have started minting DAB, and the pace of DAB minting will accelerate each week as more DBONDS accumulate. The value of the RUG tokens dropped a little this week, to be expected with all the volatility in the markets. That volatility is what generated the big DBOND drop, so its all good.

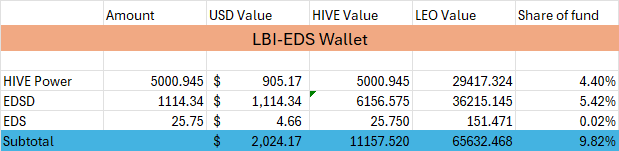

@lbi-eds

This wallet will be a slow and steady one. Each week, we will get a little more EDS, and the subsequent income they generate will grow weekly. For now, all the HBD that comes in from post payouts will be converted to EDSD, to grow that. The HBD interest rate drop will have an impact here, reducing the yield that EDSD produces a bit, but it is what it is.

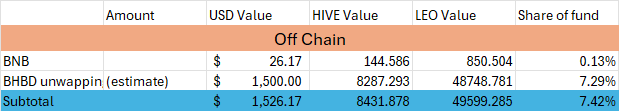

Off Chain.

No change here. The BNB is only being held incase I need to do anything more for the BHBD unwrap. The amount indicated for the BHBD unwrap is still a guess. We are in the queue with the LEO support team to have our case looked at, and awaiting our turn.

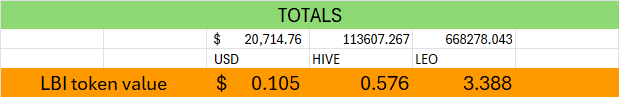

Totals.

So overall for the week, the LBI token value dropped a bit in terms of USD and HIVE value, and increased in LEO value. The main cause of this divergence is the fact LEO declined from 0.19 to 0.17 HIVE each, while HIVE itself remained flat from this time last week.

The fund is worth just over $20K USD which would be a nice benchmark to grow from. Of course we can't control the market prices, all we can do is set the fund up to give it the best shot at growth.

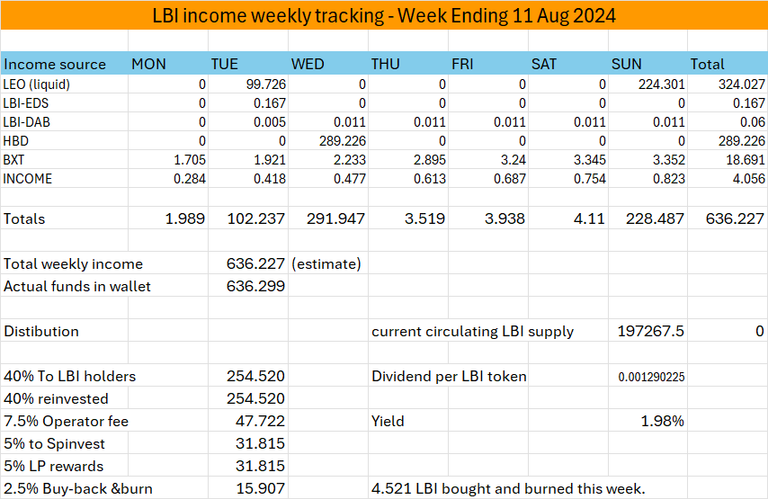

Income.

So this is the new part in this weeks report.

The income by source is shown for each day, and then the bottom part shows how those funds will get distributed. The reason the "total weekly income" is an estimate is that some comes in as HIVE, and there could be a time delay (meaning price changes) between when it comes in and when it is converted to LEO. There is also conversion fees and slippage.

Currently the "distribution" section is an indication only. Dividends and such have not been restarted yet.

One thing I have done is set up @lbi-pool. This wallet will manage the LBI/LEO liquidity pool, and the incentives that will go there. I'm likely to set this up fairly soon, as I think we will need to have it in place before we switch dividends on, as tokens held in the pool need to be included in the dividend calculations, and the coder will likely need the pool there to set it all up (I imagine)

The "Buy back and burn" has been started. As you can see this week 4.521 LBI have been bought of the market and sent to @null. LBI has become a deflationary asset.

https://inleo.io/@lbi-token/let-it-burn-fvd

As you can see in that post, all the tokens held by the fund have been burnt, and if you check the comments, @spinvest has (as requested) minted and burnt all remaining token supply that had not been minted. So, there can never be any more LBI's enter circulation, and each week we will buy a few off the market and burn them, slowly reducing supply.

That's all I have for this week. I hope you have found this update informative.

Feel free to drop your comments below:

Cheers,

JK

@jk6276

If you want to learn more about what LBI is doing, read on...

And remember, you can see up to date asset backed values for the LBI token everyday on our Inleo profile page

Posted Using InLeo Alpha

Are you still planning on doing some kind of Hive/LBI pool?

Yes, planning to set it up soon. It will be LEO/LBI rather than HIVE pair. Likely will be set up in the next few days, possibly tomorrow. I want it in place before dividends restart, so the coder can set dividends to include LBI held in the pool.

Oh, okay, so we will still get credit for our LBI even if it is pooled? That is cool. I can't remember, will the pool have rewards outside of dividends?

Yes, the pool will get 5% of the weekly income, allocated to it as rewards for providing liquidity. so holding LBI paired with LEO in the pool will earn some daily LEO payout from pool rewards, plus the LBI will still count for dividends.

!BBH

@lbi-token! @fiberfrau likes your content! so I just sent 1 BBH to your account on behalf of @fiberfrau. (1/20)

(html comment removed: )

)