The US dollar and other currencies are no longer ‘good as gold’

Since the 1700s our currencies have been backed by real money, gold and silver. You used to be able to take your currency, a claim check for money, and say ‘Here’s my $20 bill please give me the same worth of Gold or Silver’. However during the First World War countries were printing their currencies in order to fund the war and give themselves a better chance of winning. What happened here was that the amount of gold in their vaults remained the same yet the amount of dollars had increased. Therefore the ratio between Dollars and Gold was no longer fixed at a 100% reserve, but had reduced to about 40%. What this meant was when you went to claim your Gold with your dollars, you got 2.5x less gold for your money. The US dollar was devaluing and gold was increasing in value.

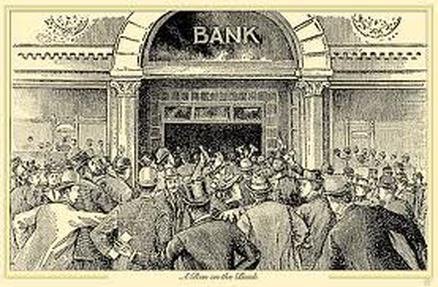

Loss of Trust

In 1944 countries came together and agreed that their currencies would be backed by the US dollar. The US dollar at the time was backed by gold at $35 per ounce. There was no such thing therefore as foreign exchange as all the rates were fixed between the currencies. However, the US continued to print currency to fund wars such as Korea, Vietnam and more. Other countries started to recognise that because of the dollar printing, the rate for 1oz of Gold being $35 was a lie. Countries that held US Dollar lost confidence in the currency and decided to purchase large quantities of gold. Instead of trusting the US and relying on the peg, countries such as France decided to take ownership into their own hands.

History May Not Repeat. But it Often Rhymes.

This resulted in a world wide bank run and people wanted their money back. Thus, President Nixon decided to suspend the convertability of Dollars into gold. If people continued to recieve gold at a rate of $35 per ounce, America would have totally run out of gold. The world monetary system would have totally collapsed. This is also what happened in Athens in 400BC. And look what happened to them! Who’s to say the same won’t happen again. But, this isn’t all doom and gloom. You can either be wiped out from it or you can profit from it. Have you figured out yet what you could do?

Zooming Out

Even though it was only 40-50 year ago that Gold was seen as money, we have almost toally forgotten about it and the beauty of it. It’s not discussed in schools and seen as a commodity in the financial world. This perspective that we now have allows us to zoom out of the current political chaos and see what has happened financially over a long period of time and allow us to prepare ourselves.

Financial education is really important, especially right now. COVID is happening and there are significant health and social reciprocations. Yet it is important to understand the financial implications too and what is going on behind the scenes. Please continue to read my blogs about financial education and crypto as they come out. This is aimed to educate people who know nothing about these topics with the aim of having some protection when an inevitable financial collapse happens.

Currently, if you are new to this, you are not too late. The talk in crpyto is that if you aren't already in you are too late. This is not true. This is not true for gold or silver either. There is still an opportunity to educate yourself and make appropriate decisions for yourself!

Please upvote, reblog, and comment! I look forward to your thoughts on these topics too as I want to get this discussion going! Thank you.

Posted Using LeoFinance Beta

It's nice to see your spreading this history. Just think about how much Gold has gone up from initial $20

Posted Using LeoFinance Beta

Thanks! Thanks for supporting and following!

$35 per Oz in 1944!!!

Posted Using LeoFinance Beta

Congratulations @localgrower! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @hivebuzz: