In the past 24 hours, Thorchain has faced significant challenges that have sent shockwaves through the ecosystem. The situation stems from a combination of experimental financial products and market conditions that have tested the resilience of the protocol.

Source

Key Data Overview

Liabilities: Thorchain currently holds $97M in lending liabilities denominated in BTC and ETH, along with approximately $102M tied to savers and synthetic assets.

Assets: The protocol’s liquidity pools contain $107M of exogenous assets, primarily in BTC and ETH.

Source

Recent Developments

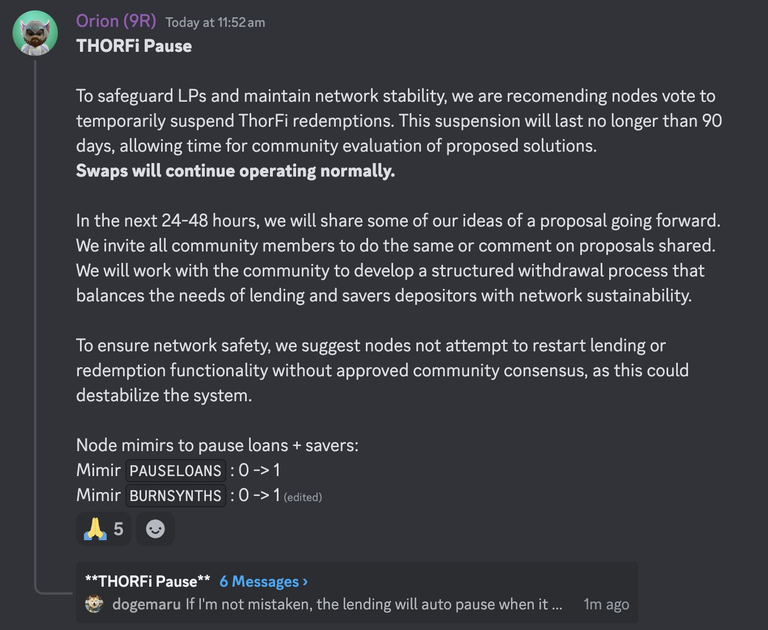

The RUNE token experienced a sharp decline in price over the past few weeks, culminating in a dramatic drop that prompted immediate action. Thorchain validators made the decision to pause the network temporarily to allow for a restructuring process.

As part of the response:

- ThorFi Functions Suspended: Lending and Savers have been paused for 90 days, giving the community time to assess and propose solutions.

- Swaps Remain Operational: The core functionality of Thorchain—the decentralized exchange (DEX)—continues uninterrupted, ensuring that the protocol’s primary value proposition remains intact.

Understanding the Challenges

The addition of Lending and Savers aimed to attract more liquidity to the protocol. However, these features introduced complex risks:

- Over-Leverage: The liabilities from these products grew beyond what the protocol’s liquidity could securely manage.

- Uncertainty: The long-term sustainability of these products was unclear, creating a lingering overhang on the ecosystem.

This situation highlights a misalignment between Thorchain’s original ethos and the recent focus on aggressive growth. Thorchain was built on the principle that liquidity should scale naturally as a function of pool depth, volume, and yield. However, the push to grow liquidity to excessive levels created vulnerabilities.

The Path Forward

Despite the challenges, Thorchain remains one of the most profitable protocols in the ecosystem. In 2023, it generated over $30M in fees, with an even higher run rate this year. These metrics underline its potential for recovery and future growth.

Several factors point toward a positive resolution:

- Restructuring Debt: Remaining debts and collateral positions from Lending and Savers are frozen, allowing the community to focus on practical solutions.

- Sustainable Liquidity Growth: By refocusing on first principles, liquidity pools can stabilize and attract organic growth based on usage and fees.

- Community-Led Solutions: The decentralized nature of Thorchain means its community will play a critical role in crafting a recovery plan.

Conclusion

Thorchain’s core functionality as a DEX remains operational, ensuring that swaps and liquidity provision can continue uninterrupted. While Lending and Savers have been suspended, this presents an opportunity for the protocol to realign with its foundational principles and address its liabilities.

The events of the past 24 hours have been a test of Thorchain’s resilience, but the protocol’s profitability and utility provide a strong foundation for recovery. With careful planning and community input, Thorchain can emerge stronger and better equipped to navigate the challenges of decentralized finance.

References

~~~ embed:1882616341926162653?s=46 twitter metadata:MTk4NF9pc190b2RheXx8aHR0cHM6Ly90d2l0dGVyLmNvbS8xOTg0X2lzX3RvZGF5L3N0YXR1cy8xODgyNjE2MzQxOTI2MTYyNjUzfA== ~~~

Posted Using INLEO

It should have stayed aligned with them from the start. This is BS honestly and I don't even own any of it lol

It seems like the gas currency should be different than the counter asset. The counter asset should have been skmething in the top 5 market cap but not operating on a chain which is too expensive for small trades.

Wow thats bad. Does Leo have any exposure to this?

!BBH