Over the past several days, we've been having a lot of conversations with people from many differing perspectives on Hive. One of the amazing things about Hive that I have always admired is the ability for many of us to have the same vision of the future - where Hive belongs - but differing visions of how we get there.

I think this is a critical indicator of true decentralization. Hive has it as you can see all the different perspectives coming together to form the same vision at the end of the day, but radically different roadmaps of how to make that vision reality.

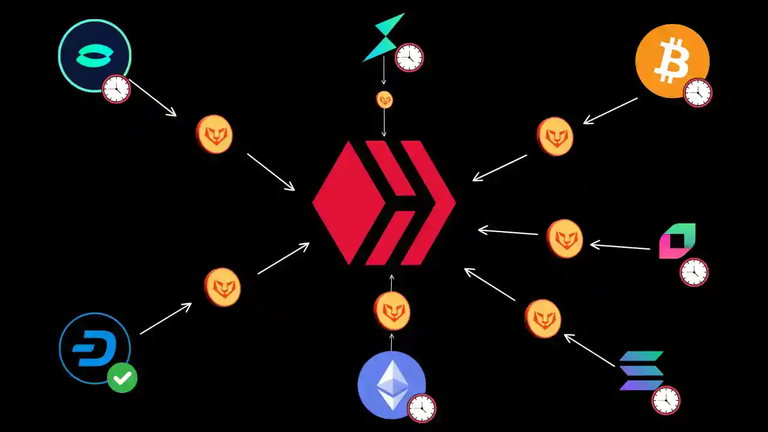

As many of you know, INLEO's Proposal is live and we are asking for some funding from the DHF to help us launch 10 more collaborations with industry-leading ecosystems like we did with Dash in 2024. We believe the Dash collab offers a template on how we can collaborate with more ecosystems in the space like Arbitrum, Solana, ChainFlip, ChainLink, Litecoin, Base and many others.

By collaborating with these ecosystems, we can do a lot of good for Hive. We can - in my opinion - achieve the vision for Hive that many of us share.

HIVE deserves to be a top 10 crypto. The technology here is unparalleled in the space. You don't need me to tell you that. We all believe it.

But why are we not a top 10 crypto? What is different about Hive than these other cryptos that do gain these wildly high market caps? I believe that one of the core differences is that they capture value more effectively than we do on Hive.

These 10 collaborations will help change this. We are not only collaborating with 10 of the largest crypto projects in the ecosystem, we're also installing deeply entrenched value capture mechanisms with each collaboration. This post will dive into the details of how and why we're doing that.

Capturing Value for Hive From External Economies

What this means is capturing value and bringing it back to the mother chain, aka Hive. It's quite simple and it actually is used by every single global economy in the world. Since... forever.

Economies are grown and built on exporting goods & services to other economies. This is no secret, you can look at your history books or look at the things sitting right in front of you on your desk or wherever you're at. A large % of the things in front of you aren't from the country you reside in. They're imported goods from other countries.

When countries get really good at exporting something, they're able to generate massive economic value. How? They are exporting something that other countries need and they are charging a premium for it.

Again, this is nothing new. There are some blockchains who also do this and I think it's a very smart approach. The majority of these chains capture economic value through Gas Fees or some similar mechanism.

These chains build some "exportable" good that no other chain has (or has in the right way). Solana, as an example, has meme coins and DEX Trading. These two things have driven SOL's market cap up to $100B. Are there other things, perhaps, but these are the two biggest. Solana is actually now the #1 market for DEXes and it made this climb in record time.

How Can We Capture Economic Value for HIVE & HBD?

This is a question I've thought a lot about. I hold a significant stake in Hive and obviously I've spent the last 6 years building INLEO on Hive. My stake and desire for this blockchain to grow and thrive is immense.

In my opinion, there are many ways to capture economic value for Hive and HBD. I love to see that we have many other teams on Hive all working toward that collective goal as well. I see the @vsc.network team doing this in a big way by working hard to bring other assets onto Hive and leverage the unique selling points of Hive (fast, free and scalable TXs) in order to capture external economic value and assets and bring them back to the mother chain.

How INLEO Captures Economic Value For Hive

In thinking of all these ideas, I've come up with many ways that INLEO brings value back into Hive from other economies, let's dive in:

- LeoDex Swap Fees

- INLEO Premium Payments

- LeoMerchants (Pilot Program Launched in 25 IRL Stores)

- Ad Revenue (Soon)

LeoDex Swap Fees

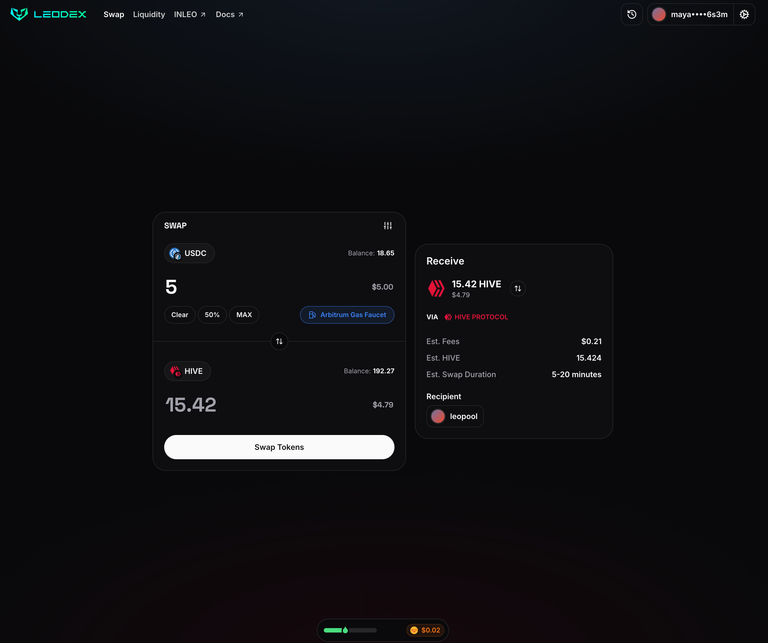

LeoDex is a multi-chain trading interface for decentralized exchange protocols. Right now, we support Maya Protocol and our own in-house Hive Aggregation Technology (HAT) to support both Maya Swaps & Hive/HBD/Hive L2 Swaps.

Our team has recently developed and is currently testing ChainFlip, Thorchain and Rango swaps on LeoDex as we speak. To integrate these, we built a whole new swap net in the background. This allows us to route your swap through whichever of the 4 protocols offers the cheapest/fastest route at the time (if you're familiar with aggregators like 1INCH, it works similarly but across multiple blockchains).

With these 3 new protocols added in addition to Maya Protocol and Hive Aggregation Technology (HAT), we will support over 300+ cryptocurrencies on LeoDex.

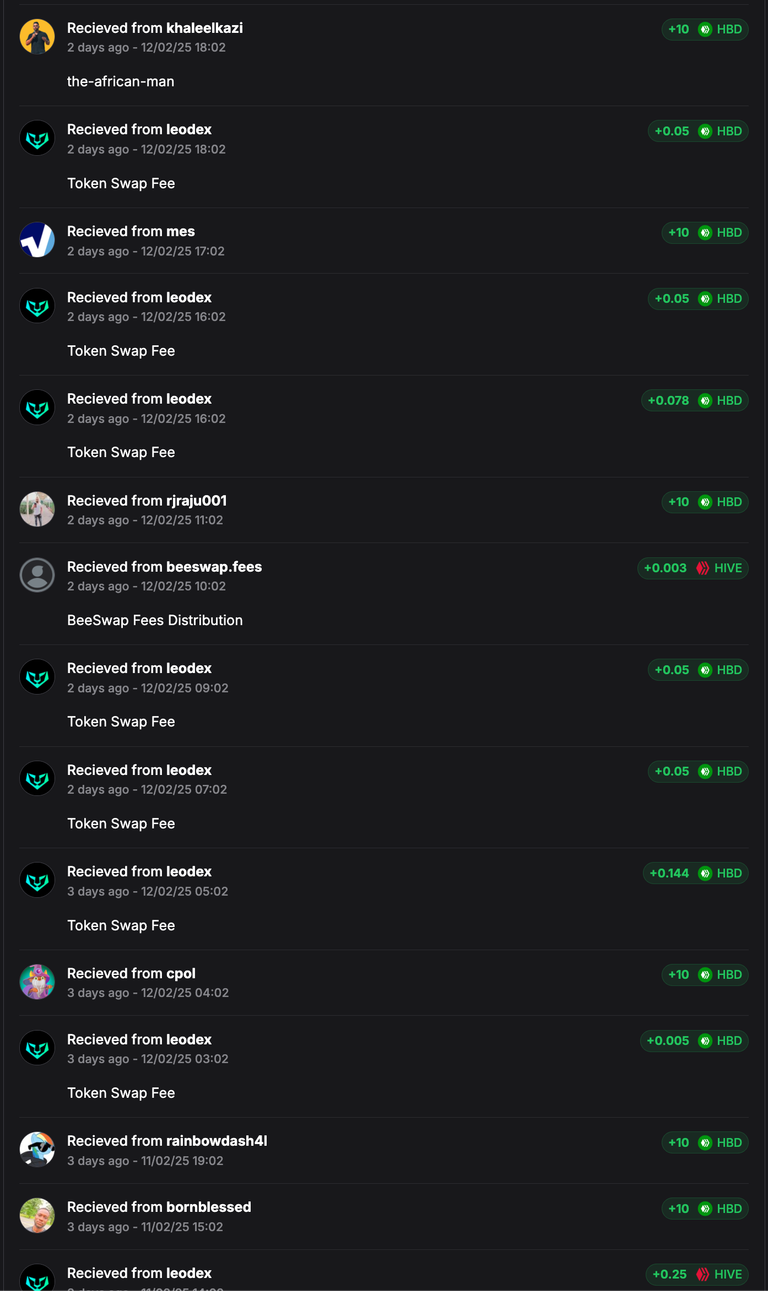

LeoDex is paid affiliate swap fees from whichever protocol it swaps on. For example, Maya pays us in CACAO when we complete swaps on Maya Protocol. Thorchain pays us RUNE, etc. etc.

100% of our affiliate fees buy and permanently pool LEO in either the LEO-CACAO pool or the LEO-SWAP.HIVE pool on Hive (which pool is determined based on need - since our HAT uses the two pools to aggregate swaps, deepening both pools has a dramatically positive effect at making swap slippage more efficient).

Whether it's deployed on Maya or on Hive as liquidity is less important than the fact that all the swap fees are buying an L2 token on Hive. The more the LEO Liquidity grows, the more that aggregated swaps through Hive can be more efficient.

Our goal is to bring >10% of the currently monthly trading volume for HIVE/HBD from Centralized Exchanges to Decentralized Exchanges. We believe this is a great thing for Hive in the long-run as DEXes gain more popularity and reliance on CEXes should decrease.

When we buy LEO and perma-pool with HIVE on LEO-SWAP.HIVE, we are actively buying HIVE with our Affiliate Revenue from these 4 protocols (Maya, Thorchain, ChainFlip, Rango). This creates economic inflow for Hive - capturing value from the 4 protocols and bringing it back to Hive.

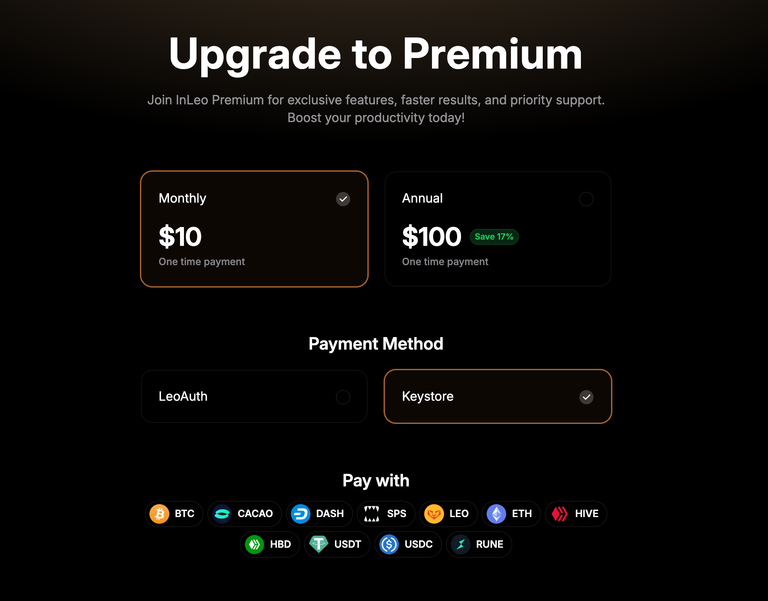

INLEO Premium Payments

INLEO has a Premium Subscription Service on INLEO frontend for $10/Month or $100/Year.

Up until about a month ago, we only accepted HBD as the sole form of payment for subscribing to INLEO Premium.

With our new LeoMerchants technology, we now can accept ANY cryptocurrency (currently, anything listed on Maya. Soon anything listed on Rango, ChainFlip, Thorchain, etc. which is pretty much every crypto on the planet between the 4 protocols).

There is a key element here - and this is how we capture value back to Hive - we still ONLY ACCEPT HBD as the final settlement cryptocurrency.

So a user can pay in any crypto they want - BTC, USDC, USDT, ETH, CACAO, RUNE, LEO, SPS, HIVE, etc. - but we ONLY accept HBD. So when the user pays in one of those cryptos, it is auto-swapped using LeoDex on the backend (LeoMerchants API) into HBD and then sent to our Premium collection account.

This means that every time any user pays for INLEO Premium using any cryptocurrency, we are bringing their $10 or $100 settled payment onto the Hive blockchain and settling it in HBD. This creates a continuous inflow for the Hive ecosystem as other ecosystems swap their coins into HBD (but it all happens automagically on the backend. The user just sees that they're buying Premium using DASH or BTC or whatever coin they have).

LeoMerchants

You may have seen our blog post from 7 days ago that talked about the Pilot program that just officially went live with a local point of sale provider.

LeoMerchants is now slowly being rolled out to some brick-and-mortar businesses.

These businesses connect to our API and that allows them to accept ANY CRYPTO from their customers.

Similar to how we accept ANY CRYPTO for INLEO Premium but settle in HBD, our partner merchants can accept any crypto and receive any crypto they want.

Our partner merchants set what they want to receive and then off they go.

Example: customer John comes in and wants to buy an energy drink. It's $4. They go to the counter and indicate they are "Paying with Crypto". The clerk selects crypto in their PoS system.

Then the customer taps the icon of the crypto they're paying in on the iPad PoS device. John selects DASH as his payment method.

A DASH QR code is populated on the device. John uses his Dashpay app to scan the QR code which prompts a $4 DASH TX to the LeoMerchant receiving address.

Our merchant has decided to receive USDC (Arbitrum), so LeoMerchants autonomously swaps the DASH into USDC (Arbitrum) and sends it to the store's USDC (Arbitrum) wallet address.

The customer just paid in Dash and the merchant just received USDC. INLEO receives a 1.25% merchant fee on this transaction. We receive all of our merchant fees as HBD on the Hive Blockchain.

This means that 1.25% of every processed purchase is being swapped for HBD and sent to our wallet. Yet another inflow for the Hive blockchain. This time, we're pulling in crypto from other chains and economic value from brick-and-mortar businesses. Ever seen how much credit card processors like Visa, Mastercard, etc. make for processing payments? That's the market we're attempting to tap into.

Ad Revenue

We have an update sitting in the pipeline for the new LeoAds. This is a completely rebuilt LeoAds protocol. This time, we are not using Google Adsense nor Coinzilla or any other middle-man marketplace for ads.

Instead, we are selling B2B ads using our own native ad platform. This cuts out the middle man.

Now that we have the LeoMerchants API live, we are getting close to releasing LeoAds on INLEO.

LeoAds will allow any B2B customer who wants to buy ad space on INLEO the ability to use the LeoAds dashboard to create Ad Campaigns that target various segments of the INLEO userbase (can target based on hashtag interest, following, etc.).

When a LeoAds customers buys Ad Space, they pay in any crypto and their payment is settled in HBD in our account (exactly like INLEO Premium).

This creates yet another economic inflow for the Hive blockchain since they can pay in DASH, BTC or whatever crypto they want but we are autonomously swapping it into HBD and settling the payment on the Hive blockchain.

Economic Inflows and the Importance of Value Capture

As you can see, the heart of a great economy is in creating economic inflows. The importance of Value Capture cannot go understated. I believe that this is how we return Hive to where it belongs: amongst the top 10 cryptos by market cap.

My team and I have put extraordinary effort into making this possible. It's been literally years of development to build out this tech stack. Now that we've got INLEO, LeoDex and LeoMerchants all in their final positions, it's time to open the flood gates and bring economic value into HIVE at a massive scale.

To scale all of this, we are launching 10 collaborations like the "Join INLEO, Earn DASH" Campaign that we did with the Dash team.

We are asking for funding from the Hive DHF in order to make these 10 collaborations happen in 2025. Our collaborations with Solana, ChainLink, ChainFlip, Arbitrum, Litecoin and many other ecosystems will dramatically change Hive for the better.

It's time to bring unprecedented users, investment and most importantly; value capture to HIVE and HBD. If you support the ideals laid out in this post and our approach to bringing value to Hive, consider voting our DHF Proposal:

Posted Using INLEO

This is exactly what HIVE DAPPs should have been doing in the first place. Partnerships with other projects is a great way to build awareness without spending hand over fist. Most people of cryptosphere who are even talking about blockchain social media are unaware of HIVE. This is a disgrace to to a project with ~9 years of history.

We have been isolated for too long. I used to think that getting more exposure on Web 2 will put HIVE on the mainstream. What I didn't realize at the time was that the best way to get Web 2 exposure is collaborating with those who are already established on Web 2. @khaleelkazi is making exactly the kind of moves we should be making to put HIVE back in Top 100 cryptocurrencies. Once we are back in there we will have a far more exposure.

Hive ecosystem needs to attract people from outside to grow its TVL and volume before chasing for an absolute mass-adoption.

The growth of ecosystem has been fueled by successful games and the Leo products that create use cases for $HIVE and $HBD for non-Hivians.

I support every source that InLEO comes up with to make Hive better! It is certain that both InLEO and the future of Hive are in safe hands 🙌

Hive On ✌️ 🦁

Collaborations like that are completely necessary for Hive. Other chains with less to offer than what Hive has have succeeded because they have done great job at putting themselves out there and collaborating with other projects.

It's great that Inleo has not only built the social media platform, which is awesome itself, but have built the economic tools necessary to get revenue and move the volume for both LEO and HIVE. Everything that goes through LeoDex is positive for out ecosystem in general.

And LeoMerchants is awesome, because the onboarding of business to Hive has been going good but slow, because it means the customers need to have Hive or HBD too, but allowing the business to receive anything, and still settle on HBD, opens the possibilities for them while bringing money into Hive.

I can't wait to see what the collaboration with ChainFlip and other ecosystems can bring, because the first round with Dash has been very productive.

@tipu curate

Upvoted 👌 (Mana: 24/54) Liquid rewards.

!BBH

!PIZZA

$PIZZA slices delivered:

@sacra97(7/15) tipped @leofinance

Open Source is good! 😎